China is still a major contributor to global real estate market. Image credit: Knight Frank

China is still a major contributor to global real estate market. Image credit: Knight Frank

After a strong showing in the first quarter of 2017, Chinese cities have dropped from the leaderboard of top performing real estate markets around the world. Knight Frank has released its quarterly Global Residential Cities Index, which ranks global cities based on the prices and performance of their residential real estate markets. Last quarter saw China dominating, but the country has undergone a deceleration of performance while Canadian cities surge ahead taking the top spot for Q2.

“Long-term frontrunners such as Hong Kong, Reykjavik, Wellington and Budapest are holding firm this quarter, but we have seen some new contenders rise up the rankings, most notably key Indian cities," said Kate Everett-Allen, international research resident at Knight Frank, London.

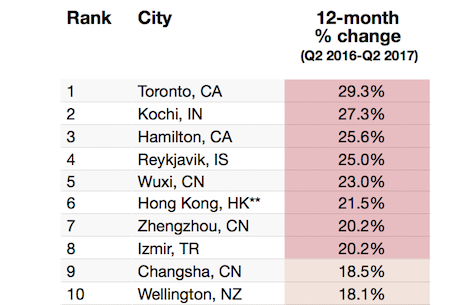

Top 10 cities this quarter. Image credit: Knight Frank

In their place, Canadian cities have ascended. The number one ranked city this quarter was Toronto, with 29 percent growth in prices.

Hamilton, another Canadian city, is close behind at number three with Victoria just missing the top 10 by two spots.

Notably, a few Indian cities have also jumped up the rankings. Altogether, the 10 Indian cities in the index jumped from 3 percent annual growth to 12 percent.

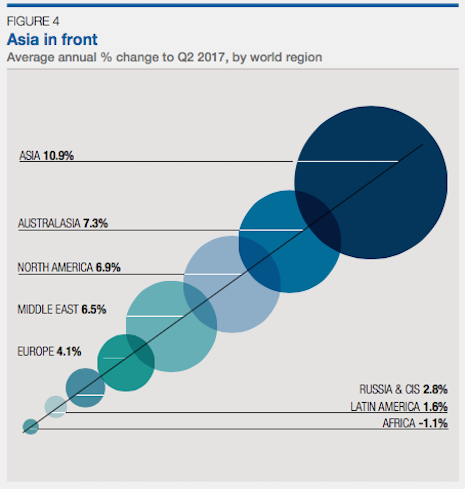

Knight Frank has found that Asia is still outperforming other world regions with prices rising by almost 11 percent across the region. China, despite its slowdowns, is still a major contributor to that growth.

China remains strong

While China’s major cities are continuing to grow in terms of price rate, Knight Frank’s Global Cities Index predicts this will slow due to restrictions on loan-to-value ratios and tighter lending on an individual's second or third properties.

The growth of China’s cities has supported strong investment into the luxury property sector worldwide. While the rest of the world’s properties have seen instability in price rates, investment into the luxury market has been strong this year (see story).

Chinese real estate buyers are not just a boon to their own cities. In fact, many wealthy Chinese travelers buy property in other cities around the world to aid in their frequent global trips.

Top 10 cities this quarter. Image credit: Knight Frank

In their place, Canadian cities have ascended. The number one ranked city this quarter was Toronto, with 29 percent growth in prices.

Hamilton, another Canadian city, is close behind at number three with Victoria just missing the top 10 by two spots.

Notably, a few Indian cities have also jumped up the rankings. Altogether, the 10 Indian cities in the index jumped from 3 percent annual growth to 12 percent.

Knight Frank has found that Asia is still outperforming other world regions with prices rising by almost 11 percent across the region. China, despite its slowdowns, is still a major contributor to that growth.

China remains strong

While China’s major cities are continuing to grow in terms of price rate, Knight Frank’s Global Cities Index predicts this will slow due to restrictions on loan-to-value ratios and tighter lending on an individual's second or third properties.

The growth of China’s cities has supported strong investment into the luxury property sector worldwide. While the rest of the world’s properties have seen instability in price rates, investment into the luxury market has been strong this year (see story).

Chinese real estate buyers are not just a boon to their own cities. In fact, many wealthy Chinese travelers buy property in other cities around the world to aid in their frequent global trips.

Asia has come out on top. Image credit: Knight Frank

As legions of Chinese consumers venture overseas during Golden Week, searching for real estate is one of their top priorities.

The Chinese National Tourism administration expects that the holiday this year will see about half of the nation’s population, or 710 million individuals, on the move. According to a report from Juwai, 57 percent of Chinese tourists heading abroad on trips this year anticipate buying property in their destination, making this en masse migration a prime time for real estate investment (see story).

China still remains a global power in the real estate industry. Even as its overall growth slips in comparison to previous quarters, Chinese consumers have an effect both in and out of the country.

Asia has come out on top. Image credit: Knight Frank

As legions of Chinese consumers venture overseas during Golden Week, searching for real estate is one of their top priorities.

The Chinese National Tourism administration expects that the holiday this year will see about half of the nation’s population, or 710 million individuals, on the move. According to a report from Juwai, 57 percent of Chinese tourists heading abroad on trips this year anticipate buying property in their destination, making this en masse migration a prime time for real estate investment (see story).

China still remains a global power in the real estate industry. Even as its overall growth slips in comparison to previous quarters, Chinese consumers have an effect both in and out of the country.