Chinese affluence

Chinese affluence

French fashion house Chanel was found to have the highest level of brand awareness in China, with 84 percent of surveyed consumers citing familiarity with the brand, according to a new report by Bomoda.

But for the majority of brands from the West, China has been a challenge due to consumer behavior and decision-making processes that differ, leaving marketers to scramble to appropriately communicate and drive sales. The inaugural “2015 China Luxury Blueprint” report is a guide for marketers looking to construct a profitable relationship with affluent Chinese consumers and offers some approaches for tapping into the region’s marketplace through data points.

“Communicating with Chinese consumer is a multi-market and multi-platform endeavor,” said Brian Buchwald, CEO of Bomoda, New York. "It is about ensuring positive experiences in New York, Paris, Tokyo, Seoul and duty free for a Mandarin speaker who may not be as comfortable abroad.

“It is about then connecting that international experience with retail and online in China itself. It entails communicating through paid media vehicles like print and Baidu Brandzone and honing your voice and loyalists through social platforms like Youku and WeChat,” he said. “It necessitates understanding the global curiosity that the Chinese consumer possesses, but also the local flavor that makes information and merchandise more digestible and ultimately desirable.

“Start with the basic question: What do I stand for? How can I communicate that and extend it for my new Chinese prospect? Too many brands lose sight of the core values that made them attractive to this buyer in the first place.”

Findings for the 2015 China Luxury Blueprint were drawn from more than 1.25 million curated data points on the top 50 luxury brands with a presence in China, such as Chanel, Prada, Alexander McQueen and Michael Kors. Bomoda also conducted a survey with 2,200 affluent Chinese consumers for a more personal perspective.

Cracking China

Judging ROI can be tricky in a familiar market, but the difficulties of measuring consumer response is especially difficult in a region that is foreign to the brand and its marketing team. Within the China Luxury Blueprint, Bomoda examined the impact of marketing strategies such as media spend, search optimization, Mandarin-language localization and social media engagement to judge if brands are on the right track in China.

Through the data, Bomoda offers a holistic view of consumer behavior in China, purchasing patterns and demonstrates which brands have successfully achieved their business goals, and how.

Essentially, Mr. Buchwald says that if a brand is successful China, such as Chanel for example, then that success “will echo across the globe.”

Chanel's Web site translated into Chinese for a comfortable consumer experience

The China Luxury Blueprint discovered that in the eyes of Chinese consumers Chanel is the most prominent luxury brand. This sentiment mirrors that of other consumers found around the world due to the brand’s success in every market where it is present.

With an 84 percent brand awareness in the country, half of respondents in the survey portion stated that they have previously purchased a Chanel product.

France’s Chanel is frequently found at the top of “most sought-after” surveys (see story) due to the brand’s intelligence in communicating to international consumers in a localized voice across traditional and digital marketing tactics as well as operating top tier boutiques. Unlike other brands who have faced difficulties entering China, Chanel has made “concerted efforts” to appeal to the native consumer in ways that she wishes to communicate with luxury houses.

“Chanel benefits from being a private family owned company,” Mr. Buchwald said. “The owners think about wealth preservation as much as accumulation.

“They are not looking to sacrifice to meet quarterly or annual goals,” he said. “Growing at 10 percent each year beats attempting to grow at 15 percent by pushing more supply into the market or diminishing manufacturing quality and then seeing the bottom fall out like we've seen with other 'hot' brands in the past.”

Chanel's Web site translated into Chinese for a comfortable consumer experience

The China Luxury Blueprint discovered that in the eyes of Chinese consumers Chanel is the most prominent luxury brand. This sentiment mirrors that of other consumers found around the world due to the brand’s success in every market where it is present.

With an 84 percent brand awareness in the country, half of respondents in the survey portion stated that they have previously purchased a Chanel product.

France’s Chanel is frequently found at the top of “most sought-after” surveys (see story) due to the brand’s intelligence in communicating to international consumers in a localized voice across traditional and digital marketing tactics as well as operating top tier boutiques. Unlike other brands who have faced difficulties entering China, Chanel has made “concerted efforts” to appeal to the native consumer in ways that she wishes to communicate with luxury houses.

