Image from Net-A-Porter's The Edit

Image from Net-A-Porter's The Edit

In a surprising finding, traditional department stores sometimes make more effective investments in online content and ecommerce than pure digital players, according to a new report from L2.

Although ecommerce-only outlets far outpace retail brands with bricks-and-mortar locations in using shoppable content, on the whole they do not consistently use the best practices across all platforms. This means that every brand has an opportunity to emerge as a leader in cultivating brand identity and leveraging online content to generate sales.

“Ecommerce capabilities of branded content should allow the shopper to make purchases with as few clicks as possible, ideally being able to add multiple products to a cart without leaving the page,” said Rebecca Edelman, research analyst at L2. “L2 studied a select group for pure plays and for bricks-and-mortar brands, all of which showed strong investments in content marketing.

“Within this group, the bricks-and-mortar brands better integrate ecommerce capabilities into their content, with Neiman Marcus doing a great job with their on-site magazine InSite,” she said.

“Department Stores: Shoppable Content” looks at the various content and features on the Web sites of 58 brands, including four “select” brands in Barneys New York, Harrods, Neiman Marcus and Harvey Nichols, as compared to pure players Net-A-Porter, Mr Porter, Yoox and ASOS.

Opportunities abound

Although every brand with the exception of Yoox and Harvey Nichols has a shoppable editorial hub or magazine that doubles to establish brand identity, Net-A-Porter is singled out for the integration of its magazine, “The Edit,” onto its homepage and accessible links to begin shopping the look.

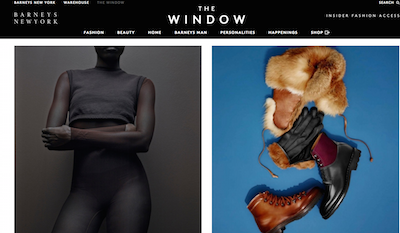

Barneys' The Window microsite homepage

Of the pure players and select bricks-and-mortar brands, only Neiman Marcus lacks a link to its branded content from its homepage. Pure players Net-A-Porter and Mr Porter and department store Barneys are the most aggressive, with homepage links in addition to links in the dropdown menu and the header and footer.

It is the bricks-and-mortar brands that excel at using lookbooks and magazines to encourage sales. All brands link from content to product pages, but neither Net-A-Porter nor Mr Porter allows an impulse buy or the option to save an item to the wishlist, while all department stores do one or the other.

Barneys' The Window microsite homepage

Of the pure players and select bricks-and-mortar brands, only Neiman Marcus lacks a link to its branded content from its homepage. Pure players Net-A-Porter and Mr Porter and department store Barneys are the most aggressive, with homepage links in addition to links in the dropdown menu and the header and footer.

It is the bricks-and-mortar brands that excel at using lookbooks and magazines to encourage sales. All brands link from content to product pages, but neither Net-A-Porter nor Mr Porter allows an impulse buy or the option to save an item to the wishlist, while all department stores do one or the other.

Image from Neiman Marcus' Christmas Book

Neiman Marcus excels in this area, with both quick-buy and wishlist buttons on its lookbook and its editorial hubs. Barneys is behind, with no quick-buy option and a wishlist option only on the lookbook, as well as an over-reliance on microsites whose design and layout is not up to par.

In the report, L2 recommends guided selling that will allow consumers to sort product pages based on the organization of the in-site magazine and more specifically target products with filters. Only Barneys includes sorting options based on branded content and uses product badging to help the consumer narrow her options and suggest particular items.

Many brands are missing an opportunity going the other way, too. Most sites do not link from product pages to editorial content and a handful do not cross-sell or recommend products based on purchases, either.

Image from Neiman Marcus' Christmas Book

Neiman Marcus excels in this area, with both quick-buy and wishlist buttons on its lookbook and its editorial hubs. Barneys is behind, with no quick-buy option and a wishlist option only on the lookbook, as well as an over-reliance on microsites whose design and layout is not up to par.

In the report, L2 recommends guided selling that will allow consumers to sort product pages based on the organization of the in-site magazine and more specifically target products with filters. Only Barneys includes sorting options based on branded content and uses product badging to help the consumer narrow her options and suggest particular items.

Many brands are missing an opportunity going the other way, too. Most sites do not link from product pages to editorial content and a handful do not cross-sell or recommend products based on purchases, either.

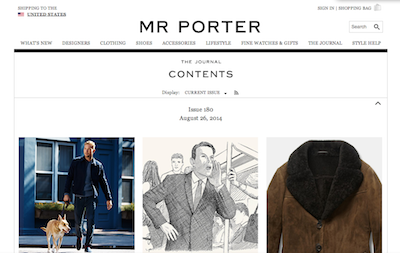

Mr Porter's The Journal

Guided cross-selling by writers and product recommendations provide the opportunity to increase sales, giving the consumer a more significant experience with the brand. Similarly, directing consumers from products to content gives them a window into the brand where they may previously have only been looking for a particular product.

