LVMH retail associates

LVMH retail associates

Despite monitoring store traffic, conversions and related metrics, many retailers have not yet analyzed the connection these factors have with one another, according to a new report by RetailWire. Accurately tracking traffic and determining how it relates to conversions is a key to sustaining in-store revenue, yet many retailers have not equipped themselves or their employees with the tools to determine and act upon these relationships. In-store remains a crucial part of a retailer’s strategy even as numbers fall, but brands must first make use of the data they already have before they can improve. "Retailers across most categories are concerned about declining store traffic," said Mark Ryski, founder and CEO of HeadCount, who designed the study. "Store traffic has never had more focus than it does today, but as much as retailers worry about the traffic they don’t have, we urge them to be just as concerned about the traffic they do get and focus on converting as much of this traffic as possible.

"Most retailers today track traffic and conversion rates in their stores," he said. "However, in our experience, few fully leverage the insights that come from this data. We often find that traffic and conversion data are being used to keep score, but it’s not being applied or actioned to create better sales results.

"What we showed in our study is that, by focusing store and district managers on their store traffic and conversion trends and then engaging them with some coaching based on the actual data, that they could make better decisions and ultimately deliver better results than comparable stores that didn’t. Traffic and conversion are the ‘corn flakes’ of retail analytics, and like the cereal, retailers are re-discovering them as a way to help make sense of an ever changing and complex retail environment."

Interpreting data Many retailers are concentrating efforts in the digital and mobile space, but RetailWire cites a recent L2 report showing that 72 percent of consumers still rate the traditional in-store experience as an important part of the purchase journey, a higher number than any other channel. Nevertheless, traffic is decreasing and stores are closing down en masse. Bloomingdale's shopper

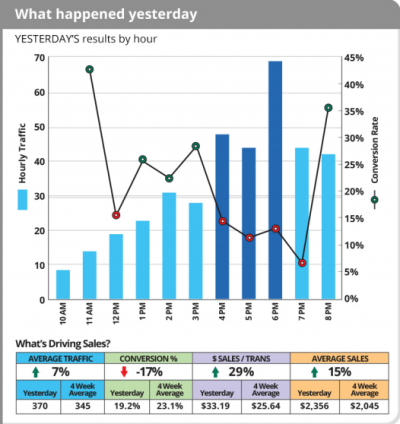

RetailWire finds that many retailers are testing without consistent measurement, making it difficult to determine which factor was the cause of a particular effect. In order to pinpoint what works and what doesn’t, retailers need hour-by-hour metrics that make it clear what is happening at each location.

Too many retailers correlate traffic with conversions, assuming that more of the former will generate more of the latter. In fact, this is not always the case, and merchandising, design, operation efficiency, employee engagement, location and time of the year are all significant factors as well.

The people with the most power to affect sales in a particular store are managers and employees, but analytics programs are rarely geared toward them. By gathering data, amassing it and then analyzing it, store-specific influencers are lost, and any conclusions may be too broad to impact particular branches.

Even when managers are given access, they often have trouble interpreting it and devising action, or else the data is dumbed down and no longer sufficient. To combat the problem, RetailWire and HeadCount devised a program focusing heavily on analytics and data-riven coaching.

Bloomingdale's shopper

RetailWire finds that many retailers are testing without consistent measurement, making it difficult to determine which factor was the cause of a particular effect. In order to pinpoint what works and what doesn’t, retailers need hour-by-hour metrics that make it clear what is happening at each location.

Too many retailers correlate traffic with conversions, assuming that more of the former will generate more of the latter. In fact, this is not always the case, and merchandising, design, operation efficiency, employee engagement, location and time of the year are all significant factors as well.

The people with the most power to affect sales in a particular store are managers and employees, but analytics programs are rarely geared toward them. By gathering data, amassing it and then analyzing it, store-specific influencers are lost, and any conclusions may be too broad to impact particular branches.

Even when managers are given access, they often have trouble interpreting it and devising action, or else the data is dumbed down and no longer sufficient. To combat the problem, RetailWire and HeadCount devised a program focusing heavily on analytics and data-riven coaching.

Luxury shoppers

Among the changes, the study focused on revenue generated per traffic count, a mix of conversion rate and average sale value that accounts for the fact that sometimes less crowded stores are filled with more likely purchasers.

Additionally, improvements in sales productivity were only taken into consideration if they could be directly linked to store staff. This is because spikes in traffic that may be attributable to marketing, season or anything else and that result in higher revenue should not be accredited to the team or the use of analytics.

Equipping managers with hour-by-hour results from the previous today, which chart both traffic and conversion rate, helped them better understand the patterns within their own stores. Staff was coached on the data and how to interpret it.

Among the findings, many employees are able to find the most apparent opportunities on their own, an explanation for the widely reported “pop” in sales when traffic analytics are first incorporated. However, coaching that is specific to the store and employee level and repeated engagement with data are necessities in getting the biggest benefit.

Just as crucial, managers reported that having data pushed to them rather than being required to retrieve data in their own accord made them more likely to use it. This, along with ongoing coaching, keeps engagement high, preventing the atrophy that follows the initial “pop.”

Luxury shoppers

Among the changes, the study focused on revenue generated per traffic count, a mix of conversion rate and average sale value that accounts for the fact that sometimes less crowded stores are filled with more likely purchasers.

