Millennials and older HNWIs disagree over investment priorities and more. Image credit: U.S. Trust

Millennials and older HNWIs disagree over investment priorities and more. Image credit: U.S. Trust

The increasing longevity of human life is unsettling traditional notions of responsibility among high-net-worth families, according to a new report from Bank of America's U.S. Trust. U.S. Trust surveyed 800 high-net-worth families and noted some stark changes and disagreements between young wealthy individuals and older ones. These conflicts mainly took the form of what kind of investments they are interested in, their attitudes toward charitable giving and the new problem of multiple generations competing for the same jobs.

“As many as five different generations are now active in the workforce and contributing to family dynamics and financial decision-making,” said Keith T. Banks, president of U.S. Trust, Bank of America Wealth Management, Charlotte, NC. “Perspective and participation of multiple generations are highly valued, but are also complex and require advanced planning and communication.”

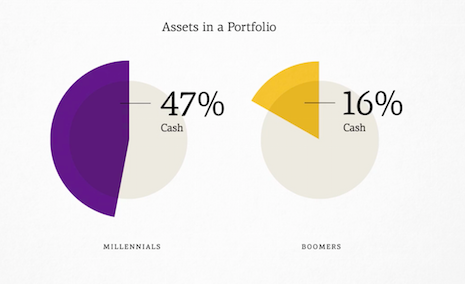

Wealth management High-net-worth individuals (HNWIs) make up the core of the luxury industry’s consumer base, so their attitudes toward managing their wealth are of utmost importance. U.S. Trust called on more than 800 high-net-worth families to survey their attitudes toward wealth, specifically as it pertains to the gap between affluent millennials and their older counterparts. One of the central themes that emerged was that older individuals are staying in the workforce far longer and staying active in personal wealth management longer as well due to longer life spans. This is creating some conflict with their millennial children, who often compete with people far older than themselves for the same jobs. Also, millennials are often considered incapable of properly managing money and inheritance by their elders. Millennials keep more cash on time. Image credit: U.S. Trust

Eighty-nine percent of respondents said that having a generationally diverse workplace is valuable, but many felt like they are competing with other generations for the same jobs. Almost 60 percent of millennials said they feel like they cannot advance in their careers as easily because older employees are not retiring as early.

Younger HNWIs are also more keen on alternate forms of investing, such as in real estate and art. In contrast, older generations are more likely to store their wealth in traditional bonds and stocks.

Finally, millennials are much more committed to using personal wealth to make a positive impact on the world, in contrast to older HNWIs for whom this is less of a priority.

But that perception may be just because different generations treat philanthropy differently.

For example, millennials are three times more likely than baby boomers to view the jobs and companies they create as their way of giving back to a community.

Intergenerational conflict

Understanding the movements and shifts of how the world’s wealthiest manage and view their money is an integral part of luxury market research.

This will only continue given the growing rate of inequality, which will put half of the world’s wealth in the hands of millionaires by 2021, according to BCG.

While the recession is behind affluent consumers, wealth managers are still grappling with heightened client expectations developed during the crisis, which force advisors to do more for their investors for less. While strained by the necessity to cut costs, BCG argues that increased digital investment is necessary to propel these firms into the future (see story).

Millennials keep more cash on time. Image credit: U.S. Trust

Eighty-nine percent of respondents said that having a generationally diverse workplace is valuable, but many felt like they are competing with other generations for the same jobs. Almost 60 percent of millennials said they feel like they cannot advance in their careers as easily because older employees are not retiring as early.

Younger HNWIs are also more keen on alternate forms of investing, such as in real estate and art. In contrast, older generations are more likely to store their wealth in traditional bonds and stocks.

Finally, millennials are much more committed to using personal wealth to make a positive impact on the world, in contrast to older HNWIs for whom this is less of a priority.

But that perception may be just because different generations treat philanthropy differently.

For example, millennials are three times more likely than baby boomers to view the jobs and companies they create as their way of giving back to a community.

Intergenerational conflict

Understanding the movements and shifts of how the world’s wealthiest manage and view their money is an integral part of luxury market research.

This will only continue given the growing rate of inequality, which will put half of the world’s wealth in the hands of millionaires by 2021, according to BCG.

While the recession is behind affluent consumers, wealth managers are still grappling with heightened client expectations developed during the crisis, which force advisors to do more for their investors for less. While strained by the necessity to cut costs, BCG argues that increased digital investment is necessary to propel these firms into the future (see story).

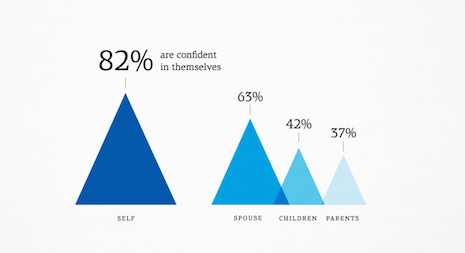

Generations have little trust in each other's competence. Image credit: U.S. Trust

The movements of younger HNWIs are of particular interest to the luxury world.

Gen Y is not investing in real estate or the stock markets. Instead, Gen Y are “WELLth investors” who would rather spend their income on personal and societal wellness.

Cassandra’s research found that 73 percent of Gen Y would rather be healthy than wealthy, and 68 percent would rather splurge on healthy eating than junk food (see story).

As wealth management continues to be a major priority for HNWIs and the conflicts between older and younger affluents grow, luxury brands will have to keep any eye on how these issues are being navigated in order to keep abreast of how best to reach their primary customers.

Generations have little trust in each other's competence. Image credit: U.S. Trust

The movements of younger HNWIs are of particular interest to the luxury world.

Gen Y is not investing in real estate or the stock markets. Instead, Gen Y are “WELLth investors” who would rather spend their income on personal and societal wellness.

Cassandra’s research found that 73 percent of Gen Y would rather be healthy than wealthy, and 68 percent would rather splurge on healthy eating than junk food (see story).

As wealth management continues to be a major priority for HNWIs and the conflicts between older and younger affluents grow, luxury brands will have to keep any eye on how these issues are being navigated in order to keep abreast of how best to reach their primary customers.

“While the impact of generational diversity continues to manifest itself in family dynamics, by empowering each generation to interpret, innovate and contribute in its own way, families can be enriched, rather than divided, by generational differences,” said Chris Heilmann, vice chairman of U.S. Trust, Charlotte, NC.