“Chanel benefits from being a private family owned company,” Mr. Buchwald said. “The owners think about wealth preservation as much as accumulation.

“They are not looking to sacrifice to meet quarterly or annual goals,” he said. “Growing at 10 percent each year beats attempting to grow at 15 percent by pushing more supply into the market or diminishing manufacturing quality and then seeing the bottom fall out like we've seen with other 'hot' brands in the past.”

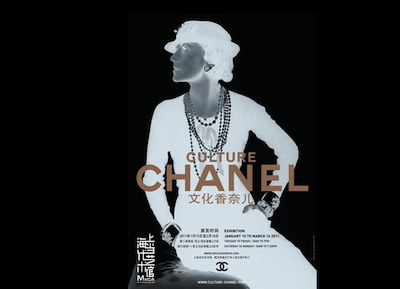

In 2011, Chanel held an exhibit in the Chinese city of Shanghai (see story)

This is not to say that Chanel has not met a market it was unable to tackle.

“Chanel learned from mistakes it made in Japan over two to three decades ago,” Mr. Buchwald said. “When the Japanese first became enamored with Chanel, the brand started to mass produce to meet demand.

“In doing so, they diluted the quality of the product and its perceived value,” he said. “They no longer take that approach. There is an understanding that the nature of luxury has an element of desire rather than simple acquisition to it."

Recently, the Japanese luxury market has witnessed a resurgence of interest by brands as the Chinese and Russian markets face uncertainty.

European and American brands have traditionally focused on Japan, but dwindling consumption teamed with emerging markets elsewhere led to a reevaluation in recent years. This is beginning to change again, as seen through events, exhibits and pop-ups from luxury brands across the island nation that indicate the market’s surging appeal (see story).

Cases of sentiment

It is understood that consumers in different parts of the world have varying sentiments of brands, quality, price and how they wish to interact with marketing communications. Localized communications, especially for Chinese consumers, may be the driving force in converting a brand’s messages into sales.

Bomoda found that in China, consumers who search for a brand’s name in Chinese, rather than the Westernized moniker, were 34 percent more likely to buy for authenticity rather than a price point. With counterfeit products running rampant in the Asian market, and globally, communicating on a local language level may help curb imitations and direct consumers to the official brand, rather than a copy.

The idea of quality over price has also been founded by research conducted by Agility Research & Strategy who suggested in China, if a product is expensive it does not equal luxury unless it meets a standard of quality. Also, quality is a driver in terms of luxury consumption with only 4 percent of Chinese consumers responding that quality is not considered when making a high-priced purchase (see story).

Finding a “happy medium” of brand communications is also key for marketers targeting consumers in China. Bomoda suggests that if a brand engages with Chinese consumers too often, or too aggressively, on local social media networks it may have a negative impact on sales potential.

In 2011, Chanel held an exhibit in the Chinese city of Shanghai (see story)

This is not to say that Chanel has not met a market it was unable to tackle.

“Chanel learned from mistakes it made in Japan over two to three decades ago,” Mr. Buchwald said. “When the Japanese first became enamored with Chanel, the brand started to mass produce to meet demand.

“In doing so, they diluted the quality of the product and its perceived value,” he said. “They no longer take that approach. There is an understanding that the nature of luxury has an element of desire rather than simple acquisition to it."

Recently, the Japanese luxury market has witnessed a resurgence of interest by brands as the Chinese and Russian markets face uncertainty.

European and American brands have traditionally focused on Japan, but dwindling consumption teamed with emerging markets elsewhere led to a reevaluation in recent years. This is beginning to change again, as seen through events, exhibits and pop-ups from luxury brands across the island nation that indicate the market’s surging appeal (see story).

Cases of sentiment

It is understood that consumers in different parts of the world have varying sentiments of brands, quality, price and how they wish to interact with marketing communications. Localized communications, especially for Chinese consumers, may be the driving force in converting a brand’s messages into sales.

Bomoda found that in China, consumers who search for a brand’s name in Chinese, rather than the Westernized moniker, were 34 percent more likely to buy for authenticity rather than a price point. With counterfeit products running rampant in the Asian market, and globally, communicating on a local language level may help curb imitations and direct consumers to the official brand, rather than a copy.

