Sixty percent of the world's population live in the Next 15

Sixty percent of the world's population live in the Next 15

As emerging markets continue to grow, 600 of the world’s top cities will be responsible for nearly 85 percent of global economic growth by 2025, according to a new report by McKinsey.

McKinsey suggests that through mass urbanization there will be 60 megacities, double that of today, accounting for a quarter of global GDP. To target these areas of growth, luxury brands must adjust strategies to include cities that may not yet be on their radar to ensure that they have a presence as new markets begin to flourish.

"It is hard for a brand entering a new emerging market to do everything at once," said Sophie Marchessou, associate partner at the apparel, fashion & luxury group at McKinsey, New York.

"Resources are often time limited (management attention, investment available...), so it is better to have a disciplined approach to target in priority cities that matter most," she said. "The largest cities in an emerging market also usually have a spillover effect on smaller cities, so by being present in the right cities, you improve your brand awareness overall.

"[Economic rebalancing] will affect [marketers] in many ways. There will be a constant conversation in companies about resource allocation, offer tailoring, brand building, etc."

McKinsey's LuxuryScope “The glittering power of cities for luxury growth” report used a methodology called CityScope that draws upon economic and socio-demographics for more than 2,600 cities around the world. McKinsey’s data goes down to the city level to predict growth and can be used by luxury brands to determine how to approach growth opportunities based on location.

Finding a city

For the first time since the Industrial Revolution, the world is undergoing a significant economic transformation. For example, modern-day China is urbanizing at a speed 10 times faster than the urbanization of 19th-century Britain, thus making Asia the world’s “economic center of gravity.”

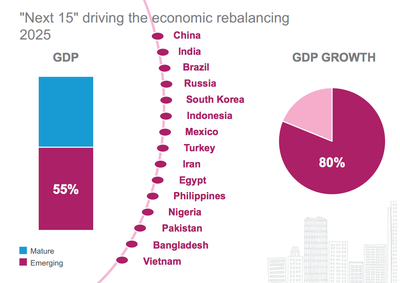

Growth extends beyond China and the other BRICs to include what McKinsey calls the “Next 15.” These additional 11 countries are set to drive 80 percent of emerging market growth even though they only account for 25 percent of the global GDP.

These regions include South Korea, Indonesia, Mexico, Turkey, Iran, Egypt, the Philippines, Nigeria, Pakistan, Bangladesh and Vietnam. With 60 percent of the world’s population living within these countries, brands now have opportunities for growth outside the traditional established markets.

McKinsey's LuxuryScope Next 15 chart

Although a significant amount of these emerging city markets are located in China, brands must extend their retail footprint within the Next 15’s smaller cities where growth potential is high. The 100 highest-growing cities such as Pune, India, Harbin, China and Luanda, Angola, will grow significantly in comparison to megacities such as Shanghai and Moscow.

McKinsey suggests that within the next 15 years the approximately 400 “second-tier” cities will yield wealth equivalent to the United States economy today.

Though other cities are growing, this does not necessarily mean the irrelevance of established markets. In terms of women’s ready-to-wear in the 20 largest city markets in 2025, for example, no Chinese cities make the cut and no emerging market cities fall within the top 5.

McKinsey's LuxuryScope Next 15 chart

Although a significant amount of these emerging city markets are located in China, brands must extend their retail footprint within the Next 15’s smaller cities where growth potential is high. The 100 highest-growing cities such as Pune, India, Harbin, China and Luanda, Angola, will grow significantly in comparison to megacities such as Shanghai and Moscow.

McKinsey suggests that within the next 15 years the approximately 400 “second-tier” cities will yield wealth equivalent to the United States economy today.

Though other cities are growing, this does not necessarily mean the irrelevance of established markets. In terms of women’s ready-to-wear in the 20 largest city markets in 2025, for example, no Chinese cities make the cut and no emerging market cities fall within the top 5.

Chart showing the 20 largest luxury women RTW cities in 2025, McKinsey

Western mega cities will benefit from “riding the wave of growth” as emerging countries develop and their maintained status will be driven by “cultural fit” and factors determined by category and price point. This is especially true for women’s luxury ready-to-wear, dominated by established fashion capitals such as Paris, Milan and New York.

Growth in emerging market cities is already apparent in luxury sectors such as fashion, spirits and beauty. Research suggests that luxury women’s wear will grow from less than 10 percent a decade ago to 32 percent in 2025, while high-end beauty products will double to represent 47 percent.

Chart showing the 20 largest luxury women RTW cities in 2025, McKinsey

Western mega cities will benefit from “riding the wave of growth” as emerging countries develop and their maintained status will be driven by “cultural fit” and factors determined by category and price point. This is especially true for women’s luxury ready-to-wear, dominated by established fashion capitals such as Paris, Milan and New York.

Growth in emerging market cities is already apparent in luxury sectors such as fashion, spirits and beauty. Research suggests that luxury women’s wear will grow from less than 10 percent a decade ago to 32 percent in 2025, while high-end beauty products will double to represent 47 percent.

McKinsey chart showing shift in emerging marekt categories

Although this growth signals that emerging markets are growing three times faster than their mature counterparts, moving into these areas is less advanced and will enable brands to make an impression much easier than they would in an established city.

Ninety percent of global luxury growth will result from consumers living in the top 20 apparel growth cities, seven of which are found in the Next 15 countries. China leads the way by driving half of this growth, while the remaining markets account for one-fifth of luxury consumers by 2025, a population four times that of the United Kingdom.

