Four Seasons mobile app

Four Seasons mobile app

Online travel agency Priceline and home-sharing service Airbnb have higher valuations than any hotel chain, according to a new report by L2.

Over the last five years, the market share of the top 10 luxury hoteliers has remained stagnant at 27 percent but home-sharing platforms could offer a future threat to the business. As such services attract tomorrow’s luxury consumer and OTAs eat away at margins, hotels must focus on superb digital platforms and unique experiences.

“Airbnb valuation is more a reflection of a disruptive business model which investors view as high potential,” said Sam Lee, study lead at L2 Inc. “If they were just another hotel business their valuation would be similar to the other hotels or probably even lower because there revenues are much lower at this point.

“But this is something that’s going on in the industry that’s worth noting and a potential future threat,” he said. “Airbnb’s customers are mainly younger millennial consumers who are more digitally savvy and more budget-conscious.While they may not be the primary target for luxury hotels right now, they represent future growth.

“Where are these consumers going to go, what hotels are they going to go to in five years or 10 years when they actually do make more money? So how are you going to be relevant to them and get their loyalty?”

Fighting disruption

Presently, acquisition is one of the key ways hotels are fighting back. Marriott International will soon acquire Starwood Hotels & Resorts for $14.4 billion and AccorHotels has purchased both Fairmont for $2.9 billion and One Fine Stay, a home-sharing service with more upscale properties than Airbnb, for an additional $168 million.

While AccorHotels' purchase of One Fine Stay reflects an awareness of the future threat home-sharing services, which currently pillage more from down-market than luxury hotels, pose to the industry.

Home-sharing services and OTAs both appeal to digitally-savvy, younger natives, meaning that hotels must appeal to these consumers on digital and mobile platforms. L2 estimates that mobile bookings will result in $95 billion of revenue in 2019, up from $32 billion in 2014, while desktop sales drop ever-so-slightly as consumers book on mobile instead.

Airbnb user

To wrangle the young affluents of 2019 and beyond, luxury brands must offer content that will drive consumers to brand sites and apps rather than to OTAs. The fee imposed by online travel agencies, an average of 20 percent according to L2, has eroded the margins of luxury hotels while also offering consumers a one-stop-shop for online booking, making bookings through a brand platform particularly important.

Marriott was the sole brand to achieve “genius status” for its digital IQ, with Hilton right behind and Mandarin Oriental in third place with 132. Mandarin Oriental’s integration of user-generated content, the visibility of the He’s a Fan/She’s a Fan campaign across all platforms and the “best-in-class mobile site.”

The Ritz-Carlton ranked sixth with a score of 127 owing to its responsive Web site and social media engagement. Waldorf Astoria ranked eighth, Fairmont, Four Seasons, Shangri-La and St. Regis tied for ninth, and Le Meridien ranked 13th, a mere two IQ points behind Waldorf Astoria.

Airbnb user

To wrangle the young affluents of 2019 and beyond, luxury brands must offer content that will drive consumers to brand sites and apps rather than to OTAs. The fee imposed by online travel agencies, an average of 20 percent according to L2, has eroded the margins of luxury hotels while also offering consumers a one-stop-shop for online booking, making bookings through a brand platform particularly important.

Marriott was the sole brand to achieve “genius status” for its digital IQ, with Hilton right behind and Mandarin Oriental in third place with 132. Mandarin Oriental’s integration of user-generated content, the visibility of the He’s a Fan/She’s a Fan campaign across all platforms and the “best-in-class mobile site.”

The Ritz-Carlton ranked sixth with a score of 127 owing to its responsive Web site and social media engagement. Waldorf Astoria ranked eighth, Fairmont, Four Seasons, Shangri-La and St. Regis tied for ninth, and Le Meridien ranked 13th, a mere two IQ points behind Waldorf Astoria.

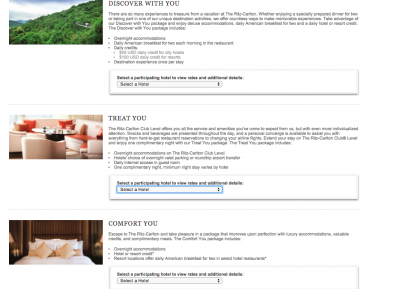

Ritz-Carlton "offers" page

However, a few notable brands lagged behind. Trump Hotels, Peninsula and The Dorchester Collection fell within the “average” range, while Taj and Small Luxury Hotels of the World are “challenged.”

