Michael Kors fall/winter 2014 ad campaign

Michael Kors fall/winter 2014 ad campaign

The luxury sector is continuing to evolve with the majority of affluent consumers recognizing that the definition of luxury is not what it was five years ago, according to a new report by Martini Media. As consumers’ tastes have changed from exclusive or status-oriented products to an interest in rare experiences, the Internet has been a driving factor in how these individuals make decisions regarding purchases and bookings. Marketers have invested heavily in digital marketing to account for this trend and to provide consumers with content geared toward ensuring informative purchases.

"I would say, first and foremost, that the pool of luxury consumers is expanding fairly quickly, especially in the United States, and that’s going to catalyze change," Erik Pavelka, CEO of Martini Media, San Francisco. "It means new brands and different strategies will be able to succeed.

"But generally, within luxury there will be a push towards authenticity and imparting unique experiences, and a move away from 'exclusivity' or status-oriented branding," he said. "That’s true of travel, auto companies, fashion, jewelry, etc. And luxury brands are going to expand their digital presence very considerably, including video and multimedia production, where they can really leave a lasting impression on consumers."

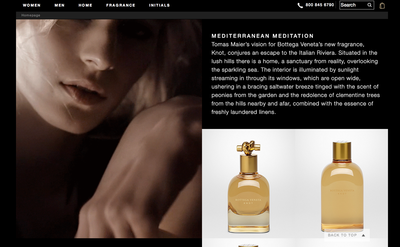

“The Martini Report: The Affluent Audience Online Vol. 2 Luxury Goods” details luxury interests and online engagement among several high-earning segments, and in particular focuses on the hyper affluent (the 3-4 percent of Americans with at least $250,000 in annual household income). The survey was conducted online by Ipsos MediaCT from Jan. 5-12, 2015 among 882 adults aged 18 or older with at least $75,000 in annual household income; the sample included 145 Hyper Affluent consumers, defined as those with at least $250,000 in annual household income. The data were weighted to reflect U.S. Census figures to ensure representative results. Reshaped behavior Consumer inspiration and research, as well as brand marketing tactics have been reshaped by the Internet in the luxury space. Now that affluent consumers are increasingly mobile-savvy and rely on their devices for research and purchasing it is essential for brands to be functional and present on the Web. For luxury product purchases, affluent consumers undertake a large amount of research to ensure quality and the best available price for an item. The report determined that 83 percent of hyper affluent consumers surveyed spent time researching a product online before coming to a decision. Bottega Veneta Web site for The Knot

Though before the research is conducted, affluent consumers responded that for ideas and inspiration regarding luxury purchases, they consult online outlets the most. However, in other non-luxury market categories, consumers gravitate toward retail stores and peer recommendations for inspiration.

The role of the Internet expands into how affluent consumers communicate about luxury purchases and preferred products. Of the respondents, 44 percent of hyper affluents agreed that they “really enjoy talking about [their] favorite luxury brands with others.”

This dialogue is extended with 32 percent saying that they have participated in an online forum, written a blog or posted on a social media site regarding a preferred brand. With this said, affluent consumers who engage with a brand online become an organic advocate for its products, experiences and services.

Martini also found that these figures are significantly higher among younger affluents who are never far from their device and strive for personal interactions from their favored brands.

Bottega Veneta Web site for The Knot

Though before the research is conducted, affluent consumers responded that for ideas and inspiration regarding luxury purchases, they consult online outlets the most. However, in other non-luxury market categories, consumers gravitate toward retail stores and peer recommendations for inspiration.

The role of the Internet expands into how affluent consumers communicate about luxury purchases and preferred products. Of the respondents, 44 percent of hyper affluents agreed that they “really enjoy talking about [their] favorite luxury brands with others.”

This dialogue is extended with 32 percent saying that they have participated in an online forum, written a blog or posted on a social media site regarding a preferred brand. With this said, affluent consumers who engage with a brand online become an organic advocate for its products, experiences and services.

Martini also found that these figures are significantly higher among younger affluents who are never far from their device and strive for personal interactions from their favored brands.

Estee Lauder user-generated content for Lipstick Envy

Estee Lauder user-generated content for Lipstick Envy

"The most surprising finding is the degree to which affluent consumers, and younger consumers in particular, consider online outlets the most trusted source for pre-purchase research for luxury goods," Mr. Pavelka said.

"That goes against the instincts a lot of luxury marketers have held about digital media and luxury goods not being a good fit and is also a surprise because in other market research you find people look to friends and family or retail associates," he said. "This survey shows that if anything, affluent consumers are more at home doing product research online, and the response among emerging affluents points to that being a trend and not one-off for this survey."

