Digital is no longer enough, brands must go mobile

Digital is no longer enough, brands must go mobile

With three out of four affluent consumers turning to mobile devices to assist in purchases, their behavior and interactions with luxury brands are changing almost as fast as the technology itself, according to a report by the Altagamma-McKinsey Online Observatory.

As the affluent become more reliant on their devices to shop, marketers will need to work to create worthwhile digital experiences to keep pace with consumers’ preferences. But, as Altagamma-McKinsey found, this is not as simple as just redeveloping a Web site or creating an active Twitter account.

"Digital is going to enhance and complement the luxury experience as we know it today," said Linda Dauriz, principal at McKinsey & Company, Cologne, Germany.

"It's not going to question the luxury experience that customers have been demanding from stores and their staff," she said. "Digital is going to give luxury brands the opportunity to complement their customer's journeys.

"[Digital] is about branding the customer journey, branding a customer experience and digital will increasingly be component of this digital journey. The luxury customer is becoming more fluid and moving from the offline world to the online world seamlessly."

The Altagamma Foundation and McKinsey & Company collaborate to form the Altagamma-McKinsey Online Observatory. The group’s second report, the "Digital Luxury Experience 2013," studied the behaviors of 3,000 consumers living in Germany, France, Italy, the United Kingdom, the United States and Japan as well as the digital performances of 300 luxury brands in 12 product categories.

Keepin’ up

Altagamma-McKinsey Online Observatory’s report found that 20 percent of total sales in the luxury space, both online and in-store, were driven directly by digital touchpoints. Also, the total sales from pure digital marketing generated $12.5 billion, a 20 percent growth rate from the year-ago period.

In terms of growth momentum, in 2013 pure online sales raised 20 percent even though the overall market was considered to be “stagnant”. In the next five years, these figures are expected to reach $27.8 billion, but may increase even higher as new technologies are developed and incorporated into the daily lives of affluent consumers.

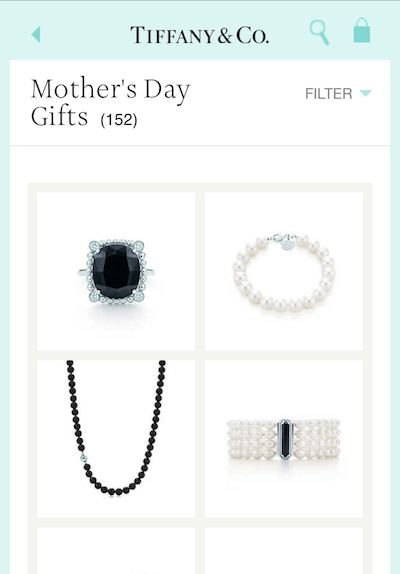

Tiffany & Co.'s mobile commerce gift guide for Mother's Day

The report discovered that the mono-brand store format, or a storefront that carries a brand’s entire range, is growing at a faster pace than other retail models. For luxury consumers, this mono-brand format allows for a better depiction of a brand’s lifestyle.

For instance, French footwear maker Berluti continued its move toward a full-service lifestyle brand with the opening of a new boutique on New York’s Madison Avenue.

Berluti’s bricks-and-mortar location opened Feb. 6 only blocks away from its prior location on the high-end retail stretch. Although known as a bespoke cobbler, Berluti has expanded to apparel and furnishings to better represent the lifestyle of its brand (see story).

Tiffany & Co.'s mobile commerce gift guide for Mother's Day

The report discovered that the mono-brand store format, or a storefront that carries a brand’s entire range, is growing at a faster pace than other retail models. For luxury consumers, this mono-brand format allows for a better depiction of a brand’s lifestyle.

For instance, French footwear maker Berluti continued its move toward a full-service lifestyle brand with the opening of a new boutique on New York’s Madison Avenue.

Berluti’s bricks-and-mortar location opened Feb. 6 only blocks away from its prior location on the high-end retail stretch. Although known as a bespoke cobbler, Berluti has expanded to apparel and furnishings to better represent the lifestyle of its brand (see story).

