Galleries still serve as a guidance point for art collectors. Image credit: UBS Global Art

Galleries still serve as a guidance point for art collectors. Image credit: UBS Global Art

According to a new report from UBS, 41 percent of art collectors have never insured or appraised their collections because the hobby is not viewed as an investment, but rather a passion pursuit.

In UBS’ Investor Watch report “For the love of art,” the financial advisor surveyed art collectors to better understand their motivations, finding that an appreciation of beauty and a want to nurture creative talent is a driving factor. Also, despite fine art being viewed as a secure investment, art collectors do not partake in curating a personal collection with profits in mind.

“We know our clients well and understand that art is a pursuit of passion for many of them,” said John Mathews, head of private wealth management and ultra high net worth, UBS Americas, New York. “So that was not a surprise.

“We were surprised however, that many of these clients don’t apply the same principles to buying art that they would to a typical investment portfolio of stocks and bonds, with 41 percent of those surveyed confessing that they have never had their collection appraised or insured,” he said.

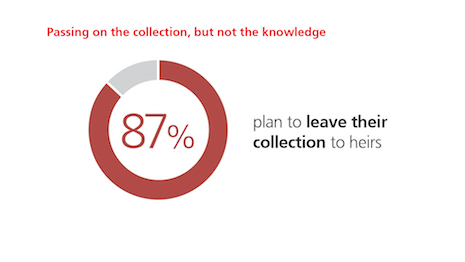

“Since the report also found that 87 percent of collectors plan to pass their collections on to their heirs, we feel that it is important to institute management structures to ensure their legacy remains protected, correctly valued and insured.”

For UBS Investor Watch, 2,475 high-net-worth investors with at least $1 million in investable assets, including 608 individuals with at least $5 million, were surveyed in September 2017. Of the total survey respondents, 1,017 are collectors and of those, 363 collect fine art.

Passion projects

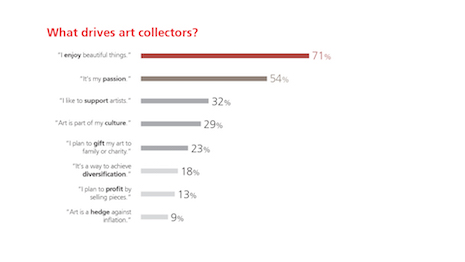

When asked by UBS what is the motivating factor behind purchasing art, an overwhelming 71 percent explained that it is the enjoyment of beautiful things that has driven them toward collecting fine art.

Responses such as “It’s my passion” and “I like to support artists” were claimed by 54 and 32 percent of survey participants, respectively.

While others explained they buy art to leave to their heirs or a charity and use art to diversify their assets, only a small number of respondents, 13 percent, plan on using their collections as a source of profit.

What drives art collectors? Infographic provided with courtesy by UBS

As such, 65 percent of those most-passionate about art have never sold a piece from their collection, with 25 percent considering their collection priceless.

Although you “can’t put a price on passion,” 41 percent of collectors have not bothered to appraise their collection and 65 percent have never sold a piece of art from their collections.

The art market is booming, and 46 percent of UBS’ affluent respondents shared that they have increased how much they are spending on art over time.

But where do art collectors find guidance? Although UBS found that 88 percent of collectors do not have an official art advisor, and 62 percent visit galleries to discover new artists and works for their growing collections.

What drives art collectors? Infographic provided with courtesy by UBS

As such, 65 percent of those most-passionate about art have never sold a piece from their collection, with 25 percent considering their collection priceless.

Although you “can’t put a price on passion,” 41 percent of collectors have not bothered to appraise their collection and 65 percent have never sold a piece of art from their collections.

The art market is booming, and 46 percent of UBS’ affluent respondents shared that they have increased how much they are spending on art over time.

But where do art collectors find guidance? Although UBS found that 88 percent of collectors do not have an official art advisor, and 62 percent visit galleries to discover new artists and works for their growing collections.

Online guidance is also increasing with 60 percent using Web sites for discovery, but only 26 percent of respondents have actually bought a piece, site unseen, meaning without seeing the work in person prior to purchase, via an online art platform. “Most surprisingly, one in four collectors admit to purchasing art online, sight unseen,” UBS’ Mr. Mathews said. “This gravitation toward alternative sources, in particular digital, underscores the evolution of the art buyer's journey and how the industry will need to adapt to keep pace,” he said. The numerous international art festivals also offer guidance to affluent collectors, with 26 percent heading to shows to immerse themselves in contemporary art. The top five most-attended art events include Art Basel, The Armory, TEFAF, Frieze and the Venice Biennale. Although only 23 percent of respondents are driven primarily by the potential of passing down an art collection to heirs, 87 percent of art collectors plan to leave their trove to their kin.

