Animation courtesy of BCG

Animation courtesy of BCG

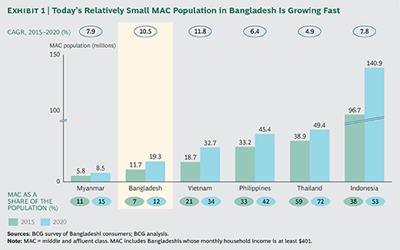

Bangladesh’s middle and affluent class (MAC) is expected to triple in 10 years to approximately 34 million consumers, offering luxury brands an unexpected market for growth, according to a new report by Boston Consulting Group.

While Bangladeshi consumers are optimistic about the future, they remain wary of debt and maintain support of small, local businesses over chains, which will create a challenge for luxury brands attempting to be impactful as the market matures. Despite this, Bangladeshi consumers value foreign brands and are becoming increasingly digital- and mobile-savvy.

"Bangladesh is one of the greatest untapped growth markets in Asia, yet it has been off the radar of most major consumer-product companies," said Zarif Munir, a BCG partner and coauthor of the report. "Companies that move now to get into position have an opportunity to build a lasting competitive advantage."

For its “Bangladesh: The Surging Consumer Market Nobody Saw Coming,” BCG’s Center for Customer Insight (CCI) surveyed 2,000 Bangladeshi consumers and analyzed their consumption patterns. The report focuses on Bangladesh’s middle and affluent class (MAC), which is defined as an individual whose annual income is $5,000 or more, thus providing disposable income for goods offering convenience and luxury.

A market surprise

For brands that have good understanding of consumer behavior, Bangladesh offers immense opportunity, as its middle and affluent class grows by 2 million consumers each year.

While this demographic is only 7 percent of the country’s 160 million citizens, the MAC is increasing rapidly due to stable economic growth, a surging working-age population and strong upward mobility. In comparison to its neighbors, this middle and affluent class is small when considering Vietnam’s 21 percent and Indonesia’s 38 percent.

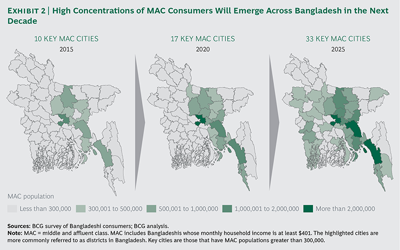

Within the next 10 years, consumer wealth is projected to disperse among the country’s major cities, Dhaka and Chittagong. In total, BCG suggests that 63 Bangladeshi cities will have a MAC population of at least 100,000, compared to 36 now.

Graph courtesy of BCG

As the MAC population in Bangladesh grows there will be more opportunities for luxury and high-end brands. BCG’s survey found that, although nervous about acquiring debt, consumers in the market are willing to spend.

This is in part due to many respondents expecting their incomes to increase over the next year, and 69 percent feeling that they would like to be able to make more purchases.

Respondents also said that brand is a top factor when considering making a purchase and a majority placed high priority on the quality of an item as well. As with many emerging markets, stressors such as not having full trust and optimism regarding the country’s economy are important to note.

Roughly two-thirds of surveyed MACs are uncertain that the success of the Bangladeshi economy will affect their personal finances, thus causing price to be a top priority.

Graph courtesy of BCG

As the MAC population in Bangladesh grows there will be more opportunities for luxury and high-end brands. BCG’s survey found that, although nervous about acquiring debt, consumers in the market are willing to spend.

This is in part due to many respondents expecting their incomes to increase over the next year, and 69 percent feeling that they would like to be able to make more purchases.

Respondents also said that brand is a top factor when considering making a purchase and a majority placed high priority on the quality of an item as well. As with many emerging markets, stressors such as not having full trust and optimism regarding the country’s economy are important to note.

Roughly two-thirds of surveyed MACs are uncertain that the success of the Bangladeshi economy will affect their personal finances, thus causing price to be a top priority.

Graph courtesy of BCG

Similar to the development of other emerging markets, brands that choose to enter the country now must implement plans to win over the long term since Bangladesh is still underdeveloped.

BCG suggests that brands should enter the market now to begin establishing loyalty among Bangladeshis by stressing high quality products for the cost. Even in established markets, brands often tout quality to justify the asking price that may seem to be expediential to some consumers.

Likewise, for brands that sell high-ticket prices, such as automakers or home appliances makers, there is potential in offering credit at an affordable rate or in helping consumers manage debt. This will quell consumers’ weariness of taking on debt.

