Nordstrom Rewards

Nordstrom Rewards

The affluent classes are quickly losing interest in loyalty programs, according to new research from Collinson Group.

In August 2014, only 18 percent of consumers aid they “can’t be bothered” with loyalty programs, but that number doubled in the latest survey. With the traditional method losing its steam among desirable prospects, retailers will need to re-think how they engage and cultivate loyalty among their consumers.

"Our research is a wake-up call to brands in every industry where points-based programmes offering generic rewards are still being used," said Christopher Evans, Director, Collinson Group. "Given the importance of affluent middle class consumers on the fortunes of companies, it is imperative that low-performing initiatives are aborted, and that brands rethink how they recognize, engage and reward customers.

"Global consumers now expect real-time interactions with brands on a platform of their choosing," he said. "These interactions should be highly personalized and relevant, and as ever, consumers expect to be rewarded for their continued custom. Brands that are not innovating and addressing evolving customer expectation will simply be left behind."

Collinson Group surveyed 6,125 of the top 10-15 percent of earners from Australia, Brazil, China, France, Hong Kong, India, Singapore, the United Kingdom, the United States and the United Arab Emirates.

Earning loyalty

Previous research has shown that it costs between four and 10 times more to acquire a new client than it takes to retain an existing customer, making loyalty programs highly cost-effective. However, it is not enough just to have a loyalty program in place, and brands need to consistently deliver to keep their clients coming back (see story)

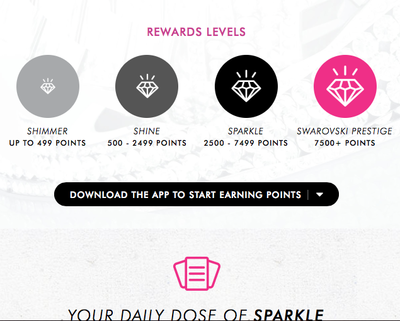

Swarovski rewards levels

Although half of respondents still say loyalty programs are beneficial to them, this was most true in supermarket, frequent flyer and credit card rewards programs, not among luxury brands and retailers.

Across all categories, loyalty was lowest among clothing brands, with only 46 percent affirming loyalty to a particular brand, compared to 60 percent for technology providers and supermarkets.

Personalized programs, however, can still encourage higher spending, and the tactic is more effective in certain geographies.

Swarovski rewards levels

Although half of respondents still say loyalty programs are beneficial to them, this was most true in supermarket, frequent flyer and credit card rewards programs, not among luxury brands and retailers.

Across all categories, loyalty was lowest among clothing brands, with only 46 percent affirming loyalty to a particular brand, compared to 60 percent for technology providers and supermarkets.

Personalized programs, however, can still encourage higher spending, and the tactic is more effective in certain geographies.

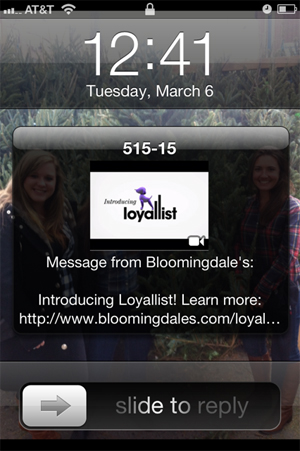

Bloomingdale's loyalty SMS

Eighty-nine percent of consumers in Mainland China and 87 percent of those in Hong Kong say that loyalty programs are increasing their spending. Nevertheless, consumers from both markets agree that the value of loyalty programs has not increased over the past year.

While the relatively young market is still enthralled with loyalty programs, the diminishing belief that value is maintained throughout the life of the program suggests that retailers need to re-engage these consumers and find new ways of providing value. Complacency on the part of the brand will cause engaged markets to go the way of the global trend.

Loyalty programs have long been viewed as a good way of bringing back first-time customers, as tiered rewarding or initial discounts create a high value when the customer first enrolls. However, with digital commerce increasing access to all brands for consumers, the difficulty of managing and maintaining more accounts can lead to abandon.

