Amazon Fashion promotional image

Amazon Fashion promotional image

Online marketplace Amazon is a threat to many luxury brands with its expanding presence and recent ranking as the top store for affluent consumers, according to Shullman Research Center.

Consumers are increasingly turning to mass-market online retailers to shop for the convenience, lower prices and better selection. Competing with retailers that can offer these benefits to consumers is a challenge among luxury labels, but the exclusivity and service options of these brands often win with top consumers looking for the total experience when purchasing a product.

“Amazon has been running full page fashion ads in The New York Times, so Amazon, to me, is already pounding on the whole luxury business,” said Bob Shullman, founder/CEO of the Shullman Research Center, New York. “They are doing it in beauty and now in fashion.”

“Where The Buys Are — Shopping by the Affluent Generations,” focuses on the different generations of affluent adults — those adults (age 18+) living in households whose household incomes begin at $75,000 (the top 34 percent of all U.S. households) and range to $500,000 or more — this time by looking at differences in how the generations shop. The total adults household income of $75,000 or more in the U.S. is 99 million.

Amazing Amazon

Last week it was speculated that Amazon may be in talks to purchase British ecommerce site Net-A-Porter.

The etail giant has been unsuccessful in entering the luxury industry in spite of attempts in recent years, and this potential acquisition could be significant for the future of both companies. The impact that this purchase could have have had on Net-A-Porter is unclear, but the retailer has been not been profitable despite its popularity (see story).

Also, ecommerce is being challenged by larger online retailers. When British retailer AllSaints began accepting Amazon Payments there was concern among fashion brands, which escalated with the rumors surrounding Amazon and Net-A-Porter.

Amazon Prime’s rewards encourage consumers to shop online and receive free shipping for an annual fee. The Prime membership concept has been adapted by ShopRunner, a platform used by one-fifth of luxury brands (see story).

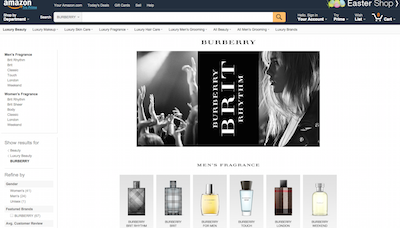

Also, with the addition of Burberry and others in Amazon’s beauty selection, fashion collections and brands will likely follow.

Burberry fragrance on Amazon

Despite Amazon’s efforts to attract luxury fashion labels, the online retailer’s official distribution rates sit at 16 percent, showing a general aversion to selling on the platform, according to a new report by L2.

Luxury brands are very protective of their image, including retail, and they now have more options to turn to for ecommerce, whether their own direct-operated online stores or third party online retailers that specialize in fashion. If Amazon wants to woo more luxury brands, it will need to clean up its image (see story).

Amazon’s influences are seen through the 67 percent, or almost 67 million, affluent adults who report Amazon as their top shopping destination. This number correlates with age as millennials are reported below the average and 76 percent of baby boomers claim to choose the retailer.

“At some point the luxury people need to be aware that Amazon is coming at them in many different directions,” Mr. Shullman said.

The top luxury brand is Nordstrom, falling in as the 24th highest store with about 11 million affluents shopping at the department store.

The research and discovery phases of affluent shopping reflects the online shopping influence with 84 percent of affluent consumers claiming to research online prior to shopping. However, 42 percent of affluents report choosing in-store shopping over online, indicating that the in-store experience is not completely lost.

Consumers chose indoor options because they prefer to see, touch, smell, try and taste the item prior to their purchase. Twenty-nine percent of affluent chose to shop in-store out of pure enjoyment of shopping and others like the immediate gratification.

Burberry fragrance on Amazon

Despite Amazon’s efforts to attract luxury fashion labels, the online retailer’s official distribution rates sit at 16 percent, showing a general aversion to selling on the platform, according to a new report by L2.

