Instagram photo from Mulberry

Instagram photo from Mulberry

As with consumers based in emerging markets, the tastes and behavior of affluent individuals living within the United Kingdom are also evolving, according to new report by Deloitte.

Luxury brands spend ample time curating content and experiences to meld to the demands, expectations and cultural expectations of consumers living in emerging markets, but attention should also be paid to individuals based in established and stable regions. Deloitte’s Insights report, “The Evolving UK Luxury Consumer,” examines how brands can capture and keep consumer interest as tastes evolve using various purchase and decision drivers, mostly in digital channels.

“The UK luxury consumer has never been more international, more varied (in terms of age and lifestyle), and more aware of the choices they have,” said Nick Pope, fashion and luxury lead, at Deloitte, London. “We really are seeing this as the ‘decade of change’ for luxury brands in terms of the changing dynamic of the consumer – in the UK and more broadly.

“The takeaway for luxury brands is to step-back and acknowledge this direction of travel: understand how these forces are shaping the consumer mind-set and experience and to work out how to win in this reality,” he said.

“Looking at this decade of change – there really will be a remarkable difference between 2010 and 2020.”

For The Evolving UK Luxury Consumer, Deloitte surveyed 1,300 individuals, a near even split between males and females ages 18 to 55 plus, with a yearly household income, before tax, of $341,495. The markets covered included the UK, France, Italy, Switzerland, Germany and Spain.

A UK state of mind

With time, a consumer's behavior and attitude toward luxury evolves. In response, brands must adapt their strategies to cater to the changing wants of its core consumer group.

Deloitte found that there are four primary solution points brands can use to meet the changing consumer sentiment in the UK. By relying on decision drivers, channels, digital and social and gifting, luxury brands will be better able to service the wealthy individuals of this specific market.

In the UK, impulse purchases remain a dominant driver of luxury goods, but additional drivers such as trend, routine and change in circumstance, and even the offer at hand can drive a sale. An understanding of these drivers can lead brands to a greater knowledge of their consumers' habits and individual drivers to give insights to what, when and how a client wishes to experience the brand at hand.

By respondents, Deloitte found that the UK luxury consumer has a strong impulsive purchasing driver. This is more pronounced among female and older consumers, while millennials are driven by trends and less defined by routine.

Deloitte infographic

Consumer behavior is drastically different between the West and Asia, for instance, but it is important to note the differences between consumers living within Europe itself. To target this inhomogeneous group of European consumers, especially in the UK, brands must operate according to that specific market.

For instance, UK consumers are less likely than their European counterparts to be driven by a brand’s new collection. Also, when discovering a new brand in non-digital channels, the UK consumer is much more enamored with department stores than monobrand boutiques.

In comparison, Italian consumers are more interested in new collections when they first arrive in stores and mark the point of discovery as monobrand stores over department stores.

Awareness channels are also shifting in the UK with digital touchpoints rising to offer consumers an “art without a frame” concept. Traditionally the luxury “frame” was represented by flagship boutiques where consumers could go explore the brand’s offerings through their senses, but now digital offers an alternative way to display its products.

Going forward, luxury brands will have to carefully develop “digital frames” to ensure they create desire, honor heritage and a valuable experience for the consumer. But, digital is still very much a generational shift.

Among European luxury consumers, magazines remain the primary channel for discovering new brands at 57 percent, but digital is gaining at 43 percent, predominantly among millennials.

For purchasing, omnichannel is quickly changing digital and with many brands still hesitant and wary of ecommerce they may be left behind completely if they do not adapt. For example, Deloitte found that UK consumers are shifting buying habits to online at a fast pace through Web sites such as online retailers Net-A-Porter, Yoox and Farfetch.

For example, Net-A-Porter increased its mobile efforts with the launch of two applications that blend content with commerce.

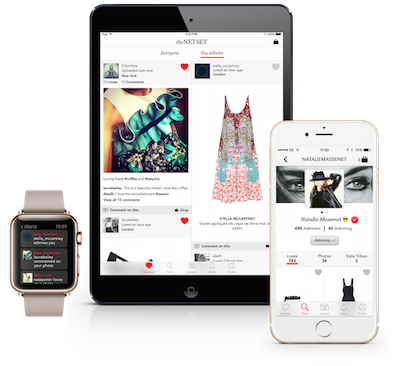

Net-A-Porter’s digital magazine The Edit has a new shoppable app, while a social shopping network from the retailer, called The Net Set, debuted May 13. For Net-A-Porter’s digital-savvy audience, these mobile apps give consumers more ways and choices of how to interact and shop (see story).

