Luxury product development must match consumer behavior. Image credit: Amati & Associates

Luxury product development must match consumer behavior. Image credit: Amati & Associates

Thanks to increased connectedness, the traditional barriers between work, play and relaxation have blurred, causing marketers to struggle to develop impactful strategies.

In Amati & Associates’ white paper “Premium Beyond Digital,” the consulting firm examined how technology such as smartphones and innovations in digital media have caused consumption and consumer behavior to evolve. For luxury, this transformation has transitioned from a sector of material possessions to one of “quality time, own space and immersive experiences,” with digital on course to disrupt the luxury goods industry at the product level.

"Luxury - as we know it today - is changing independently of the blur,"said Filiberto Amati, partner at Amati & Associates, Warsaw, Poland. "There is growing evidence that luxury will be less and less about physical possession, and more about fostering own culture, improving own health and develop tailor-made experiences.

"The blur will definitely be a catalyst for immaterial luxury, because with leisure and work blurring, there will be more opportunities to experience immaterial luxuries," he said. "With regards to physical consumption, it’s difficult to assess an overall impact, because consumption will move from certain categories to others.

"And finally the blur is definitely playing a positive role for super-premium products, because with sales staff being connected with customers 24/7, a lot of purchase transactions are anticipated."

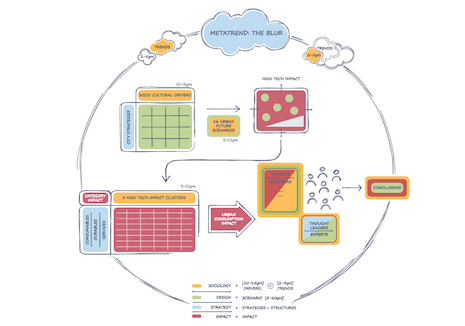

Amati & Associates' white paper was created in dialog with more than 20 senior industry experts and thought leaders in marketing, design and leisure.

Blurred lines

Using “the blur” as a starting point, Amati & Associates seeks to demonstrate how the integration of technology and consumers’ connectedness in all aspects of their lives has made marketers’ jobs more complicated as it has become harder to develop strategic plans that are innovative enough for sophisticated audiences.

Consumption trends traditionally evolve from the context of urban environments where the elite and sub-cultures converge.

In its white paper, Amati & Associates explains how historically, luxury brands were a by-product of royal courts, before spreading through capital cities and regional centers of commerce and industry. Luxury is essentially the “offspring of class dynamics and a vertically-structured society.”

Amati & Associates research approach. Image credit: Amati & Associates

The urban environment thus has continued to lead to the creation and adoption of products, propositions and practices of leisure to become a lifestyle.

As technology has become an inescapable factor of daily life, the blur has redefined consumption in the various sub-sectors of luxury such as personal care, jewelry and watches, fashion and retail.

Luxury was once focused on material possessions and characterized as “the best exclusively attainable” goods. Likewise, craftsmanship and refinement of the products were top considerations as well as the experiences built around luxury goods.

But, there has been a behavioral shift among the affluent that places more of an importance on time, space and experience. In the future, Amati & Associates predicts in its white paper that more attention will be placed on immaterial experiences as well as a heightened demand for sensorial design.

To account for this change in perspective, luxury brands must craft storytelling narratives that are “underpinned by authenticity” in addition to innovating as a method to redefine their raison d’etre in a rapidly evolving consumer culture.

Changing categories

Over the centuries, luxury has maintained its expression of aspiration, craftsmanship and technical excellence and has, in many ways, stood the test of time with little technological input.

Due to the technology blur and changes in consumer behavior, luxury’s sub-sectors have become disrupted. Amati & Associates examined the primary pillars of luxury, pinpointing sector trends and offering recommendations to respond to these challenges and opportunities.

Amati & Associates research approach. Image credit: Amati & Associates

The urban environment thus has continued to lead to the creation and adoption of products, propositions and practices of leisure to become a lifestyle.

As technology has become an inescapable factor of daily life, the blur has redefined consumption in the various sub-sectors of luxury such as personal care, jewelry and watches, fashion and retail.

Luxury was once focused on material possessions and characterized as “the best exclusively attainable” goods. Likewise, craftsmanship and refinement of the products were top considerations as well as the experiences built around luxury goods.

But, there has been a behavioral shift among the affluent that places more of an importance on time, space and experience. In the future, Amati & Associates predicts in its white paper that more attention will be placed on immaterial experiences as well as a heightened demand for sensorial design.

To account for this change in perspective, luxury brands must craft storytelling narratives that are “underpinned by authenticity” in addition to innovating as a method to redefine their raison d’etre in a rapidly evolving consumer culture.

