Michael Kors watch promotional image

Michael Kors watch promotional image

In the last 15 years, consumer sentiment has shifted from apparel to accessories with nearly 20 global fashion brands signing licensing agreements with mass watchmakers such as Fossil, Movado and Timex.

With that in mind, U.S. fashion label Michael Kors timepieces, produced under a license held by Fossil, was the top selling watch brand in the United States by value today. For Fossil alone, its license agreements drive more than 50 percent of the Group’s overall revenue and account for more than 90 percent of annual growth, signaling the unwavering interest among consumers.

"The main areas for improvement for fashion and licensed brands are increased programming for watch collections, better on-site integration and better product imagery," said Reid Sherard, research lead on watches & jewelry at L2, New York. "Almost all of brands in the report were under-supported compared to other product categories on email, Facebook, YouTube and Instagram.

"One quarter of brands include watches as part of the main site navigation (next to accessories, apparel, handbags, etc.), while over half hide watches as a sub-category (i.e. accessories, jewelry), obscuring visibility," he said. "And diversity of available image collateral for watches is the lowest across competing retail categories, including luxury watches & jewelry, fashion and retail."

The 2015 Digital IQ Index: Mass & Licensed Watches looked at the digital performance of 74 watch brands including Web site and ecommerce, digital marketing, social media and mobile touchpoints. Data was collected during the first quarter of 2015.

Brands featured in the report were 40 mass brands which included Timex, Fossil and Swatch as well as licensed brands such as Michael Kors, Gucci and Versace.

Watching out

In L2’s Digital IQ Index: Mass & Licensed Watches, the frontrunner is Michael Kors with a Digital IQ of 148. The label received its high rating in part due to its #MKTimeless digital campaign.

Michael Kors expanded its social media footprint with its #MKTimeless Tumblr channel that connects enthusiasts who have affinity for the brand’s watch collection.

The branded hashtag was inspired by a 2010 Twitter trend where enthusiasts used #MKTimeless to discuss their Michael Kors watches. The Tumblr joined Michael Kors’ Twitter, Facebook and Instagram accounts that also use the hashtag to connect with enthusiasts (see story).

#MKTimeless Pinterest board by Michael Kors

Brands listed as gifted by L2, and found within the top 25, included Swarovski, Gucci, Tag Heuer, Burberry and Marc by Marc Jacobs. Those listed as average include Longines, Hugo Boss, Scuderia Ferrari, Ralph Lauren and Versace, while brands defined as challenged included Dior, Chanel, Salvatore Ferragamo, Fendi and Dolce & Gabbana.

On the end of the spectrum, categorized as feeble, were brands such as Porsche Design, Karl Lagerfeld and Versus Versace.

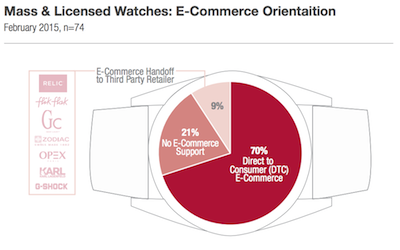

L2 found that mass and licensed brand watches are better at ecommerce than their luxury counterpoints, likely due to a lower price bracket. Of the brands surveyed 70 percent offer direct to consumer ecommerce, whereas only 45 percent of luxury watchmakers offer the same.

Also, approximately 10 percent of mass and licensed brands link the consumer to a third-party retailer for purchase. This means that only one in five brands surveyed lack an ecommerce strategy.

Because many of the licensed watches are part of a fashion brand’s portfolio, marketers invest in an omnichannel strategy, such as click-and-collect, which leverages a larger retail footprint. In comparison, for mass brands, there is more reliance on wholesale distribution.

#MKTimeless Pinterest board by Michael Kors

Brands listed as gifted by L2, and found within the top 25, included Swarovski, Gucci, Tag Heuer, Burberry and Marc by Marc Jacobs. Those listed as average include Longines, Hugo Boss, Scuderia Ferrari, Ralph Lauren and Versace, while brands defined as challenged included Dior, Chanel, Salvatore Ferragamo, Fendi and Dolce & Gabbana.

On the end of the spectrum, categorized as feeble, were brands such as Porsche Design, Karl Lagerfeld and Versus Versace.

L2 found that mass and licensed brand watches are better at ecommerce than their luxury counterpoints, likely due to a lower price bracket. Of the brands surveyed 70 percent offer direct to consumer ecommerce, whereas only 45 percent of luxury watchmakers offer the same.

Also, approximately 10 percent of mass and licensed brands link the consumer to a third-party retailer for purchase. This means that only one in five brands surveyed lack an ecommerce strategy.

Because many of the licensed watches are part of a fashion brand’s portfolio, marketers invest in an omnichannel strategy, such as click-and-collect, which leverages a larger retail footprint. In comparison, for mass brands, there is more reliance on wholesale distribution.

Infographic on ecommerce, courtesy of L2

L2 determined that there is a “gross underinvestment” in terms of promotion of watch-specific content via email.

The report found that 83 percent of mass brands send out watch-specific email communications about 0.51 times per week. Although fashion brands send out four times the amount of email volume, with about 2.10 messages per week, less than 5 percent focus on timepieces. This factors out to be only one watch-related email per quarter.

While data was collected, in the first quarter of 2015, two-thirds of fashion brands did not send out any messages regarding their watch offerings. The exception of this is Michael Kors which frequently includes its timepieces in multi-item promotions and product-specific gift guides.

YouTube use among these brands has shown to be lackluster as well with only six of the 74 watchmakers producing video content that has garnered more than 1 million views. These include Tag Heuer, Calvin Klein and Chanel.