Bloomingdale's loyalty SMS

Eighty-nine percent of consumers in Mainland China and 87 percent of those in Hong Kong say that loyalty programs are increasing their spending. Nevertheless, consumers from both markets agree that the value of loyalty programs has not increased over the past year.

While the relatively young market is still enthralled with loyalty programs, the diminishing belief that value is maintained throughout the life of the program suggests that retailers need to re-engage these consumers and find new ways of providing value. Complacency on the part of the brand will cause engaged markets to go the way of the global trend.

Loyalty programs have long been viewed as a good way of bringing back first-time customers, as tiered rewarding or initial discounts create a high value when the customer first enrolls. However, with digital commerce increasing access to all brands for consumers, the difficulty of managing and maintaining more accounts can lead to abandon.

Ritz-Carlton rewards

Indeed, many consumers take the initial rewards a loyalty program grants and then abandon the program. Brands need to ensure they provide a sufficient reason for the consumer to continue returning.

Trying new things

Enhancing customer experience and customer engagement is retailers’ top priority, according to an executive from Boston Retail Partners speaking at the Mcommerce Summit: State of Mobile Commerce 2016 on May 5.

Consumers have embraced mobile devices, and improving their experience equates to meeting their needs on that platform. From the business’ perspective, integrating a unified commerce experience will not only improve service but also increase productivity and mitigate costs (see story).

The disappointment with loyalty programs are tied at least in part to new commerce channels. Retailers, however, are attuned to this effect and are taking counteractive measures.

A Boston Retail Partners study from August 2015 showed that 62 percent of retailers planned to allocate more funds toward their loyalty programs.

Consumers are becoming more digitally driven, and loyalty programs have to change with them, incorporating mobile, gamification or consumer data to make the reward process more personal. Thinking of a loyalty program as another part of the omnichannel shopping experience enables a brand to reach consumers however they choose to interact (see story).

"In the face of shifting customer expectation, the ubiquity of mobile, and a demand for brand interactions that are both personal and immediate, companies must adapt," Mr. Evans said. "This means doing away with the old ways of engaging with, and rewarding customers.

"The opportunity to turn apathy into active loyalty by meeting the expectations of the ever-demanding consumer exists now," he said. "It is only by rethinking loyalty to deliver something that truly adds value to consumers that brands will benefit from an engaged and committed customer base."

Ritz-Carlton rewards

Indeed, many consumers take the initial rewards a loyalty program grants and then abandon the program. Brands need to ensure they provide a sufficient reason for the consumer to continue returning.

Trying new things

Enhancing customer experience and customer engagement is retailers’ top priority, according to an executive from Boston Retail Partners speaking at the Mcommerce Summit: State of Mobile Commerce 2016 on May 5.

Consumers have embraced mobile devices, and improving their experience equates to meeting their needs on that platform. From the business’ perspective, integrating a unified commerce experience will not only improve service but also increase productivity and mitigate costs (see story).

The disappointment with loyalty programs are tied at least in part to new commerce channels. Retailers, however, are attuned to this effect and are taking counteractive measures.

A Boston Retail Partners study from August 2015 showed that 62 percent of retailers planned to allocate more funds toward their loyalty programs.

Consumers are becoming more digitally driven, and loyalty programs have to change with them, incorporating mobile, gamification or consumer data to make the reward process more personal. Thinking of a loyalty program as another part of the omnichannel shopping experience enables a brand to reach consumers however they choose to interact (see story).

"In the face of shifting customer expectation, the ubiquity of mobile, and a demand for brand interactions that are both personal and immediate, companies must adapt," Mr. Evans said. "This means doing away with the old ways of engaging with, and rewarding customers.

"The opportunity to turn apathy into active loyalty by meeting the expectations of the ever-demanding consumer exists now," he said. "It is only by rethinking loyalty to deliver something that truly adds value to consumers that brands will benefit from an engaged and committed customer base."