Lancôme La Vie Est Belle

Lancôme La Vie Est Belle

Brands are still struggling to sell fragrances to consumers in the digital space, according to a new report by L2. Consumers are influenced heavily in their fragrance purchases by having a chance to test or otherwise smell it before purchasing, neither of which is possible online. Brands can partially overcome this limitation through more specific and saturated online promotions, from user-generated content to filters on user reviews. “Beauty Fragrance Product Merchandising” examines the merchandising strategies of 33 brands selling fragrances, comparing fragrance-only against multi-product sellers and determining best approaches and practices. "The scent experience is obviously important to the path to purchase, but beauty as a category is experiential in nature, and the question posed of fragrance is really a variation on that posed within the larger beauty category," said Jenny Shen, research lead at L2. "How do you translate what has historically required in-person try-ons and consultations to an online commerce environment?"

"Short of digital scent technology (which people are working on), brands must make sure that they are merchandising their products in an effective and compelling manner," she said. "With most brands that we benchmarked, that means visual merchandising in the form of advertising and TV collateral.

"There are also many brands with offline brand equity that have not necessarily made the same investment in online equity. Consumers are increasingly moving online, and the online demographic is young and wealthy--even brands with "iconic" fragrances need to be adapting their messaging and tactics to reach these newcomers, rather than just relying on the decades of brand equity they've previously built."

Content push While having a chance to test the scent on the skin, whether the scent is one the consumer usually wears and getting to smell the scent on a blotter are the most important factors for purchasing fragrances. Packaging, advertising and celebrity endorsements were ranked as the least significant. The limitations of ecommerce necessitate promoting the least significant factors and forsaking the more influential ones, thereby limiting fragrance ecommerce. To elevate fragrance sales, 30 percent of surveyed brands have embedded campaign prints and 36 percent have embedded video collateral. Both are attempts to tie artistic or celebrity-fueled offline campaigns to the online space. Many fashion brands operate microsites or separate sites for fragrance product offerings. In general, brands with a fragrance-only designation, such as Hugo Boss Fragrance, Jimmy Choo or Viktor & Rolf, were less likely to embed campaign or video materials than multi-category sellers including Estée Lauder, Gucci and Giorgio Armani Beauty. Black Opium ad in September Vogue

L2 cites Saint Laurent’s Black Opium fragrance as a best in class, as it uses print and video campaign materials in addition to incorporating a UGC gallery, a technique exclusive to the brand among those studied and one tightly curated according to the #YSLBeauty hashtag.

YSL also highlights fragrance notes and includes a makeup tie-in, thus leveraging product coordination to generate sales.

Multi-category sellers are also more adept at guided selling compared to fragrance-only vendors. None of 17 reviewed fragrance-only sellers allow consumers to filter search results by user characteristics compared versus two of 16 multi-category sellers.

Other brands have adapted their beauty selling techniques directly to fragrance, allowing for irrelevant filters such as “skin type and concern” for fragrance products. Additionally, 18 percent of fragrance sellers overall and 31 percent of those that are multi-category allow consumers to filter user reviews.

Black Opium ad in September Vogue

L2 cites Saint Laurent’s Black Opium fragrance as a best in class, as it uses print and video campaign materials in addition to incorporating a UGC gallery, a technique exclusive to the brand among those studied and one tightly curated according to the #YSLBeauty hashtag.

YSL also highlights fragrance notes and includes a makeup tie-in, thus leveraging product coordination to generate sales.

Multi-category sellers are also more adept at guided selling compared to fragrance-only vendors. None of 17 reviewed fragrance-only sellers allow consumers to filter search results by user characteristics compared versus two of 16 multi-category sellers.

Other brands have adapted their beauty selling techniques directly to fragrance, allowing for irrelevant filters such as “skin type and concern” for fragrance products. Additionally, 18 percent of fragrance sellers overall and 31 percent of those that are multi-category allow consumers to filter user reviews.

