Estée Lauder Pure Color Envy Sculpting lipsticks

Estée Lauder Pure Color Envy Sculpting lipsticks

Guided selling tactics are used by the majority of beauty marketers to encourage discovery, exploration and decision-making, but brands often make tactical missteps that diminish effectiveness, according to a new report by L2.

L2’s “Beauty: Guided Selling” Insight Report found that ecommerce sales in the beauty sector have increased in part by the incorporation of guided selling practices ranging from content blended with personalization to interactive tools and navigational filters to a combination of approaches. These tactics have helped widen the consumers’ scope by inspiring the purchase of new products, rather than relying on ecommerce to simply replenish favorites.

"Brands can use guided selling to improve the consumer experience by personalizing the discovery, exploring and purchasing of products which suit their specific needs," said Eleanor Powers, director, Insight Reports, at L2, New York.

L2's Insight Reports complements its Digital IQ Index with an in-depth analysis of specific tactics and opportunities. A Digital IQ Index assesses the digital performance of the top 60-100 brand across 12 industry verticals and 11 geographies. Brands are ranked against their peers on more than 850 data points to determine their strengths and weaknesses.

Guided tours

Although beauty brands have leveraged at least one form of guided selling, and the sector itself over-indexes their usage when compared to other product categories, tactical missteps are often made.

L2 found that siloing is the most basic misstep made by brands. Instead, brands should be integrating these tactics into the path to purchase path through a combined approach of product navigation, gallery pages and product pages.

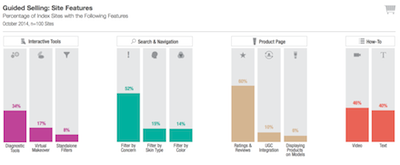

The report’s findings broke down the various Web site features that fall under the guided selling umbrella. These include: interactive tools, search and navigation, product page and how-to.

Of the 100 beauty brand Web sites surveyed, 34 percent include interactive tools such as diagnostics, 52 percent use filter by concern search and navigation and 60 percent rely on ratings and reviews within the product page. How-to features incorporate video and text 46 and 40 percent of the time, respectively.

Lesser used tactics are visual makeovers, standalone filters for consumer interaction, filter by skin type or color for search and navigation, user-generated content integration and products displayed on models within the product page. Thus a combination of diagnostics, filters based on concern, peer ratings and reviews and a video- and content-based tutorial is likely a winning recipe for beauty brands.

Chart on guided selling site features in the beauty space, provided by L2

L2 suggests that beauty brands place interactive tools on primary navigation pages rather than within a product page because it will ensure discoverability and have an impact on conversions. Of the 47 percent of sites with interactive tools, only 22 featured on primary navigation pages while 17 percent were housed within a product page.

Diagnostic tools were the most common interactive touchpoints on the Web sites surveyed. These allow consumers who know what they are looking for to find their products easily through product-specific navigation while also offering new consumers to be given recommendations by taking a simple quiz.

Of the beauty brand surveyed only 7 percent of branded sites on L2’s Beauty Index offer a virtual makeover tool. Luxury brands can benefit from including this tactic as consumers can upload an image of themselves to virtually apply cosmetics as well as the added convenience of saving the picture for a later date to be reviewed or new products tried.

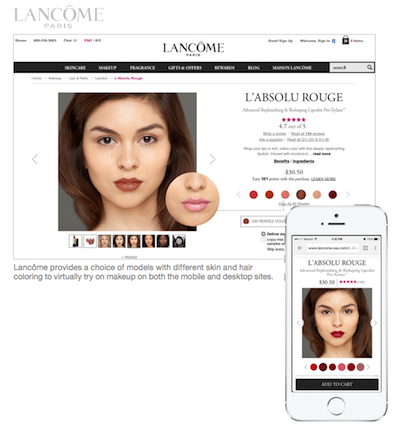

This reflects the practice of many marketers by relying on a model display to showcase beauty products. But, as L2 puts it “one shade does not always fit all,” which has resulted in beauty marketers, such as Estée Lauder and Lancôme, to add models of different races and skin tones to their model displays giving a better representation of their consumer base.

For example, Lancôme is letting consumers see what a product will look like on a similar skin tone with a new ecommerce tool.

Chart on guided selling site features in the beauty space, provided by L2

L2 suggests that beauty brands place interactive tools on primary navigation pages rather than within a product page because it will ensure discoverability and have an impact on conversions. Of the 47 percent of sites with interactive tools, only 22 featured on primary navigation pages while 17 percent were housed within a product page.

