A new report by Forrester Research found that 49 percent of investors check their investment account balances on a PC, while 3 percent use a mobile phone.

The "Trends 2013: Digital Wealth Management" report also found that computers are used more frequently than other modes of communication in all investment activities except communicating with financial advisors and contacting customer service. The report goes on to outline six digital trends that will change wealth management in 2013 such as mobile devices and social media.

"Digital touchpoints have become the channel of choice for most affluent consumers," said Bill Doyle, vice president and principal analyst of Forrester Research, Cambridge, MA.

"Despite this massive shift in channel preferences, few firms dedicate sufficient resources to digital touchpoints, at least in wealth management," he said.

Forrester Research surveyed more than 5,000 U.S. online adults who own investment accounts in Q3 2012.

Catching up to digital

The report argues that wealth management firms have been slow to catch up to the rising importance of digital touch points. A reason for this lack of adaptability is that firms rely on traditional touch points such as face-to-face interactions.

Rising client expectations, substantial sums invested by leading firms and the long build-up time required for infrastructure, expertise and skills are listed as reasons for why a refusal to develop digital touchpoints can be hazardous.

Although mobile phones and tablets are used by no more than 5 percent of investors for all investment activities, they have been picking up momentum.

The report discusses six digital trends that will impact wealth management in 2013.

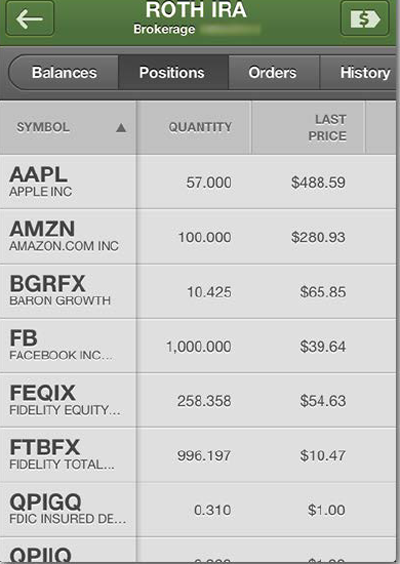

Mobile devices continue to grow at huge volumes every year and finance professionals are using them more frequently for account information. E-trade and Fidelity excel in presenting account data on mobile devices, according to Forrester.

Image taken from Forrester's "Trends 2013: Digital Wealth Management"

Social networks will change investor behavior due to the vast amounts of professionals that share advice and personal data on channels such as LinkedIn.

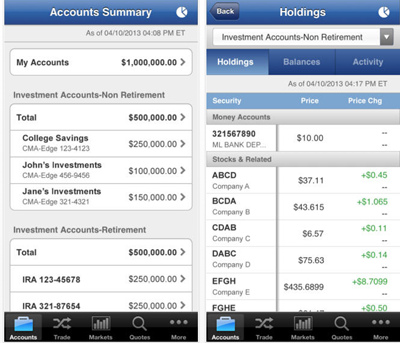

Building upon multi-touch point experiences such as what Merrill Lynch did with its mobile application will allow firms to stay relevant.

Image taken from Forrester's "Trends 2013: Digital Wealth Management"

Social networks will change investor behavior due to the vast amounts of professionals that share advice and personal data on channels such as LinkedIn.

Building upon multi-touch point experiences such as what Merrill Lynch did with its mobile application will allow firms to stay relevant.

Merril Lynch iPhone app

Although firms should continue to cultivate in-person connections, consumers appreciate receiving collaborative advice from sources such as email or text messaging.

The report says that disruptors in the realm of self-service advice are on their way. These online solutions will attract investors who cannot afford financial advisors.

The level of usability on digital touch points is the final area that will begin to see widespread improvements, according to the report.

Digital: not either or

The report offers three primary outlooks to cope with the industry's digital transformation.

First, firms should stop avoiding digital investments even if their business is predominantly person-to-person. Clients will begin to acutely recognize which brands fall behind.

Secondly, digital is not a threat to the traditional model. Instead, a combination of digital and human will propel firms into the future.

Monitoring the engagement levels of clients will help firms decide where to invest.

A related study conducted by Forrester Research, "The 12 Must-Have Features for Wealth Management Firms," examines areas that are important for public sites of wealth management to develop.

"Specific product details are the information most frequently sought by prospects who research online," Mr. Doyle said.

"Our research also shows that prospects doing product research online always prefer more information to less," he said.

"Right behind product details in the list of things online researchers want: product comparisons."

Final take

Joe McCarthy, editorial assistant on Luxury Daily, New York

Merril Lynch iPhone app

Although firms should continue to cultivate in-person connections, consumers appreciate receiving collaborative advice from sources such as email or text messaging.

The report says that disruptors in the realm of self-service advice are on their way. These online solutions will attract investors who cannot afford financial advisors.

The level of usability on digital touch points is the final area that will begin to see widespread improvements, according to the report.

Digital: not either or

The report offers three primary outlooks to cope with the industry's digital transformation.

First, firms should stop avoiding digital investments even if their business is predominantly person-to-person. Clients will begin to acutely recognize which brands fall behind.

Secondly, digital is not a threat to the traditional model. Instead, a combination of digital and human will propel firms into the future.

Monitoring the engagement levels of clients will help firms decide where to invest.

A related study conducted by Forrester Research, "The 12 Must-Have Features for Wealth Management Firms," examines areas that are important for public sites of wealth management to develop.

"Specific product details are the information most frequently sought by prospects who research online," Mr. Doyle said.

"Our research also shows that prospects doing product research online always prefer more information to less," he said.

"Right behind product details in the list of things online researchers want: product comparisons."

Final take

Joe McCarthy, editorial assistant on Luxury Daily, New York