The world's UHNW population continues to grow

The world's UHNW population continues to grow

The global ultra-high-net-worth population is larger than ever and will continue to grow, according to a new report by Wealth-X and UBS. In 2014 there were 211,275 UHNW individuals with a combined net worth of almost $30 trillion, increase from 2013 of 6 percent and $2 trillion, respectively. This population number will continue to grow, with another 40,000 individuals set to add another $10 trillion by 2020, although economic patterns could alter buying behavior despite the increase in wealth.

The macroeconomic factors definitely impact the ultra affluent, but it depends on their level of net-worth and in particular their liquidity as to much it impacts them beyond the psychological," aid David Friedman, president of Wealth-X, New York. "They all are impacted by the psychological factor, but how much it actually trickles down on their buying habits is going to depend on them as an individual too.

"There is this economic mindset and mind-frame defined by each person who is ultra affluent who might say, 'gosh the market is down, I really feel like I need to cut back so I’m not going to be spending on luxury, but when it comes to things I really care about, I’m still going to buy the new Harley-Davidson,'" he said. "It absolutely impacts them in a pyschological perspective how it manifests depends on that person."

Money trees UHNW individuals hold a large portion of wealth in cash or cash equivalents – nearly a quarter. However, the purchasing power of cash has declined much faster than inflation while high-end luxury goods have had significant price increases. For example, since 2010, London houses have become on average 40 percent more expensive and Louis Vuitton Keepall Bandouliere duffle bags are 30 percent pricier, but the buying power of cash has dropped 8.5 percent. This means that a much larger share of cash assets is needed to buy goods today than five years ago. Louis Vuitton Keepall Bandouliere

Similarly, many UHNW individuals have an additional two-thirds of their wealth in their core business. Although this could generate big short-term gains, longer periods generally yield higher returns for more diverse portfolios. Diversifying assets could help offset economic factors in the long-term.

While North America and Europe continue to perform well for UHNW individuals, the slowdown in Asia has had an effect at the top of the market. India continues to grow, but Japan and China underperformed compared to expectations, and China’s real estate market is slowing.

Latin America & the Caribbean recovered from last year’s decline, but the region’s growth was still slower than any other region due to currency devaluation. The Middle East and Africa were the fastest growing regions, although instability in particular countries or areas raises questions about the sustainability of such growth.

Louis Vuitton Keepall Bandouliere

Similarly, many UHNW individuals have an additional two-thirds of their wealth in their core business. Although this could generate big short-term gains, longer periods generally yield higher returns for more diverse portfolios. Diversifying assets could help offset economic factors in the long-term.

While North America and Europe continue to perform well for UHNW individuals, the slowdown in Asia has had an effect at the top of the market. India continues to grow, but Japan and China underperformed compared to expectations, and China’s real estate market is slowing.

Latin America & the Caribbean recovered from last year’s decline, but the region’s growth was still slower than any other region due to currency devaluation. The Middle East and Africa were the fastest growing regions, although instability in particular countries or areas raises questions about the sustainability of such growth.

"The reality is, those markets are growing so fast because the wealth distribution from an infrastructure standpoint is so bifurcated and polarized," Mr. Friedman said. "Most of the wealth is going to accumulate and flow into the upper echelons, especially in Africa. Wherever the Chinese are pouring investment in, primarily they’re going to see the higher levels benefitting from that — not that everyone won’t benefit from the infrastructure investment, but the wealth it creates is going to be accumulated in the upper echelons.

"In the Middle East, there’s not much wealth that’s being created and so much of their wealth is in oil except a place like Qatar where they diversified, and it has the highest GDP in the world, but that trend is just the continuation of an existing trend," he said. "The trend in Africa is being driven by the growth of an emerging middle class and wealth investment from China, so there’s domestic and external factors, whereas in the Middle East its continued based on the same factors as historically have been the case.

"Wherever there is an emerging class, an elite layer will benefit from that growth in terms of wealth generation accumulation."

Placencia, Belize SANCAS realty listing

Although UHNW individuals are overwhelmingly male, the female UHNW population grew from around 23,600 to almost 27,500. Such women are on average two years younger than male counterparts and have a higher percentage of their wealth in real estate and luxury assets, slightly less than 16 percent. They also work for nonprofits and social organizations or in textiles and list philanthropy as their favorite hobby, followed by art.

By contrast, UHNW men tend to work in finance, banking and investment or real estate, hold about 10 percent of wealth in real estate or luxury assets, and list sports as their favorite hobby, with philanthropy second and outdoors third.

The report forecasts fastest growth in terms of UHNW population for Africa and the Middle East, noting that the raw numbers will remain lowest in those two regions. North America and Europe will likely be seen as second citizenship opportunities for African and Middle Eastern UHNW individuals.

Placencia, Belize SANCAS realty listing

Although UHNW individuals are overwhelmingly male, the female UHNW population grew from around 23,600 to almost 27,500. Such women are on average two years younger than male counterparts and have a higher percentage of their wealth in real estate and luxury assets, slightly less than 16 percent. They also work for nonprofits and social organizations or in textiles and list philanthropy as their favorite hobby, followed by art.

By contrast, UHNW men tend to work in finance, banking and investment or real estate, hold about 10 percent of wealth in real estate or luxury assets, and list sports as their favorite hobby, with philanthropy second and outdoors third.