Deloitte infographic

Consumer behavior is drastically different between the West and Asia, for instance, but it is important to note the differences between consumers living within Europe itself. To target this inhomogeneous group of European consumers, especially in the UK, brands must operate according to that specific market.

For instance, UK consumers are less likely than their European counterparts to be driven by a brand’s new collection. Also, when discovering a new brand in non-digital channels, the UK consumer is much more enamored with department stores than monobrand boutiques.

In comparison, Italian consumers are more interested in new collections when they first arrive in stores and mark the point of discovery as monobrand stores over department stores.

Awareness channels are also shifting in the UK with digital touchpoints rising to offer consumers an “art without a frame” concept. Traditionally the luxury “frame” was represented by flagship boutiques where consumers could go explore the brand’s offerings through their senses, but now digital offers an alternative way to display its products.

Going forward, luxury brands will have to carefully develop “digital frames” to ensure they create desire, honor heritage and a valuable experience for the consumer. But, digital is still very much a generational shift.

Among European luxury consumers, magazines remain the primary channel for discovering new brands at 57 percent, but digital is gaining at 43 percent, predominantly among millennials.

For purchasing, omnichannel is quickly changing digital and with many brands still hesitant and wary of ecommerce they may be left behind completely if they do not adapt. For example, Deloitte found that UK consumers are shifting buying habits to online at a fast pace through Web sites such as online retailers Net-A-Porter, Yoox and Farfetch.

For example, Net-A-Porter increased its mobile efforts with the launch of two applications that blend content with commerce.

Net-A-Porter’s digital magazine The Edit has a new shoppable app, while a social shopping network from the retailer, called The Net Set, debuted May 13. For Net-A-Porter’s digital-savvy audience, these mobile apps give consumers more ways and choices of how to interact and shop (see story).

Net-A-Porter's Net Set app

Going forward, luxury brands should treat ecommerce as a distinct business because more of consumers’ wallet share will be spent in this fashion.

In the UK, 58 percent of millennials buy luxury goods through ecommerce channels, thus driving omnichannel. But, 78 percent of UK millennials purchase goods in-store because of the desire to touch and seen an item before it is bought.

When it comes to digital engagement, millennial respondents were twice as likely to believe that “when a brand uses social media, I like that brand more.” For brands in the UK market, this presents the opportunity to share brand heritage, collections, happenings and news on social media to begin the consumer journey.

By targeting millennials via social media, brands are upping their chances of building a relationship with this consumer, which may translate to lifelong loyalty. If done smartly and strategically, social channels can be a cost-effective way to share innovative visions while building up the brand’s allure and lifestyle.

Net-A-Porter's Net Set app

Going forward, luxury brands should treat ecommerce as a distinct business because more of consumers’ wallet share will be spent in this fashion.

In the UK, 58 percent of millennials buy luxury goods through ecommerce channels, thus driving omnichannel. But, 78 percent of UK millennials purchase goods in-store because of the desire to touch and seen an item before it is bought.

When it comes to digital engagement, millennial respondents were twice as likely to believe that “when a brand uses social media, I like that brand more.” For brands in the UK market, this presents the opportunity to share brand heritage, collections, happenings and news on social media to begin the consumer journey.

By targeting millennials via social media, brands are upping their chances of building a relationship with this consumer, which may translate to lifelong loyalty. If done smartly and strategically, social channels can be a cost-effective way to share innovative visions while building up the brand’s allure and lifestyle.

Deloitte inforgraphic

Social media also allows brands to create a two-way dialogue with consumers, 58 percent of whom are use an average of three social channels to connect with friends, family and preferred luxury brands.

“The research suggests a couple of things: first, that consumers (especially the millennials) truly value the social media experience they have and actively prefer brands which engage with them via this channel,” Mr. Pope said.

“Second, the imperative for the luxury (or premium) sector is subtly different from mass-market brands – they need to explore new experiences and ‘interaction stories’ with the consumer,” he said.

“Lastly, rather than being on social for the sake of it (or because everyone else is), we think there are smart ways to actually link the social strategy back to the corporate or brand strategy so that they positively reinforce each other.”

In the UK, social media is mainly used by female consumers who rely on brand postings to discover price points of particular products and to generate gifting ideas.

Gifting requires careful consideration, but it also provides an entry-point opportunity and high sales potential for luxury brands. Also, gifting presents brands with the chance to continuously promote gift ideas throughout the year to keep their wares top of mind for birthdays, anniversaries, small-scale holidays and other milestone occasions.

