Omega's Aqua Terra GoodPlanet 185

Omega's Aqua Terra GoodPlanet 185

After much hesitation, watch and jewelry brands have begun to embrace digital selling channels as a potential solution to the global turndown their industry has recently faced, per a new report from L2.

L2’s “Watches & Jewelry: Ecommerce Insight Report” found that while the sector is learning to adapt to online channels, the industry is finding it difficult to transfer brand equity that may have taken decades, if not centuries, to establish does not transfer to the digital realm. With luxury ecommerce sales forecasted to double by 2020, the watches and jewelry sector must continue forging ahead to incorporate online selling into its strategies or risk losing market share.

“The biggest takeaway is thinking about how to build and market an experience that gives consumers everything they need to make the purchase decision online, and then seamlessly hand them off to a location where they can execute the purchase, whether that's an ecommerce-enabled brand site, an owned boutique or a licensed retailer,” said Reid Sherard, research lead, Europe at L2.

“The benefits to having an ecommerce experience have ripple effects throughout SEO/SEM and the research process, and we've started to see even higher price points getting better at approaching digital more as e-influence than just ecommerce,” he said.

Buy buy buy

The majority of watchmakers and jewelers tracked in L2’s Digital IQ Index: Watches & Jewelry are now ecommerce enabled after online selling was resisted by many brands in the industry.

Interestingly, the top 10 brands represent only about 40 percent of global sales. But, when the online space is considered, these top 10 brands are responsible for approximately 75 percent of all traffic to sector Web sites.

Of the top 10 brands, only Tiffany & Co., Rolex and Omega appear on both the share of global sales offline versus the share of total site visits list determined by L2’s research. This finding shows that smaller brands have an opportunity to grab consumer attention through ecommerce and online equity where other brands have fallen off.

Tiffany & Co. Key campaign

As a result, heritage brands have faced difficulties in catching up to these “challenger” brands due to their initial hesitancies and poor digital investments.

At first, when ecommerce began to boom, the watch and jewelry industry was hesitant to adapt because of the price tag often associated with the channel. But as the number of brands that have invested in ecommerce has grown, this challenge has been largely dismissed.

Indeed, L2 found that 58 percent of brands surveyed offer direct online purchase for goods priced at $10,000 or more. Thirty-nine percent of the brands also feel comfortable selling items that retail for more than $20,000, thus rejecting the notion that high-priced goods have no place within the ecommerce model.

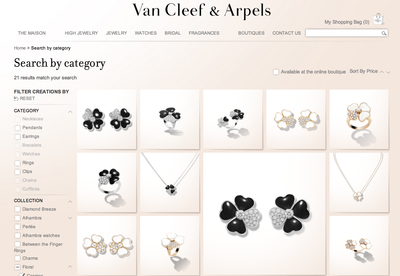

Brands that do not offer their highest priced items for sale online have begun to share prices online to give consumers more information before a formal inquiry is made. Van Cleef & Arpels, for example, will share its prices up to approximately the $400,000 level, but only sells jewelry online that retails for below $100,000.

Jeweler Fred of Paris, in comparison, shares its pricing and sells pieces online that near $500,000 in asking price. Others in the industry, including Bell & Ross, Tiffany, Chopard and De Beers, have similar approaches, but with a much lower pricing structure.

Tiffany & Co. Key campaign

As a result, heritage brands have faced difficulties in catching up to these “challenger” brands due to their initial hesitancies and poor digital investments.

At first, when ecommerce began to boom, the watch and jewelry industry was hesitant to adapt because of the price tag often associated with the channel. But as the number of brands that have invested in ecommerce has grown, this challenge has been largely dismissed.

Indeed, L2 found that 58 percent of brands surveyed offer direct online purchase for goods priced at $10,000 or more. Thirty-nine percent of the brands also feel comfortable selling items that retail for more than $20,000, thus rejecting the notion that high-priced goods have no place within the ecommerce model.

