Burberry SS16 Snapchat campaign

Burberry SS16 Snapchat campaign

Social media is no longer just a tool for reaching young people, according to a new report from Fashionbi.

Although those in the 16-24 demographic are the most prolific users averaging active usage on almost four channels, those in the 35-44 range also have multiple accounts. Simply being on social media is no longer enough, as the diversity and popularity of myriad networks requires brands to calibrate more detailed strategies.

"Long gone are the days when luxury was equivalent to inaccessibility," said Ambika Zutshi, CEO of Fashionbi, Milan. "Today, if a brand is not visible/accessible a consumer will simply turn to the competitor.

"The competition is so fierce, and any opportunity lost can put a big dent in a brand's positioning, both in reputation and financially," she said. "A consumer changes mind very fast, and in the present consumer culture, the 'pull' is more crucial than the 'push'.

"This is what social media supports the brands with - to pull the right targets by telling them a tempting story. And this is where the challenge lies. Instead of taking no action at all, a brand can share the most refined content that screams luxury while simulating the senses of the audience and give them a clear next call-to-action."

Fashionbi’s Western Social Media Platforms report examines the demographic make-up of eight social media platforms – Facebook, Twitter, Instagram, Google+, Pinterest, LinkedIn, YouTube and Snapchat – and offers content advice for each.

Analyze and adapt

There are now 2.3 billion social media users in the world, 1.9 billion of whom are mobile, meaning there are now more mobile social media users than Internet users who are not active. The average person has five social media accounts and spends a quarter of her time online on the various platforms. In the 35-44 range, the number is three.

In the future, these numbers will only escalate. Today’s 13-year-olds – tomorrow’s luxury consumers – check social media 100 times per day on average.

Chanel Facebook post

Even today, mere presence is not enough, and fashion brands need to adjust strategy according to each channel. As online fashion sales grow – projected to exceed $300 billion by 2018 – social media will be a key component of driving business, as it already is for managing CRM for several brands.

Facebook is the most active platform, with nearly a billion daily users, predominantly female and most prominent in the United States, India, Brazil and Indonesia. Fashionbi recommends it as a platform for showing off products and marketing the brand experience.

Eighty-six percent of fashion brands are active on Facebook, with some, namely Chanel and Dior, tailoring the content in accordance with the network’s user interface. Both brands highlight their beauty products, with Chanel opting for creative content and animated videos where Dior has recently spotlighted brand ambassadors Johnny Depp and Jennifer Lawrence.

Facebook has made several updates in recent months and years to make it a better platform for marketers.

Its algorithmic timeline has been heavily borrowed and tinkered with by other networks seeking to acquire advertising capital and has made it a pay-to-play platform. Its videos have kept people on-site and interacting with the brand, and the new Facebook Live will offer its own opportunities.

These, along with the ease with which calls to action can be integrated into the content, ensure it will remain a significant player.

Chanel Facebook post

Even today, mere presence is not enough, and fashion brands need to adjust strategy according to each channel. As online fashion sales grow – projected to exceed $300 billion by 2018 – social media will be a key component of driving business, as it already is for managing CRM for several brands.

Facebook is the most active platform, with nearly a billion daily users, predominantly female and most prominent in the United States, India, Brazil and Indonesia. Fashionbi recommends it as a platform for showing off products and marketing the brand experience.

Eighty-six percent of fashion brands are active on Facebook, with some, namely Chanel and Dior, tailoring the content in accordance with the network’s user interface. Both brands highlight their beauty products, with Chanel opting for creative content and animated videos where Dior has recently spotlighted brand ambassadors Johnny Depp and Jennifer Lawrence.

Facebook has made several updates in recent months and years to make it a better platform for marketers.

Its algorithmic timeline has been heavily borrowed and tinkered with by other networks seeking to acquire advertising capital and has made it a pay-to-play platform. Its videos have kept people on-site and interacting with the brand, and the new Facebook Live will offer its own opportunities.

These, along with the ease with which calls to action can be integrated into the content, ensure it will remain a significant player.

Hermes From Dusk til Dawn FB post

Until recently, Instagram was the organic alternative to Facebook’s ad-driven platform. Engagements were 10 times as high on the photo-sharing platform.

In March 2016, Instagram followed its parent company’s lead, introducing an Algorithmic timeline. While it remains to be seen how the new model will impact engagement rates, similar strategies will likely lead to similar results.

Instagram’s community is much smaller at 400 million users, but it skews young, international (namely France, Italy, Sweden and Russia) and toward fashion fans. People naturally respond more strongly to visuals, making it an ideal platform for products, inspiration, celebrities and campaigns. That versatility in turn is the impetus behind the move toward ecommerce, prefigured with Curalate’s Like2Buy.

