Coco Chanel walking past 31 Rue Cambon

Coco Chanel walking past 31 Rue Cambon

MONTE-CARLO, Monaco – Powerhouses such as LVMH, Richemont and Estée Lauder Companies continue to use portfolio-wide best practices to nurture both newcomers and finely tuned veterans, according to research by Deloitte.

During the “Global Powers of Luxury Goods” session June 8 at Financial Times’ Business of Luxury Summit, Deloitte presented data of the top 100 global brands, with a focus on luxury, as well as how the global economy dictates these industry leaders and the behavior of affluent consumers. To show how a top 10 position among luxury brands is maintained, Deloitte shared challenges and opportunities to combat economic and social stressors and to engage consumers in a worthwhile way.

"[The luxury] sector needs to continue to create a strong relationship with an ever increasing array of technologies," said Patrizia Arienti, EMEA fashion and luxury leader, Deloitte.

"Second, the rapidly evolving consumer profile means companies must understand the buying behavior and changing desires of luxury consumers, and shift the channels to reach them," she said.

"Finally, companies must always stay focused on their history and communities by giving back. This can strengthen brand equity and create long term strategic and financial rewards for the business."

Global powerhouses

Deloitte’s research found that the top 10 luxury goods companies, in order, include LVMH, Richemont, Estée Lauder Companies, Chow Tai Fook Jewelry, Luxottica, Swatch Group, Kering, L’Oreal, Ralph Lauren and PVH Corporation.

While these brands account for nearly 50 percent of sales from the top 100 brands, Deloitte noted that 8.4 percent of luxury good sales for these companies was driven by new additions from the 2014 ranking. These include a 42 percent increase in sales by PVH, which owns Calvin Klein, and Hong Kong-based Chow Tai Fook whose business grew by 34.8 percent due to rising gold prices.

Among the fastest growing brands in luxury, Deloitte named U.S. label Michael Kors as the industry leader among Kate Spade, Tory Burch and Christian Louboutin.

Michael Kors leads this list for the second year due to its global expansions and a 62.4 percent increase in sales of $26 million.

Recently, the label has invested in its menswear lines with new hires (see story) and global business strategies through distribution centers (see story).

Michael Kors menswear spring 2015

By country, Deloitte profiled top performing markets in terms of luxury production and consumer spend. China and Hong Kong, grouped together for this purpose, were responsible for 33.4 percent of luxury sales, whereas Italy, including conglomerate-owned brands such as Bulgari and Gucci, for example, generated 65.4 percent of luxury sales.

The report also broke down the amount of luxury brands that count these markets as countries of origin. For instance, France has the largest share of brands due to the successes of L’Oreal, Kering and LVMH.

Comparably, Italy has 29 brands in the top 100’s luxury listing where as Switzerland counts 11, including Richemont, Swatch Group and Rolex, while the United States has 15, three of which are in the top 10, Estee Lauder Companies, Ralph Lauren and PVH, and the United Kingdom has six.

Michael Kors menswear spring 2015

By country, Deloitte profiled top performing markets in terms of luxury production and consumer spend. China and Hong Kong, grouped together for this purpose, were responsible for 33.4 percent of luxury sales, whereas Italy, including conglomerate-owned brands such as Bulgari and Gucci, for example, generated 65.4 percent of luxury sales.

The report also broke down the amount of luxury brands that count these markets as countries of origin. For instance, France has the largest share of brands due to the successes of L’Oreal, Kering and LVMH.

Comparably, Italy has 29 brands in the top 100’s luxury listing where as Switzerland counts 11, including Richemont, Swatch Group and Rolex, while the United States has 15, three of which are in the top 10, Estee Lauder Companies, Ralph Lauren and PVH, and the United Kingdom has six.

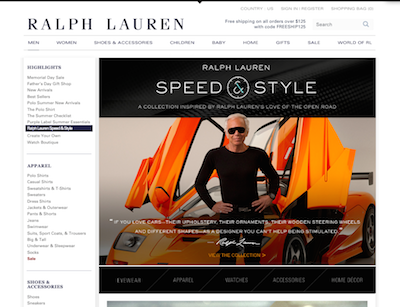

Ralph Lauren's Web site

Of the UK’s six brands, Burberry is a leader accounting for 60 percent of its country of origin’s luxury sales.

“Burberry is probably the best innovator, covering all the aspects of the value chain, not only in marketing, but technology relating to production,” Ms. Arienti said. “[Also, Burberry is] known as a best performer in ecommerce."

Technology will continue to influence the entire luxury value chain, but brands must move cautiously in this space due to concerns of heritage. The rapid evolution of the consumer profile, such as buying behavior and tourism trends, and forging a positive impact within one’s local and global community also opens up engagement opportunities for luxury houses.

To this effect, Deloitte found that 58 percent of ultra-high-net-worth consumers under 34-years old actively search for brand information on the Internet, but 75 percent feel that the most important benefit of buying luxury in-store is the ability to touch and feel products. Also, half of consumers feel knowledgeable sales associates and service level is an in-store advantage.

"The luxury space can create powerful experiences that will help to positively influence societies and cultures," Ms. Arienti said. "It is likely that leading luxury players will increasingly adopt such platforms, promoting their products while having a positive influence on communities and the environment.

"Luxury brands are doing so in three ways: fostering long-term talent, celebrating history and culture and charitable support," she said.

