Image courtesy of Salvatore Ferragamo

Image courtesy of Salvatore Ferragamo

In today’s retail environment, digital touchpoints serve as the “connective tissue” between Web sites, bricks-and-mortar storefronts, inventory and the consumer, according to a new report by L2.

The “L2 Intelligence Report: Omnichannel Retail 2015,” developed in partnership with RichRelevance, provides insights into how digital alone does not offer marketers substantial ROI. But, an omnichannel approach, offering consumers a number of “fluid” touchpoints, leads to higher consumer spend.

"Luxury retailers have built their brand on the idea of exclusivity, beauty and high touch," said Diane Kegley, CMO at RichRelevance, San Francisco. "They have been slow to adopt digital because it’s historically been a transactional channel: buy immediately. Without digital – and ecommerce in particular - an effective omnichannel strategy doesn’t exist.

"This mentality is shifting as more and more luxury consumers head online to research and browse," she said. "This year’s reports reinforced that, while luxury brands have been slow to embrace ecommerce, major brands such as Gucci, Dior and Louis Vuitton are prioritizing it for the first time. Although luxury brands remain 3-5 years out, expect to see fast gains as they marry digital innovation with tremendous expertise in delivering a premium experience."

The L2 Intelligence Report: Omnichannel Retail 2015 examines the omnichannel efforts of 116 United States retailers and 18 European brands. The report qualified the organizational and technological best practices that enabled a true omnichannel experience while also detailing online and offline drivers across luxury, prestige and mass price points.

On vs. off

Although the benefits of an omnichannel retail strategy are clear, many brands have taken a step back due to the cost and complexity of retooling their approach. In 2013, 38 percent of brands said they were in the development phases of an omnichannel strategy, but that dropped to 32 percent in 2014.

One of the standout indicators of omnichannel retail’s success is net sales capabilities. The report found that while ecommerce typically nets 77 cents on the dollar, and 23 percent of the order value on returns, retailers that offer in-store pick-up and returns generate more sales in the long run.

Consumers who visited a bricks-and-mortar store left with 107 percent of their original basket size, after exchanges or initial purchases, a behavior rarely seen online where many shopping carts are often abandoned. As a result, investments in in-store pick-up have increased year over year.

Fendi's Madison Avenue boutique

A number of department stores offer click-and-collect services where consumers can order items online and pick them up in-person in-store and, in most cases, with no delivery fee. By doing this, stores are able to merge the ease of online shopping with speedier return, getting consumers to visit their stores in-person for convenience (see story).

L2 and RichRelevance found that in 2015, 64 percent of offline sales were influenced by digital channels, up 49 percent from the year-ago. Though for luxury goods this is not a new notion, it shows that consumers are relying more heavily on pre-purchase research regardless of the product.

Seventy-two percent of these consumers, although firmly rooted in the online experience, feel that the traditional store experience outweighs other channels, such as Web sites, social media and mobile applications, when considering a purchase.

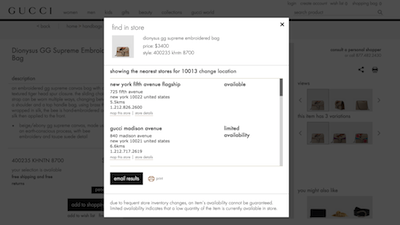

In terms of online features, 82 percent of digital consumers find value and importance in the ability to check in-store availability. This concept has become widespread for mass brands with 50 percent at the aspirational price point offering in-store inventory transparency and 52 percent of prestige brands such as Michael Kors and Marc Jacobs doing the same.

But, luxury, a notorious late-adopter of digital, falls short, with only Italian fashion label Gucci investing in online inventory for its boutiques.

Fendi's Madison Avenue boutique

A number of department stores offer click-and-collect services where consumers can order items online and pick them up in-person in-store and, in most cases, with no delivery fee. By doing this, stores are able to merge the ease of online shopping with speedier return, getting consumers to visit their stores in-person for convenience (see story).

