Promotional image for #InstaKors

Promotional image for #InstaKors

Beauty and fashion marketers continue to be enamored by photo-sharing application Instagram’s organic reach, with 95 and 98 percent of brands in those sectors operating accounts, according to a new report by L2. Instagram has presented marketers with a platform that is more engaging than Facebook or Twitter with fashion labels growing their communities by 27 percent to 2 million followers and beauty brands increasing by 30 percent, or 600,000 individuals. The popular app, which boasts 300 million monthly users, recently announced plans to open the platform to create a stronger relationship with all advertisers through the use of direct response within advertisements to grow revenue opportunities.

"In early June Instagram announced that it is increasing direct-response functionalities in sponsored ads," said Eleanor Powers, insight director at L2, New York. "Based on what Instagram has previewed, brands will be able to use ads for direct sales, app installments, newsletter or account sign-ups, or providing additional content regarding the products directly from the platform.

"The opportunity for direct sales could be attractive to fashion and beauty brands which often focus on specific products in posts and receive a direct return from their efforts on the platform," she said. "The most important takeaway for brands that are not fully engaging with Instagram is that the platform still offers 100 percent organic reach and high engagement rates.

"While engagement hasn’t kept up with the tremendous growth rate, fashion and beauty brands still yield an average engagement rate of 0.59 percent and 0.79 percent, respectively, which is over 10 times more than the category brands experience on Facebook and over 30 times more than on Twitter," she said.

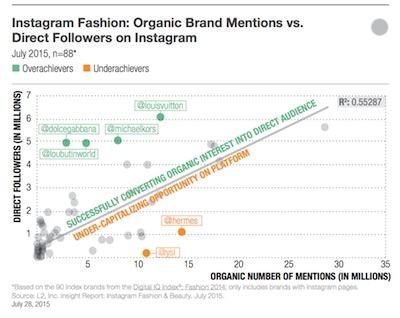

L2’s “Fashion and Beauty Instagram” Insight Report gives an in-depth analysis of specific trends in the marketing industry and presents opportunities in the space. Information sourced for the report was drawn from the Digital IQ Index: Fashion 2014 and Digital IQ Index: Beauty 2014. Insta-glam Fashion brands have a very strong presence on Instagram with 27 labels tracked by L2 counting more than 1 million followers. This community in numbers is not only reserved for luxury brands such as Chanel, which gained 1.8 million followers in a single day in October 2014, but contemporary brands including Calvin Klein and Kate Spade as well. Since the second quarter of 2014, fashion brands have increased interactions at a rate of 77 percent from 8.6 posts per week to more than 10 each week. To this point, brands on Instagram have taken advantage of the link between organic brand mentions, hashtags such as #Chanel for instance, and the size of their communities. Labels can take these brand mentions and translate the interest and enthusiasm into a direct audience. Infographic by L2 showing organic brand mentions vs. direct followers on Instagram

L2 found that Dolce & Gabbana, Christian Louboutin, Louis Vuitton and Michael Kors overperformed through this tactic while brands such as Givenchy, Prada and Miu Miu underperformed. The latter three brands experienced the sharpest decline in follower gains resulting from organic mentions.

The main drawback for marketers using Instagram to interact with consumers is the platform’s lack of hyperlinks outside the account’s profile page. Since fashion brands often feature products in their images it has been difficult to create a call-to-action that continues the consumer journey to a purchase.

Instagram has been slow to react, only releasing its Carousel advertisement function in March which allows sponsored posts to include multiple images in a slideshow paired with a “Learn More” prompt (see story). But fashion and beauty marketers have worked around this through the use of third parties including Like2Buy and similar vendors that host intermediary “stores.”

For instance, fashion label Marc Jacobs’ beauty division developed a new way for consumers to shop the brand’s cosmetics collection on Instagram. To do so, Marc Jacobs worked with its email provider to create a custom shopping experience to make discovering and purchasing Marc Jacobs Beauty products fun and seamless.

Infographic by L2 showing organic brand mentions vs. direct followers on Instagram

L2 found that Dolce & Gabbana, Christian Louboutin, Louis Vuitton and Michael Kors overperformed through this tactic while brands such as Givenchy, Prada and Miu Miu underperformed. The latter three brands experienced the sharpest decline in follower gains resulting from organic mentions.

The main drawback for marketers using Instagram to interact with consumers is the platform’s lack of hyperlinks outside the account’s profile page. Since fashion brands often feature products in their images it has been difficult to create a call-to-action that continues the consumer journey to a purchase.