Diagnostic tools were the most common interactive touchpoints on the Web sites surveyed. These allow consumers who know what they are looking for to find their products easily through product-specific navigation while also offering new consumers to be given recommendations by taking a simple quiz.

Of the beauty brand surveyed only 7 percent of branded sites on L2’s Beauty Index offer a virtual makeover tool. Luxury brands can benefit from including this tactic as consumers can upload an image of themselves to virtually apply cosmetics as well as the added convenience of saving the picture for a later date to be reviewed or new products tried.

This reflects the practice of many marketers by relying on a model display to showcase beauty products. But, as L2 puts it “one shade does not always fit all,” which has resulted in beauty marketers, such as Estée Lauder and Lancôme, to add models of different races and skin tones to their model displays giving a better representation of their consumer base.

For example, Lancôme is letting consumers see what a product will look like on a similar skin tone with a new ecommerce tool.

Lancôme visualizer

Lancôme is using Sight Commerce’s Infinite cloud-based visual commerce solution, which allows consumers to select a model that is the closest to their skin color and then see how any products they browse would look once applied. Shopping for cosmetics online can be stressful, since it can be difficult for consumers to tell how a certain color or product will look on their face, a problem this tool aims to solve (see story).

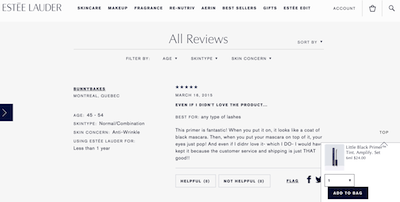

Ratings and reviews made by peers are important elements to consumer purchasing decisions. Only 32 percent of online consumers in the United States trust a brand’s own marketing communications, but 76 percent are more likely to purchase if positive peer ratings and reviews are seen.

As useful as ratings and reviews are, not all brands are making full use of the information that may aid in a consumer’s path to purchase. L2 found that 52 percent of sites allow reviews to be sorted, while only 18 percent allow products to be filtered by characteristic and 22 percent by user characteristic.

If a consumer is able to filter out results that are not reflective of their own needs or a preferred product quality they may become deterred because sufficient information was not provided.

Lancôme visualizer

Lancôme is using Sight Commerce’s Infinite cloud-based visual commerce solution, which allows consumers to select a model that is the closest to their skin color and then see how any products they browse would look once applied. Shopping for cosmetics online can be stressful, since it can be difficult for consumers to tell how a certain color or product will look on their face, a problem this tool aims to solve (see story).

Ratings and reviews made by peers are important elements to consumer purchasing decisions. Only 32 percent of online consumers in the United States trust a brand’s own marketing communications, but 76 percent are more likely to purchase if positive peer ratings and reviews are seen.

As useful as ratings and reviews are, not all brands are making full use of the information that may aid in a consumer’s path to purchase. L2 found that 52 percent of sites allow reviews to be sorted, while only 18 percent allow products to be filtered by characteristic and 22 percent by user characteristic.

If a consumer is able to filter out results that are not reflective of their own needs or a preferred product quality they may become deterred because sufficient information was not provided.

Filterable reviews for Estée Lauder's Little Black Primer

Recently, user-generated content has been incorporated into branded communications as a way for brands to present an authentic representation of its products in a natural setting. With 48 percent of consumers trusting UGC over other variations of branded communications, many brands still position their user-generated content at the top of the funnel for brand equity play rather than to drive conversions.

For instance, Estée Lauder is introducing its latest Pure Color Envy sculpting lipstick with an online boutique that combines user-generated content with interactive features that explore the range (see story).

The use of how-to videos and instructional text allows the brand to steer consumers to a specific product by showing how to best use it.

Video tutorials play an important role and 37 percent of online beauty consumers will watch a how-to prior to making a purchase as part of her decision making. YouTube is the preferred video outlet for how-tos, but 32 percent of consumers have also watched tutorials directly on a brand’s Web site.

Dolce & Gabbana winter 2014 makeup video tutorial with Pat McGrath

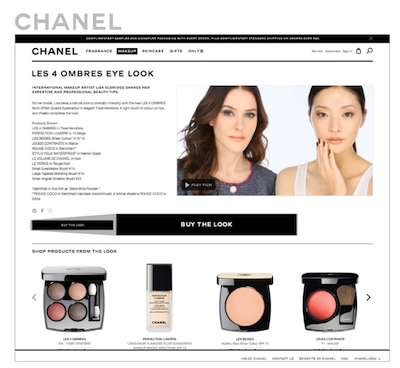

Placement of video tutorials occurred on the product page of 46 percent of the brand sites. This allows the consumer to visualize the product within her daily routine as she plans her purchase.