The report forecasts fastest growth in terms of UHNW population for Africa and the Middle East, noting that the raw numbers will remain lowest in those two regions. North America and Europe will likely be seen as second citizenship opportunities for African and Middle Eastern UHNW individuals.

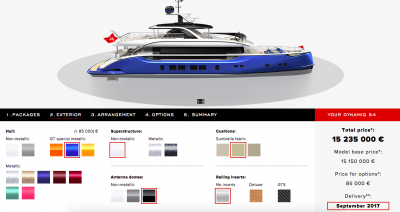

Dynamiq customizable superyacht

Asia, despite the slowdown, will have the biggest growth in wealth. Asian UHNW individuals are already and will continue to influence the luxury market through their preference for wealth managers and more specific preferences for superyachts.

Also included in the report are analyses breakdowns of each region’s UHNW population and growth, a world ranking of countries by UHNW population and buying profiles.

Around the world

Experience-based luxuries are popular with UHNW individuals, with travel and hospitality being the sector with the most money spent on it by the demographic, at $45 billion, although automobiles and jewelry/watches account for a combined $65 billion. Also popular are art, private aviation and yachts, with apparel and accessories, wine and beauty products much further down.

Some of these spending habits may become more pronounced as burgeoning regions grow. For example, the Middle East has emerged as a strong market for private aviation, according to a November report by Wealth-X and WINGX Advance.

Dynamiq customizable superyacht

Asia, despite the slowdown, will have the biggest growth in wealth. Asian UHNW individuals are already and will continue to influence the luxury market through their preference for wealth managers and more specific preferences for superyachts.

Also included in the report are analyses breakdowns of each region’s UHNW population and growth, a world ranking of countries by UHNW population and buying profiles.

Around the world

Experience-based luxuries are popular with UHNW individuals, with travel and hospitality being the sector with the most money spent on it by the demographic, at $45 billion, although automobiles and jewelry/watches account for a combined $65 billion. Also popular are art, private aviation and yachts, with apparel and accessories, wine and beauty products much further down.

Some of these spending habits may become more pronounced as burgeoning regions grow. For example, the Middle East has emerged as a strong market for private aviation, according to a November report by Wealth-X and WINGX Advance.

TCS World Travel Private Jet; image courtesy Robb Report

The typical private jet owner in the Middle East is younger than global jet owners and, despite an average net-worth of more than $500 million less, has planes an average of three times as expensive, near $50 million compared to the average global owner’s $16.4 million. The numbers show not only that private aviation is a viable market in the Middle East, but other high-priced luxury offerings could also find a home (see story).

Second homes, especially in the U.S and UK, are popular, and many UHNW individuals, are expatriated. Chinese and Indian UHNWs are the most likely to relocate and also are fast-growing segments, while around 9 percent of Europeans, Middle Easterners and Australians have become expatriates. The number is smaller in the Americas, approaching 5 percent in Central and South America but only 3.6 percent of North Americans.

Most ultra-high-net-worth consumers make investments in residential real estate, with 79 percent owning at least two homes, but for those in emerging markets, these property purchases are often for more than pleasure, according to a Wealth-X and Sotheby’s International Realty report from August 2015.

While many UHNW individuals make their decision to buy a secondary home as a means toward personal enjoyment or financial investment, a number of affluents are now using property for the opportunities afforded to them through their purchase. With the economies and political climates of a number of countries in flux, more wealthy consumers are likely to be looking for these “opportunity gateways,” seeking citizenship or financial security outside of their home nation (see story).

Although macroeconomic trends factor into the location and development of UHNW populations, countries can foster it from within as well.

"A major factor is the growth of the E.B. 5 program in the U.S. and the tentacles have extended far and wide," Mr. Friedman said. "It's driving ultra wealthy individuals to the U.S and with that comes luxury purchases."

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

TCS World Travel Private Jet; image courtesy Robb Report

The typical private jet owner in the Middle East is younger than global jet owners and, despite an average net-worth of more than $500 million less, has planes an average of three times as expensive, near $50 million compared to the average global owner’s $16.4 million. The numbers show not only that private aviation is a viable market in the Middle East, but other high-priced luxury offerings could also find a home (see story).

Second homes, especially in the U.S and UK, are popular, and many UHNW individuals, are expatriated. Chinese and Indian UHNWs are the most likely to relocate and also are fast-growing segments, while around 9 percent of Europeans, Middle Easterners and Australians have become expatriates. The number is smaller in the Americas, approaching 5 percent in Central and South America but only 3.6 percent of North Americans.

Most ultra-high-net-worth consumers make investments in residential real estate, with 79 percent owning at least two homes, but for those in emerging markets, these property purchases are often for more than pleasure, according to a Wealth-X and Sotheby’s International Realty report from August 2015.

While many UHNW individuals make their decision to buy a secondary home as a means toward personal enjoyment or financial investment, a number of affluents are now using property for the opportunities afforded to them through their purchase. With the economies and political climates of a number of countries in flux, more wealthy consumers are likely to be looking for these “opportunity gateways,” seeking citizenship or financial security outside of their home nation (see story).

Although macroeconomic trends factor into the location and development of UHNW populations, countries can foster it from within as well.

"A major factor is the growth of the E.B. 5 program in the U.S. and the tentacles have extended far and wide," Mr. Friedman said. "It's driving ultra wealthy individuals to the U.S and with that comes luxury purchases."

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York