Image courtesy of LVMH-owned Veuve Clicquot

Image courtesy of LVMH-owned Veuve Clicquot

Although major Champagne brands are visible on social media platforms, the category lacks the investment of other spirits and luxury goods players needed for worthwhile engagement, according to a new report by L2. Due to a lack in social media investment, even Champagne category leaders’ efforts are diminished by the likes of Jack Daniels and Chanel, two brands with the highest social media engagement and reach across channels. L2’s “Champagne: Social Media” report suggests that the brands dominating the social conversation are largely due to spend and pay-to-play strategies. “As Facebook, Instagram and YouTube all become increasingly pay-to-play platforms, spend is key to earning share of voice,” said Ariel Meranus, research associate at L2. “On Facebook, for example Moët & Chandon and Dom Pérignon promote a much higher percent of posts than their competitors, and therefore dominate the conversation. “A similar phenomenon plays out on YouTube, where Veuve Clicquot, who earns the most total views, also pays for a higher percent of views than any of their competitors,” she said. “Instagram and Facebook are the key social platforms for Champagne brands, accounting for an almost equal share of engagement (likes, comments, shares) in 2016. Lifestyle and product-focused imagery tends to perform well across platforms.” L2’s report examined the top 14 Champagne brands on social media platforms such as Facebook, Instagram, YouTube and Twitter. Social bubbly By interaction, Champagne brands see the most consumer engagement on Facebook and Instagram, with a 49 percent and 50 percent engagement rate, respectively. Twitter only counts consumer interactions at 1 percent. The Champagne: Social Media report found that LVMH-owned Moët & Chandon and Dom Pérignon dominate the conversation on Facebook. In 2016, these two brands accounted for 17 percent of Champagne makers, but earned a combined 74 percent of total interactions, including likes, comments and shares. The success on the platform for these two Champagne brands rests largely on their ad spend. L2 found that Moët & Chandon promoted 67 percent of its posts and Dom Pérignon promoted 93 percent, while the average of the remaining brands was only 24 percent. Although Moët & Chandon and Dom Perignon are successful in their category with 1.9 million and 1.5 million interactions in 2016, Chanel, in comparison, saw 6 million interactions for the same year. Veuve Clicquot, also owned by LVMH, is top on Instagram and ties Moët & Chandon for the largest shares of interactions at 27 percent. Veuve Clicquot boasts a larger audience than its peers with 310,000 followers compared to the average of 80,000.

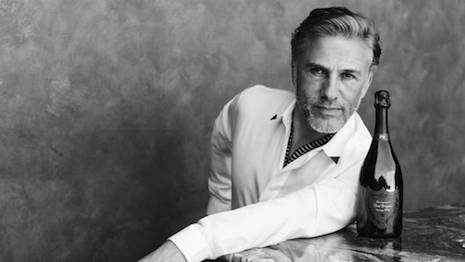

In addition to its larger audience, Veuve Clicquot is far more active than its peers. The brand posts on Instagram 9.7 times per week, more than double the category average. Thirty-three percent of Veuve Clicquot’s posts included video content, whereas its competitors only average 13 percent. Veuve Clicquot is also a leader on YouTube due to its pay-to-play strategy despite Champagne makers lacking support and reach on the video platform. But, despite an average video viewership of 241,000, this is still small change when compared to other spirits brands, such as Grey Goose, which sees more than 750,000 per film. L2’s research suggests that to see social media ROI, Champagne makers must be willing to push promoted content via a play-to-pay strategy. Popping bottles of opportunity Based on its findings, L2 points to Champagne makers' missed opportunities as ways to yield better results on social media. One such missed opportunity is leveraging user-generated content that is actively encouraged and incentivized by the brand. Veuve Clicquot, for example, operates a UGC hub (see story) and uses the hashtag #VeuveCliquot on its posts, but does not repurpose the content across its social channels. Another is not partnering with brand ambassadors. While many team with well-known influencers and professional chefs, leveraging the popularity of a Hollywood actor or athlete is not as prevalent. Dom Pérignon, for example, often shares Instagram content from photographers and fashion bloggers. In a move away from its usual strategy, Dom Pérignon tapped actor Christoph Waltz’s theatricality to portray the emotions felt as its bubbles are savored. “Touched with Plénitude” was the debut campaign for Dom Pérignon P2, a Champagne first released in 2014 that was 16 years in the making. For this campaign, Dom Pérignon chose to let Mr. Waltz's expressions do the talking, with each subtle movement of his eyes or lips telling the story of the Champagne's intensity (see story).

Christoph Waltz for Dom Pérignon's P2

L2 also notes the importance of a reciprocal relationship when working with a celebrity ambassador.

Using Roger Federer, who is a Rolex and Moët & Chandon ambassador (see story) as an example, L2 found that the tennis pro shared posts about the watch brand three times, but has never shared content relevant to the Champagne maker to his 2.8 million Instagram followers.

Since Moet & Chandon only has a following of 302,000 on Instagram, the brand missed out on visibility provided by Mr. Federer.

“Champagne brand marketers should look to other luxury brands for inspiration on how to model their post promotion strategies,” said L2’s Ms. Meranus. “As Facebook and now Instagram have transitioned to an algorithmic feed, post frequency is less correlated with overall share of interactions.

“Other luxury categories such as fashion and auto have done a better job responding to this change--pulling back on post frequency and instead ensuring content is backed with targeted media spend.”

Christoph Waltz for Dom Pérignon's P2

L2 also notes the importance of a reciprocal relationship when working with a celebrity ambassador.

Using Roger Federer, who is a Rolex and Moët & Chandon ambassador (see story) as an example, L2 found that the tennis pro shared posts about the watch brand three times, but has never shared content relevant to the Champagne maker to his 2.8 million Instagram followers.

Since Moet & Chandon only has a following of 302,000 on Instagram, the brand missed out on visibility provided by Mr. Federer.

“Champagne brand marketers should look to other luxury brands for inspiration on how to model their post promotion strategies,” said L2’s Ms. Meranus. “As Facebook and now Instagram have transitioned to an algorithmic feed, post frequency is less correlated with overall share of interactions.

“Other luxury categories such as fashion and auto have done a better job responding to this change--pulling back on post frequency and instead ensuring content is backed with targeted media spend.”