L2 and RichRelevance found that in 2015, 64 percent of offline sales were influenced by digital channels, up 49 percent from the year-ago. Though for luxury goods this is not a new notion, it shows that consumers are relying more heavily on pre-purchase research regardless of the product.

Seventy-two percent of these consumers, although firmly rooted in the online experience, feel that the traditional store experience outweighs other channels, such as Web sites, social media and mobile applications, when considering a purchase.

In terms of online features, 82 percent of digital consumers find value and importance in the ability to check in-store availability. This concept has become widespread for mass brands with 50 percent at the aspirational price point offering in-store inventory transparency and 52 percent of prestige brands such as Michael Kors and Marc Jacobs doing the same.

But, luxury, a notorious late-adopter of digital, falls short, with only Italian fashion label Gucci investing in online inventory for its boutiques.

Gucci's store inventory results for New York

Similarly, the number of luxury brands that offer in-store pick-ups after a purchase is made online remains stagnant. In 2015, only 23 percent of U.S. luxury brands offer the service, an increase of only 8 percent since 2013. In comparison, U.S. prestige brands have steadily increased the practice from 12 percent of brands in 2013, 20 percent in 2014 and 24 percent in 2015.

The push between site and store is also an area in omnichannel where luxury brands have lagged. Brands that succeeded in creating a robust omnichannel experience included store locator experiences and promotion of in-store services and events with online incentives including free shipping offers, exclusive product and online-only sales.

Although most of luxury placed poorly on L2’s data matrix for omnichannel fulfillment, brands such as Gucci, Christian Dior and Louis Vuitton included “push-to-store” features and for the first time prioritized ecommerce, albeit three to five years later than other retailers.

Interestingly, while mass brands offer some type of shipping promotion regularly, luxury brands have included free shipping as an element of high-touch customer service.

For example, luxury marketplace Farfetch made it easy for consumers to shop on-the-go with a new service that delivers purchases to travelers enjoying the summer on yachts.

Farfetch & Away allows consumers who are sailing the Mediterranean to have their purchases delivered directly to the marina at the nearest port city in Italy, France, Spain and Greece. Providing unique services for affluent consumers will help Farfetch appeal to this unique demographic (see story).

In 2015 and 2014, 100 percent of U.S. luxury brands surveyed for the report offer regular free shipping, an increase of 8 percent from 2013.

Gucci's store inventory results for New York

Similarly, the number of luxury brands that offer in-store pick-ups after a purchase is made online remains stagnant. In 2015, only 23 percent of U.S. luxury brands offer the service, an increase of only 8 percent since 2013. In comparison, U.S. prestige brands have steadily increased the practice from 12 percent of brands in 2013, 20 percent in 2014 and 24 percent in 2015.

The push between site and store is also an area in omnichannel where luxury brands have lagged. Brands that succeeded in creating a robust omnichannel experience included store locator experiences and promotion of in-store services and events with online incentives including free shipping offers, exclusive product and online-only sales.

Although most of luxury placed poorly on L2’s data matrix for omnichannel fulfillment, brands such as Gucci, Christian Dior and Louis Vuitton included “push-to-store” features and for the first time prioritized ecommerce, albeit three to five years later than other retailers.

Interestingly, while mass brands offer some type of shipping promotion regularly, luxury brands have included free shipping as an element of high-touch customer service.

For example, luxury marketplace Farfetch made it easy for consumers to shop on-the-go with a new service that delivers purchases to travelers enjoying the summer on yachts.

Farfetch & Away allows consumers who are sailing the Mediterranean to have their purchases delivered directly to the marina at the nearest port city in Italy, France, Spain and Greece. Providing unique services for affluent consumers will help Farfetch appeal to this unique demographic (see story).

In 2015 and 2014, 100 percent of U.S. luxury brands surveyed for the report offer regular free shipping, an increase of 8 percent from 2013.

