Classic cars took a hit as luxury investments over the last 12 months. Image credit: Knight Frank

Classic cars took a hit as luxury investments over the last 12 months. Image credit: Knight Frank

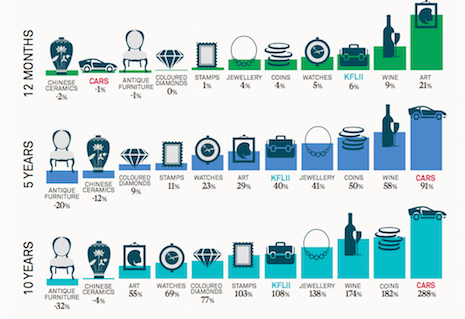

According to a new report from Knight Frank, automotive assets have taken a hit as an area for luxury investment as other categories surge ahead of classic cars. Vintage vehicles' return on investment was down 1 percent in the last year, while art has grown by 21 percent. This research shows that brands need to reevaluate traditional understandings of what affluent individuals invest their wealth into.

“Prices for works by Impressionists and post-war artists have dominated auction sales for the past two decades," said Sebastian Duthy of art market research at Knight Frank, London. "But this picture has been changing, with works by some contemporary artists appreciating rapidly in the last few years.

Changing trends The fine art market has seen some impressive milestones over the last year.

Most notably, Salvator Mundi, a rediscovered painting by Leonardo da Vinci, was sold at the highest price ever for a painting (see story). But other paintings and works by lesser-known artists also made huge sales. Sales of fine art both big and small have helped propel the category to the top of the luxury investment index put out by Knight Frank. With a 21 percent annual increase growth, art has catapulted from near the bottom of the index last year to the number one spot. The current rankings. Image credit: Knight Frank

At the same time, fine wines have also dramatically increased their prominence as an area of investment for wealthy consumers.

There was a 9 percent growth in performance for fine wine since last year, although Knight Frank notes that different sectors within that category are moving at different speeds.

Meanwhile, classic cars have taken a hit, dropping much further down the index behind jewelry and watches, among others. Knight Frank attributes this to the departure of many of the speculative investors that have helped make cars a strong area of investment in past years.

This is surprising given the fact that classic cars performance had grown by 91 percent over the past five years, only to sink all the way down to negative 1 percent in the last year.

Today's affluents

In addition to art and wine taking over the top spots, younger investors are also increasingly looking towards investments that benefit society and the planet.

Young high-net-worth individuals differ from their older counterparts in key ways, from a greater emphasis on international holdings to placing less of an importance on financial education.

According to a new study from OppenheimerFunds, 50 percent of young investors hold international investments while older investors are far more biased towards their home countries, with only 38 percent having international investments. This data corresponds to the larger divide between the two generations, which the new study examines (see story).

The current rankings. Image credit: Knight Frank

At the same time, fine wines have also dramatically increased their prominence as an area of investment for wealthy consumers.

There was a 9 percent growth in performance for fine wine since last year, although Knight Frank notes that different sectors within that category are moving at different speeds.

Meanwhile, classic cars have taken a hit, dropping much further down the index behind jewelry and watches, among others. Knight Frank attributes this to the departure of many of the speculative investors that have helped make cars a strong area of investment in past years.

This is surprising given the fact that classic cars performance had grown by 91 percent over the past five years, only to sink all the way down to negative 1 percent in the last year.

Today's affluents

In addition to art and wine taking over the top spots, younger investors are also increasingly looking towards investments that benefit society and the planet.

Young high-net-worth individuals differ from their older counterparts in key ways, from a greater emphasis on international holdings to placing less of an importance on financial education.

According to a new study from OppenheimerFunds, 50 percent of young investors hold international investments while older investors are far more biased towards their home countries, with only 38 percent having international investments. This data corresponds to the larger divide between the two generations, which the new study examines (see story).

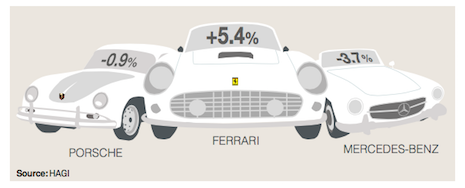

Some car brands did better than others. Image credit: Knight Frank

This is a time of prosperity for luxury investments as high-net-worth investors have more wealth than ever.

Reflective of an improving global economy, the wealth held by high-net-worth individuals grew 10.6 percent this past year, according to data from Capgemini.

The consulting firm’s World Wealth Report 2018 found that the population of wealthy consumers and their collective wealth both rose for the sixth consecutive year. Since the last edition of the report, 1.6 million more individuals gained high-net-worth status, led by wealth creation in Asia and North America (see story).

Knight Frank’s report shows that the whims of the ultra wealthy are easily changed, but by closely monitoring the trends, luxury brands can adjust their strategies accordingly.

Some car brands did better than others. Image credit: Knight Frank

This is a time of prosperity for luxury investments as high-net-worth investors have more wealth than ever.

Reflective of an improving global economy, the wealth held by high-net-worth individuals grew 10.6 percent this past year, according to data from Capgemini.

The consulting firm’s World Wealth Report 2018 found that the population of wealthy consumers and their collective wealth both rose for the sixth consecutive year. Since the last edition of the report, 1.6 million more individuals gained high-net-worth status, led by wealth creation in Asia and North America (see story).

Knight Frank’s report shows that the whims of the ultra wealthy are easily changed, but by closely monitoring the trends, luxury brands can adjust their strategies accordingly.

"In March, artist Mark Bradford hit the headlines when his painting 'Helter Skelter I' was sold by ex-tennis star John McEnroe for a record $10.4m at Phillips in London," Mr. Duthy said. "In May, rapper Sean Combs, aka P Diddy, paid $21.1m at Sotheby’s for a painting by artist Kerry James Marshall.

"The figure represents an 800-fold increase on the $25,000 paid for the same work in 1997.”