In terms of purchasing, online is the most widespread among affluent consumers. Of those surveyed, 69 percent said that are very comfortable purchasing luxury products and services online, while 55 percent plan to continue to do so in the coming year. In addition to consumers' purchasing behavior, the products they are most interested in have also changed. Sixty-three percent of respondents noted that “the definition of luxury is not the same as it was five years ago.” Louis Vuitton's Series 2 campaign

Nowadays, affluent consumers would much rather buy a luxury good that is elegant and minimalist over an item that is flashy or ornate. The same is true for experiences, with consumers seeking out rare, curated moments rather than something considered to be a prestigious or status-oriented event.

Research by Wealth-X supports the notion that experiential marketing is the best way to reach affluent consumers.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

Above all, Martini found that respondents place an emphasis on quality. When on the fence about a particular item or service, affluent consumers use quality as a “tiebreaker,” well ahead of price, consumer reviews or even brand notoriety.

This sentiment is shared by consumers outside of the U.S. as well.

In China, if a product is expensive it does not equal luxury unless it meets a standard of quality. For the rising middle class and younger generation of Chinese luxury products are used to express personal style while recognition of a worn or used brand is seen as a reflection of status (see story).

Evolution of marketing

As consumer behavior has developed to account for the Internet, marketing tactics have matured to meet affluents where they would like to shop and interact with luxury brands.

Nearly all marketing efforts have a video element to some degree, whether it is a Vine-format or an extended campaign film. Of those surveyed, 61 percent of hyper affluents agree that the videos in digital advertisements have helped bring the brand to life.

For example, department store chain Saks Fifth Avenue is generating traffic to its Tumblr page with new shoe graphics interchange formats, or GIFs.

The page is full of different women in various shoes sporting their own style. The dynamic nature of GIFs adds spunk to the page and will likely appeal to consumers with its bright colors and fun patterns (see story).

Also, 41 percent of respondents said that they would most likely make more purchases if they were able to speak or video chat with a sales associate on a brand’s Web site.

For instance, British smartphone manufacturer Vertu has updated its Web site and online services to offer an ecommerce platform for consumers.

The new online purchasing capabilities on Vertu’s Web site is released alongside a new live chat option for consumers. The updated Web site will likely draw consumers for extended time periods and will help Vertu to maintain its white glove service on a digital platform (see story).

Mr. Pavelka suggests working with publishers in the digital space to better fortify a brand's connection to consumers.

Louis Vuitton's Series 2 campaign

Nowadays, affluent consumers would much rather buy a luxury good that is elegant and minimalist over an item that is flashy or ornate. The same is true for experiences, with consumers seeking out rare, curated moments rather than something considered to be a prestigious or status-oriented event.

Research by Wealth-X supports the notion that experiential marketing is the best way to reach affluent consumers.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

Above all, Martini found that respondents place an emphasis on quality. When on the fence about a particular item or service, affluent consumers use quality as a “tiebreaker,” well ahead of price, consumer reviews or even brand notoriety.

This sentiment is shared by consumers outside of the U.S. as well.

In China, if a product is expensive it does not equal luxury unless it meets a standard of quality. For the rising middle class and younger generation of Chinese luxury products are used to express personal style while recognition of a worn or used brand is seen as a reflection of status (see story).

Evolution of marketing

As consumer behavior has developed to account for the Internet, marketing tactics have matured to meet affluents where they would like to shop and interact with luxury brands.

Nearly all marketing efforts have a video element to some degree, whether it is a Vine-format or an extended campaign film. Of those surveyed, 61 percent of hyper affluents agree that the videos in digital advertisements have helped bring the brand to life.

For example, department store chain Saks Fifth Avenue is generating traffic to its Tumblr page with new shoe graphics interchange formats, or GIFs.

The page is full of different women in various shoes sporting their own style. The dynamic nature of GIFs adds spunk to the page and will likely appeal to consumers with its bright colors and fun patterns (see story).

Also, 41 percent of respondents said that they would most likely make more purchases if they were able to speak or video chat with a sales associate on a brand’s Web site.

For instance, British smartphone manufacturer Vertu has updated its Web site and online services to offer an ecommerce platform for consumers.

The new online purchasing capabilities on Vertu’s Web site is released alongside a new live chat option for consumers. The updated Web site will likely draw consumers for extended time periods and will help Vertu to maintain its white glove service on a digital platform (see story).

Mr. Pavelka suggests working with publishers in the digital space to better fortify a brand's connection to consumers.

"Identify the publishers you want to be associated with, and develop ad campaigns that enhance, and are enhanced by, the content and message for that outlet," he said.

"For luxury brands especially, you don’t want to have your marketing splashed 'across the Web.' Know your consumer, and understand the places where they live online."

Final Take Jen King, lead reporter on Luxury Daily, New York