Changing categories

Over the centuries, luxury has maintained its expression of aspiration, craftsmanship and technical excellence and has, in many ways, stood the test of time with little technological input.

Due to the technology blur and changes in consumer behavior, luxury’s sub-sectors have become disrupted. Amati & Associates examined the primary pillars of luxury, pinpointing sector trends and offering recommendations to respond to these challenges and opportunities.

"Most radical change happens in two contexts," Mr. Amati said. "On one end, categories which depend widely from retail operations will have to adapt to a business model where increasing costs of prime real estate, combined with switching of sales to online, will make retail very unprofitable for many; yet a physical presence will play a critical platform for developing the brand, to convince the consumers, to generate an adoption which will see most of the volumes online.

"For example we posit that a lot of up-and-coming new personal care and fragrance brands will decide more and more to go develop pop-up/mobile-stores, or bet almost exclusively on travel retail to showcase brand experience and generate product trial," he said.

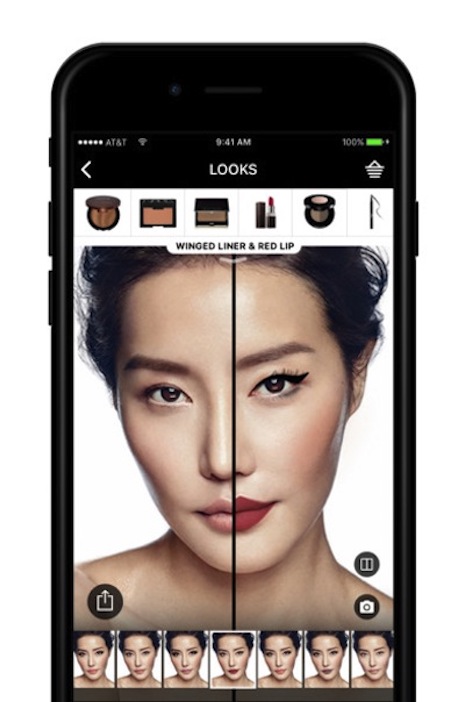

Sephora is one example of personal care retailer embracing the mobile store. Image credit: Sephora

Sephora is one example of personal care retailer embracing the mobile store. Image credit: Sephora

Marc Jacobs' hybrid Riley wearable launched Aug. 30. Image credit: Marc Jacobs

Despite the apparel and accessories category embracing digital from a marketing standpoint due to the popularity of influencer marketing and user-generated content, Amati & Associates does not see fashion adopting intelligent or smart materials in the near future, but manufacturing technologies are likely to go mainstream eventually (see story).

Instead, fashion retail is more poised to benefit from technological advancements. Hybrid retail methods will continue to emerge led by purchasing algorithms and showrooming models with commercial experience becoming digitized further for the long-term.

"On the other end, radical change is coming because of technology to fashion and accessories, probably beyond the 10 years range, and definitely in the next five years to 10 years, interior design and consumer electronics will converge," Mr. Amati said. "Because of the blur, technology will be key for either working or relaxing at home.

"However consumers are expecting technology to be embedded in their own style at home, with cable, routers, sensors and remotes being effectively being hid in furniture, lighting objects and furnishings," he said. "Of course that is a big challenge for both industries: consumer electronics will need to switch to a business model which is more relying on revenues from license, than selling items in-store.

"Interior designers will need work closely in an open innovation type of environment with a technology that does not discriminate them, but will be necessary. Exactly like the challenge that we observe today for smart-luxury-watches."

Marc Jacobs' hybrid Riley wearable launched Aug. 30. Image credit: Marc Jacobs

Despite the apparel and accessories category embracing digital from a marketing standpoint due to the popularity of influencer marketing and user-generated content, Amati & Associates does not see fashion adopting intelligent or smart materials in the near future, but manufacturing technologies are likely to go mainstream eventually (see story).

Instead, fashion retail is more poised to benefit from technological advancements. Hybrid retail methods will continue to emerge led by purchasing algorithms and showrooming models with commercial experience becoming digitized further for the long-term.

"On the other end, radical change is coming because of technology to fashion and accessories, probably beyond the 10 years range, and definitely in the next five years to 10 years, interior design and consumer electronics will converge," Mr. Amati said. "Because of the blur, technology will be key for either working or relaxing at home.

"However consumers are expecting technology to be embedded in their own style at home, with cable, routers, sensors and remotes being effectively being hid in furniture, lighting objects and furnishings," he said. "Of course that is a big challenge for both industries: consumer electronics will need to switch to a business model which is more relying on revenues from license, than selling items in-store.

"Interior designers will need work closely in an open innovation type of environment with a technology that does not discriminate them, but will be necessary. Exactly like the challenge that we observe today for smart-luxury-watches."