As China's share of the world's billionaires grows, so too does its luxury market. Image credit: Peninsula Hotels

As China's share of the world's billionaires grows, so too does its luxury market. Image credit: Peninsula Hotels

As China’s share of global high-net-worth individuals grows, the country’s wealthy elites increasingly believe that in the next 10 years it will overshadow the United States as the country with the most ultra-affluent consumers.

Last year, only 30 percent of Chinese affluents believed the country would outpace the U.S. in the next decade, but now that number is up to 37 percent. China’s importance in the luxury business has been well known and as more HNWIs are created in China or migrate to China, its central place in the luxury world will grow.

“Global asset allocation is one of the biggest trends now for China’s high net worth individuals, led by real estate,” said Rupert Hoogewerf, Chairman and Chief Researcher of Hurun Report.

Rapid growth

It is no secret in the luxury world that China has swiftly become one of the most lucrative and important fields for upscale brands.

This can be attributed to the growth of HNWIs in the country over the past few years. A new report from Hurun Research shows that the HNWI population in China grew by an astonishing 64 percent last year.

Chinese HNWIs have begun throwing this newfound wealth around considerably, with Hurun reporting that 14 percent of HNWIs said that they will be increasing their overseas investments in the next three years.

Real estate outside of China is popular among wealthy Chinese. Image credit: Sotheby's

Additionally, enthusiasm for buying homes in other countries has increased by 25 percent in China, which should excite luxury retailers and realtors who have been waiting for the opportunity to capture revenue from wealth Chinese travelers, who are always looking for the latest luxury brands and experiences from around the world.

Some of the most desired brands in China right now are Louis Vuitton, Chanel, Cartier and Hermés. These brands all are among the top 10 most desired brands in China along with Apple, Rolex, Burberry and Dior.

Finally, one of the most intriguing trends reported by Hurun is now just how many wealthy people are in China, but how those people are actually paying for their goods.

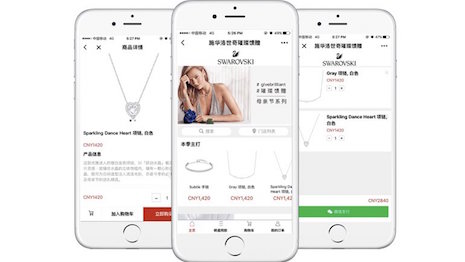

The report found that payment by cash or credit card has dropped 40 percent in the last year, while payment by WeChat or Alibaba’s Alipay has grown by 40 percent in turn. Chinese HNWIs now use mobile payment to pay for goods more than any other method.

Chinese opportunity

China’s spectacular growth in luxury consumption recently is primarily driven by Chinese women buying ready-to-wear fashion, jewelry and cosmetics, according to Bain & Company.

Per Bain’s "2017 China Luxury Market Study," China’s luxury consumption is outstanding and outpaces much of the world. In addition to the value of Chinese consumers traveling outside of Asia, Bain's report also notes that Chinese domestic spending has outpaced overseas purchases in the last year (see story).

Digital campaigns in China are juggernauts for driving brand sales due to the country’s technological advancements, which have resulted in it being the largest ecommerce market worldwide.

Real estate outside of China is popular among wealthy Chinese. Image credit: Sotheby's

Additionally, enthusiasm for buying homes in other countries has increased by 25 percent in China, which should excite luxury retailers and realtors who have been waiting for the opportunity to capture revenue from wealth Chinese travelers, who are always looking for the latest luxury brands and experiences from around the world.

Some of the most desired brands in China right now are Louis Vuitton, Chanel, Cartier and Hermés. These brands all are among the top 10 most desired brands in China along with Apple, Rolex, Burberry and Dior.

Finally, one of the most intriguing trends reported by Hurun is now just how many wealthy people are in China, but how those people are actually paying for their goods.

The report found that payment by cash or credit card has dropped 40 percent in the last year, while payment by WeChat or Alibaba’s Alipay has grown by 40 percent in turn. Chinese HNWIs now use mobile payment to pay for goods more than any other method.

Chinese opportunity

China’s spectacular growth in luxury consumption recently is primarily driven by Chinese women buying ready-to-wear fashion, jewelry and cosmetics, according to Bain & Company.

Per Bain’s "2017 China Luxury Market Study," China’s luxury consumption is outstanding and outpaces much of the world. In addition to the value of Chinese consumers traveling outside of Asia, Bain's report also notes that Chinese domestic spending has outpaced overseas purchases in the last year (see story).

Digital campaigns in China are juggernauts for driving brand sales due to the country’s technological advancements, which have resulted in it being the largest ecommerce market worldwide.

WeChat and Alipay have come to dominate Chinese commerce. Image credit: WeChat

In China, brands are able to create a two-way relationship with consumers as 62 percent communicate with brands through social media and by the year 2028, it is likely that 50 percent of all purchases will be made online, according to a report from Fashionbi. However, brand strategies there may be lacking variation, with many marketers using the same campaign tropes on social media (see story).

China’s rapid growth has seen brands from Gucci to Prada to Burberry all flocking to China’s mainland in an attempt to cash in on the steadily growing appetite for luxury goods there.

WeChat and Alipay have come to dominate Chinese commerce. Image credit: WeChat

In China, brands are able to create a two-way relationship with consumers as 62 percent communicate with brands through social media and by the year 2028, it is likely that 50 percent of all purchases will be made online, according to a report from Fashionbi. However, brand strategies there may be lacking variation, with many marketers using the same campaign tropes on social media (see story).

China’s rapid growth has seen brands from Gucci to Prada to Burberry all flocking to China’s mainland in an attempt to cash in on the steadily growing appetite for luxury goods there.