Brands that do not offer their highest priced items for sale online have begun to share prices online to give consumers more information before a formal inquiry is made. Van Cleef & Arpels, for example, will share its prices up to approximately the $400,000 level, but only sells jewelry online that retails for below $100,000.

Jeweler Fred of Paris, in comparison, shares its pricing and sells pieces online that near $500,000 in asking price. Others in the industry, including Bell & Ross, Tiffany, Chopard and De Beers, have similar approaches, but with a much lower pricing structure.

Van Cleef & Arpels' Web site

Increasingly, brands have turned to third party retailers to test ecommerce channels. Tiffany, for example, which does operate monobrand ecommerce via its Web site, paired with online retailer Net-A-Porter as an exclusive retail partner for a limited time (see story).

“Brands hesitant to launch their own ecommerce can start by piloting sales of a smaller range of products through a trusted retailer like Net-A-Porter or Tourneau where the risk is pretty low, and the partner already has the logistics in place,” Mr. Sherard said.

“Chanel and Zenith have both sold products on Net-A-Porter or Mr Porter with a lot of success, I've even seen a Rolex special-edition on Mr Porter, and some brands are doing similar pilots with Selfridge's Wonder Room click-and-collect program,” he said. “I know Chanel's collection of jewelry on Net-A-Porter had almost sold out after the first 24 hours.”

To assist with sales, luxury brands have incorporated online concierge services to recreate the in-store experience. Of the brands surveyed, 75 percent offer assisted purchase offers and 36 percent, a finding lower than expected, offer online consumers the option to book an appointment on a brand Web site.

Van Cleef & Arpels' Web site

Increasingly, brands have turned to third party retailers to test ecommerce channels. Tiffany, for example, which does operate monobrand ecommerce via its Web site, paired with online retailer Net-A-Porter as an exclusive retail partner for a limited time (see story).

“Brands hesitant to launch their own ecommerce can start by piloting sales of a smaller range of products through a trusted retailer like Net-A-Porter or Tourneau where the risk is pretty low, and the partner already has the logistics in place,” Mr. Sherard said.

“Chanel and Zenith have both sold products on Net-A-Porter or Mr Porter with a lot of success, I've even seen a Rolex special-edition on Mr Porter, and some brands are doing similar pilots with Selfridge's Wonder Room click-and-collect program,” he said. “I know Chanel's collection of jewelry on Net-A-Porter had almost sold out after the first 24 hours.”

To assist with sales, luxury brands have incorporated online concierge services to recreate the in-store experience. Of the brands surveyed, 75 percent offer assisted purchase offers and 36 percent, a finding lower than expected, offer online consumers the option to book an appointment on a brand Web site.

Chanel jewelry capsule, sold by Net-A-Porter

How watch and jewelry brands have incorporated ecommerce also differs by regional markets. L2 found that all brands, most notably watchmakers, have developed stronger channels for the United States, but are lagging in the European markets.

In the U.S., 42 percent of watch brands operate ecommerce and 67 percent of jewelers do the same. When compared with the United Kingdom, watchmakers’ ecommerce presence drops significantly to 14 percent, while jewelers' stays up at 50 percent.

The same finding is true in markets such as France, Germany, Italy and Spai,n where watchmakers barely have ecommerce, at a rate of less than 10 percent, but jewelry brands hover around 40 percent.

Price point also comes into play for regional ecommerce as well. In the U.S. 76 percent of accessible priced brands operate ecommerce, compared to 57 percent of masstige brands and 36 percent of prestige.

In European markets such as the UK, France, Germany, Italy and Spain these percentages all drop down to 35 percent or below. In France, for example, 29 percent of accessible brands, 14 percent of masstige brands and 25 percent of prestige brands offer ecommerce.

“One reason there are fewer ecommerce enabled brands in Europe is that many brands are currently in the process of using the U.S. as a test market,” Mr. Sherard said. “We've seen TAG Heuer and Chopard launch pilots in the U.S. and then quickly iterate on that by expanding to the UK and other markets.

