Neiman Marcus preorder marketing image

Neiman Marcus preorder marketing image

Forty-seven percent of consumers also prefer to make purchases online, according to a report from the Shullman Research Center.

The report also calls attention to the retailers where affluent consumers across generations like to shop. For instance, Amazon was the most popular store among those surveyed, while Nordstrom had consistent responses from all generations and Neiman Marcus skewed toward millennials.

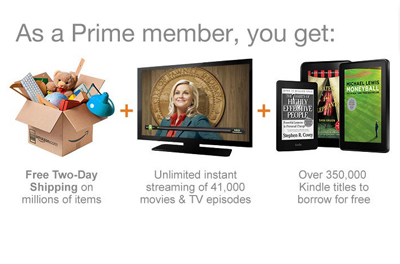

"You can’t ignore Amazon," said Bob Shullman, founder/CEO of the Shullman Research Center, New York. "They're exercising their muscle.

"A majority [of consumers] are willing to shop online," he said. "Go back five years and the numbers wouldn’t be that way."

The information found in the “Where and How the Wealthy Shop” report is based on the Shullman Luxury and Affluence Monthly Pulse Fall 2013 Preview Wave that was conducted online Aug. 20-27 among United States adults ages 18 or older.

A total of 1,013 completed interviews were obtained from five sample groups divided among four income brackets: $75,000 to $149,999, $150,000 to $249,999, $250,000 to $499,999 and $500,000+.

Making the rounds

Luxury consumers are not often associated with mass retailers such as Walmart and Target, but the latest Shullman report notes that these are the most commonly shopped at stores among affluent consumers.

Sixty-two percent of surveyed consumers shopped at Amazon in the 12 months prior to the period of data collection, fifty-four percent shopped at Walmart and 49 percent shopped at Target. Interestingly, Baby Boomers shopped at these retailers at a higher rate than other generations.

Amazon Prime ad

Of course, the bulk of these purchases are for inexpensive products that do not necessarily impinge on the sales of luxury retailers. Regardless, understanding that affluent consumers regularly shop at mass retailers may motivate some higher-end retailers to diversify price points.

Thirteen percent of respondents shopped at Neiman Marcus in the 12 months prior to the collection period, but millennials shopped at the retailer at a rate three times higher than Gen X'ers and Baby Boomers.

Nordstrom clocked even shopping results across generations with an overall rate of 22 percent.

Amazon Prime ad

Of course, the bulk of these purchases are for inexpensive products that do not necessarily impinge on the sales of luxury retailers. Regardless, understanding that affluent consumers regularly shop at mass retailers may motivate some higher-end retailers to diversify price points.

Thirteen percent of respondents shopped at Neiman Marcus in the 12 months prior to the collection period, but millennials shopped at the retailer at a rate three times higher than Gen X'ers and Baby Boomers.

Nordstrom clocked even shopping results across generations with an overall rate of 22 percent.

Nordstrom Rack Web site

In addition to outlining shopping preferences, the report also includes shopping aversions. For instance, 49 percent of affluent consumers are uncomfortable using a personal shopper to make purchases, and 41 percent are uncomfortable using a smartphone.

Rounding up

Although digital media is usurping more traditional forms, television, newspapers and out-of-home advertising still hold considerable sway, according to a report by the Shullman Research Center.

The “Reaching the Wealthy Consumer” report also looks into the engagement differences between consumers with a net-worth above $1 million and those below. Overall, the monthly pulse suggests that brands should continue to diversify their marketing strategy and continue to invest in traditional platforms (see story).

While not all millionaires have a high annual income, the report argues that they should still be a primary focus for marketers. As the report splits up its survey base, different attitudes emerge that may be useful for marketers (see story).

Also,72 percent of ultra-affluent said that they buy based on quality and less on price, and 64 percent said that they seek out superior service when shopping. This study builds upon the Shullman Research Center’s last study by providing a closer look at Amazon from the consumer’s perspective (see story).

Fifty-nine percent of adults in the United States have made a purchase on Amazon in the past year, according to the survey.

The “Shullman Luxury and Affluence Monthly Pulse” survey suggests that the consumer shift toward Amazon is powered by the engines of competitive pricing and convenience. Although Amazon’s ascent, capabilities and penetration of the luxury market are nothing new, determining the size of jeopardized market share will help luxury brands find a common ground with the online retailer (see story).

"There are certain groups that are very well poised to grow over time as the young wealthy get wealthier," Mr. Shullman said.

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

Nordstrom Rack Web site

In addition to outlining shopping preferences, the report also includes shopping aversions. For instance, 49 percent of affluent consumers are uncomfortable using a personal shopper to make purchases, and 41 percent are uncomfortable using a smartphone.

Rounding up

Although digital media is usurping more traditional forms, television, newspapers and out-of-home advertising still hold considerable sway, according to a report by the Shullman Research Center.

The “Reaching the Wealthy Consumer” report also looks into the engagement differences between consumers with a net-worth above $1 million and those below. Overall, the monthly pulse suggests that brands should continue to diversify their marketing strategy and continue to invest in traditional platforms (see story).

While not all millionaires have a high annual income, the report argues that they should still be a primary focus for marketers. As the report splits up its survey base, different attitudes emerge that may be useful for marketers (see story).

Also,72 percent of ultra-affluent said that they buy based on quality and less on price, and 64 percent said that they seek out superior service when shopping. This study builds upon the Shullman Research Center’s last study by providing a closer look at Amazon from the consumer’s perspective (see story).

Fifty-nine percent of adults in the United States have made a purchase on Amazon in the past year, according to the survey.

The “Shullman Luxury and Affluence Monthly Pulse” survey suggests that the consumer shift toward Amazon is powered by the engines of competitive pricing and convenience. Although Amazon’s ascent, capabilities and penetration of the luxury market are nothing new, determining the size of jeopardized market share will help luxury brands find a common ground with the online retailer (see story).

"There are certain groups that are very well poised to grow over time as the young wealthy get wealthier," Mr. Shullman said.

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York