Rachel Newton is vice president at SessionM

Rachel Newton is vice president at SessionM

Each year as the holiday season ramps up, retailers plan for the busiest and most competitive time of the year.

We often think of this competition in terms of how to gain attention from new customers, but in fact there is much more to be gained from shifting focus to existing customers.

According to recently compiled data, acquiring a new customer is five times more expensive than retaining an existing customer. Yet, 44 percent of companies admit they "have a greater focus" on acquisition, while a mere 18 percent focus on retention. The remaining 38 percent claim to be split down the middle.

While the idea of customer retention is not new, how we think about it in today’s era of Big Data and AI-driven personalization is vital.

Retailers need to find ways of achieving two goals: (1) ensuring customers continue to shop with them instead of choosing the competition, and (2) motivating the customer to come back if they have not made a recent purchase.

Boiled down further, these goals map back to two critical metrics respectively: risk of churn and customer lifetime value (LTV).

Risk of churn

When working to assess the likelihood of a customer jumping ship from your store to shop at another, several factors are at play.

The equations are different from retailer to retailer, but most include the key ingredient of historical purchase data.

Risk of churn is calculated as a percentile, and the higher the score the more likely a customer will churn.

With advanced loyalty solutions today, retailers can leverage this percentile to engage differently with customers who show the highest and lowest risk of churn.

For those at high risk, perhaps you target them with a special 25 percent off on a product they love to get them back into the store.

For those at low risk, how about 10 percent off their favorite item based on past purchases as a thank-you for their loyalty?

At either end of the spectrum, leading the customer down a personalized journey with relevant information and offers delivered over time can keep your retail brand top-of-mind, while ensuring that customers are properly motivated to purchase with you rather than going with the competition.

There is an abundance of generic, one-size-fits-all loyalty programs, which can cause customers to tune out. But if offers are targeted to customers, especially if they factor in that individual’s risk of churn, it could help convert them back into regular purchasing customers – both during and after the holiday season.

Marketers can target an entire segment of customers who are considered at risk of churn for the most efficient outreach, while tailoring the message to the individual in order to cut through the noise.

Customer lifetime value

Customer LTV typically is calculated by subtracting purchase frequency rate from the customer’s average purchase value, and then multiplying it by the customer lifespan. This can be a good customer engagement indicator.

If a customer has a high lifetime value, then she has purchased frequently and most likely has spent a lot of money with you.

Ensuring those customers with the highest LTV do not choose to go with the competition is important, so a strategy of surprise-and-delight is often in order during the holidays.

Exclusive benefits and content for your most loyal customers will keep them engaged throughout the season despite noise from the competition. And what is more, they will remember your generosity as they continue making purchases throughout the year.

In addition to retaining your most loyal customers, creating a segment based on customer LTV allows marketers to analyze the attributes which make up their most valuable customers. Are they mostly in a specific region? Are they a specific age?

Knowing this can help marketers better determine which types of offers to promote, where, and when.

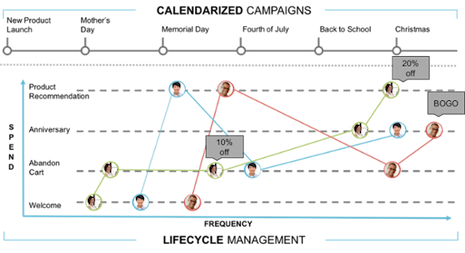

Lifecycle management. Image credit: SessionM

Lifecycle management. Image credit: SessionM

Taking action

Arming the marketing team with risk of churn and customer LTV stats is the first step.

Taking action based on those numbers is where holiday retail battles are truly won and lost.

Tools such as a customer data platform (CDP) and loyalty solutions enable retailers to unify customer data collected from disparate sources, then create targeted segments to customers based on previous activity or behavior.

Marketers can leverage calculated metrics applied on each customer profile, such as risk of churn or customer lifetime value to create targeted segments to increase sales and traffic.

A recent Gartner report describes how customers are overwhelmed with the number and diversity of loyalty programs, resulting in poor participation, engagement and brand outcomes.

Customer retention has become more difficult as points, miles and coupons become commodities.

IN THIS ENVIRONMENT, marketers must understand that loyalty is no longer about the programs themselves, but the actions that retailers take each day to show the customer that they understand and care.

Knowing the metrics that matter most to a business and how those metrics can fuel actions to grow loyalty over time is the best way to win the holiday season.

Rachel Newton is vice president at SessionM, Boston. Reach her at [email protected].