But, brands can be doing more to encourage a purchase after the video content has been viewed. Many, about a third, allow products to be added directly to a cart from the video page while 6 percent include a “buy all” or “add all to cart” prompt. Fifty-nine percent of brands include a link for the featured products to encourage consumers to make a purchase.

Filterable reviews for Estée Lauder's Little Black Primer

Recently, user-generated content has been incorporated into branded communications as a way for brands to present an authentic representation of its products in a natural setting. With 48 percent of consumers trusting UGC over other variations of branded communications, many brands still position their user-generated content at the top of the funnel for brand equity play rather than to drive conversions.

For instance, Estée Lauder is introducing its latest Pure Color Envy sculpting lipstick with an online boutique that combines user-generated content with interactive features that explore the range (see story).

The use of how-to videos and instructional text allows the brand to steer consumers to a specific product by showing how to best use it.

Video tutorials play an important role and 37 percent of online beauty consumers will watch a how-to prior to making a purchase as part of her decision making. YouTube is the preferred video outlet for how-tos, but 32 percent of consumers have also watched tutorials directly on a brand’s Web site.

Dolce & Gabbana winter 2014 makeup video tutorial with Pat McGrath

Placement of video tutorials occurred on the product page of 46 percent of the brand sites. This allows the consumer to visualize the product within her daily routine as she plans her purchase.

But, brands can be doing more to encourage a purchase after the video content has been viewed. Many, about a third, allow products to be added directly to a cart from the video page while 6 percent include a “buy all” or “add all to cart” prompt. Fifty-nine percent of brands include a link for the featured products to encourage consumers to make a purchase.

Chanel offers "buy all" on beauty how-to pages

As for text-based tutorials, 40 percent offer this type of instruction, with 75 percent linking to featured products and only 35 percent allow products to be placed in a cart from the how-to section. Only 5 percent provide a “buy all” option.

The beauty of spending

Increasingly, beauty brands are making investments in digital, simultaneously retaining or reducing their spend in traditional print media.

From choosing a new spokesperson based on social media followers to launching a new line centered on a blogger, marketers are using digital to guide their decisions, recognizing the influence that these tastemakers have on their audience. Beauty brands are largely embracing social media themselves as a way to connect directly with consumers (see story).

The “Insight Report: Prestige Retailer Ecommerce” details the digital IQ of beauty brands in today’s market and found that those that focused on both online reviews and search visibility were more successful than their competitors. The study’s statistics revealed that brands such as Estée Lauder and Christian Dior have been especially savvy in these departments (see story).

These beauty brands have likely been highly ranked given their understanding and incorporation of multiple guided selling practices within campaign efforts.

"While the best tools will vary according to the type of product, integration of guided selling tools along the path to purchase in navigation, gallery pages and product pages is critical for their discovery and use," Ms. Powers said.

"Navigational filters are an intuitive integration for consumers, leveraging expectations for site functionality," she said. "Gallery and page integrations place tools and information where the consumer will see them as they are evaluating a product."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Chanel offers "buy all" on beauty how-to pages

As for text-based tutorials, 40 percent offer this type of instruction, with 75 percent linking to featured products and only 35 percent allow products to be placed in a cart from the how-to section. Only 5 percent provide a “buy all” option.

The beauty of spending

Increasingly, beauty brands are making investments in digital, simultaneously retaining or reducing their spend in traditional print media.

From choosing a new spokesperson based on social media followers to launching a new line centered on a blogger, marketers are using digital to guide their decisions, recognizing the influence that these tastemakers have on their audience. Beauty brands are largely embracing social media themselves as a way to connect directly with consumers (see story).

The “Insight Report: Prestige Retailer Ecommerce” details the digital IQ of beauty brands in today’s market and found that those that focused on both online reviews and search visibility were more successful than their competitors. The study’s statistics revealed that brands such as Estée Lauder and Christian Dior have been especially savvy in these departments (see story).

These beauty brands have likely been highly ranked given their understanding and incorporation of multiple guided selling practices within campaign efforts.

"While the best tools will vary according to the type of product, integration of guided selling tools along the path to purchase in navigation, gallery pages and product pages is critical for their discovery and use," Ms. Powers said.

"Navigational filters are an intuitive integration for consumers, leveraging expectations for site functionality," she said. "Gallery and page integrations place tools and information where the consumer will see them as they are evaluating a product."

Final Take

Jen King, lead reporter on Luxury Daily, New York