Affluent consumers

Affluent consumers

NEW YORK – Luxury brands are delving into more bespoke options and marketing, according to Wealth-X’s president at Luxury Retail Summit: Holiday Focus 2014 Sept. 9.

Mr. Friedman spoke about the necessity among brands to understand their consumer, who they are, what they do and who their friends and family are in order to gain a full understanding of these individuals in order to effectively market. Luxury brands can learn from Wealth-X’s research on the ultra-high-net-worth individuals to create specific marketing strategy for the ultra-affluent.

“Wealth-X data looks at the relationships around the individuals, their wife, or girlfriend," said David Friedman, president of Wealth-X, New York.

“Content is the new black, content is the most important to generate insights into brands and into the ultra-high-net-worth-individuals,” he said.

Luxury Retail Summit: Holiday Focus 2014 was organized by Luxury Daily.

Bespoke in every way

The greater the compressed focus, the more a brand is able to connect with someone. Interaction with consumers is so short that brands have to make an impression and connect, in the right way, instantly.

Many brands turn to technology and social media to rake through their ultra-affluent consumers, but these individuals do not have a large online presence, they have to be determined manually.

Wealth-X has fielded through the UHNW individuals and have determined who they are, their stories and their lives. UHNW individuals are those who have a net worth of over $30 million, there are more than 200,000 people worldwide.

UHNW individuals

UHNW individuals have an average net worth of $139 million. This population is growing, especially in Asia.

China, in particular, has a fast growing population of UHNW individuals; Asia is becoming the new normal of luxury.

“When we talk about the new normal, it is the Wild West, literally,” Mr. Friedman said.

UHNW individuals

UHNW individuals have an average net worth of $139 million. This population is growing, especially in Asia.

China, in particular, has a fast growing population of UHNW individuals; Asia is becoming the new normal of luxury.

“When we talk about the new normal, it is the Wild West, literally,” Mr. Friedman said.

David Friedman at Luxury Retail Summit

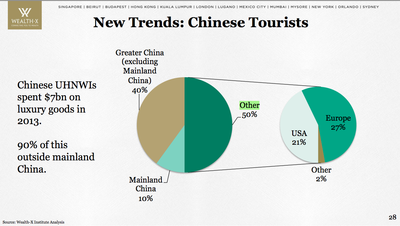

However, Chinese ultra-affluents are not buying in their home cities, or even their home countries, these consumers are traveling to other countries to make their large purchases.

The Chinese UHNW individuals spent about $7 billion on luxury goods in 2013, but about 90 percent of this spending was outside of mainland China.

David Friedman at Luxury Retail Summit

However, Chinese ultra-affluents are not buying in their home cities, or even their home countries, these consumers are traveling to other countries to make their large purchases.

The Chinese UHNW individuals spent about $7 billion on luxury goods in 2013, but about 90 percent of this spending was outside of mainland China.

Chinese Consumers look outside China

In these scenarios, brands must be aware of the client’s spending habits. If a brand is hosting an event in China for their top consumers and do not invite a Chinese consumer who happens to spend time primarily in Paris, they are harming a relationship with a top consumer.

Brands have to be aware of their consumer. It cannot be just a general database, but rather must really look into the person.

Many brands try "hope marketing," but this is not as efficient as knowing and understanding a client’s personal histories.

For example, having an event where consumers are invited to bring a guest may not necessarily bring similar consumers to the brand. But, having a dinner at a conference to a select guest list that has already been screened, a brand is more likely to end in a positive result for the brand.

Brands should look at their consumers individually, not in a mass sense. An email that is sent to the entire database will reach both aspirational consumers and UHNW individuals, a very broad range of consumers.

To account for this, brands can look through their own databases and find those who are UHNW individuals and create a bespoke marketing technique geared toward those specific people.

Previous research

Wealth-X has had several reports dedicated to the understanding of UHNW individuals.

For instance, 68 percent of luxury industry insiders believe digital marketing is not an effective method to reach ultra-high-net-worth individuals, according to a report by Wealth-X.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

Similarly, 84 percent of luxury marketers host events to reach ultra-high-net-worth individuals.

For the 62 percent that calculate ROI from their events, the most successful parties were product-centric, either launches, displays or educational. Even though events typically revolve around merchandise, the focus is usually more about making a connection (see story).

The ability to reach the UHNW individuals comes down to how well the brand understands the individual.

“It is not about the brand, but the consumer’s passions and interests and [marketers] weaving [their] brand into that,” Mr. Friedman said.

“Bespoke marketing develops sales and marketing strategy that radiates from the core and heart of the narrative of an individual person,” he said. “Who they are is more important than the way [marketers] are selling.”

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York, NY

Chinese Consumers look outside China

In these scenarios, brands must be aware of the client’s spending habits. If a brand is hosting an event in China for their top consumers and do not invite a Chinese consumer who happens to spend time primarily in Paris, they are harming a relationship with a top consumer.

Brands have to be aware of their consumer. It cannot be just a general database, but rather must really look into the person.

Many brands try "hope marketing," but this is not as efficient as knowing and understanding a client’s personal histories.

For example, having an event where consumers are invited to bring a guest may not necessarily bring similar consumers to the brand. But, having a dinner at a conference to a select guest list that has already been screened, a brand is more likely to end in a positive result for the brand.

Brands should look at their consumers individually, not in a mass sense. An email that is sent to the entire database will reach both aspirational consumers and UHNW individuals, a very broad range of consumers.

To account for this, brands can look through their own databases and find those who are UHNW individuals and create a bespoke marketing technique geared toward those specific people.

Previous research

Wealth-X has had several reports dedicated to the understanding of UHNW individuals.

For instance, 68 percent of luxury industry insiders believe digital marketing is not an effective method to reach ultra-high-net-worth individuals, according to a report by Wealth-X.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

Similarly, 84 percent of luxury marketers host events to reach ultra-high-net-worth individuals.

For the 62 percent that calculate ROI from their events, the most successful parties were product-centric, either launches, displays or educational. Even though events typically revolve around merchandise, the focus is usually more about making a connection (see story).

The ability to reach the UHNW individuals comes down to how well the brand understands the individual.

“It is not about the brand, but the consumer’s passions and interests and [marketers] weaving [their] brand into that,” Mr. Friedman said.

“Bespoke marketing develops sales and marketing strategy that radiates from the core and heart of the narrative of an individual person,” he said. “Who they are is more important than the way [marketers] are selling.”

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York, NY