Wealthy investors think that now is an excellent time to start a business. Image credit: UBS

Wealthy investors think that now is an excellent time to start a business. Image credit: UBS

The majority of wealthy investors in the United States feel that the climate is ripe for opportunity and would be willing to invest in new businesses, according to a report from UBS. Due to key political considerations in the U.S., including a recent tax law that reduced tax burdens for the wealthy, 73 percent of wealthy investors believe that now is a good time to invest in new businesses. For luxury brands, a healthy and confident wealthy class is key to the business’ success.

“Small businesses are experiencing an important shift,” said Paula Polito, client strategy officer of UBS Global Wealth Management, New York. “Most owners are choosing to sell instead of passing businesses to the next generation to fill their shoes.”

Brighter futures The GOP tax reform law that was passed in December of last year has already had a noticeable impact on the luxury business. By allowing the wealthiest Americans to keep more of their wealth, while putting a heavier burden on poor people, luxury’s primary customer bloc was given even more purchasing power. This has translated into an increased confidence among this class in a number of other areas. According to UBS, 72 percent of the country’s wealthiest citizens feel confident in the future of the economy for themselves. The political climate has made business ownership enticing for wealthy investors. Image credit: UBS

Fifty-eight percent of wealthy investors are considering starting a business in the near future, and 73 percent think the conditions are favorable for business ownership right now.

The difference comes from millennials, who are much more reluctant to start businesses due to their average lower amount of wealth than older generations and the recent memory of the 2008 financial crisis.

Seventy-seven percent of millennials believe that starting a business at the moment is too risky, compared to 55 percent of Generation X and 43 percent of boomers.

Favorable conditions

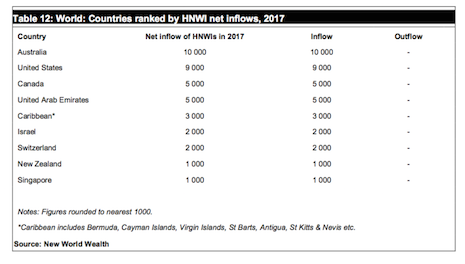

The current political climate in the U.S. is highly favorable to the wealthy class. The United Kingdom has traditionally been one of the most desirable destinations for the world’s wealthiest people, but in 2017 the country experienced a larger outflow of high-net-worth individuals than inflow for the first time as more wealthy citizens left for the U.S.

This data comes from New World Wealth’s annual "Global Wealth Migration Review" which tracked the movements of highly wealthy individuals around the globe in 2017. In contradiction to previous years of growth, more of the world’s wealthy are leaving the U.K. for other destinations around the world (see story).

The political climate has made business ownership enticing for wealthy investors. Image credit: UBS

Fifty-eight percent of wealthy investors are considering starting a business in the near future, and 73 percent think the conditions are favorable for business ownership right now.

The difference comes from millennials, who are much more reluctant to start businesses due to their average lower amount of wealth than older generations and the recent memory of the 2008 financial crisis.

Seventy-seven percent of millennials believe that starting a business at the moment is too risky, compared to 55 percent of Generation X and 43 percent of boomers.

Favorable conditions

The current political climate in the U.S. is highly favorable to the wealthy class. The United Kingdom has traditionally been one of the most desirable destinations for the world’s wealthiest people, but in 2017 the country experienced a larger outflow of high-net-worth individuals than inflow for the first time as more wealthy citizens left for the U.S.

This data comes from New World Wealth’s annual "Global Wealth Migration Review" which tracked the movements of highly wealthy individuals around the globe in 2017. In contradiction to previous years of growth, more of the world’s wealthy are leaving the U.K. for other destinations around the world (see story).

Countries ranked by inflow of HNWIs. Image credit: New World Wealth

But luxury brands need to understand how these new immigrants are valuing their assets. Despite the significant time and money wealthy individuals put into collecting art or automobiles, a new report from UBS finds that wealthy individuals typically do not prioritize the value of these assets.

For the quarter of well-off consumers who consider themselves collectors, passion tops the list of reasons why they choose to build collections, with profit a consideration for only 13 percent. While the average collector estimates their collection to be worth about one-tenth of their total assets, about half of these individuals have not had their collections appraised (see story).

Additionally, many luxury brands and financial service providers are overlooking a major section of the country’s affluents: women.

Female consumers control around 30 percent of the world’s wealth, and yet many financial services companies do little to focus specifically on their women clientele.

Speaking at the Women in Luxury conference Sept. 26, an executive from UBS spoke about the ways in which women are a valuable client segment in the financial services industry, and yet continue to be underserved in terms of their specific needs and desires. These wealthy women can be powerful investors if companies take the time to learn what kinds of investments they want to make (see story).

Under these favorable political conditions, the country’s wealthiest citizens are feeling more confident than ever. Smart luxury brands and retailers will be able to turn that confidence into increased sales if leveraged correctly.

Countries ranked by inflow of HNWIs. Image credit: New World Wealth

But luxury brands need to understand how these new immigrants are valuing their assets. Despite the significant time and money wealthy individuals put into collecting art or automobiles, a new report from UBS finds that wealthy individuals typically do not prioritize the value of these assets.

For the quarter of well-off consumers who consider themselves collectors, passion tops the list of reasons why they choose to build collections, with profit a consideration for only 13 percent. While the average collector estimates their collection to be worth about one-tenth of their total assets, about half of these individuals have not had their collections appraised (see story).

Additionally, many luxury brands and financial service providers are overlooking a major section of the country’s affluents: women.

Female consumers control around 30 percent of the world’s wealth, and yet many financial services companies do little to focus specifically on their women clientele.

Speaking at the Women in Luxury conference Sept. 26, an executive from UBS spoke about the ways in which women are a valuable client segment in the financial services industry, and yet continue to be underserved in terms of their specific needs and desires. These wealthy women can be powerful investors if companies take the time to learn what kinds of investments they want to make (see story).

Under these favorable political conditions, the country’s wealthiest citizens are feeling more confident than ever. Smart luxury brands and retailers will be able to turn that confidence into increased sales if leveraged correctly.