Berluti's new Madison Avenue flagship is categorized as a mono-brand store

By having a mono-brand store location, the consumer’s in-store experience will be more similar to digital interactions, where all of the brand’s products are available at a click. Although common practice among luxury brands, which develop multiple social accounts and Web sites to accommodate different ranges such as a dedicated beauty page, the research suggests that this model is likely not needed.

In its assessment of the digital luxury marketplace, the report found that 65 percent of online sales are generated by fashion accessories, perfumes and cosmetics. One must only look at online retailer Amazon’s luxury ecommerce presence to understand how significant that finding is.

Amazon launched its luxury beauty store Oct. 10 to expand its luxury offerings to aspirational consumers aiming to save money on high-end products while still obtaining a piece of the luxury lifestyle. With Amazon stepping into the luxury beauty sector, brands and high-end retailers should look to increase levels of consumer engagement and customer service via online and mobile commerce so brand allure is not diluted (see story).

Berluti's new Madison Avenue flagship is categorized as a mono-brand store

By having a mono-brand store location, the consumer’s in-store experience will be more similar to digital interactions, where all of the brand’s products are available at a click. Although common practice among luxury brands, which develop multiple social accounts and Web sites to accommodate different ranges such as a dedicated beauty page, the research suggests that this model is likely not needed.

In its assessment of the digital luxury marketplace, the report found that 65 percent of online sales are generated by fashion accessories, perfumes and cosmetics. One must only look at online retailer Amazon’s luxury ecommerce presence to understand how significant that finding is.

Amazon launched its luxury beauty store Oct. 10 to expand its luxury offerings to aspirational consumers aiming to save money on high-end products while still obtaining a piece of the luxury lifestyle. With Amazon stepping into the luxury beauty sector, brands and high-end retailers should look to increase levels of consumer engagement and customer service via online and mobile commerce so brand allure is not diluted (see story).

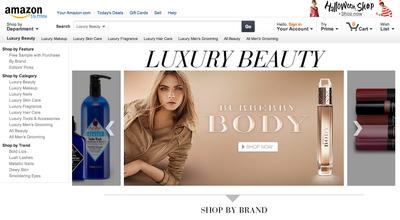

Amazon's Luxury Beauty page

Digital investments

As for consumer behavior the report saw that, in general, “digital passion” via “mobile penetration” is becoming more important in marketing. That being said, the report suggests that more can be done to further engage consumers online.

This engagement stems from four sources: online marketing metrics, or OMEX, that supports awareness and consideration to purchase and loyalty, social media, consumer feedback and the brand’s economic performance. Based on how the surveyed brands replied to their use of engagement tactics they were categorized by three archetypes.

Brands that use mono- and multi-brand retail strategies for both ecommerce and bricks-and-mortar stores and also engage consumers on all types of digital communication are branded as “plugged-in pros.”

Amazon's Luxury Beauty page

Digital investments

As for consumer behavior the report saw that, in general, “digital passion” via “mobile penetration” is becoming more important in marketing. That being said, the report suggests that more can be done to further engage consumers online.

This engagement stems from four sources: online marketing metrics, or OMEX, that supports awareness and consideration to purchase and loyalty, social media, consumer feedback and the brand’s economic performance. Based on how the surveyed brands replied to their use of engagement tactics they were categorized by three archetypes.

Brands that use mono- and multi-brand retail strategies for both ecommerce and bricks-and-mortar stores and also engage consumers on all types of digital communication are branded as “plugged-in pros.”

Cartier can be defined as a "plugged-in pro"

The second distinction is “selective e-tailers” that maintain only a mono-brand Web site for entry-level products geared toward aspirational consumers and use digital as a marketing channel while the third is “hesitant holdouts.” This title is given to smaller brands with tight control on retail and which sell from mono-brand stores only and use digital platforms as showrooms rather than a point of sale.