Additionally, improvements in sales productivity were only taken into consideration if they could be directly linked to store staff. This is because spikes in traffic that may be attributable to marketing, season or anything else and that result in higher revenue should not be accredited to the team or the use of analytics.

Equipping managers with hour-by-hour results from the previous today, which chart both traffic and conversion rate, helped them better understand the patterns within their own stores. Staff was coached on the data and how to interpret it.

Among the findings, many employees are able to find the most apparent opportunities on their own, an explanation for the widely reported “pop” in sales when traffic analytics are first incorporated. However, coaching that is specific to the store and employee level and repeated engagement with data are necessities in getting the biggest benefit.

Just as crucial, managers reported that having data pushed to them rather than being required to retrieve data in their own accord made them more likely to use it. This, along with ongoing coaching, keeps engagement high, preventing the atrophy that follows the initial “pop.”

HeadCount sample scorecard

"As the store gets busy, it can be difficult for the associates to serve customers and some will leave without purchasing," Mr. Ryski said. "This is precisely the dynamic that we coach store managers to try to avoid. We focus the store managers on the actions she can take to minimize these types of sags."

Overall, these changes resulted in an extra 26 cents of revenue for every customer on the floor (including those that did not buy) for apparel retailers, 81 cents for consumer electronic brands, and $1.01 for houseware sellers. With traffic at some stores reaching into several hundred or thousands, such incremental increases per store add up quickly.

The next step

Other data suggests that retailers are not always capable of gathering and interpreting the data that they need.

Outdated software and applications are hindering retailers’ abilities to properly analyze data and predict demand or create effective plans, according to a February 2016 report by Boston Retail Partners.

Fifty-eight percent of retailers say improving analytics is a top goal for 2016, more than any other priority, and consequently around half have plans to upgrade or replace planning applications. More detailed analytics will help retailers move to a unified commerce experience and allow for more targeted, cost-effective marketing (see story).

The rise of mobile technology also presents stores with an opportunity to better reach customers via personalized messages and identification.

Currently, only 6 percent of retailers can identify a customer by her phone when she walks through the door, but 39 percent plan to implement such technology within two years. This information will help the salesperson give personalized service and allows the retailer to send personalized messages to the consumer.

Customer WiFi will also help retailers to personalize service and messages. If the customer needs to create an account to login, the retailer can use that information to track the customer’s browsing history or triangulate location and use that data for guided selling.

Twenty-seven percent of retailers are taking this technology to the next step with geolocation technology, which will allow relevant messages to be sent to the consumer from locations outside the store (see story).

"I think it’s very important for retailers to look for new ways to serve customers and to understand how these new technologies might help," Mr. Ryski said. "But the fact is, I hear a lot about promised benefits, but I’m not sure retailers are actually finding the return on investment they had hoped for.

"Retailers are willing to invest, but they want proof of efficacy," he said. "We encourage more retailers to do A/B testing and use traffic and conversion analytics as context to help measure the impact of these experimental initiatives."

HeadCount sample scorecard

"As the store gets busy, it can be difficult for the associates to serve customers and some will leave without purchasing," Mr. Ryski said. "This is precisely the dynamic that we coach store managers to try to avoid. We focus the store managers on the actions she can take to minimize these types of sags."

Overall, these changes resulted in an extra 26 cents of revenue for every customer on the floor (including those that did not buy) for apparel retailers, 81 cents for consumer electronic brands, and $1.01 for houseware sellers. With traffic at some stores reaching into several hundred or thousands, such incremental increases per store add up quickly.

The next step

Other data suggests that retailers are not always capable of gathering and interpreting the data that they need.

Outdated software and applications are hindering retailers’ abilities to properly analyze data and predict demand or create effective plans, according to a February 2016 report by Boston Retail Partners.

Fifty-eight percent of retailers say improving analytics is a top goal for 2016, more than any other priority, and consequently around half have plans to upgrade or replace planning applications. More detailed analytics will help retailers move to a unified commerce experience and allow for more targeted, cost-effective marketing (see story).

The rise of mobile technology also presents stores with an opportunity to better reach customers via personalized messages and identification.

Currently, only 6 percent of retailers can identify a customer by her phone when she walks through the door, but 39 percent plan to implement such technology within two years. This information will help the salesperson give personalized service and allows the retailer to send personalized messages to the consumer.

Customer WiFi will also help retailers to personalize service and messages. If the customer needs to create an account to login, the retailer can use that information to track the customer’s browsing history or triangulate location and use that data for guided selling.

Twenty-seven percent of retailers are taking this technology to the next step with geolocation technology, which will allow relevant messages to be sent to the consumer from locations outside the store (see story).

"I think it’s very important for retailers to look for new ways to serve customers and to understand how these new technologies might help," Mr. Ryski said. "But the fact is, I hear a lot about promised benefits, but I’m not sure retailers are actually finding the return on investment they had hoped for.

"Retailers are willing to invest, but they want proof of efficacy," he said. "We encourage more retailers to do A/B testing and use traffic and conversion analytics as context to help measure the impact of these experimental initiatives."

There is lots of experimentation going on, but full-chain rollouts seem few and far between. Part of the challenge has to do with the complexity and effort it takes to successfully deploy and maintain these systems. A great technology poorly implemented or maintained won’t deliver much value, so whether it’s the technology itself or implementation, it seems that many of these new technologies are still very much experimental.

"The fact that many of these technologies are not broadly adopted is indicative of where retailers are at with them," Mr. Ryski said.