Lauder for Men cologne

Where brands have largely failed to optimize fragrance ecommerce sites, LVMH-owned Sephora has emerged as a sophisticated fragrance product merchandiser.

Sephora includes video, print collateral, product variations, UGC and editorial integration on its product pages. For comparison, Macy’s, which registered a market-leading 27 percent of fragrance sales in 2014, and Ulta both include only the first three features and Nordstrom only product variations.

"There's a bit of a 'frenemy' relationship between brands and retailers, more for some brands than others," Ms. Shen said. "Estée Lauder brands, for example, have historically relied heavily on department stores as a retail channel, but Sephora has eaten into department stores' share of sales in beauty.

"But the fact is that most beauty purchases are occurring on third party retail sites," she said. In that sense, brand sites really can't compete; rather, they should be thinking about to what extent they can leverage these retailers' scale and wider reach to achieve incremental sales, which also means optimizing their presence on retailer sites, whether it's paid placements or enhancing content. To reduce it to an either/or scenario of Sephora vs. brand site is a counterproductive exercise.

Lauder for Men cologne

Where brands have largely failed to optimize fragrance ecommerce sites, LVMH-owned Sephora has emerged as a sophisticated fragrance product merchandiser.

Sephora includes video, print collateral, product variations, UGC and editorial integration on its product pages. For comparison, Macy’s, which registered a market-leading 27 percent of fragrance sales in 2014, and Ulta both include only the first three features and Nordstrom only product variations.

"There's a bit of a 'frenemy' relationship between brands and retailers, more for some brands than others," Ms. Shen said. "Estée Lauder brands, for example, have historically relied heavily on department stores as a retail channel, but Sephora has eaten into department stores' share of sales in beauty.

"But the fact is that most beauty purchases are occurring on third party retail sites," she said. In that sense, brand sites really can't compete; rather, they should be thinking about to what extent they can leverage these retailers' scale and wider reach to achieve incremental sales, which also means optimizing their presence on retailer sites, whether it's paid placements or enhancing content. To reduce it to an either/or scenario of Sephora vs. brand site is a counterproductive exercise.

"To go back to the Estée Lauder example, while the brand still concentrates major promotions through Nordstrom and Macy's, the flagship Estée Lauder brand and Clinique are partnering with Sephora for exclusive launches of new product lines that appeal to younger audiences."

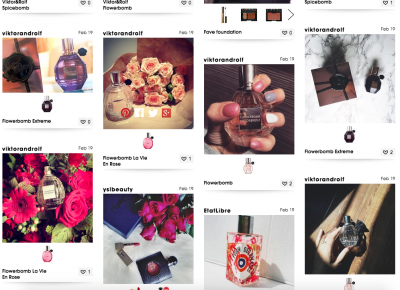

Beauty board Fragrance campaigns are highly visual, and Sephora has leveraged that quality with its online marketing. L’Oréal brands have also taken notice, with YSL's Black Opium, Viktor & Rolf’s Flowerbomb and Lancôme’s La Vie Est Belle all making use of UGC. The returns are visible on Sephora’s Beauty Board, where their appearances far outpace the field at large. Sephora Beauty Board

Fragrances have more advertising collateral and user-generated content on Sephora.com than on brand Web sites, by margins of 51 percent and 55 percent, respectively. Campaign video and editorial content disparities are similarly stark.

L2 notes that the content gap on Sephora’s Web site compared to the brand’s site also speaks to the nature of licensing deals between fashion houses and fragrance manufacturers.

In terms of user-generated content visibility, some brands may eschew it because of potential brand dilution in the long term. Brands must weigh that potential negative against the likelihood of improved sales and visibility.

User-generated content has revealed itself as an effective sales vehicle in adjacent sectors. Among the major changes in beauty marketing from 2015 compared to 2014, user-generated content is playing more of a role for beauty marketers.

