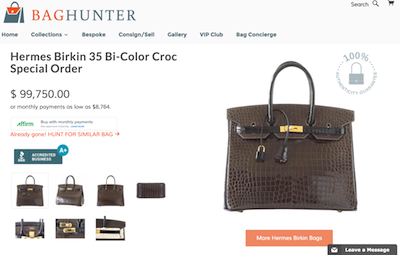

A Birkin bag sold on Baghunter for $99,750

A Birkin bag sold on Baghunter for $99,750

In the last 35 years, French leather goods brand Hermès’ iconic Birkin handbag has increased in value by more than 500 percent, according to a new study by Baghunter.

In Baghunter’s study, the online handbag consignment marketplace compared three different types of popular investments: the S&P 500, gold and Hermès Birkin Handbags. The Birkin bag, named for actress and It-girl Jane Birkin in 1984, and based on an Hermès design from 1981, is a status symbol for the fashion elite, and as it turns out, a sound investment.

"As a whole, the study findings show how stable the ultra-luxury industry has been over the past 35 years when compared to more traditional investment opportunities," said Evelyn Fox, founder of Baghunter. "In particular, the study displays how high-end, rare and sought-after luxury items such as Hermès Birkin handbags have never dropped in value, even during times of recession and economic difficulty.

"There is a difference between luxury and ultra-luxury. While the luxury market suffers during worse economic times the ultra-luxury market is impervious to economic factors that can affect other industries such as high-street retail and stock markets," she said.

"As such, potential volatility in the economy throughout 2016 will likely have little to no effect on the ultra-luxury collectors market and we expect it to continue to thrive for the foreseeable future, remaining the least risky investment opportunity in 2016 in my opinion."

Baghunter selected the S&P 500, gold and Birkin bags as they represent distinct and popular forms of investments. The S&P 500 reflects overall returns of the stock market as a whole while gold is the most popular commodity and Hermès Birkin bags are a collectible and tangible investment.

The study follows investment trends over the course of 35 years, to align with the release of the Birkin bag.

All in the bag

In the time period evaluated, the S&P 500 has returned an average of 11.66 percent, or 8.65 percent in real returns. But, the S&P 500 averages do not reflect market fluctuations during the 35-year period and assume that investors have neither bought or sold stocks during that time.

Gold prices have offered a return of 1.9 percent, or a real return average of -1.5 percent. As with the S&P 500, the averages do not take into account the variations in the prices and investor behavior. For example, gold prices surged to an average of $1,571.52 per ounce in 2011, and a low of $271.04 in 2001.

During the 35-year period, Baghunter found that Hermès Birkin handbags have increased in value year over year. The handbag has offered an average annual value increase of 14.2 percent.

Unlike the S&P 500 and gold, the value of Birkin handbags has never decreased and has steadily and consistently increased. The handbag’s peak surge value occurred in 2001 when it increased in value by 25 percent, and the lowest increase was 2.1 percent in 1986.

Baghunter suggests that the data of these three investment options can be used as an indicator of future market fluctuations. While the S&P 500 and gold are subjected to normal increases and decreases, Birkin bags have only weighed positively since the style's introduction.

Infographic provided by Baghunter

The data also reveals the risk involved in investing in either the S&P 500 or the gold market. Depending on the year, selling stocks or gold commodities could have resulted in staggering loss, when a different year could have been profitable.

Birkin bags incur the least investment risk regardless of the year. Economic factors, such as recessions, that strongly affect the S&P 500 and gold, have no influence on Birkin bags as the handbag maintains and increases value.

To give investors a full picture representation of today’s economic climate, Baghunter also evaluated the performance of the S&P 500, gold and Hermès Birkin bags in 2015.

Last year, the S&P 500 had an average annual return of 1.36 percent, the worst performance since 2008’s recession. On Jan. 4, 2016, the S&P 500 saw its worst start to a new year in more than a decade.

