Image courtesy of Bloomingdale's

Image courtesy of Bloomingdale's

Affluent households in the United States will purchase $33 billion worth of goods this holiday season, a 4 percent increase from the year-ago, according to American Affluence Research Center’s 27th annual Millionaire Monitor.

Of that $33 billion, $5.6 billion will be in gift cards, the most popular gift of the season. Gift cards enable the receiver to make purchases that he or she will definitely enjoy, thereby eliminating the awkwardness of unwanted or ill-fitting gifts, but they also represent an opportunity for brands to earn extra revenue on cards that are not fully redeemed.

“There is an opportunity for retailers to upsell given that the affluent have the money to spend and they are in a fairly good mood about their personal situation and the economy,” said Ron Kurtz, president of the American Affluence Research Center, Atlanta. “If the stock market recovers some, the buying after Thanksgiving will get a boost.”

The Millionaire Monitor, a newly retitled survey now in its 27th year, looks at the 12 million households with a net worth of at least $1 million, which puts those homes in the wealthiest 10 percent of U.S. residents, and analyzes their moods and spending plans. This year the survey was taken in September amidst stock market volatility, indicating that the numbers may outperform the forecast especially if the economy improves.

Time of the seasons

The 4 percent boost compared to last year is more than normal and is attributed in the report to declining energy prices and the improvements in the job market. Predicting holiday shopping is difficult, however, with other forecasts ranging from increases of only 2.4 percent to nearly 6 percent.

Promotional image for Saks Fifth Avenue gift cards

Subjects covered by the Millionaire Monitor account for 40 percent of consumer spending, making their confidence especially important during the holiday season. Affluent consumers are more prone to overspending while shopping for gifts, sometimes by over 15 percent, another reason that political and market outlook will be important in the coming months.

The survey shows that on average the top 10 percent will spend $470 on gift cards, but one-third said they would buy more if they received a personal $10 gift card for every $50 spent on gift cards. Similar offers are sometimes made by retailers, which offer consumers a form of store currency as a percentage of purchases made during a specified timeframe; extending such promotions to the holiday season may cause a similar bump to the bottom-line.

Another way retailers can maximize revenue is by placing expiration dates on gift cards, although this practice would be limited by laws in many states, which would increase the chances that some cards go unredeemed. This tactic, especially if it were combined with offering additional currency to the customer based on other purchases, may lead to more unused gift cards, although the two in tandem could also decrease consumer spending.

Promotional image for Saks Fifth Avenue gift cards

Subjects covered by the Millionaire Monitor account for 40 percent of consumer spending, making their confidence especially important during the holiday season. Affluent consumers are more prone to overspending while shopping for gifts, sometimes by over 15 percent, another reason that political and market outlook will be important in the coming months.

The survey shows that on average the top 10 percent will spend $470 on gift cards, but one-third said they would buy more if they received a personal $10 gift card for every $50 spent on gift cards. Similar offers are sometimes made by retailers, which offer consumers a form of store currency as a percentage of purchases made during a specified timeframe; extending such promotions to the holiday season may cause a similar bump to the bottom-line.

Another way retailers can maximize revenue is by placing expiration dates on gift cards, although this practice would be limited by laws in many states, which would increase the chances that some cards go unredeemed. This tactic, especially if it were combined with offering additional currency to the customer based on other purchases, may lead to more unused gift cards, although the two in tandem could also decrease consumer spending.

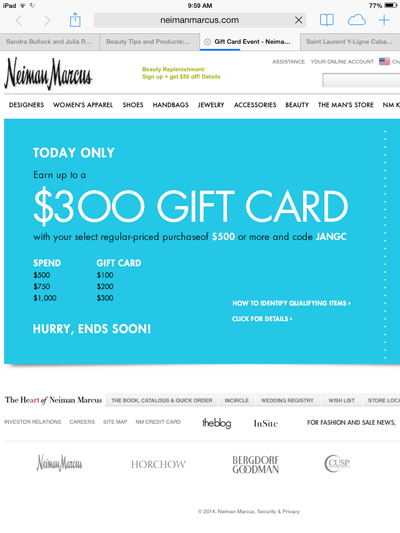

Gift card promotion from Neiman Marcus

Moreover, there may be reluctance to employ these tactics in part due to the accounting difficulties they create; revenue being generated independently from outgoing merchandise and vice-versa occurring in separate years could lead to difficulty in reporting financial performance or allocating budget.

Winter wonderland

Holiday gift season is a crucial time for retailers, who spend a disproportionate amount of resources to make it a success.

During the holiday season, luxury brands and retailers spend an average of 26 percent of their annual marketing budgets, according to recent research from the Shullman Research Center and Kantar Media.

Presented at the Luxury Retail Summit: Holiday Focus 2015, the findings show that the 14 luxury advertisers studied spent $204 million between November and December last year. While generally making large investments during this crucial shopping season, advertisers varied significantly in their preferred channels, timing of placements and overall messaging (see story).

Other reports have shown that brands need to change the way they approach the holiday season.

In the past, retailers have depended on the holiday build-up the Christmas shopping season provided, but this is no longer paying off. Unity Marketing found that in 1995, approximately one-third of sales by retailers were generated in the last three months of the year.

The same period in 2014 showed only 29.4 percent of sales. The decrease has been caused, in part, by gifting dollars being allocated away from bricks-and-mortar stores and spent online as consumers resort to researching and buying gift items via ecommerce (see story).

“[Brands can maximize revenue by] promoting gift cards by offering ‘bonus rewards,’ fancy wrapping/presentation of the cards and offering other incentives for buying gift cards online,” Mr. Kurtz said.

“Online purchases of gift cards online were expected to be: 16 percent (all or almost all online), 21 percent (about half online), 16 percent (much less than half) and 47 percent (none online)," he said. "Online purchases should be much bigger for gift cards."

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

Gift card promotion from Neiman Marcus

Moreover, there may be reluctance to employ these tactics in part due to the accounting difficulties they create; revenue being generated independently from outgoing merchandise and vice-versa occurring in separate years could lead to difficulty in reporting financial performance or allocating budget.

Winter wonderland

Holiday gift season is a crucial time for retailers, who spend a disproportionate amount of resources to make it a success.

During the holiday season, luxury brands and retailers spend an average of 26 percent of their annual marketing budgets, according to recent research from the Shullman Research Center and Kantar Media.

Presented at the Luxury Retail Summit: Holiday Focus 2015, the findings show that the 14 luxury advertisers studied spent $204 million between November and December last year. While generally making large investments during this crucial shopping season, advertisers varied significantly in their preferred channels, timing of placements and overall messaging (see story).

Other reports have shown that brands need to change the way they approach the holiday season.

In the past, retailers have depended on the holiday build-up the Christmas shopping season provided, but this is no longer paying off. Unity Marketing found that in 1995, approximately one-third of sales by retailers were generated in the last three months of the year.

The same period in 2014 showed only 29.4 percent of sales. The decrease has been caused, in part, by gifting dollars being allocated away from bricks-and-mortar stores and spent online as consumers resort to researching and buying gift items via ecommerce (see story).

“[Brands can maximize revenue by] promoting gift cards by offering ‘bonus rewards,’ fancy wrapping/presentation of the cards and offering other incentives for buying gift cards online,” Mr. Kurtz said.

“Online purchases of gift cards online were expected to be: 16 percent (all or almost all online), 21 percent (about half online), 16 percent (much less than half) and 47 percent (none online)," he said. "Online purchases should be much bigger for gift cards."

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York