Instagram has been slow to react, only releasing its Carousel advertisement function in March which allows sponsored posts to include multiple images in a slideshow paired with a “Learn More” prompt (see story). But fashion and beauty marketers have worked around this through the use of third parties including Like2Buy and similar vendors that host intermediary “stores.”

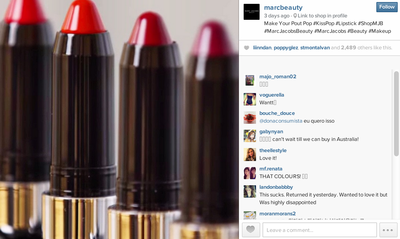

For instance, fashion label Marc Jacobs’ beauty division developed a new way for consumers to shop the brand’s cosmetics collection on Instagram. To do so, Marc Jacobs worked with its email provider to create a custom shopping experience to make discovering and purchasing Marc Jacobs Beauty products fun and seamless.

Marc Jacobs Beauty Instagram post for #ShopMJB

Followers of Marc Jacobs Beauty on Instagram can click the link provided in the brand’s bio section. The page that loads in the Web browser on the consumer’s device presents a simple field and explains how Shop via @MarcBeauty Instagram works.

Consumers must enter their Instagram handle and email address into the fields provided on the sign-up page. When the consumer clicks the Instagram heart icon to like a photo on Marc Jacob Beauty’s account containing the hashtag #ShopMJB, an email related to the featured product will be sent to their inbox (see story).

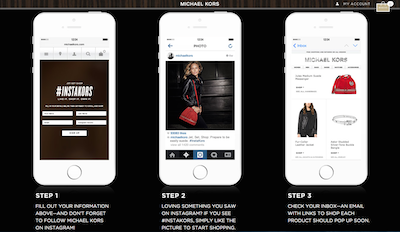

U.S. label Michael Kors also tied social content to commerce through a similar feature.

#InstaKors asks consumers to sign up, linking their Instagram handle with an email address, and then sends them an email when they like a shoppable image on the brand’s Instagram feed. Unveiling this feature before the holidays let Michael Kors’ 3 million followers use social media to buy gifts directly or send ideas to family and friends as a wish list (see story).

Marc Jacobs Beauty Instagram post for #ShopMJB

Followers of Marc Jacobs Beauty on Instagram can click the link provided in the brand’s bio section. The page that loads in the Web browser on the consumer’s device presents a simple field and explains how Shop via @MarcBeauty Instagram works.

Consumers must enter their Instagram handle and email address into the fields provided on the sign-up page. When the consumer clicks the Instagram heart icon to like a photo on Marc Jacob Beauty’s account containing the hashtag #ShopMJB, an email related to the featured product will be sent to their inbox (see story).

U.S. label Michael Kors also tied social content to commerce through a similar feature.

#InstaKors asks consumers to sign up, linking their Instagram handle with an email address, and then sends them an email when they like a shoppable image on the brand’s Instagram feed. Unveiling this feature before the holidays let Michael Kors’ 3 million followers use social media to buy gifts directly or send ideas to family and friends as a wish list (see story).

Michael Kors' #InstaKors

Bold in beauty

Beauty has also seen a similar growth projection with 90 percent of brands having community growth in the first half of 2015.

On average, beauty brands shared 7.5 posts per week in the second quarter with an absolute engagement of 7,509. This is double the engagement seen from the year-ago period.

User-generated content has presented beauty marketers with an outlet for enthusiasts to share curated looks with the larger community on Instagram. Many beauty brands, 40 percent of the 250 cross-category brands featured in the “Intelligence Report: Instagram 2015,” aggregate UGC content shared on Instagram to Web site galleries.

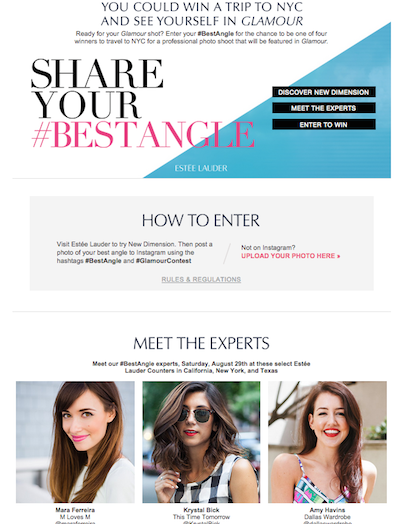

For example, Beauty marketer Estée Lauder is helping consumers look and feel their best in photos with a sponsored contest in partnership with Glamour magazine.