Both Net-A-Porter and Mr Porter include the editor’s notes/style notes on product pages, while Harrods is the only select bricks-and-mortar store that does. Harrods checks all the boxes save for recommending products, and Neiman Marcus also outperforms the pure players in this regard.

Mr Porter's The Journal

Guided cross-selling by writers and product recommendations provide the opportunity to increase sales, giving the consumer a more significant experience with the brand. Similarly, directing consumers from products to content gives them a window into the brand where they may previously have only been looking for a particular product.

Both Net-A-Porter and Mr Porter include the editor’s notes/style notes on product pages, while Harrods is the only select bricks-and-mortar store that does. Harrods checks all the boxes save for recommending products, and Neiman Marcus also outperforms the pure players in this regard.

Net-A-Porter shopping page with editors' notes

Although it might be expected for brands native to the digital age to excel, the results show that is not the case and, furthermore, that brands ahead in some regards are behind in others. Every retailer has an opportunity to find new ways to unobtrusively connect the brand building offered through editorial content with products in a way that encourages consumers to buy more and return more frequently.

Getting ahead

Perhaps because of the growth of mobile shopping, it is increasingly important for brands to offer roads between content and shopping pages in more than just brand Web sites.

Accordingly, Barneys became another luxury retailer to implement shoppable content on its Instagram account last June.

Beginning on June 23, followers of Barneys’ Instagram account have been able to shop featured goods through Like2Buy. One of Instagram’s main pitfalls is that users are unable to insert hyperlinks into photo captions, thus causing a halted, although visually engaging, interaction between brands and consumers (see story).

Retailers have also fallen short in other efforts to maximize revenue.

For example, according to a September study by Yes Lifecycle Marketing, many retailers are still unwilling or unequipped to tailor customer service to the individual.

Many retailers in a variety of sectors have not sufficiently tracked clientele and are thus unable to provide sales associates with the personalized data that will help initiate and close a transaction. With consumers navigating freely between mobile, Web and in-store shopping, and brands therefore able to gather more information than ever before about frequent shoppers, properly cataloguing clientele has emerged as a way to provide the best possible customer service and showcase a great branded experience (see story).

Although these may seem like easy opportunities to take advantage of, the implementation of new strategies is a difficult process for a number of practical reasons.

“While the lack of features may seem like an obvious fix, the hold-up may be the result of a disconnect between the teams leading content marketing and those in charge of site and ecommerce,” Ms. Edelman said. “In addition, this may be indicative of a lack of prioritization by brands to maintain or consistently update on-site branded content including integrating new content onto pages as it is created.”

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

Net-A-Porter shopping page with editors' notes

Although it might be expected for brands native to the digital age to excel, the results show that is not the case and, furthermore, that brands ahead in some regards are behind in others. Every retailer has an opportunity to find new ways to unobtrusively connect the brand building offered through editorial content with products in a way that encourages consumers to buy more and return more frequently.

Getting ahead

Perhaps because of the growth of mobile shopping, it is increasingly important for brands to offer roads between content and shopping pages in more than just brand Web sites.

Accordingly, Barneys became another luxury retailer to implement shoppable content on its Instagram account last June.

Beginning on June 23, followers of Barneys’ Instagram account have been able to shop featured goods through Like2Buy. One of Instagram’s main pitfalls is that users are unable to insert hyperlinks into photo captions, thus causing a halted, although visually engaging, interaction between brands and consumers (see story).

Retailers have also fallen short in other efforts to maximize revenue.

For example, according to a September study by Yes Lifecycle Marketing, many retailers are still unwilling or unequipped to tailor customer service to the individual.

Many retailers in a variety of sectors have not sufficiently tracked clientele and are thus unable to provide sales associates with the personalized data that will help initiate and close a transaction. With consumers navigating freely between mobile, Web and in-store shopping, and brands therefore able to gather more information than ever before about frequent shoppers, properly cataloguing clientele has emerged as a way to provide the best possible customer service and showcase a great branded experience (see story).

Although these may seem like easy opportunities to take advantage of, the implementation of new strategies is a difficult process for a number of practical reasons.

“While the lack of features may seem like an obvious fix, the hold-up may be the result of a disconnect between the teams leading content marketing and those in charge of site and ecommerce,” Ms. Edelman said. “In addition, this may be indicative of a lack of prioritization by brands to maintain or consistently update on-site branded content including integrating new content onto pages as it is created.”

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York