Affluent millennials

Affluent millennials

For apparel brands and retailers selling clothes to consumers, age is not everything, a study by A.T. Kearney and NPD Group reinforces. Slowing retail performance has led brands to target millennials to drive growth, but generational segmentations are often too broad and can inadvertently cause older consumers to feel left out. Instead, marketers need to find more specific ways to segment consumers, including methods that group consumers across different age groups. "There are common attributes that drive purchases and transcend age – for example, fashion attitude and lifestyle preferences drive heavy purchasing across all age groups,"said Helen Rhim, principal at A.T. Kearney and co-author of the report. By focusing on these attributes instead of age, retailers can capture demand from millennials, but also attract the Gen Xers and boomers that comprise over 60% of apparel purchases today.

"Based on our joint study with NPD, shoppers who consider themselves fashion-forward – at any age – are heavier purchasers across all the apparel categories surveyed," she said. "[And] shoppers who value an active lifestyle – at any age – purchase more apparel in all categories, not just activewear."

Age is just a number Millennials comprise one-fourth of the population, and they are the most frequent apparel buyers. The generation is one-and-a-half to two-and-a-half times more likely than Gen Xers or baby boomers to have purchased three or more items in a category over the previous half year. While this means millennials are a disproportionate force in the apparel market, accounting for 38 percent of total spend in the category, the comparatively high sales numbers obscure the fact that more than 60 percent of sales are still from other generations. Luxury shoppers

Additionally, millennials’ retail dominance is primarily across four product categories: jeans, activewear, dresses and bras. But differences in product purchases are equally revealing when consumers are grouped by life stage, lifestyle and fashion attitude, and these ways are less likely to alienate other groups of consumers.

When segmenting consumers by further segmenting consumers by life stage, the researchers found that childless millennials tend to be more frequent purchasers than their counterparts with children, making up 24 percent of heavy dress purchasers and 33 percent of heavy bra purchasers compared to 9 percent and 23 percent.

Similarly, Gen Xers are only slightly less likely to be heavy purchasers of jeans than millennials, but Gen Xers without children were the least likely to buy.

Luxury shoppers

Additionally, millennials’ retail dominance is primarily across four product categories: jeans, activewear, dresses and bras. But differences in product purchases are equally revealing when consumers are grouped by life stage, lifestyle and fashion attitude, and these ways are less likely to alienate other groups of consumers.

When segmenting consumers by further segmenting consumers by life stage, the researchers found that childless millennials tend to be more frequent purchasers than their counterparts with children, making up 24 percent of heavy dress purchasers and 33 percent of heavy bra purchasers compared to 9 percent and 23 percent.

Similarly, Gen Xers are only slightly less likely to be heavy purchasers of jeans than millennials, but Gen Xers without children were the least likely to buy.

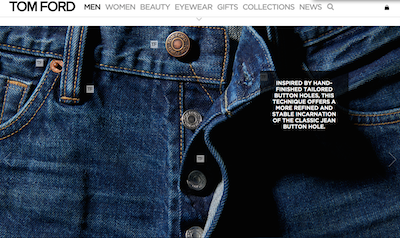

Tom Ford jeans

Expectedly, those who consider themselves “fashion-forward” and keep up on the latest trends are considerably more valuable, particularly in the dresses category.

Equally revealing, consumers of all generations who consider active lifestyles important are far more likely to be frequent purchasers of all products – not just activewear – than those who do not. The growth of the activewear market has led a number of brands to increase their focus on the category.

In one recent example, London department store Selfridges is showing its love for "EveryBODY" with the opening of a new wellness destination.

The Body Studio is the largest department in the store at 37,000 square feet and will offer clothing and accessories that will satisfy women’s demand for more sophisticated and inclusive activewear. A consciously inclusive shopping destination will hold appeal for a broad base of consumers, particularly those who are younger and more health-conscious (see story).

Similarly, Italian apparel brand Moncler has taken a retro approach to sporting goods with a collection of animated attire, aiming at the intersection of the millennial audience and the growth of activewear.

Tom Ford jeans

Expectedly, those who consider themselves “fashion-forward” and keep up on the latest trends are considerably more valuable, particularly in the dresses category.

Equally revealing, consumers of all generations who consider active lifestyles important are far more likely to be frequent purchasers of all products – not just activewear – than those who do not. The growth of the activewear market has led a number of brands to increase their focus on the category.