The idea of quality over price has also been founded by research conducted by Agility Research & Strategy who suggested in China, if a product is expensive it does not equal luxury unless it meets a standard of quality. Also, quality is a driver in terms of luxury consumption with only 4 percent of Chinese consumers responding that quality is not considered when making a high-priced purchase (see story).

Finding a “happy medium” of brand communications is also key for marketers targeting consumers in China. Bomoda suggests that if a brand engages with Chinese consumers too often, or too aggressively, on local social media networks it may have a negative impact on sales potential.

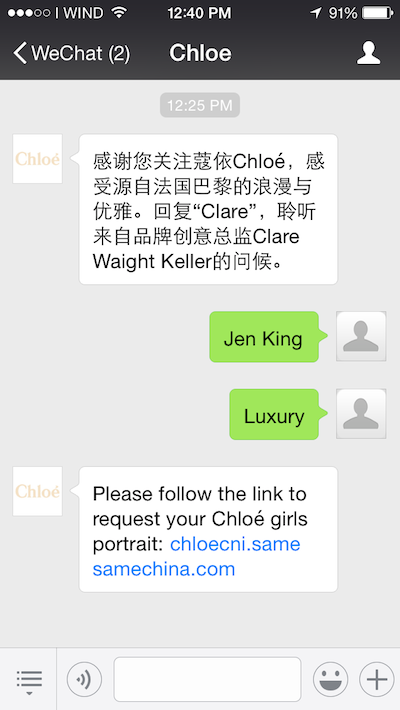

French fashion label Chloé uses WeChat to interact with Chinese consumers

This is a prime example of how sentiment differs across markets, and must be accounted for when curated communications, because in the United States and Western countries this tactic is used commonly and has proved effective at boosting sales.

For brands struggling to make an impact in China and embrace Chinese consumers, Mr. Buchwald offers the following advice:

“Leverage solid partners. Don't trust their ‘local knowledge’ or other metrics that are hard for you to vet. Understand past experiences and case studies,” he said.

“Utilize trusted data wherever possible. Platforms like Bomoda's and select other companies can give you an unvarnished unbiased view of the landscape.”

Mr. Buchwald also suggests starting at home to ensure that your own local presence is well executed.

“Chinese consumers first must desire your brand abroad before they desire it at home,” he said. “Consider the retail tourist or the expat student as the canary in the coal mine. Give them a positive experience with your brand and they will share that experience in China.

Lastly, with 51 percent of the world’s consumers being active on social media (see story), it is imperative to communicate with new and established consumers through these networks to source data and forge relations.

“Build out direct channels to the Mainland. It requires patience and time,” Mr. Buchwald said. “But build out your WeChat and Weibo and focus on core principles.

“Fan count doesn't matter. Engaged loyalists do.”

Final Take

Jen King, lead reporter on Luxury Daily, New York

French fashion label Chloé uses WeChat to interact with Chinese consumers

This is a prime example of how sentiment differs across markets, and must be accounted for when curated communications, because in the United States and Western countries this tactic is used commonly and has proved effective at boosting sales.

For brands struggling to make an impact in China and embrace Chinese consumers, Mr. Buchwald offers the following advice:

“Leverage solid partners. Don't trust their ‘local knowledge’ or other metrics that are hard for you to vet. Understand past experiences and case studies,” he said.

“Utilize trusted data wherever possible. Platforms like Bomoda's and select other companies can give you an unvarnished unbiased view of the landscape.”

Mr. Buchwald also suggests starting at home to ensure that your own local presence is well executed.

“Chinese consumers first must desire your brand abroad before they desire it at home,” he said. “Consider the retail tourist or the expat student as the canary in the coal mine. Give them a positive experience with your brand and they will share that experience in China.

Lastly, with 51 percent of the world’s consumers being active on social media (see story), it is imperative to communicate with new and established consumers through these networks to source data and forge relations.

“Build out direct channels to the Mainland. It requires patience and time,” Mr. Buchwald said. “But build out your WeChat and Weibo and focus on core principles.

“Fan count doesn't matter. Engaged loyalists do.”

Final Take

Jen King, lead reporter on Luxury Daily, New York