Tag Heuer has proven itself as “most adept at emulating luxury peers,” according to L2. The Swiss watchmaker’s #DontCrackUnderPressure campaign (see story) drove Tag Heuer’s view count on YouTube nearing 18 million, three times that of the most-viewed brand, Chanel, when adjusted to watch-specific content.

Tag Heuer's Don't Crack Under Pressure video

As for mobile adoption, L2 found that mass and licensed brands differ greatly. L2 discovered that 91 percent of fashion brands have mobile-optimized sites while only 58 percent of mass brands have done the same.

On these sites broken elements are common, with 29 percent of fashion brands and 13 percent of mass watch brands including broken videos, inaccurate geolocation or broken store locators and broken links that work on desktop. This combines to undermine the mobile experience.

Rocking the Apple cart

The Apple Watch has sparked urgency in many watchmakers to create their own version of a high-tech high-touch wearable. Nearly one quarter of brand’s surveyed by L2 have pledged to unveil a smartwatch in 2015.

At the 2015 Baselworld March 19-26, seven brands, such as Tag Heuer (see story), Breitling (see story), Swarovski (see story), Gucci (see story) and Bulgari, shared announcements with attendees and the horology industry that they would be creating smart wearables.

In a separate report, L2 analysts argued that Apple could sell more than 30 million watches in 2015, a number that will surpass all other timepiece companies in the world. Apple’s influence on the smartphone market leaves experts to believe that iPhone owners are waiting to see the proposition value of the Apple Watch, but once applications launch, the surge may be greater than expected.

Apple’s advertising campaign of its smartwatch as a fashion piece rather than just a technology toy is creating unease amongst fashion brands and experts, although many Swiss watchmakers are confident in their brand and products, but with the upcoming release date the speculations will soon have answers (see story).

"Wearables stand to take sales away from brands competing in the mid-to-low tier watch market because of comparable price points and increasingly design-conscious options that have the same signaling power that fashion watches do," Mr. Sherard said. "A buyer could easily forgo a $250 Michael Kors watch for a $350 Apple Watch.

"But wearables also could provide a new area of expansion for these brands, who are much more willing to experiment and take risks than the high-end watch brands," he said. "Gucci, Fossil (including Michael Kors and Emporio Armani) and Tag Heuer have already announced smartwatches, seeing wearables as an opportunity to signal innovation.

"How well these actually sell is still a question, but that may not be the point."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Infographic on ecommerce, courtesy of L2

L2 determined that there is a “gross underinvestment” in terms of promotion of watch-specific content via email.

The report found that 83 percent of mass brands send out watch-specific email communications about 0.51 times per week. Although fashion brands send out four times the amount of email volume, with about 2.10 messages per week, less than 5 percent focus on timepieces. This factors out to be only one watch-related email per quarter.

While data was collected, in the first quarter of 2015, two-thirds of fashion brands did not send out any messages regarding their watch offerings. The exception of this is Michael Kors which frequently includes its timepieces in multi-item promotions and product-specific gift guides.

YouTube use among these brands has shown to be lackluster as well with only six of the 74 watchmakers producing video content that has garnered more than 1 million views. These include Tag Heuer, Calvin Klein and Chanel.

Tag Heuer has proven itself as “most adept at emulating luxury peers,” according to L2. The Swiss watchmaker’s #DontCrackUnderPressure campaign (see story) drove Tag Heuer’s view count on YouTube nearing 18 million, three times that of the most-viewed brand, Chanel, when adjusted to watch-specific content.

Tag Heuer's Don't Crack Under Pressure video

As for mobile adoption, L2 found that mass and licensed brands differ greatly. L2 discovered that 91 percent of fashion brands have mobile-optimized sites while only 58 percent of mass brands have done the same.

On these sites broken elements are common, with 29 percent of fashion brands and 13 percent of mass watch brands including broken videos, inaccurate geolocation or broken store locators and broken links that work on desktop. This combines to undermine the mobile experience.

Rocking the Apple cart

The Apple Watch has sparked urgency in many watchmakers to create their own version of a high-tech high-touch wearable. Nearly one quarter of brand’s surveyed by L2 have pledged to unveil a smartwatch in 2015.

At the 2015 Baselworld March 19-26, seven brands, such as Tag Heuer (see story), Breitling (see story), Swarovski (see story), Gucci (see story) and Bulgari, shared announcements with attendees and the horology industry that they would be creating smart wearables.

In a separate report, L2 analysts argued that Apple could sell more than 30 million watches in 2015, a number that will surpass all other timepiece companies in the world. Apple’s influence on the smartphone market leaves experts to believe that iPhone owners are waiting to see the proposition value of the Apple Watch, but once applications launch, the surge may be greater than expected.

Apple’s advertising campaign of its smartwatch as a fashion piece rather than just a technology toy is creating unease amongst fashion brands and experts, although many Swiss watchmakers are confident in their brand and products, but with the upcoming release date the speculations will soon have answers (see story).

"Wearables stand to take sales away from brands competing in the mid-to-low tier watch market because of comparable price points and increasingly design-conscious options that have the same signaling power that fashion watches do," Mr. Sherard said. "A buyer could easily forgo a $250 Michael Kors watch for a $350 Apple Watch.

"But wearables also could provide a new area of expansion for these brands, who are much more willing to experiment and take risks than the high-end watch brands," he said. "Gucci, Fossil (including Michael Kors and Emporio Armani) and Tag Heuer have already announced smartwatches, seeing wearables as an opportunity to signal innovation.

"How well these actually sell is still a question, but that may not be the point."

Final Take

Jen King, lead reporter on Luxury Daily, New York