Hermes From Dusk til Dawn FB post

Until recently, Instagram was the organic alternative to Facebook’s ad-driven platform. Engagements were 10 times as high on the photo-sharing platform.

In March 2016, Instagram followed its parent company’s lead, introducing an Algorithmic timeline. While it remains to be seen how the new model will impact engagement rates, similar strategies will likely lead to similar results.

Instagram’s community is much smaller at 400 million users, but it skews young, international (namely France, Italy, Sweden and Russia) and toward fashion fans. People naturally respond more strongly to visuals, making it an ideal platform for products, inspiration, celebrities and campaigns. That versatility in turn is the impetus behind the move toward ecommerce, prefigured with Curalate’s Like2Buy.

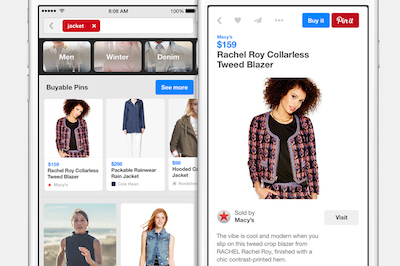

Advertising has recently surged on Instagram, with Prada, Fendi, Bottega Veneta and Max Mara, among others, variously trying their hand at photo ads, video ads and carousel ads. So popular and engaging is the platform, that brands are splitting product categories across different accounts to streamline marketing efforts without saturating news feeds. The male-dominated Twitter, unlike its larger counterparts, has struggled as an ad platform. Its interface instead favors news, events and editorials. Its “Buy Now” feature will make it easier to sell, but the feature is still uncommon, and saturating one’s feed with links to purchase on a Web site is uncreative and disengaging. On the other hand, the network’s fast pace and visibility make it ideal for CRM. Burberry and Louis Vuitton have accounts purely for customer service. This potential is largely untapped, however, with many brands seeking to maintain distance and exclusivity on the platform despite its function being designed for precisely the opposite. On the other end of the spectrum, Pinterest consists primarily of women and people over 40, primarily Australia, Brazil and Canada, with a dearth of the European audience with more interest and purchasing power for luxury fashion. Its visual interface helps both with branding and is theoretically a viable ecommerce platform, but Instagram has eclipsed it as the visual medium of choice.

Pinterest Buyable Pins screenshot

Nevertheless, Nordstrom has been successful on the platform. Creating seasonal boards and aggregating “Top Pinned Gifts” helped spur holiday gifting and propelled it to an impressive 4.4 million followers. Generally, however, the ideal interface is hampered by a less-than-ideal user base.

Smaller social networks are largely ignored by brands, and for good reason: LinkedIn is not a consumer-facing platform, and Google+ has a largely inactive user base.

Yet the most recent platform to take the world, including the luxury world, by storm is Snapchat. Its 70 percent female, overwhelmingly under-30, American and European user base is a goldmine for fashion brands and retailers.

Pinterest Buyable Pins screenshot

Nevertheless, Nordstrom has been successful on the platform. Creating seasonal boards and aggregating “Top Pinned Gifts” helped spur holiday gifting and propelled it to an impressive 4.4 million followers. Generally, however, the ideal interface is hampered by a less-than-ideal user base.

Smaller social networks are largely ignored by brands, and for good reason: LinkedIn is not a consumer-facing platform, and Google+ has a largely inactive user base.

Yet the most recent platform to take the world, including the luxury world, by storm is Snapchat. Its 70 percent female, overwhelmingly under-30, American and European user base is a goldmine for fashion brands and retailers.

Fendirumi Snapchat takeover

Accordingly, the service has blown up at recent fashion weeks (see story). It offers behind-the-scene moments and is primed for ambassador takeovers, such as Jared Leto’s recent effort on behalf of Gucci (see story).

"All channels are different; they all have their own share of demographics," Ms. Zutshi said. "Brands need to identify these targets and launch channel-specific strategies with the right targeting.

"For instance, if a product is only yet available in a brand's European stores/e-commerce to buy, there is no point in promoting it in South America," she said. "Similarly, if an influencer is chosen for a Snapchat take-over, it is important that he is known to the brand's audience it wants to target via the campaign."

New players

Brands may not yet be able to monetize Snapchat to a substantial degree, but the platform is popular among youth and is the cool new entrant to the arena. Rather than waiting for Snapchat to become a valuable ad platform, brands are wise to establish a presence and a rapport with the audience while it holds the intangible appeal.