Behind the global wheel

The economy has many drivers, from oil prices to inflation rates, and luxury is directly effected by stressors and positive points in various markets.

Deloitte’s chief global economist Dr. Ira Kalish shared a series of economic trends that has effected all facets industry, markedly luxury.

For example, the U.S. dollar has risen in value while oil prices have dropped due to the relation between the two, aggressive monetary policies have lowered inflation in the U.S., but this has hurt exports and corporate profits while it has been helpful for exporters from Europe and Japan but caused high inflation in emerging markets.

In the U.S., Dr. Kalish noted that a combination of increased wealth, reduced debt, improved cash flow, a rise in jobs and a decrease in energy prices has been good for luxury brands.

But, other markets tell a different narrative. Europe shows signs of improvement after significant economic troubles and unemployment but there has been rising retail sales and higher consumer confidence as of late due to cheap oil prices and an improved credit market.

China is decelerating, with economic growth at its lowest since 1990, due to weak exports and investments because of its dependence on the U.S. dollar as well as a government crackdown on corruption in the form of luxury goods gifting.

In contrast, Japan’s lower yen has helped exports but has harmed domestic industry because of inflation increases and wages remaining the same causing retail spending to be stagnant.

Whereas Russia is in the negative numbers, due to sanctions limiting investments and a decline in oil prices has harmed the ruble, but Latin America offers a mixed bag with promising opportunities in Mexico, but troubles in Brazil.

Although the U.S. dollar may have peaked and is a global driver of market economies, it is likely that the euro will continue to decline driven by the European Central Bank’s asset purchase which will boost inflation, asset prices, exports and foreign tourism. Essentially, the euro might have been “overshot,” so how does luxury combat this?

“I think generally when currencies move in a particular direction the often tend to overshoot," Dr. Kalish said. "So there's good reason to expect that the U.S. dollar will actually rise further, and other currencies will decline, including the euro.

"From a luxury perspective, you do not necessarily cut prices, but you gain in terms in larger margins and this has been beneficial to exporters and foreign tourism," he said.

Final Take

Jen King, lead reporter on Luxury Daily, New York

Ralph Lauren's Web site

Of the UK’s six brands, Burberry is a leader accounting for 60 percent of its country of origin’s luxury sales.

“Burberry is probably the best innovator, covering all the aspects of the value chain, not only in marketing, but technology relating to production,” Ms. Arienti said. “[Also, Burberry is] known as a best performer in ecommerce."

Technology will continue to influence the entire luxury value chain, but brands must move cautiously in this space due to concerns of heritage. The rapid evolution of the consumer profile, such as buying behavior and tourism trends, and forging a positive impact within one’s local and global community also opens up engagement opportunities for luxury houses.

To this effect, Deloitte found that 58 percent of ultra-high-net-worth consumers under 34-years old actively search for brand information on the Internet, but 75 percent feel that the most important benefit of buying luxury in-store is the ability to touch and feel products. Also, half of consumers feel knowledgeable sales associates and service level is an in-store advantage.

"The luxury space can create powerful experiences that will help to positively influence societies and cultures," Ms. Arienti said. "It is likely that leading luxury players will increasingly adopt such platforms, promoting their products while having a positive influence on communities and the environment.

"Luxury brands are doing so in three ways: fostering long-term talent, celebrating history and culture and charitable support," she said.

Behind the global wheel

The economy has many drivers, from oil prices to inflation rates, and luxury is directly effected by stressors and positive points in various markets.

Deloitte’s chief global economist Dr. Ira Kalish shared a series of economic trends that has effected all facets industry, markedly luxury.

For example, the U.S. dollar has risen in value while oil prices have dropped due to the relation between the two, aggressive monetary policies have lowered inflation in the U.S., but this has hurt exports and corporate profits while it has been helpful for exporters from Europe and Japan but caused high inflation in emerging markets.

In the U.S., Dr. Kalish noted that a combination of increased wealth, reduced debt, improved cash flow, a rise in jobs and a decrease in energy prices has been good for luxury brands.

But, other markets tell a different narrative. Europe shows signs of improvement after significant economic troubles and unemployment but there has been rising retail sales and higher consumer confidence as of late due to cheap oil prices and an improved credit market.

China is decelerating, with economic growth at its lowest since 1990, due to weak exports and investments because of its dependence on the U.S. dollar as well as a government crackdown on corruption in the form of luxury goods gifting.

In contrast, Japan’s lower yen has helped exports but has harmed domestic industry because of inflation increases and wages remaining the same causing retail spending to be stagnant.

Whereas Russia is in the negative numbers, due to sanctions limiting investments and a decline in oil prices has harmed the ruble, but Latin America offers a mixed bag with promising opportunities in Mexico, but troubles in Brazil.

Although the U.S. dollar may have peaked and is a global driver of market economies, it is likely that the euro will continue to decline driven by the European Central Bank’s asset purchase which will boost inflation, asset prices, exports and foreign tourism. Essentially, the euro might have been “overshot,” so how does luxury combat this?

“I think generally when currencies move in a particular direction the often tend to overshoot," Dr. Kalish said. "So there's good reason to expect that the U.S. dollar will actually rise further, and other currencies will decline, including the euro.

"From a luxury perspective, you do not necessarily cut prices, but you gain in terms in larger margins and this has been beneficial to exporters and foreign tourism," he said.

Final Take

Jen King, lead reporter on Luxury Daily, New York