From these categories, the report notes that the archetypes have their strengths and weaknesses that can be aided by various digital strategies. Overall, each brand has a unique DNA and style, and understanding the archetype will help marketers develop proper metrics to compete effectively in the digital space.

Behavior to savor

A main take away from the reports findings is that to succeed in the increasingly competitive digital space, brands should invest in a digital approach to reach consumers and as a secondary tactic that works to connect consumers with branded content.

For instance, a report by Boston Consulting Group explored the online shopping tendencies of Chinese consumers, such as a widely-held penchant for researching products at length. “The Chinese Digital Consumer in a Multichannel World” report explains that the number of Chinese online shoppers is expected to reach 380 million by 2016, which presents brands with huge swaths of potential customers (see story).

Also, in response to how smartphones have altered the way consumers shop, a report by Forrester Research indicated that 66 percent of luxury consumers are more willing to interact with a sales associate equipped with a mobile device.

The “A New Generation of Clienteling” report discovered that some consumers do not feel that sales associates are the best source of product information. With the role of sales associates changing, bringing mobile technology into stores may help re-establish trust while creating an enhanced experience for consumers (see story).

Digital is no longer enough for brands to create awareness and loyal consumers. These tactics must be supported by a strong mobile tactic.

"The main piece of advice is to shift your mindset from branding product to branding experience," Ms. Dauriz said. "Understand which experience or journey your customers are going through today and understand the break through they're going through.

"Measure what you're doing, " she said. "Measure the money you're spending, measure the results -- the operational KPI's.

"Don't be afraid of testing and learning as you go, but measure what you do -- but don't go wild and shift your money without knowing what the return is."

Mickey Alam Khan contributed to this article.

Final Take

Jen King, editorial assistant on Luxury Daily, New York

Cartier can be defined as a "plugged-in pro"

The second distinction is “selective e-tailers” that maintain only a mono-brand Web site for entry-level products geared toward aspirational consumers and use digital as a marketing channel while the third is “hesitant holdouts.” This title is given to smaller brands with tight control on retail and which sell from mono-brand stores only and use digital platforms as showrooms rather than a point of sale.

From these categories, the report notes that the archetypes have their strengths and weaknesses that can be aided by various digital strategies. Overall, each brand has a unique DNA and style, and understanding the archetype will help marketers develop proper metrics to compete effectively in the digital space.

Behavior to savor

A main take away from the reports findings is that to succeed in the increasingly competitive digital space, brands should invest in a digital approach to reach consumers and as a secondary tactic that works to connect consumers with branded content.

For instance, a report by Boston Consulting Group explored the online shopping tendencies of Chinese consumers, such as a widely-held penchant for researching products at length. “The Chinese Digital Consumer in a Multichannel World” report explains that the number of Chinese online shoppers is expected to reach 380 million by 2016, which presents brands with huge swaths of potential customers (see story).

Also, in response to how smartphones have altered the way consumers shop, a report by Forrester Research indicated that 66 percent of luxury consumers are more willing to interact with a sales associate equipped with a mobile device.

The “A New Generation of Clienteling” report discovered that some consumers do not feel that sales associates are the best source of product information. With the role of sales associates changing, bringing mobile technology into stores may help re-establish trust while creating an enhanced experience for consumers (see story).

Digital is no longer enough for brands to create awareness and loyal consumers. These tactics must be supported by a strong mobile tactic.

"The main piece of advice is to shift your mindset from branding product to branding experience," Ms. Dauriz said. "Understand which experience or journey your customers are going through today and understand the break through they're going through.

"Measure what you're doing, " she said. "Measure the money you're spending, measure the results -- the operational KPI's.

"Don't be afraid of testing and learning as you go, but measure what you do -- but don't go wild and shift your money without knowing what the return is."

Mickey Alam Khan contributed to this article.

Final Take

Jen King, editorial assistant on Luxury Daily, New York