Also, offering consumers a robust, mobile-centric digital ecommerce platform is always a safe bet no matter the market. BCG found that in Bangladesh 81 percent of consumers trust content read online and 66 percent search for product information through this channel.

Understanding behavior

As the luxury landscape continues to evolve and geopolitical turmoil affects emerging markets, the brands that will come out on top must be able to adapt to the resulting consumer behavior.

On Sept. 29 in New York, part of a 15-city world tour of sorts, Albatross Global Solutions shared insights from its annual research study “The Journey of the Luxury Consumer” to better understand motivators, the purchase journey and the consumer landscape on a global scale. A key finding has been the definition of luxury itself as consumer interest has developed from a desire for exclusivity to wanting ensured craftsmanship from the high-end brands they interact with (see story).

In Bangladesh, for instance, consumers are more likely to consider the immediate needs of their large households more so than other emerging markets in Asia. Also, a majority of households still purchase their goods in cash and prefer traditional mom-and-pop-style small, local businesses rather than modern chains.

Despite this, Bangladeshis are adopting advance mobile technologies with 68 percent of MAC consumers owning an Internet-enabled smartphone. Due to this, nearly 14 percent of online purchases are made using an localized online payment service, Payza. This number rivals Bangladeshi purchases made with credit and debit cards.

The share of ecommerce sales in the luxury industry has tripled since 2009 and is set to triple again by 2025, but obstacles such as currency, language, selection and payment method may make it difficult for brands to expand and capitalize on their reach. As social media, the Web and the development of BRIC and Asian nations, as well as Sub-Saharan Africa in the future give brands more visibility, it is essential that they monetize global consumers (see story).

"These findings indicate that while Bangladesh's growing consumer class is eager to trade up to higher-end brands, goods, and services, they are also budget conscious," said Olivier Muehlstein, a BCG partner and another coauthor. "Companies must create a strong value-for-money proposition to win over Bangladeshi households."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Graph courtesy of BCG

Similar to the development of other emerging markets, brands that choose to enter the country now must implement plans to win over the long term since Bangladesh is still underdeveloped.

BCG suggests that brands should enter the market now to begin establishing loyalty among Bangladeshis by stressing high quality products for the cost. Even in established markets, brands often tout quality to justify the asking price that may seem to be expediential to some consumers.

Likewise, for brands that sell high-ticket prices, such as automakers or home appliances makers, there is potential in offering credit at an affordable rate or in helping consumers manage debt. This will quell consumers’ weariness of taking on debt.

Also, offering consumers a robust, mobile-centric digital ecommerce platform is always a safe bet no matter the market. BCG found that in Bangladesh 81 percent of consumers trust content read online and 66 percent search for product information through this channel.

Understanding behavior

As the luxury landscape continues to evolve and geopolitical turmoil affects emerging markets, the brands that will come out on top must be able to adapt to the resulting consumer behavior.

On Sept. 29 in New York, part of a 15-city world tour of sorts, Albatross Global Solutions shared insights from its annual research study “The Journey of the Luxury Consumer” to better understand motivators, the purchase journey and the consumer landscape on a global scale. A key finding has been the definition of luxury itself as consumer interest has developed from a desire for exclusivity to wanting ensured craftsmanship from the high-end brands they interact with (see story).

In Bangladesh, for instance, consumers are more likely to consider the immediate needs of their large households more so than other emerging markets in Asia. Also, a majority of households still purchase their goods in cash and prefer traditional mom-and-pop-style small, local businesses rather than modern chains.

Despite this, Bangladeshis are adopting advance mobile technologies with 68 percent of MAC consumers owning an Internet-enabled smartphone. Due to this, nearly 14 percent of online purchases are made using an localized online payment service, Payza. This number rivals Bangladeshi purchases made with credit and debit cards.

The share of ecommerce sales in the luxury industry has tripled since 2009 and is set to triple again by 2025, but obstacles such as currency, language, selection and payment method may make it difficult for brands to expand and capitalize on their reach. As social media, the Web and the development of BRIC and Asian nations, as well as Sub-Saharan Africa in the future give brands more visibility, it is essential that they monetize global consumers (see story).

"These findings indicate that while Bangladesh's growing consumer class is eager to trade up to higher-end brands, goods, and services, they are also budget conscious," said Olivier Muehlstein, a BCG partner and another coauthor. "Companies must create a strong value-for-money proposition to win over Bangladeshi households."

Final Take

Jen King, lead reporter on Luxury Daily, New York