“But the biggest players, including Tiffany & Co. and the Richemont portfolio, are making European-wide investments, so brands with a U.S.-only focus are going to start falling behind,” he said.

“Anecdotally, I think it also has to do with teams in the U.S. being more active in lobbying for ecommerce launches than some of their counterparts in Europe.”

Searching for treasures

While hesitant with ecommerce, a number of watch and jewelry brands have avoided SEO/SEM tactics to strategically target affluent consumers.

Since L2 last assessed the watches and jewelry sector, luxury brands have begun to embrace various SEO/SEM strategies on the category level, having been virtually invisible on Google search results in the past.

L2’s “Watches & Jewelry 2016: Search Insights” report provides an overview of the sector’s luxury and premium players, uncovering how search strategy has evolved over time. Although watch and jewelry houses in the luxury space are taking different approaches to search, the majority are depending on organic and paid search leads using branded terms to drive Web site traffic (see story).

“Partnering with a brand like Net-A-Porter, who is in the luxury business but is also a robust ecommerce player, is a really valuable learning experience for brands, particularly for brands who have no history of building direct relationships with their customers,” Mr. Sherard said.

“A good online retail partner that's experienced in SEO/SEM can also help combat some of the grey market dominance in search.”

Chanel jewelry capsule, sold by Net-A-Porter

How watch and jewelry brands have incorporated ecommerce also differs by regional markets. L2 found that all brands, most notably watchmakers, have developed stronger channels for the United States, but are lagging in the European markets.

In the U.S., 42 percent of watch brands operate ecommerce and 67 percent of jewelers do the same. When compared with the United Kingdom, watchmakers’ ecommerce presence drops significantly to 14 percent, while jewelers' stays up at 50 percent.

The same finding is true in markets such as France, Germany, Italy and Spai,n where watchmakers barely have ecommerce, at a rate of less than 10 percent, but jewelry brands hover around 40 percent.

Price point also comes into play for regional ecommerce as well. In the U.S. 76 percent of accessible priced brands operate ecommerce, compared to 57 percent of masstige brands and 36 percent of prestige.

In European markets such as the UK, France, Germany, Italy and Spain these percentages all drop down to 35 percent or below. In France, for example, 29 percent of accessible brands, 14 percent of masstige brands and 25 percent of prestige brands offer ecommerce.

“One reason there are fewer ecommerce enabled brands in Europe is that many brands are currently in the process of using the U.S. as a test market,” Mr. Sherard said. “We've seen TAG Heuer and Chopard launch pilots in the U.S. and then quickly iterate on that by expanding to the UK and other markets.

“But the biggest players, including Tiffany & Co. and the Richemont portfolio, are making European-wide investments, so brands with a U.S.-only focus are going to start falling behind,” he said.

“Anecdotally, I think it also has to do with teams in the U.S. being more active in lobbying for ecommerce launches than some of their counterparts in Europe.”

Searching for treasures

While hesitant with ecommerce, a number of watch and jewelry brands have avoided SEO/SEM tactics to strategically target affluent consumers.

Since L2 last assessed the watches and jewelry sector, luxury brands have begun to embrace various SEO/SEM strategies on the category level, having been virtually invisible on Google search results in the past.

L2’s “Watches & Jewelry 2016: Search Insights” report provides an overview of the sector’s luxury and premium players, uncovering how search strategy has evolved over time. Although watch and jewelry houses in the luxury space are taking different approaches to search, the majority are depending on organic and paid search leads using branded terms to drive Web site traffic (see story).

“Partnering with a brand like Net-A-Porter, who is in the luxury business but is also a robust ecommerce player, is a really valuable learning experience for brands, particularly for brands who have no history of building direct relationships with their customers,” Mr. Sherard said.

“A good online retail partner that's experienced in SEO/SEM can also help combat some of the grey market dominance in search.”