Image courtesy of Bloomingdale's

Image courtesy of Bloomingdale's

Retailers are currently in the investment and adoption phase of the future of retail, a plateau on which practices and consumer behavior have yet to catch up with technology, according to a report by Walker Sands. Walker Sands’ third annual “Future of Retail 2016” study analyzes emerging retail technologies, placing an emphasis on consumer reaction to these potential game-changers and how the adoption of such strategies will affect spending habits. As to be expected, the technology leading retail’s evolution is ecommerce, with nearly a third of surveyed consumers shopping online at least once a week, a jump of 41 percent from 2014.

"On the more luxury specific side, this category saw one of the largest jumps over the past few years in terms of the sheer number of those shopping online - quadrupling since our report in 2014," said Erin Jordan, account director at Walker Sands. "Twenty-seven percent of consumers purchased a luxury item online in the past year, up from 10 percent in 2015 and just 6 percent in 2014.

"Luxury brands across the board seem to be getting started and even become digital natives in terms of integrating online and offline experiences," she said. "Still, few are really taking advantage of the space.

"Of those that come to mind, Burberry's online site is one that has received a lot of recognition. Still, up to this point startups selling or even renting luxury, such as Gilt Groupe and Rent the Runway, have taken the spotlight in terms of how to meet consumer expectations."

For the report, Walker Sands surveyed more than 1,400 United States consumers to identify four key areas retailers should focus on for the year ahead.

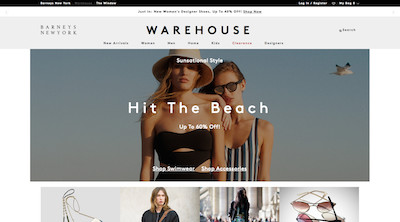

What’s in store for in-store According to the report, the Future of Retail will increasingly place importance on the supply chain. In the last three years, Walker Sands has found that seamless shipping, delivery and returns have become more important to consumers. As a primary driver of ecommerce growth, fulfillment has become an area that is heavily invested in by retailers. Last year, 29 percent of capital expenditures were allocated for fulfillment solutions such as transportation and logistics, delivery options, order management, inventory visibility and returns management. Department store chain Barneys New York’s discount outlet Barneys Warehouse, for example, made online purchasing less daunting with the addition of returns. Without the opportunity to return, some consumers may have previously been wary of buying apparel through the ecommerce site, since sizing can vary from brand to brand (see story). Barneys Warehouse Web site

Also, free shipping is a top incentive among consumers, with 88 percent of survey respondents seeking out the service when placing an order. Additional retail drivers include, one-day shipping (69 percent), free returns or exchanges (68 percent) and easy online returns (58 percent).

Talk of omnichannel retail’s importance for the industry will also continue as consumers become to expect, and feel more comfortable, with the integration of in-store and online experiences. Per Walker Sands' report, 7 in 10 consumers are now willing to opt in for in-store tracking and mobile push notifications.

As consumers become more receptive, the use of beacons to connect the in-store experience with that on mobile will evolve, although the technology has been slow to take off due to challenges brought forth by privacy concerns.

The report suggests that the next step in merging in-store and online experiences will be virtual reality ecommerce, or VR commerce. A growing number of brands have begun leveraging virtual reality to showcase products out of bricks-and-mortar contexts and offer in-store shoppers unique customer experiences.

A slew of retailers – including The North Face and IKEA – have already begun experimenting with VR commerce by showcasing products through mobile applications and complimentary headsets that pull into individuals into new dimensions(see story).

Barneys Warehouse Web site

Also, free shipping is a top incentive among consumers, with 88 percent of survey respondents seeking out the service when placing an order. Additional retail drivers include, one-day shipping (69 percent), free returns or exchanges (68 percent) and easy online returns (58 percent).

Talk of omnichannel retail’s importance for the industry will also continue as consumers become to expect, and feel more comfortable, with the integration of in-store and online experiences. Per Walker Sands' report, 7 in 10 consumers are now willing to opt in for in-store tracking and mobile push notifications.

As consumers become more receptive, the use of beacons to connect the in-store experience with that on mobile will evolve, although the technology has been slow to take off due to challenges brought forth by privacy concerns.

The report suggests that the next step in merging in-store and online experiences will be virtual reality ecommerce, or VR commerce. A growing number of brands have begun leveraging virtual reality to showcase products out of bricks-and-mortar contexts and offer in-store shoppers unique customer experiences.

A slew of retailers – including The North Face and IKEA – have already begun experimenting with VR commerce by showcasing products through mobile applications and complimentary headsets that pull into individuals into new dimensions(see story).

Dior Eyes virtual reality in-store experience (see story)

Dior Eyes virtual reality in-store experience (see story)

"One area we see as an opportunity for luxury retailers in particular is virtual reality," Ms. Jordan said. "Luxury buyers were also more likely to say they were interested in using a virtual reality device compared to the average shopper (71 percent, compared to 63 percent).