The #BestAngle campaign, which spans social media, including Instagram, in-store events and interactive participation at Estée Lauder beauty counters, will award four entrants with a trip to New York to be featured in a Glamour photo shoot that will be published in the magazine. With the rise of visual social media, women feel the need to look photo-ready at all times, which will likely help this campaign resonate with Glamour readers (see story).

Michael Kors' #InstaKors

Bold in beauty

Beauty has also seen a similar growth projection with 90 percent of brands having community growth in the first half of 2015.

On average, beauty brands shared 7.5 posts per week in the second quarter with an absolute engagement of 7,509. This is double the engagement seen from the year-ago period.

User-generated content has presented beauty marketers with an outlet for enthusiasts to share curated looks with the larger community on Instagram. Many beauty brands, 40 percent of the 250 cross-category brands featured in the “Intelligence Report: Instagram 2015,” aggregate UGC content shared on Instagram to Web site galleries.

For example, Beauty marketer Estée Lauder is helping consumers look and feel their best in photos with a sponsored contest in partnership with Glamour magazine.

The #BestAngle campaign, which spans social media, including Instagram, in-store events and interactive participation at Estée Lauder beauty counters, will award four entrants with a trip to New York to be featured in a Glamour photo shoot that will be published in the magazine. With the rise of visual social media, women feel the need to look photo-ready at all times, which will likely help this campaign resonate with Glamour readers (see story).

Share Your #BestAngle microsite

Beauty has also benefited from Instagram’s global appeal. With 70 percent of users based outside the United States, beauty brands have constructed a global content strategy through the use of regional accounts.

Global appeal also extends to influencers that help boost awareness and grow a beauty brand’s community.

For example, Estée Lauder selected model and reality star Kendall Jenner as its ambassador in November 2014 to align the brand’s namesake products with a younger consumer sect, likely enamored by the model’s notoriety.

When the model first shared her campaign with her Instagram followers, the post announcing the video for Little Black Primer garnered more than 420,000 likes. In the first two hours of its posting, the video generated over 230,000 likes on her channel (see story).

Although adapting the platform to include more insightful and sophisticated advertising is a natural progression for an app, there is a fear that Instagram's luster will fade as its parent company, Facebook's has since it increased ad exposure.

"If Instagram follows the path of Facebook to the point where organic reach is virtually zero and brands are forced to pay in order to play, brands will most likely look to other platforms where earned media is more accessible," Ms. Powers said.

"Currently, fashion and beauty brands have increased their posts on Instagram and have seen absolute engagement increase, while Facebook post frequency remains relatively flat for the categories year over year," she said.

"Christian Louboutin, one of 20 fashion brands studied that boasts a larger following on Instagram than on Facebook, has pushed its fans to its Instagram page and has experienced an 80 percent growth year over year compared to just eight percent growth to its Facebook community in the same time period.

"This eagerness to invest in Instagram will probably change when brands see that their followers are no longer seeing their posts."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Share Your #BestAngle microsite

Beauty has also benefited from Instagram’s global appeal. With 70 percent of users based outside the United States, beauty brands have constructed a global content strategy through the use of regional accounts.

Global appeal also extends to influencers that help boost awareness and grow a beauty brand’s community.

For example, Estée Lauder selected model and reality star Kendall Jenner as its ambassador in November 2014 to align the brand’s namesake products with a younger consumer sect, likely enamored by the model’s notoriety.

When the model first shared her campaign with her Instagram followers, the post announcing the video for Little Black Primer garnered more than 420,000 likes. In the first two hours of its posting, the video generated over 230,000 likes on her channel (see story).

Although adapting the platform to include more insightful and sophisticated advertising is a natural progression for an app, there is a fear that Instagram's luster will fade as its parent company, Facebook's has since it increased ad exposure.

"If Instagram follows the path of Facebook to the point where organic reach is virtually zero and brands are forced to pay in order to play, brands will most likely look to other platforms where earned media is more accessible," Ms. Powers said.

"Currently, fashion and beauty brands have increased their posts on Instagram and have seen absolute engagement increase, while Facebook post frequency remains relatively flat for the categories year over year," she said.

"Christian Louboutin, one of 20 fashion brands studied that boasts a larger following on Instagram than on Facebook, has pushed its fans to its Instagram page and has experienced an 80 percent growth year over year compared to just eight percent growth to its Facebook community in the same time period.

"This eagerness to invest in Instagram will probably change when brands see that their followers are no longer seeing their posts."

Final Take

Jen King, lead reporter on Luxury Daily, New York