Lancôme Paris, Kiehl's and L'Oréal Paris clinched the top three spots in L2 Think Tank's "Digital IQ Index: Beauty 2013" study as competition escalates on a variety of fronts.

Live video chat, loyalty, auto-replenish programs and a heightened focus on personalization are cited as trends that raise the entry barrier of sufficient participation, leaving brands inept at taking tactical cues in the cold. Although L'Oréal Group grabbed the top three finish, Estée Lauder has five brands in the top ten and the highest average digital IQ for its 11 brands at 119.

"Personalization is a key point of differentiation," said Danielle Bailey, research lead at L2 Think Tank, New York. "The ability to deliver a targeted set of products that meet beauty consumers' needs and preferences instills brand loyalty.

"For example, L'Oréal Paris' Web site, across devices, tailors product presentation and recommendations based on the user," she said. "Email personalization is another avenue to provide a customized experience. Auto-replenishment and online loyalty programs also help to foster repeat customers.

"Recognizing the on-the-go, multichannel, cross-platform nature of beauty consumers, the surge in mobile is not as much unexpected as it is overdue. Up from 50 percent a year ago, now nearly three-quarters of beauty Web sites are mobile-optimized, and 85 percent of them facilitate purchase. "

The Digital IQ Index: Beauty 2013 examines the digital proficiency of 85 beauty brands across skincare, color cosmetics and fragrance. Brand evaluations are weighted according to the following criteria: 40 percent Web site, 30 percent digital marketing, 15 percent mobile and 15 percent social media.

Specific players

Lancôme Paris earned its genius rank for its improved presence on Amazon, mobile and tablet upgrades and an ecommerce experience embellished with makeup tips, video how-to's and social promotions.

Lancôme Hypnose Drama

Kiehl's slid into second place just ahead of L'Oréal Paris because of its choice of more than 80 samples at ecommerce checkout, location-based text alerts that exploit vertical retail and a Snap & Shop application that enables consumers to virtually shop stores under construction.

Giorgio Armani made an IQ leap of 37 percent from the year-ago period as it augmented its strong Web site ecommerce with mobile and tablet options.

Lancôme Hypnose Drama

Kiehl's slid into second place just ahead of L'Oréal Paris because of its choice of more than 80 samples at ecommerce checkout, location-based text alerts that exploit vertical retail and a Snap & Shop application that enables consumers to virtually shop stores under construction.

Giorgio Armani made an IQ leap of 37 percent from the year-ago period as it augmented its strong Web site ecommerce with mobile and tablet options.

Giorgio Armani Rouge Ecstasy

A few trends

Consumers can now access samples at checkout on 72 percent of the 36 Web sites that were looked at, and 17 percent of these brands have invested in loyalty programs.

Email frequency has increased by 30 percent from the year-ago period among scrutinized brands, but this number splinters when looking at different categories, companies and business models. Twelve percent of brands send birthday emails that entice consumers with birthday-specific sales.

Twenty-eight percent of the 72 brands that offer sign-up options follow abandoned cart transactions up with an email, even though abandoned carts continue to plague the industry.

While Facebook dominates upstream traffic to brand Web sites by social media platforms, social media in general drives a paltry 3.9 percent of all upstream traffic.

Giorgio Armani Rouge Ecstasy

A few trends

Consumers can now access samples at checkout on 72 percent of the 36 Web sites that were looked at, and 17 percent of these brands have invested in loyalty programs.

Email frequency has increased by 30 percent from the year-ago period among scrutinized brands, but this number splinters when looking at different categories, companies and business models. Twelve percent of brands send birthday emails that entice consumers with birthday-specific sales.

Twenty-eight percent of the 72 brands that offer sign-up options follow abandoned cart transactions up with an email, even though abandoned carts continue to plague the industry.

While Facebook dominates upstream traffic to brand Web sites by social media platforms, social media in general drives a paltry 3.9 percent of all upstream traffic.

Estée Lauder Facebook post

Vloggers dwarf brands in terms of user engagement on YouTube, but only 37 percent of brands have vlogger collaborations.

Monster under the bed?

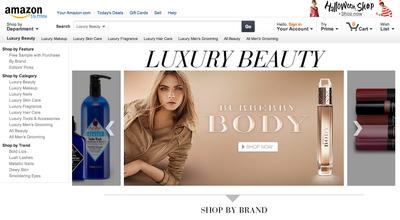

Online retailer Amazon launched its luxury beauty store Oct. 10 to expand its luxury offerings to aspirational consumers aiming to save money on high-end products while still obtaining a piece of the luxury lifestyle.

The highly-anticipated launch may spur luxury brands to heavily promote their ecommerce platforms to retain sales and prevent products from slipping toward everyday commodity status. With Amazon stepping into the luxury beauty sector, brands and high-end retailers should look to increase levels of consumer engagement and customer service via ecommerce so that the brand allure is not diluted (see story).

Estée Lauder Facebook post

Vloggers dwarf brands in terms of user engagement on YouTube, but only 37 percent of brands have vlogger collaborations.

Monster under the bed?

Online retailer Amazon launched its luxury beauty store Oct. 10 to expand its luxury offerings to aspirational consumers aiming to save money on high-end products while still obtaining a piece of the luxury lifestyle.

The highly-anticipated launch may spur luxury brands to heavily promote their ecommerce platforms to retain sales and prevent products from slipping toward everyday commodity status. With Amazon stepping into the luxury beauty sector, brands and high-end retailers should look to increase levels of consumer engagement and customer service via ecommerce so that the brand allure is not diluted (see story).

Amazon’s luxury beauty store homepage

Still, the L2 study's lead researcher says that embracing Amazon is a mixed bag for beauty brands.

"Amazon is a "frenemy,'" Ms. Bailey said. "They are definitely looking to capture a piece of the fast-growing online beauty market and leverage their influence on the purchase process. A third of online shoppers begin their searches on Amazon.

"However, they also present an opportunity for beauty products to join the basket of consumers already in the mood to shop, especially as Amazon continues to expand its offerings to soft goods and grocery," she said.

Finding inventive ways to sidestep Amazon may work in the short-term, but long-term evasion may be challenging.

"Whether brands choose to officially distribute through Amazon is an individual strategic decision," Ms. Bailey said. "It is a decision that might be made for them if Amazon can manage to shake loose some of the large beauty players, and then everyone will feel like they have to be there.

"What is certain is that all brands should be actively monitoring their presence, both official and unofficial, on the online retailer," she said.

"By claiming and merchandising brand stores, eliminating grey market goods and purchasing advertising on the platform, brands ensure their integrity and visibility."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

Amazon’s luxury beauty store homepage

Still, the L2 study's lead researcher says that embracing Amazon is a mixed bag for beauty brands.

"Amazon is a "frenemy,'" Ms. Bailey said. "They are definitely looking to capture a piece of the fast-growing online beauty market and leverage their influence on the purchase process. A third of online shoppers begin their searches on Amazon.

"However, they also present an opportunity for beauty products to join the basket of consumers already in the mood to shop, especially as Amazon continues to expand its offerings to soft goods and grocery," she said.

Finding inventive ways to sidestep Amazon may work in the short-term, but long-term evasion may be challenging.

"Whether brands choose to officially distribute through Amazon is an individual strategic decision," Ms. Bailey said. "It is a decision that might be made for them if Amazon can manage to shake loose some of the large beauty players, and then everyone will feel like they have to be there.

"What is certain is that all brands should be actively monitoring their presence, both official and unofficial, on the online retailer," she said.

"By claiming and merchandising brand stores, eliminating grey market goods and purchasing advertising on the platform, brands ensure their integrity and visibility."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York