In one recent example, London department store Selfridges is showing its love for "EveryBODY" with the opening of a new wellness destination.

The Body Studio is the largest department in the store at 37,000 square feet and will offer clothing and accessories that will satisfy women’s demand for more sophisticated and inclusive activewear. A consciously inclusive shopping destination will hold appeal for a broad base of consumers, particularly those who are younger and more health-conscious (see story).

Similarly, Italian apparel brand Moncler has taken a retro approach to sporting goods with a collection of animated attire, aiming at the intersection of the millennial audience and the growth of activewear.

Selfridges' Body Studio window

Taking inspiration from 1980s video games, Moncler’s Athletic Attitude line features pixelated elements on white shirts, jackets and accessories. Promoting the release in a playful way, Moncler has envisioned a tennis match reminiscent of early games (see story).

Creative segmentation

In other sectors, the focus on millennials as a single encompassing group is even more misguided.

Marketers spend an enormous amount of time and effort attracting millennial attention, when in reality the demographic will only spend approximately $49 billion across luxury categories in 2016, according to a recent YouGov report.

The older generations, the baby boomers and Generation Xers, control the “lion’s share” of luxury spending across nine categories, which include apparel, travel and personal care, among others, for a combined spend of $215 billion for the year. In the inaugural “2016 Affluent Perspective Global Study,” presented in New York on May 3, YouGov forecasts affluent spending, the difference between the two main demographics and how each approaches and interacts with luxury brands (see story).

Similarly, other researchers have also suggested segmenting millennials to avoid trying to market to a large, diverse group as if it were a uniform entity.

The millennial generation is too diverse and broad for marketers to avoid segmenting, according to a report by The Shullman Research Center.

Consumers born between 1981 and 2000 are considered millennials, meaning that people as young as 15 and as old as 35 (34 at the time of the survey) comprise the group. Because that 20-year gap is particularly profound in the early stages of life, marketers need to segment millennial consumers into specific groups to take advantage of particular habits and beliefs (see story).

"Age-based segmenting is still a useful starting point, but retailers need to understand that all millennials do not shop equally," Ms. Rhim said. "If you double-click on millennials, you find that life stage is a significant differentiator: Single females aged 18-34 are almost 2X more likely to buy dresses than married millennials; millennials who are parents are more likely to buy jeans and activewear than their peers without kids.

Selfridges' Body Studio window

Taking inspiration from 1980s video games, Moncler’s Athletic Attitude line features pixelated elements on white shirts, jackets and accessories. Promoting the release in a playful way, Moncler has envisioned a tennis match reminiscent of early games (see story).

Creative segmentation

In other sectors, the focus on millennials as a single encompassing group is even more misguided.

Marketers spend an enormous amount of time and effort attracting millennial attention, when in reality the demographic will only spend approximately $49 billion across luxury categories in 2016, according to a recent YouGov report.

The older generations, the baby boomers and Generation Xers, control the “lion’s share” of luxury spending across nine categories, which include apparel, travel and personal care, among others, for a combined spend of $215 billion for the year. In the inaugural “2016 Affluent Perspective Global Study,” presented in New York on May 3, YouGov forecasts affluent spending, the difference between the two main demographics and how each approaches and interacts with luxury brands (see story).

Similarly, other researchers have also suggested segmenting millennials to avoid trying to market to a large, diverse group as if it were a uniform entity.

The millennial generation is too diverse and broad for marketers to avoid segmenting, according to a report by The Shullman Research Center.

Consumers born between 1981 and 2000 are considered millennials, meaning that people as young as 15 and as old as 35 (34 at the time of the survey) comprise the group. Because that 20-year gap is particularly profound in the early stages of life, marketers need to segment millennial consumers into specific groups to take advantage of particular habits and beliefs (see story).

"Age-based segmenting is still a useful starting point, but retailers need to understand that all millennials do not shop equally," Ms. Rhim said. "If you double-click on millennials, you find that life stage is a significant differentiator: Single females aged 18-34 are almost 2X more likely to buy dresses than married millennials; millennials who are parents are more likely to buy jeans and activewear than their peers without kids.

"Apparel brands and retailers must look beyond age and take a multi-dimensional approach to targeting consumers," Ms. Rhim said.