With so many disruptors in the field, even gifted brands should continue to improve digital performance and highlight experiences specific to destinations or the brand portfolio.

At the booking point, comprehensive loyalty/membership integration, user-generated content, guest reviews and SEO will help brands draw consumers to their own booking points rather than an OTA's. While the numbers are still low, these features are being adopted at an increasing pace.

UGC use on home pages has more than tripled over the last year, and its use on property pages has more than doubled. Brands that offer guest reviews are making filtration and sorting systems more sophisticated.

On the other hand, luxury hotels are poor performers on non-branded searches. TripAdvisor appears organically on the first page for 99 percent of 452 tested non-branded search terms. Expedia and Five Star Alliance follow at 81 and 76 percent, respectively, while Small Luxury Hotels of the World and Four Seasons, the top ranking brands, only do so for 15 and 14 percent, respectively.

Half of the brands included in the study offer local destination guides covering topics such as shopping, dining and entertainment, and a quarter offer curated concierge or tips, a jump from 14 percent last year. Four Seasons and Peninsula take the next step by providing opportunities to meet with local artists and designers in the post-booking phase.

As OTAs continue to move further along the travel journey, as when Priceline acquired OpenTable, brands must further differentiate themselves beyond the booking phase. Experiences that OTAs and home-sharing services cannot replicate and impeccable service will continue to serve as key differentiators in the coming years.

A strong social media presence is also a necessary component of an attractive digital presence. In the hotel world, Facebook communities dwarf Instagram communities in size but only hold slight leads in engagement, therefore making a cross-channel push to drive consumers to Instagram would result in more engagement, and consequently more loyalty.

Hotels are behind on emerging platforms; L2 observed only four brands to be active on Snapchat and only four on Periscope. Both platforms are popular and growing among the same young consumer base likely to rely on home-sharing services and OTAs, making them desirable targets for hotel brands.

Ritz-Carlton "offers" page

However, a few notable brands lagged behind. Trump Hotels, Peninsula and The Dorchester Collection fell within the “average” range, while Taj and Small Luxury Hotels of the World are “challenged.”

With so many disruptors in the field, even gifted brands should continue to improve digital performance and highlight experiences specific to destinations or the brand portfolio.

At the booking point, comprehensive loyalty/membership integration, user-generated content, guest reviews and SEO will help brands draw consumers to their own booking points rather than an OTA's. While the numbers are still low, these features are being adopted at an increasing pace.

UGC use on home pages has more than tripled over the last year, and its use on property pages has more than doubled. Brands that offer guest reviews are making filtration and sorting systems more sophisticated.

On the other hand, luxury hotels are poor performers on non-branded searches. TripAdvisor appears organically on the first page for 99 percent of 452 tested non-branded search terms. Expedia and Five Star Alliance follow at 81 and 76 percent, respectively, while Small Luxury Hotels of the World and Four Seasons, the top ranking brands, only do so for 15 and 14 percent, respectively.

Half of the brands included in the study offer local destination guides covering topics such as shopping, dining and entertainment, and a quarter offer curated concierge or tips, a jump from 14 percent last year. Four Seasons and Peninsula take the next step by providing opportunities to meet with local artists and designers in the post-booking phase.

As OTAs continue to move further along the travel journey, as when Priceline acquired OpenTable, brands must further differentiate themselves beyond the booking phase. Experiences that OTAs and home-sharing services cannot replicate and impeccable service will continue to serve as key differentiators in the coming years.

A strong social media presence is also a necessary component of an attractive digital presence. In the hotel world, Facebook communities dwarf Instagram communities in size but only hold slight leads in engagement, therefore making a cross-channel push to drive consumers to Instagram would result in more engagement, and consequently more loyalty.

Hotels are behind on emerging platforms; L2 observed only four brands to be active on Snapchat and only four on Periscope. Both platforms are popular and growing among the same young consumer base likely to rely on home-sharing services and OTAs, making them desirable targets for hotel brands.

Mandarin Oriental, Geneva

Brands also lag behind on mobile sites; consumers frequently switch from mobile research to desktop to complete booking. Only 16 percent feature UGC on property pages, 34 percent have an option to reserve a restaurant and a minuscule 4 percent offer curated experiences. The latter two failings in particular give competitors, including Priceline’s OpenTable, a chance to steal potential revenue from the hotel.

While some see mobile sites and mobile apps as an either/or proposition, apps are particularly suited to post-booking and in-destination features. They can be used to order room services or to book restaurants while at the property in a way the site may not allow.