"They're also more open to buying these kinds of devices - More than a quarter of consumers who had purchased a luxury item in the past year reported plans to make a purchase or already own a device (28 percent plan to purchase, compared to 15 percent of consumers who haven't made a luxury purchase in the past year)," she said.

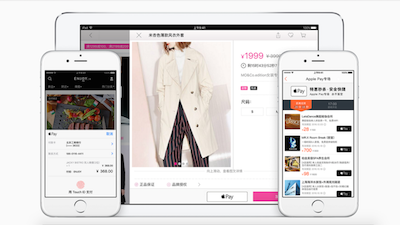

Similar to concerns about beacons invading a consumer's privacy, mobile payment adoption has been slow as well due to security concerns. Consumers’ worry has resulted in hesitation to embrace mobile payment applications by the majority of consumers. Walker Sands found that adoption of mobile payments has remained flat year over year, with only about a third of consumers having used these apps. But, mobile payment transactions in the U.S. are expected to triple in 2016 to $27 billion. Research suggests that early adopters and Apple Pay’s continued growth will cause consumer behavior to change. In the Chinese market this change is already becoming apparent. For example, Chinese department store chain Lane Crawford has announced that its Mainland China locations will now accept mobile payment via Apple Pay. Apple Pay in China

Brands and retailers have been shifting in-store strategies to offer an omnichannel retail experiences for consumers, and a large aspect of the tactic relies on mobile-based payment solutions. Mass fashion chains, such as Forever 21 and JCPenney, have been adapting, but luxury retailers are beginning to embrace the technology to better serve consumers who have begun to expect this level of service (see story).

Embracing ecommerce

Luxury retail has long been associated with the high level of service found at bricks-and-mortar locations. The rise of ecommerce has challenged the luxury industry’s long held notion of what excellent service means for affluent and discerning consumers.

For a time, luxury consumers were slow to embrace online shopping, but this may have been a result of brands in the sector being hesitant to respond to changing behavior. A number of brands and categories viewed online selling with skepticism, feeling that ecommerce would dilute offerings by lowering service qualities and disrupting exclusivity.

But, Walker Sands predicts that online sales will triple to approximately $80 billion by 2025, making the luxury category the fastest-growing ecommerce area.

In the last year luxury ecommerce has seen a spike in interest from consumers. For example, the number of consumers to purchase a luxury item, such as high-end jewelry, a category that has been notoriously slow to act, quadrupled in the past year from 2014.

U.S. jeweler Tiffany & Co., for instance, selected Net-A-Porter as its exclusive ecommerce partner, allowing its jewelry to be sold on the online retailer’s site for a limited time.

Beginning April 27, consumers have had the opportunity to purchase select Tiffany designs from Net-A-Porter. The partnership is unprecedented for Tiffany, as Net-A-Porter is now the only authorized online seller beyond the jeweler’s monobrand Web site (see story).

Apple Pay in China

Brands and retailers have been shifting in-store strategies to offer an omnichannel retail experiences for consumers, and a large aspect of the tactic relies on mobile-based payment solutions. Mass fashion chains, such as Forever 21 and JCPenney, have been adapting, but luxury retailers are beginning to embrace the technology to better serve consumers who have begun to expect this level of service (see story).

Embracing ecommerce

Luxury retail has long been associated with the high level of service found at bricks-and-mortar locations. The rise of ecommerce has challenged the luxury industry’s long held notion of what excellent service means for affluent and discerning consumers.

For a time, luxury consumers were slow to embrace online shopping, but this may have been a result of brands in the sector being hesitant to respond to changing behavior. A number of brands and categories viewed online selling with skepticism, feeling that ecommerce would dilute offerings by lowering service qualities and disrupting exclusivity.

But, Walker Sands predicts that online sales will triple to approximately $80 billion by 2025, making the luxury category the fastest-growing ecommerce area.

In the last year luxury ecommerce has seen a spike in interest from consumers. For example, the number of consumers to purchase a luxury item, such as high-end jewelry, a category that has been notoriously slow to act, quadrupled in the past year from 2014.

U.S. jeweler Tiffany & Co., for instance, selected Net-A-Porter as its exclusive ecommerce partner, allowing its jewelry to be sold on the online retailer’s site for a limited time.

Beginning April 27, consumers have had the opportunity to purchase select Tiffany designs from Net-A-Porter. The partnership is unprecedented for Tiffany, as Net-A-Porter is now the only authorized online seller beyond the jeweler’s monobrand Web site (see story).

"While online shopping as a whole has reached a saturation point luxury commerce is just getting started," Ms. Jordan said. "Consumer comfort with the convenience of online shopping and better customer experience has fueled the growth of luxury commerce and the online purchase of more expensive items.

"That being said, the answer isn't for luxury retailers to make a pure ecommerce play," she said. "Thirty-five percent of consumers say they prefer to shop luxury online and 65 percent report they prefer to shop in store for luxury items.

"Bridging the gap is the necessary next step to capture the increased online wallet share, especially as younger generations continue to have more funds to spend in this category."