More than one in five fashion brands upgraded their Web site in 2013, evincing an industry-wide push to catch up to digital trailblazers such as Burberry, Gucci and Ralph Lauren, according to L2 Think Tank's latest digital index.

Improved navigation, enhanced image collateral, increased mobile-optimization and expanded ecommerce support are primary areas that brands targeted during Web site redesign. The index also emphasizes that Amazon's heft and Apple's imminent descent upon the luxury market calls for an even more aggressive pursuit of digital innovations in the next year.

"The inordinate price increases and profits registered by the fashion industry is attracting non-traditional players, ranging from Apple to Amazon, to the sector," said Scott Galloway, founder of L2 and NYU Stern clinical professor of marketing, New York.

L2's Digital IQ Index: Fashion 2013 examines the digital proficiency of 85 fashion brands. Brand evaluations are weighted according to the following criteria: 40 percent Web site, 30 percent digital marketing, 15 percent mobile and 15 percent social media.

Clearing the path

Burberry retained its top spot due to a year crammed with digital innovations.

The British fashion house added collect-in store options to complement live-chat and call me back functions, introduced a "Customer 1-2-1" tool that allows associates in 300-plus stores to access customer information on the fly and unveiled interactive, highly-detailed email marketing to cover its live runway shows.

Burberry animated catwalk

Gucci ranked second with sophisticated email marketing and shoppable videos and a prioritized new Web site for mobile and tablet devices. The fashion brand also leveraged Google Maps for in-store tours and launched a layered campaign for the 60th anniversary of its "Horsebit" loafers.

Burberry animated catwalk

Gucci ranked second with sophisticated email marketing and shoppable videos and a prioritized new Web site for mobile and tablet devices. The fashion brand also leveraged Google Maps for in-store tours and launched a layered campaign for the 60th anniversary of its "Horsebit" loafers.

Gucci loafer campaign

An Instagram survival guide, New York Times takeovers and shrewd YouTube collaborations are cited as reasons for Ralph Lauren's number three ranking.

Other top contenders include Coach, Marc Jacobs, Diane von Furstenberg, Louis Vuitton, Michael Kors and Hugo Boss.

Gucci loafer campaign

An Instagram survival guide, New York Times takeovers and shrewd YouTube collaborations are cited as reasons for Ralph Lauren's number three ranking.

Other top contenders include Coach, Marc Jacobs, Diane von Furstenberg, Louis Vuitton, Michael Kors and Hugo Boss.

Marc Jacobs mobile site

Brands that earned a challenged or feeble score include Alfred Dunhill, Fendi, Givenchy and Loro Piana.

Versace made the most substantial IQ leap, vaulting 36 percent from average in 2012 to gifted in 2013. Oscar de la Renta had the most dismal slide, falling 31 percent from gifted in 2012 to average in 2013.

Fashionable and unfashionable trends

Eighty-four percent of the brands studied support direct ecommerce. However, beyond this curtain, many brands struggle with basic customer service.

Six percent of brands allow consumers to buy online and pick up in-store, despite this being an attribute for which many customers look.

Marc Jacobs mobile site

Brands that earned a challenged or feeble score include Alfred Dunhill, Fendi, Givenchy and Loro Piana.

Versace made the most substantial IQ leap, vaulting 36 percent from average in 2012 to gifted in 2013. Oscar de la Renta had the most dismal slide, falling 31 percent from gifted in 2012 to average in 2013.

Fashionable and unfashionable trends

Eighty-four percent of the brands studied support direct ecommerce. However, beyond this curtain, many brands struggle with basic customer service.

Six percent of brands allow consumers to buy online and pick up in-store, despite this being an attribute for which many customers look.

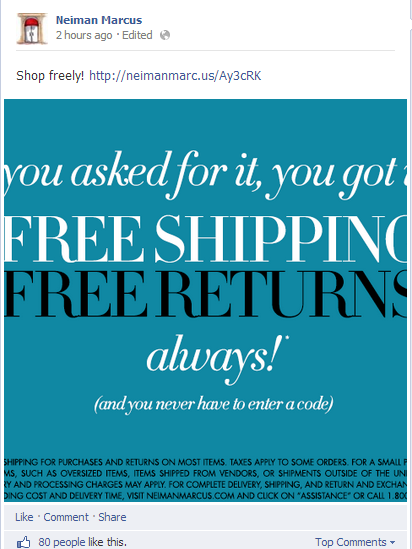

Neiman Marcus and Bergdorf Goodman free shipping announcement

Twelve percent allow consumers to customize products online, while 16 percent provide live chat and product ratings and reviews.

Fashion brands have shown an aptitude for delivery.

Fifty-four percent of the brands studied delivered to New York within 72 hours of purchase, which is a refreshing surprise to the 92 percent of consumers who are willing to wait longer than four days for a UPS delivery.

However, not all facets of fashion delivery are winning the hearts of consumers. Seventeen percent of brands make the customer pay for return shipping, and 45 percent of those studied require consumers to call or email to initiate a return.

L2 points out that the average amount of upstream traffic driven by search is 51 percent. Eighty-two percent of search comes from organic links and 18 percent stems from paid advertisements.

Despite the glaring need to address abandoned carts, 15 percent of brands send follow-up email notifications.

A video summarizes the major findings of the study.

L2's Digital IQ Fashion 2013

Ferreting out the slow-pokes

Amazon is quietly declawing the resistance shown by fashion brands reluctant to join forces. Sixty-five percent of the brands studied are now listed in Amazon's directory.

In an unexpected manner, Amazon provides a good measure of the brands that are at the forefront of digital innovation. After all, Burberry has fully embraced the online retailer.

Neiman Marcus and Bergdorf Goodman free shipping announcement

Twelve percent allow consumers to customize products online, while 16 percent provide live chat and product ratings and reviews.

Fashion brands have shown an aptitude for delivery.

Fifty-four percent of the brands studied delivered to New York within 72 hours of purchase, which is a refreshing surprise to the 92 percent of consumers who are willing to wait longer than four days for a UPS delivery.

However, not all facets of fashion delivery are winning the hearts of consumers. Seventeen percent of brands make the customer pay for return shipping, and 45 percent of those studied require consumers to call or email to initiate a return.

L2 points out that the average amount of upstream traffic driven by search is 51 percent. Eighty-two percent of search comes from organic links and 18 percent stems from paid advertisements.

Despite the glaring need to address abandoned carts, 15 percent of brands send follow-up email notifications.

A video summarizes the major findings of the study.

L2's Digital IQ Fashion 2013

Ferreting out the slow-pokes

Amazon is quietly declawing the resistance shown by fashion brands reluctant to join forces. Sixty-five percent of the brands studied are now listed in Amazon's directory.

In an unexpected manner, Amazon provides a good measure of the brands that are at the forefront of digital innovation. After all, Burberry has fully embraced the online retailer.

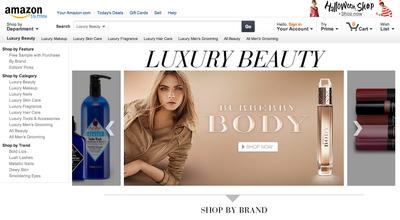

Amazon's luxury beauty store

For brands that remain defiant, increased digital innovation is likely the only way to prevent Amazon from sapping sales.

"The most powerful, if only, defense is increased product and digital innovation," Mr. Galloway said.

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

Amazon's luxury beauty store

For brands that remain defiant, increased digital innovation is likely the only way to prevent Amazon from sapping sales.

"The most powerful, if only, defense is increased product and digital innovation," Mr. Galloway said.

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York