Other ways of crafting an engaging digital presence include a luxury digital magazine, such as St. Regis' “Beyond,” which is spotlighted in the report, by leveraging artists to create UGC as Renaissance Hotels has done, or following Starwood’s lead in integrating Uber into its Loyalty app. Younger consumers are Uber’s primary customers, and the partnership gives Starwood a chance to foster brand loyalty that will stave off home-sharing services and OTAs when these consumers travel.

New frontiers

Mobile apps can also be powerful resources for those traveling abroad.

Noting the value of localization, Four Seasons Hotels and Resorts has reconstructed its mobile application to make bookings easier for Chinese guests.

Four Seasons launched an app earlier this year, but rather than merely translating it into Chinese, the chain instead decided to design an entirely different app for the new market. The dedication and precision required in tailoring an app to a specific market is emblematic of Four Seasons’ focus on service and the consumer’s convenience (see story).

While a general focus on the customer of tomorrow is a necessary position for long-term growth, brands must balance this necessity with other opportunities that could generate capital in the shorter-term.

Based on the findings of its Virtuoso Luxe Report, the high-end hospitality network has uncovered five travel trends for 2016.

In the last year, Virtuoso has added 95 new properties to its portfolio of more than 1,110 hotels in 100 countries. Demonstrating its understanding of the affluent traveler, 43 percent of properties have partnered exclusively with Virtuoso to better serve wealthy guests, thus giving the network a clear view of luxury travel trends (see story).

"Hotels have been slow to react and invest in digital, and that’s our whole monitor, ‘look, you guys are not taking this seriously and that’s why you’re paying these huge commissions to Priceline and Expedia,'" Mr. lee said. These hotels allowed some MBAs to create this intermediary business 15 years ago and basically steal billions of dollars of them.

"These hotel brands need to ramp up investment in digital and deliver better functionality and features on their site and apps, but also more content, more interesting reasons and explanations as to why you should stay with them and book on their site."

Mandarin Oriental, Geneva

Brands also lag behind on mobile sites; consumers frequently switch from mobile research to desktop to complete booking. Only 16 percent feature UGC on property pages, 34 percent have an option to reserve a restaurant and a minuscule 4 percent offer curated experiences. The latter two failings in particular give competitors, including Priceline’s OpenTable, a chance to steal potential revenue from the hotel.

While some see mobile sites and mobile apps as an either/or proposition, apps are particularly suited to post-booking and in-destination features. They can be used to order room services or to book restaurants while at the property in a way the site may not allow.

Other ways of crafting an engaging digital presence include a luxury digital magazine, such as St. Regis' “Beyond,” which is spotlighted in the report, by leveraging artists to create UGC as Renaissance Hotels has done, or following Starwood’s lead in integrating Uber into its Loyalty app. Younger consumers are Uber’s primary customers, and the partnership gives Starwood a chance to foster brand loyalty that will stave off home-sharing services and OTAs when these consumers travel.

New frontiers

Mobile apps can also be powerful resources for those traveling abroad.

Noting the value of localization, Four Seasons Hotels and Resorts has reconstructed its mobile application to make bookings easier for Chinese guests.

Four Seasons launched an app earlier this year, but rather than merely translating it into Chinese, the chain instead decided to design an entirely different app for the new market. The dedication and precision required in tailoring an app to a specific market is emblematic of Four Seasons’ focus on service and the consumer’s convenience (see story).

While a general focus on the customer of tomorrow is a necessary position for long-term growth, brands must balance this necessity with other opportunities that could generate capital in the shorter-term.

Based on the findings of its Virtuoso Luxe Report, the high-end hospitality network has uncovered five travel trends for 2016.

In the last year, Virtuoso has added 95 new properties to its portfolio of more than 1,110 hotels in 100 countries. Demonstrating its understanding of the affluent traveler, 43 percent of properties have partnered exclusively with Virtuoso to better serve wealthy guests, thus giving the network a clear view of luxury travel trends (see story).

"Hotels have been slow to react and invest in digital, and that’s our whole monitor, ‘look, you guys are not taking this seriously and that’s why you’re paying these huge commissions to Priceline and Expedia,'" Mr. lee said. These hotels allowed some MBAs to create this intermediary business 15 years ago and basically steal billions of dollars of them.

"These hotel brands need to ramp up investment in digital and deliver better functionality and features on their site and apps, but also more content, more interesting reasons and explanations as to why you should stay with them and book on their site."