Passing on the collection, but not the knowledge. Infographic provided with courtesy by UBS

UBS notes that despite collectors being very interested in sharing their collection with their family’s younger generations, 57 percent have not educated their heirs about collecting.

But, art collection does seem to transcend affluent generations with 34 percent of respondents’ heirs becoming avid collectors in their own right.

Almost all heirs, 90 percent, said they would be “honored” to have the collection and 81 percent plan to keep the collection, further supporting that art collection is not based on price tag, but rather deep appreciation and passion.

Passion versus profits

Despite the significant time and money wealthy individuals put into collecting art or automobiles, a separate UBS report found that wealthy individuals typically do not prioritize the value of these assets.

Most collectors have spent upwards of two decades amassing pieces that they are passionate about, with precious metals, fine art, jewelry and stamps the most popular hobbies.

Wealthier investors with more than $5 million in investable assets are more apt than those with assets between $1-5 million to spend more money on their collection than retirement. They are also more likely to have increased their spending on their collection over time, and they are more apt to feel that the value of their collection has risen faster than traditional investments.

These wealthier individuals are more likely to collect fine art, and are also more apt to gift their collection to a charity or museum (see story).

Per UBS’ annual Billionaires Report, billionaires are increasing their involvement with cultural pursuits in the art and sports sectors to give back to the community. According to the reports findings, investments in art are up through a combination of private museum openings and public art institutions receiving more funding.

For example, Japanese ecommerce entrepreneur Yusaku Maezawa, estimated by Forbes to have a net worth of $4.3 billion, purchased Jean-Michel Basquiat's “Untitled” painting from 1982 at auction at Sotheby’s for $110.5 million, a record-breaking price for any work created post-1980.

Instead of hanging the artwork in his home, or squirreling it away in storage, Mr. Maezawa plans to include the Basquiat in his private museum. By doing so, the public will have the opportunity to experience the painting firsthand (see story).

“We have seen that wealthy collectors are increasingly offering wider access to their artwork to the public, either by giving art to museums or opening a private museum of their own,” UBS’ Mr. Mathews said.

“However our Investor Watch report also finds that most collectors we surveyed (87 percent) plan to pass on their collections to their heirs and 81 percent of the heirs plan to keep the collection,” he said. “There still remains a very high interest to maintain a legacy.

“Yet despite this, they have not taken steps to educate their heirs on how to manage, appraise and/or sell their collection.”

Passing on the collection, but not the knowledge. Infographic provided with courtesy by UBS

UBS notes that despite collectors being very interested in sharing their collection with their family’s younger generations, 57 percent have not educated their heirs about collecting.

But, art collection does seem to transcend affluent generations with 34 percent of respondents’ heirs becoming avid collectors in their own right.

Almost all heirs, 90 percent, said they would be “honored” to have the collection and 81 percent plan to keep the collection, further supporting that art collection is not based on price tag, but rather deep appreciation and passion.

Passion versus profits

Despite the significant time and money wealthy individuals put into collecting art or automobiles, a separate UBS report found that wealthy individuals typically do not prioritize the value of these assets.

Most collectors have spent upwards of two decades amassing pieces that they are passionate about, with precious metals, fine art, jewelry and stamps the most popular hobbies.

Wealthier investors with more than $5 million in investable assets are more apt than those with assets between $1-5 million to spend more money on their collection than retirement. They are also more likely to have increased their spending on their collection over time, and they are more apt to feel that the value of their collection has risen faster than traditional investments.

These wealthier individuals are more likely to collect fine art, and are also more apt to gift their collection to a charity or museum (see story).

Per UBS’ annual Billionaires Report, billionaires are increasing their involvement with cultural pursuits in the art and sports sectors to give back to the community. According to the reports findings, investments in art are up through a combination of private museum openings and public art institutions receiving more funding.

For example, Japanese ecommerce entrepreneur Yusaku Maezawa, estimated by Forbes to have a net worth of $4.3 billion, purchased Jean-Michel Basquiat's “Untitled” painting from 1982 at auction at Sotheby’s for $110.5 million, a record-breaking price for any work created post-1980.

Instead of hanging the artwork in his home, or squirreling it away in storage, Mr. Maezawa plans to include the Basquiat in his private museum. By doing so, the public will have the opportunity to experience the painting firsthand (see story).

“We have seen that wealthy collectors are increasingly offering wider access to their artwork to the public, either by giving art to museums or opening a private museum of their own,” UBS’ Mr. Mathews said.

“However our Investor Watch report also finds that most collectors we surveyed (87 percent) plan to pass on their collections to their heirs and 81 percent of the heirs plan to keep the collection,” he said. “There still remains a very high interest to maintain a legacy.

“Yet despite this, they have not taken steps to educate their heirs on how to manage, appraise and/or sell their collection.”