Facebook's scandals are unlikely to make too much of a difference to its legion of advertisers. Image credit: Facebook

Facebook's scandals are unlikely to make too much of a difference to its legion of advertisers. Image credit: Facebook

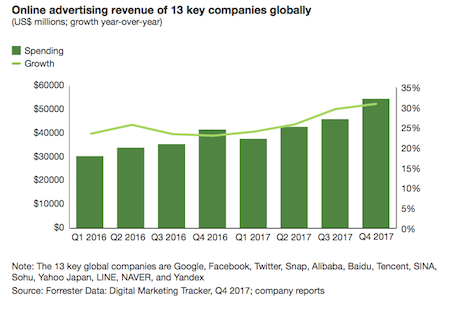

Despite its troubles, Facebook was still far and away the most popular platform for digital advertising this past year, according to a report from Forrester Research. The report found that Facebook and Alibaba together were jointly responsible for 48 percent of the year-over-year ad spend growth throughout the world. Facebook’s overall share of global advertising also has grown significantly since 2015, making it an even more dominant presence for brands of all sizes.

"Facebook saw price-per-ad growth accelerate to 43 percent year-over-year in Q4 2017, up from 35 percent in Q3 2017," said Brandon Verblow, analyst at Forrester, New York. "Because ad supply on Facebook is constrained by lower average time spent and slower growth in ad load, marketers are clearly willing to pay higher prices to place their ads on the network."

Global advertising figures. Image credit: Forrester

Facebook even beat out its own sister company Instagram in terms of ad dollars spent. While Instagram is increasingly a popular choice for advertisers due to its young and engaged audience, most businesses still turn to Facebook for the majority of their advertising.

The Cambridge Analytica scandal, in which the political data firm illegally gained access to more than 50 million users’ personal information, has made Facebook so vigilant about protecting its users’ information that it is cracking down on which third parties can access data.

According to TechCrunch, a number of third-party applications were suddenly made incompatible with Instagram this week after the Facebook-owned company abruptly changed access to its API. This came just a few days after Facebook revoked its Partner Categories feature, which allowed brands and advertisers to target relevant users through Facebook and Instagram (see story).

Even in spite of Facebook’s issues with the Cambridge Analytica scandal, its prevalence in digital advertising is unlikely to change.

Forrester analyst Jessica Liu says that marketers will not make a mass exodus from Facebook over the scandal. Since Facebook has such a large role in so many brands' marketing budgets, it would severely upset many strategies to cut Facebook out entirely.

Potential problems

While advertisers might stick around for Facebook, publishers may have a different attitude.

For publishers, the problems with Facebook began long before the Cambridge Analytica scandal. Even as Facebook's user base has remained large, overall traffic and site use time is down.

One of the major complaints of publishers is that Facebook frequently introduces a new feature or concept, making sweeping promises to media brands about the potential revenue and traffic gains from using it, only to abandon the feature soon after. This was the case with Facebook Live, for which Facebook paid publishers to create content for before abruptly cutting off funding (see story).

Global advertising figures. Image credit: Forrester

Facebook even beat out its own sister company Instagram in terms of ad dollars spent. While Instagram is increasingly a popular choice for advertisers due to its young and engaged audience, most businesses still turn to Facebook for the majority of their advertising.

The Cambridge Analytica scandal, in which the political data firm illegally gained access to more than 50 million users’ personal information, has made Facebook so vigilant about protecting its users’ information that it is cracking down on which third parties can access data.

According to TechCrunch, a number of third-party applications were suddenly made incompatible with Instagram this week after the Facebook-owned company abruptly changed access to its API. This came just a few days after Facebook revoked its Partner Categories feature, which allowed brands and advertisers to target relevant users through Facebook and Instagram (see story).

Even in spite of Facebook’s issues with the Cambridge Analytica scandal, its prevalence in digital advertising is unlikely to change.

Forrester analyst Jessica Liu says that marketers will not make a mass exodus from Facebook over the scandal. Since Facebook has such a large role in so many brands' marketing budgets, it would severely upset many strategies to cut Facebook out entirely.

Potential problems

While advertisers might stick around for Facebook, publishers may have a different attitude.

For publishers, the problems with Facebook began long before the Cambridge Analytica scandal. Even as Facebook's user base has remained large, overall traffic and site use time is down.

One of the major complaints of publishers is that Facebook frequently introduces a new feature or concept, making sweeping promises to media brands about the potential revenue and traffic gains from using it, only to abandon the feature soon after. This was the case with Facebook Live, for which Facebook paid publishers to create content for before abruptly cutting off funding (see story).

Facebook's data rules have become stricter. Image credit: Facebook

In yet another move sure to send Facebook’s many brand and publishing partners into a panic, the social media behemoth announced earlier this year that it will no longer prioritize branded posts and publisher content in favor of users’ friends and families.

After a series of shakeups have left brand partners of Facebook feeling hung out to dry, the latest move seems the most difficult. While Facebook has admittedly had a problem with overloading users with ads, branded content and publisher media, the effect on brands’ relationships with the social media platform will certainly be affected (see story).

Facebook's data rules have become stricter. Image credit: Facebook

In yet another move sure to send Facebook’s many brand and publishing partners into a panic, the social media behemoth announced earlier this year that it will no longer prioritize branded posts and publisher content in favor of users’ friends and families.

After a series of shakeups have left brand partners of Facebook feeling hung out to dry, the latest move seems the most difficult. While Facebook has admittedly had a problem with overloading users with ads, branded content and publisher media, the effect on brands’ relationships with the social media platform will certainly be affected (see story).