Instagram adoption rates are nearing 100 percent, but Snapchat penetration lags behind, as brands remain unsure if the platform is right for them, according to a recent report from L2.

It is too soon to judge what ROI Snapchat is having for brands since there is a lack of data available, but that has not stopped many brands from turning to the time-sensitive platform to reach audiences in an unfiltered way. Both Instagram and Snapchat present unique organic and paid storytelling opportunities for marketers, as the platforms continue to be hits particularly with a younger audience (see story).

In addition to all the aforementioned western media, brands must also give themselves a chance with China's enormous market. A number of popular western social networks are banned in China, and the country has adapted by creating enormously popular, market-specific apps, most notably Weibo and WeChat.

Even those without a strong presence in China need to ensure they remain visible to the country's consumers. Those who fail to do so will have a much tougher time catering to inbound tourists.

Chinese residents will make 90 million outbound trips in 2020, with that number increasing by an additional 36 million over the following decade, according to a report by Euromonitor.

As reported in “How to Target Chinese Shoppers Abroad,” outbound trips have increased on average by an impressive 13 percent since 2000, helping China overtake Japan as the second largest consumer market in 2011. With the significance and size of the Chinese tourist market only projected to swell, brands will need to develop a more nuanced understanding of the market in order to reach consumers (see story).

"[Best practices] depend per brand and per channel," Ms. Zutshi said. "As a standard, and from what we at Fashionbi have observed in all these years of luxury brands analysis on their social media channels is: first of all, to communicate on their websites all their social media icons where they are present; a website is a brand's most important touchpoint and can only assure the authenticity of the account.

"Secondly, the accounts should be verified, otherwise for the audience it can get very confusing," she said. "As a third, it is a must to give the brand's description and related links on each account profile; many times brands take this "about" section for granted and lose an opportunity of sharing their world and promoting their other channels there."

Fendirumi Snapchat takeover

Accordingly, the service has blown up at recent fashion weeks (see story). It offers behind-the-scene moments and is primed for ambassador takeovers, such as Jared Leto’s recent effort on behalf of Gucci (see story).

"All channels are different; they all have their own share of demographics," Ms. Zutshi said. "Brands need to identify these targets and launch channel-specific strategies with the right targeting.

"For instance, if a product is only yet available in a brand's European stores/e-commerce to buy, there is no point in promoting it in South America," she said. "Similarly, if an influencer is chosen for a Snapchat take-over, it is important that he is known to the brand's audience it wants to target via the campaign."

New players

Brands may not yet be able to monetize Snapchat to a substantial degree, but the platform is popular among youth and is the cool new entrant to the arena. Rather than waiting for Snapchat to become a valuable ad platform, brands are wise to establish a presence and a rapport with the audience while it holds the intangible appeal.

Instagram adoption rates are nearing 100 percent, but Snapchat penetration lags behind, as brands remain unsure if the platform is right for them, according to a recent report from L2.

It is too soon to judge what ROI Snapchat is having for brands since there is a lack of data available, but that has not stopped many brands from turning to the time-sensitive platform to reach audiences in an unfiltered way. Both Instagram and Snapchat present unique organic and paid storytelling opportunities for marketers, as the platforms continue to be hits particularly with a younger audience (see story).

In addition to all the aforementioned western media, brands must also give themselves a chance with China's enormous market. A number of popular western social networks are banned in China, and the country has adapted by creating enormously popular, market-specific apps, most notably Weibo and WeChat.

Even those without a strong presence in China need to ensure they remain visible to the country's consumers. Those who fail to do so will have a much tougher time catering to inbound tourists.

Chinese residents will make 90 million outbound trips in 2020, with that number increasing by an additional 36 million over the following decade, according to a report by Euromonitor.

As reported in “How to Target Chinese Shoppers Abroad,” outbound trips have increased on average by an impressive 13 percent since 2000, helping China overtake Japan as the second largest consumer market in 2011. With the significance and size of the Chinese tourist market only projected to swell, brands will need to develop a more nuanced understanding of the market in order to reach consumers (see story).

"[Best practices] depend per brand and per channel," Ms. Zutshi said. "As a standard, and from what we at Fashionbi have observed in all these years of luxury brands analysis on their social media channels is: first of all, to communicate on their websites all their social media icons where they are present; a website is a brand's most important touchpoint and can only assure the authenticity of the account.

"Secondly, the accounts should be verified, otherwise for the audience it can get very confusing," she said. "As a third, it is a must to give the brand's description and related links on each account profile; many times brands take this "about" section for granted and lose an opportunity of sharing their world and promoting their other channels there."