Growth spurt

To find success in these new market cities, McKinsey suggests a “city-by-city” strategy that allows brand to readjust business models, resource allocations and organizational structure. McKinsey sees this approach as a “compass for companies seeking to navigate the vast sea of emerging markets” whether in Belo Horizonte, Brazil or Wuhan, China.

Five main touchpoints should be tackled before a brand selects to enter an emerging city market. These include identifying the right go-to-market model per location, determining the need for local customization, ensuring standards in global customer service, gauging the need for organizational alterations and how to allocate resources.

These tactics have been undertaken by other brands that have entered emerging markets before the floodgates were opened, despite the risk.

For example, Estée Lauder Cos.’ expansion practices are marked by entering emerging markets ahead of other companies despite the increased risk, according to the “Building Empire” session May 13 at the FT Business of Luxury Summit.

Understanding risk tolerance is a must when embarking on any new project, especially when setting up shop in marketplace that is still developing. As one of the world’s most valuable brands, Estée Lauder strives to introduce its products ahead of competitors to better understand emerging markets (see story).

Beyond general market demographics, brands entering a new city location must have a handle on local culture, especially in the beauty sector.

For beauty marketers targeting consumers in emerging markets, it is essential to understand the grooming habits and preferred personal care products in the country at hand, according to a survey conducted by Euromonitor International.

In 2013, global sales of skin care products totaled more than $107 billion and the hair care market totaled $77 billion. These global sales figures, estimated to grow by 20 percent between 2014 and 2018, are reflective of the time, money and effort consumers spend on their appearances (see story).

Strategies must be outlined per country, rather than an oversweeping global tactic for all.

"The power of mega cities in the future," Ms. Marchessou said. "Many cities will be as large as countries - Tianjin will be the size of Sweden, Shanghai will be the size of Poland and Portugal together.

"It varies slightly by category but for luxury women ready to wear for example, Moscow, Singapore, Mexico City, Seoul and St. Petersburg will be in the top 20 largest cities by size," she said. "Beijing or Shanghai don't make it to the top 20 but are among the fastest growing.

"What those cities share is a growing upper class that drives the purchase of luxury apparel and potentially some tourist spend [which is] usually more relevant for developed cities though.

Authors: Aimee Kim, partner at McKinsey’s Seoul office, Nathalie Remy, principal and co-leader of McKinsey’s apparel, fashion & luxury group, Jennifer Schmidt, partner and Leader of Americas’

apparel, fashion & luxury group at McKinsey, NJ and Benjamin Durand-Servoingt, engagement manager at McKinsey, Paris.

Final Take

Jen King, lead reporter on Luxury Daily, New York

McKinsey chart showing shift in emerging marekt categories

Although this growth signals that emerging markets are growing three times faster than their mature counterparts, moving into these areas is less advanced and will enable brands to make an impression much easier than they would in an established city.

Ninety percent of global luxury growth will result from consumers living in the top 20 apparel growth cities, seven of which are found in the Next 15 countries. China leads the way by driving half of this growth, while the remaining markets account for one-fifth of luxury consumers by 2025, a population four times that of the United Kingdom.

Growth spurt

To find success in these new market cities, McKinsey suggests a “city-by-city” strategy that allows brand to readjust business models, resource allocations and organizational structure. McKinsey sees this approach as a “compass for companies seeking to navigate the vast sea of emerging markets” whether in Belo Horizonte, Brazil or Wuhan, China.

Five main touchpoints should be tackled before a brand selects to enter an emerging city market. These include identifying the right go-to-market model per location, determining the need for local customization, ensuring standards in global customer service, gauging the need for organizational alterations and how to allocate resources.

These tactics have been undertaken by other brands that have entered emerging markets before the floodgates were opened, despite the risk.

For example, Estée Lauder Cos.’ expansion practices are marked by entering emerging markets ahead of other companies despite the increased risk, according to the “Building Empire” session May 13 at the FT Business of Luxury Summit.

Understanding risk tolerance is a must when embarking on any new project, especially when setting up shop in marketplace that is still developing. As one of the world’s most valuable brands, Estée Lauder strives to introduce its products ahead of competitors to better understand emerging markets (see story).

Beyond general market demographics, brands entering a new city location must have a handle on local culture, especially in the beauty sector.

For beauty marketers targeting consumers in emerging markets, it is essential to understand the grooming habits and preferred personal care products in the country at hand, according to a survey conducted by Euromonitor International.

In 2013, global sales of skin care products totaled more than $107 billion and the hair care market totaled $77 billion. These global sales figures, estimated to grow by 20 percent between 2014 and 2018, are reflective of the time, money and effort consumers spend on their appearances (see story).

Strategies must be outlined per country, rather than an oversweeping global tactic for all.

"The power of mega cities in the future," Ms. Marchessou said. "Many cities will be as large as countries - Tianjin will be the size of Sweden, Shanghai will be the size of Poland and Portugal together.

"It varies slightly by category but for luxury women ready to wear for example, Moscow, Singapore, Mexico City, Seoul and St. Petersburg will be in the top 20 largest cities by size," she said. "Beijing or Shanghai don't make it to the top 20 but are among the fastest growing.

"What those cities share is a growing upper class that drives the purchase of luxury apparel and potentially some tourist spend [which is] usually more relevant for developed cities though.

Authors: Aimee Kim, partner at McKinsey’s Seoul office, Nathalie Remy, principal and co-leader of McKinsey’s apparel, fashion & luxury group, Jennifer Schmidt, partner and Leader of Americas’

apparel, fashion & luxury group at McKinsey, NJ and Benjamin Durand-Servoingt, engagement manager at McKinsey, Paris.

Final Take

Jen King, lead reporter on Luxury Daily, New York