Zegna overnight shipping promotion on social media

Retail’s chance

Omnichannel strategies have helped traditional bricks-and-mortar retailers operate in a changing consumer climate as more and more interaction is based online.

With declining traffic and loss of market share in a more crowded space filled with mono brand boutiques and large ecommerce players, department stores have to leverage their in-store capabilities with their online channels to capture sales from consumers seeking a seamless, hassle-free shopping experience. From opportunities to upsell at point of return to allowing for varied purchase paths, bricks-and-mortar retailers can use their physical locations to their advantage.

In L2’s rankings, Nordstrom was the highest ranked luxury retailer, tying for second place with JC Penney right behind top ranked Macy’s (see story).

It is not just industry sectors that have benefited from an omnichannel retail strategy.

The ecommerce market is booming in China, and the best way for brands to take advantage of this is to develop omnichannel marketing strategies that will appeal to the increasingly savvy Chinese consumer, according to a report by Fashionbi.

In the past year, China has become the world leader in ecommerce, overtaking the United States and European Union as a result of its exponential economic growth. As social media and mobile devices become more common in the country, mobile marketing and omnichannel strategies are necessary to satisfy consumer demands (see story).

"Omnichannel is an enormous opportunity in luxury, given the massive investments that these brands have made in their store environments, and the desire of consumers to pre-research luxury purchases digitally," said Claude de Jocas, Intelligence Group director at L2, New York. "But the category is still three to five years behind other retailers. Most brands have ignored even low hanging fruit, such as the ability to book a personal shopping appointment online.

"Stores continue to increase in importance -- even pure play ecommerce retailers have recognized the opportunity, with everyone from Rent the Runway to Gilt opening up brick-and-mortar locations. Particularly with luxury purchases, consumers want to be able to touch and feel product before committing. Omnichannel investments provide a way to put the consumer on a blue line path from online research to in-store experiences."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Zegna overnight shipping promotion on social media

Retail’s chance

Omnichannel strategies have helped traditional bricks-and-mortar retailers operate in a changing consumer climate as more and more interaction is based online.

With declining traffic and loss of market share in a more crowded space filled with mono brand boutiques and large ecommerce players, department stores have to leverage their in-store capabilities with their online channels to capture sales from consumers seeking a seamless, hassle-free shopping experience. From opportunities to upsell at point of return to allowing for varied purchase paths, bricks-and-mortar retailers can use their physical locations to their advantage.

In L2’s rankings, Nordstrom was the highest ranked luxury retailer, tying for second place with JC Penney right behind top ranked Macy’s (see story).

It is not just industry sectors that have benefited from an omnichannel retail strategy.

The ecommerce market is booming in China, and the best way for brands to take advantage of this is to develop omnichannel marketing strategies that will appeal to the increasingly savvy Chinese consumer, according to a report by Fashionbi.

In the past year, China has become the world leader in ecommerce, overtaking the United States and European Union as a result of its exponential economic growth. As social media and mobile devices become more common in the country, mobile marketing and omnichannel strategies are necessary to satisfy consumer demands (see story).

"Omnichannel is an enormous opportunity in luxury, given the massive investments that these brands have made in their store environments, and the desire of consumers to pre-research luxury purchases digitally," said Claude de Jocas, Intelligence Group director at L2, New York. "But the category is still three to five years behind other retailers. Most brands have ignored even low hanging fruit, such as the ability to book a personal shopping appointment online.

"Stores continue to increase in importance -- even pure play ecommerce retailers have recognized the opportunity, with everyone from Rent the Runway to Gilt opening up brick-and-mortar locations. Particularly with luxury purchases, consumers want to be able to touch and feel product before committing. Omnichannel investments provide a way to put the consumer on a blue line path from online research to in-store experiences."

Final Take

Jen King, lead reporter on Luxury Daily, New York