Infographic provided by Baghunter

The data also reveals the risk involved in investing in either the S&P 500 or the gold market. Depending on the year, selling stocks or gold commodities could have resulted in staggering loss, when a different year could have been profitable.

Birkin bags incur the least investment risk regardless of the year. Economic factors, such as recessions, that strongly affect the S&P 500 and gold, have no influence on Birkin bags as the handbag maintains and increases value.

To give investors a full picture representation of today’s economic climate, Baghunter also evaluated the performance of the S&P 500, gold and Hermès Birkin bags in 2015.

Last year, the S&P 500 had an average annual return of 1.36 percent, the worst performance since 2008’s recession. On Jan. 4, 2016, the S&P 500 saw its worst start to a new year in more than a decade.

Image provided by Portero

Experts suggest that the poor opening to start the year hints toward a global recession for 2016. The global recession likely will be driven by economic influencers such as Europe’s debt crisis, growing student loan debt, a decrease in retail sales, low United States factory orders, weakened U.S. export growth and a decline in corporate profits.

Gold saw a decrease of 10 percent at the end of 2015, finishing the year at $1,061.71. This is a 40 percent decrease from its 2011 peak. Gold is expected drop further to approximately $1,114 per ounce for the year, down from its $1,156 average for 2015.

Economic disturbances, namely dollar trends, are intrinsically linked to gold prices. Also, the direction of crude oil prices also affects the price of gold. For example, if sanctions are lifted on Iran mixed with high oil output, gold will be negatively affected.

While it is difficult to accurately predict economic trends of the S&P 500 and gold, Birkin bags are on pace to continue positively for investors.

In general, the handbag market has been positively affected by consumers in the BRIC nations.

Increased spending power, growing Internet penetration and access to ecommerce has caused handbag sales to grow at a fast rate in BRIC nations, according to a new report by Technavio.

The market is expected to continue to thrive in these countries as they become increasingly urbanized and Western trends infiltrate the regions. In 2015, shoulder bags were the most popular style, with brands like Chanel, Burberry and Michael Kors capitalizing on the market (see story).

"Many major luxury handbag brands offer some potential in the resale market, however, we have found no handbag, other than the Birkin, that has increased in price so much over the last 35 years when sold on the secondary market," Ms. Fox said.

"The main reason for this is a combination of the difficulty in purchasing a new Birkin directly from Hermès and the small number of Birkins made each year in comparison to other luxury brands," she said. "If someone wanted a new Chanel or Louis Vuitton bag, they could simply go to their nearest boutique and purchase one, however, this isn’t the case with Birkin bags, which is why they are a sound investment for 2016."

Rising resale

Described by Fortune Magazine as a handbag that “holds it value the best (and longest),” 2015 was a record-breaking year for the Birkin. With celebrity handlers such as Kim Kardashian and Victoria Beckham, the wait list for a Birkin can be as long as six years, a factor that has also worked to drive demand and value.

Birkin handbags have high market retail prices when purchased directly from Hermès, and often reach even higher prices at auction and resale due to the infamy of the bag as a status symbol. For example, last year was marked by a record sale for a pink crocodile-skin Birkin handbag, selling at auction for $223,000.

Baghunter also had a record sale in 2015, selling a $99,750 elephant gray and black bi-color crocodile special-order Hermès Birkin to a VIP client. This particular Birkin bag was listed on Baghunter in pristine condition, showing no signs of previous wear and tear.

Image provided by Portero

Experts suggest that the poor opening to start the year hints toward a global recession for 2016. The global recession likely will be driven by economic influencers such as Europe’s debt crisis, growing student loan debt, a decrease in retail sales, low United States factory orders, weakened U.S. export growth and a decline in corporate profits.

Gold saw a decrease of 10 percent at the end of 2015, finishing the year at $1,061.71. This is a 40 percent decrease from its 2011 peak. Gold is expected drop further to approximately $1,114 per ounce for the year, down from its $1,156 average for 2015.