While other features, such as store locators, user reviews, auto-replenishment and loyalty programs were not adapted by many more brands this year, twice as many have UGC gallery pages compared to last year, with many also adapting UGC boards on product pages. User-generated content offers brands a chance to get consumers more directly involved and fosters loyalty.

More directly, UGC offers a “guided selling opportunity,” as research suggests shoppable UGC can increase conversion by as much as 12 percent. Of the 112 brand sites studied in a previous L2 report, 35 percent have a diagnostic quiz, 23 percent have an advanced filter and 6 percent have virtual makeover options, indicating that while guided selling is definitely being adopted, brands still have room to improve (see story).

Online commerce is projected to be luxury’s primary growth area in the future, but brands that are still adjusting must also prepare themselves for the accelerating rise of mobile commerce.

Mobile commerce creates myriad opportunities for retailers, but they must first accommodate consumers’ concerns, according to a new report by Boston Retail Partners.

Sixty-one percent of Internet usage in the United States is on mobile devices, and mobile commerce, already one-third of ecommerce sales, is set to grow over two-and-a-half times as fast as total online sales. Although mobile commerce has been seen as a lagging point for retailers, most are focusing resources on improving mobile sites and implementing other mobile-based strategies over the next few years (see story).

"Like the rest of the beauty industry, fragrance brands have to find ways to connect with consumers," Ms. Shen said. "Niche fragrance, which falls into the prestige category, is currently having a bit of moment with smaller fragrance houses seeing a surge in interest.

"While it is a fragmented and crowded field, fragrance is an intensely personal experience, which means there's room for newcomers to differentiate themselves."

Sephora Beauty Board

Fragrances have more advertising collateral and user-generated content on Sephora.com than on brand Web sites, by margins of 51 percent and 55 percent, respectively. Campaign video and editorial content disparities are similarly stark.

L2 notes that the content gap on Sephora’s Web site compared to the brand’s site also speaks to the nature of licensing deals between fashion houses and fragrance manufacturers.

In terms of user-generated content visibility, some brands may eschew it because of potential brand dilution in the long term. Brands must weigh that potential negative against the likelihood of improved sales and visibility.

User-generated content has revealed itself as an effective sales vehicle in adjacent sectors. Among the major changes in beauty marketing from 2015 compared to 2014, user-generated content is playing more of a role for beauty marketers.

While other features, such as store locators, user reviews, auto-replenishment and loyalty programs were not adapted by many more brands this year, twice as many have UGC gallery pages compared to last year, with many also adapting UGC boards on product pages. User-generated content offers brands a chance to get consumers more directly involved and fosters loyalty.

More directly, UGC offers a “guided selling opportunity,” as research suggests shoppable UGC can increase conversion by as much as 12 percent. Of the 112 brand sites studied in a previous L2 report, 35 percent have a diagnostic quiz, 23 percent have an advanced filter and 6 percent have virtual makeover options, indicating that while guided selling is definitely being adopted, brands still have room to improve (see story).

Online commerce is projected to be luxury’s primary growth area in the future, but brands that are still adjusting must also prepare themselves for the accelerating rise of mobile commerce.

Mobile commerce creates myriad opportunities for retailers, but they must first accommodate consumers’ concerns, according to a new report by Boston Retail Partners.

Sixty-one percent of Internet usage in the United States is on mobile devices, and mobile commerce, already one-third of ecommerce sales, is set to grow over two-and-a-half times as fast as total online sales. Although mobile commerce has been seen as a lagging point for retailers, most are focusing resources on improving mobile sites and implementing other mobile-based strategies over the next few years (see story).

"Like the rest of the beauty industry, fragrance brands have to find ways to connect with consumers," Ms. Shen said. "Niche fragrance, which falls into the prestige category, is currently having a bit of moment with smaller fragrance houses seeing a surge in interest.

"While it is a fragmented and crowded field, fragrance is an intensely personal experience, which means there's room for newcomers to differentiate themselves."