Nordstrom was one of the top luxury retailers in brand equity

Nordstrom was one of the top luxury retailers in brand equity

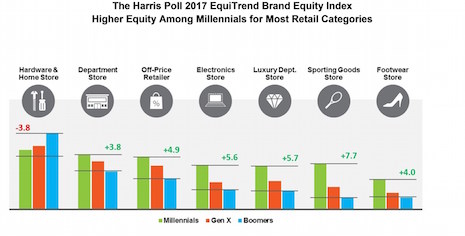

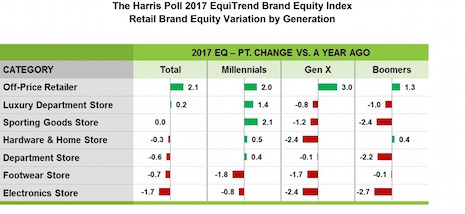

Millennials tend to have a higher opinion of retailers that carry luxury goods, though this perception is not present for older generations, according to a new study from The Harris Poll. The Harris Poll's "2017 EquiTrend Brand Equity Index" surveyed brand reputation among consumers, particularly Generation X and millennials, to gauge how various demographics feel about different brands. The report found that retail stores do not receive a notable boost in reputation generally for being associated with luxury brands, although millennials do have a slight increase in opinion of these stores. "Department stores have struggled with Gen X and millennials for some time; Gen X led the charge toward bricks-and-mortar specialty stores and millennials followed suit, favoring online specialty shopping," said Joan Sinopoli, vice president of brand solutions at The Harris Poll, Rochester, NY. "Meanwhile mainstream retailers such as Kohl's and Target, experimenting with different formats and designer names, have forced luxury stores to play price wars," she said. Brand equity For many consumers, one of the largest draws of luxury brands is not just the product, but the association with the product. Luxury, by definition, is unnecessary and most luxury goods, while high-quality, are significantly more expensive than their actual value would suggest. Instead, something that both luxury manufacturers and consumers understand is that the brands are also selling image along with product. If one displays a luxury product, it means that they can afford it and are declaring a certain level of status in doing so. Because of this, consumers’ overall opinions of luxury brands are important to denoting their value. Associated entities can benefit from the second-hand positive opinion that luxury brands draw.

Millennials have a high opinion of luxury retailers compared to other sectors

Millennials have a high opinion of luxury retailers compared to other sectors

The Harris Poll's retail brand equity report

Gucci Bloom, the first scent developed by Mr. Michele, is officially launching in August, but the brand is offering a limited selection of bottles for pre-order via ecommerce from May 3. After introducing new motifs and design aesthetics for the brand's ready-to-wear, accessories and jewelry collections, this fragrance debut enables Mr. Michele to communicate his brand vision through a new product category and medium (see story).

This is important not just for luxury brands seeking millennial consumers in the future, but the retail stores that will hope to participate in that business as the demographic increasingly grow into their wealth in the years ahead.

"To many consumers, luxury stores have simply stopped offering a luxury difference, and that is why we see retailers such as Nordstrom actively working to bring millennials into their stores with rotating pop-up shops and personalized customer experiences, and Lord & Taylor taking steps to reposition and differentiate as the shopping destination for dresses," The Harris Poll's Ms. Sinopoli said.

The Harris Poll's retail brand equity report

Gucci Bloom, the first scent developed by Mr. Michele, is officially launching in August, but the brand is offering a limited selection of bottles for pre-order via ecommerce from May 3. After introducing new motifs and design aesthetics for the brand's ready-to-wear, accessories and jewelry collections, this fragrance debut enables Mr. Michele to communicate his brand vision through a new product category and medium (see story).

This is important not just for luxury brands seeking millennial consumers in the future, but the retail stores that will hope to participate in that business as the demographic increasingly grow into their wealth in the years ahead.

"To many consumers, luxury stores have simply stopped offering a luxury difference, and that is why we see retailers such as Nordstrom actively working to bring millennials into their stores with rotating pop-up shops and personalized customer experiences, and Lord & Taylor taking steps to reposition and differentiate as the shopping destination for dresses," The Harris Poll's Ms. Sinopoli said.