Economic disturbances, namely dollar trends, are intrinsically linked to gold prices. Also, the direction of crude oil prices also affects the price of gold. For example, if sanctions are lifted on Iran mixed with high oil output, gold will be negatively affected.

While it is difficult to accurately predict economic trends of the S&P 500 and gold, Birkin bags are on pace to continue positively for investors.

In general, the handbag market has been positively affected by consumers in the BRIC nations.

Increased spending power, growing Internet penetration and access to ecommerce has caused handbag sales to grow at a fast rate in BRIC nations, according to a new report by Technavio.

The market is expected to continue to thrive in these countries as they become increasingly urbanized and Western trends infiltrate the regions. In 2015, shoulder bags were the most popular style, with brands like Chanel, Burberry and Michael Kors capitalizing on the market (see story).

"Many major luxury handbag brands offer some potential in the resale market, however, we have found no handbag, other than the Birkin, that has increased in price so much over the last 35 years when sold on the secondary market," Ms. Fox said.

"The main reason for this is a combination of the difficulty in purchasing a new Birkin directly from Hermès and the small number of Birkins made each year in comparison to other luxury brands," she said. "If someone wanted a new Chanel or Louis Vuitton bag, they could simply go to their nearest boutique and purchase one, however, this isn’t the case with Birkin bags, which is why they are a sound investment for 2016."

Rising resale

Described by Fortune Magazine as a handbag that “holds it value the best (and longest),” 2015 was a record-breaking year for the Birkin. With celebrity handlers such as Kim Kardashian and Victoria Beckham, the wait list for a Birkin can be as long as six years, a factor that has also worked to drive demand and value.

Birkin handbags have high market retail prices when purchased directly from Hermès, and often reach even higher prices at auction and resale due to the infamy of the bag as a status symbol. For example, last year was marked by a record sale for a pink crocodile-skin Birkin handbag, selling at auction for $223,000.

Baghunter also had a record sale in 2015, selling a $99,750 elephant gray and black bi-color crocodile special-order Hermès Birkin to a VIP client. This particular Birkin bag was listed on Baghunter in pristine condition, showing no signs of previous wear and tear.

Baghunter Web site

The handbag was likely purchased for value rather than as a fashion statement. If the VIP purchaser decides to sell the crocodile special-order Hermès Birkin in the future, it is likely to fetch more than the price for which it was purchased (see story).

"Historical data is generally a very good indicator of future performance, and there are many indicators to predict Birkins will continue to rise in value at such a rapid rate," Ms. Fox said.

"The secondary market for Birkins is at an all-time high, with many women who have been turned away from Hermès or are unwilling to wait years for a Birkin instead buying from a trusted reseller," she said. "Last year alone, a Birkin broke the record for the sale of a handbag at auction, going for $222,000, and at Baghunter we also announced a record sale with a pre-loved Birkin selling for almost $100,000.

"These figures indicate Birkin bags are maintaining and even exceeding their market value on the secondary market, making them among the safest investment types available."

Final Take

Jen King, lead reporter on Luxury Daily, New York

Baghunter Web site

The handbag was likely purchased for value rather than as a fashion statement. If the VIP purchaser decides to sell the crocodile special-order Hermès Birkin in the future, it is likely to fetch more than the price for which it was purchased (see story).

"Historical data is generally a very good indicator of future performance, and there are many indicators to predict Birkins will continue to rise in value at such a rapid rate," Ms. Fox said.

"The secondary market for Birkins is at an all-time high, with many women who have been turned away from Hermès or are unwilling to wait years for a Birkin instead buying from a trusted reseller," she said. "Last year alone, a Birkin broke the record for the sale of a handbag at auction, going for $222,000, and at Baghunter we also announced a record sale with a pre-loved Birkin selling for almost $100,000.

"These figures indicate Birkin bags are maintaining and even exceeding their market value on the secondary market, making them among the safest investment types available."

Final Take

Jen King, lead reporter on Luxury Daily, New York