Luxury brands are very protective of their image, including retail, and they now have more options to turn to for ecommerce, whether their own direct-operated online stores or third party online retailers that specialize in fashion. If Amazon wants to woo more luxury brands, it will need to clean up its image (see story).

Amazon’s influences are seen through the 67 percent, or almost 67 million, affluent adults who report Amazon as their top shopping destination. This number correlates with age as millennials are reported below the average and 76 percent of baby boomers claim to choose the retailer.

“At some point the luxury people need to be aware that Amazon is coming at them in many different directions,” Mr. Shullman said.

The top luxury brand is Nordstrom, falling in as the 24th highest store with about 11 million affluents shopping at the department store.

The research and discovery phases of affluent shopping reflects the online shopping influence with 84 percent of affluent consumers claiming to research online prior to shopping. However, 42 percent of affluents report choosing in-store shopping over online, indicating that the in-store experience is not completely lost.

Consumers chose indoor options because they prefer to see, touch, smell, try and taste the item prior to their purchase. Twenty-nine percent of affluent chose to shop in-store out of pure enjoyment of shopping and others like the immediate gratification.

Digital influence seen at Faberge's Big Egg Hunt

The 28 percent of affluents who claim to shop in-store because of the immediacy are being pulled to the next day shipping options seen by online retailers, such as Amazon.

Those who prefer online shopping do so because of the convenience and free shipping as well as a better price and more selection online.

As digital channel continue to surge, the influence of ecommerce and online retailers will likely change the face of luxury consumption.

Digital prevails

Research prior to in-store arrival is an increasingly common trend that brands are being forced to accommodate to in order to be strong competitors among the many other options available for consumers.

Consumers are split on their willingness to download luxury brand applications, but when dispersed into generations, 72 percent of millennials are inclined to download a branded app, according to a report from The Luxury Institute.

Digitization of the luxury world is slowly evolving as younger generations grow into being affluent consumers. Luxury clients differ across more than just generations, but understanding the prime and upcoming consumer can prepare marketing teams for the future (see story).

Research can lead to online purchase if a consumer finds a better price, or free shipping options, a concept that can drive purchases away from direct brand purchasing. Some brands have been adapting to this with increase physical store presences.

“If you are a luxury brand there are not that many stores where you can buy that stuff, if you put a pop-up store in a location where a lot of people pass it and you put aspirational type items in it, you might do well,” Mr. Shullman said.

“They are getting the millennials who are buying gifts, or splurging for themselves and going into their store,” he said. "It is a way for brands to introduce themselves."

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York

Digital influence seen at Faberge's Big Egg Hunt

The 28 percent of affluents who claim to shop in-store because of the immediacy are being pulled to the next day shipping options seen by online retailers, such as Amazon.

Those who prefer online shopping do so because of the convenience and free shipping as well as a better price and more selection online.

As digital channel continue to surge, the influence of ecommerce and online retailers will likely change the face of luxury consumption.

Digital prevails

Research prior to in-store arrival is an increasingly common trend that brands are being forced to accommodate to in order to be strong competitors among the many other options available for consumers.

Consumers are split on their willingness to download luxury brand applications, but when dispersed into generations, 72 percent of millennials are inclined to download a branded app, according to a report from The Luxury Institute.

Digitization of the luxury world is slowly evolving as younger generations grow into being affluent consumers. Luxury clients differ across more than just generations, but understanding the prime and upcoming consumer can prepare marketing teams for the future (see story).

Research can lead to online purchase if a consumer finds a better price, or free shipping options, a concept that can drive purchases away from direct brand purchasing. Some brands have been adapting to this with increase physical store presences.

“If you are a luxury brand there are not that many stores where you can buy that stuff, if you put a pop-up store in a location where a lot of people pass it and you put aspirational type items in it, you might do well,” Mr. Shullman said.

“They are getting the millennials who are buying gifts, or splurging for themselves and going into their store,” he said. "It is a way for brands to introduce themselves."

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York