When gifting a UK consumer is more likely to “trade up” to purchase a luxury good for the holiday when compared to European consumers.

The difference is

An understanding of consumer behavior and approach to luxury is important no matter the market.

For example, whereas consumers in the U.S. view luxury as an overall lifestyle their Chinese counterparts use high-end goods as a marker of status. Now that luxury consumption is slowing and the amount of attention placed on China is waning, the U.S. is returning to post-recession trends of luxury purchases.

In China, if a product is expensive it does not equal luxury unless it meets a standard of quality. For the rising middle class and younger generation of Chinese luxury products are used to express personal style while recognition of a worn or used brand is seen as a reflection of status (see story).

In Mr. Pope’s opinion brands that have catered to the sentiment of UK consumers have used mobile and cross market strategies to capture attention and drive awareness and conversions.

“I think there are heaps of good examples – and many outside the traditional luxury goods area,” Mr. Pope said. “However, if we look beyond the consumer and back into the business, I think campaigns stand out when they really encourage the delivery of strategy – be that a pure focus on building brand equity, or be it supporting the delivery of the omni-channel business.

“As an example of the latter, I’m impressed with the ease and slickness of the EDIT from Net-a-Porter,” he said. “From a pure aesthetic point of view, personally, I think the Hermes (cross-market) campaigns have been built with great sensitivity and punch.

"It’s important for luxury brands to continue to innovate in their marketing, and there are a number of good examples of that – from Burberry to Jaguar to Four Seasons. Socially – and from a UK perspective – I think Harrods, Orlebar Brown and Graff have built beautiful, bottom-up social campaigns which focus nicely on their brand values.”

Final Take

Jen King, lead reporter on Luxury Daily, New York

Deloitte inforgraphic

Social media also allows brands to create a two-way dialogue with consumers, 58 percent of whom are use an average of three social channels to connect with friends, family and preferred luxury brands.

“The research suggests a couple of things: first, that consumers (especially the millennials) truly value the social media experience they have and actively prefer brands which engage with them via this channel,” Mr. Pope said.

“Second, the imperative for the luxury (or premium) sector is subtly different from mass-market brands – they need to explore new experiences and ‘interaction stories’ with the consumer,” he said.

“Lastly, rather than being on social for the sake of it (or because everyone else is), we think there are smart ways to actually link the social strategy back to the corporate or brand strategy so that they positively reinforce each other.”

In the UK, social media is mainly used by female consumers who rely on brand postings to discover price points of particular products and to generate gifting ideas.

Gifting requires careful consideration, but it also provides an entry-point opportunity and high sales potential for luxury brands. Also, gifting presents brands with the chance to continuously promote gift ideas throughout the year to keep their wares top of mind for birthdays, anniversaries, small-scale holidays and other milestone occasions.

When gifting a UK consumer is more likely to “trade up” to purchase a luxury good for the holiday when compared to European consumers.

The difference is

An understanding of consumer behavior and approach to luxury is important no matter the market.

For example, whereas consumers in the U.S. view luxury as an overall lifestyle their Chinese counterparts use high-end goods as a marker of status. Now that luxury consumption is slowing and the amount of attention placed on China is waning, the U.S. is returning to post-recession trends of luxury purchases.

In China, if a product is expensive it does not equal luxury unless it meets a standard of quality. For the rising middle class and younger generation of Chinese luxury products are used to express personal style while recognition of a worn or used brand is seen as a reflection of status (see story).

In Mr. Pope’s opinion brands that have catered to the sentiment of UK consumers have used mobile and cross market strategies to capture attention and drive awareness and conversions.

“I think there are heaps of good examples – and many outside the traditional luxury goods area,” Mr. Pope said. “However, if we look beyond the consumer and back into the business, I think campaigns stand out when they really encourage the delivery of strategy – be that a pure focus on building brand equity, or be it supporting the delivery of the omni-channel business.

“As an example of the latter, I’m impressed with the ease and slickness of the EDIT from Net-a-Porter,” he said. “From a pure aesthetic point of view, personally, I think the Hermes (cross-market) campaigns have been built with great sensitivity and punch.

"It’s important for luxury brands to continue to innovate in their marketing, and there are a number of good examples of that – from Burberry to Jaguar to Four Seasons. Socially – and from a UK perspective – I think Harrods, Orlebar Brown and Graff have built beautiful, bottom-up social campaigns which focus nicely on their brand values.”

Final Take

Jen King, lead reporter on Luxury Daily, New York