Ulta has a well-rounded retail strategy, attracting shoppers online and on mobile, as well as in-store, where it delivers the beauty experience. Image credit: Ulta

Ulta has a well-rounded retail strategy, attracting shoppers online and on mobile, as well as in-store, where it delivers the beauty experience. Image credit: Ulta

Both Ulta and Sephora are exceptional retailers. Roughly equivalent in footprint—1,174 Ulta stores and about 1,100 freestanding Sephora stores and J.C. Penney shop-in-shops—both retailers did extremely well last year.

Ulta Beauty just announced sales were up 14.1 percent in 2018, reaching $6.7 billion. And while LVMH does not break out Sephora from within its Selective Retailing group, it highlighted Sephora’s sales growth as contributing to its 10 percent corporate growth in 2018.

Then there is Amazon.

EMarketer estimates Amazon reached $16 billion in total health, personal care and beauty product sales, a 37.9 percent increase over 2017. Though only a subset of that total compares with Ulta and Sephora’s range, it is notable that health, personal care and beauty products is Amazon’s third fastest-growing category after food and beverage and apparel and accessories.

The beauty business is an extremely active one in terms of frequency of purchase, with some 70 percent of consumers making monthly purchases, according to Cowen’s Consumer Tracker. And in beauty retail, Ulta, Sephora and Amazon are the major players.

One chart explains it all

With all the numbers and accompanying analysis floating around, sometimes the answer to what is really happening in the fiercely competitive beauty retail business boils down to one chart.

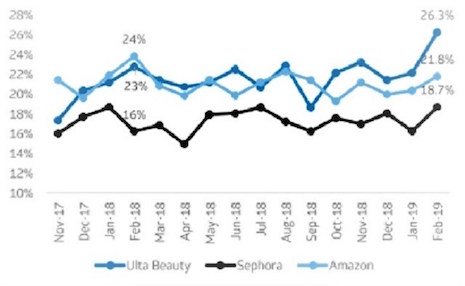

This is it: The survey question, “When shopping for beauty products (e.g. cosmetics, skincare, fragrance, hair products), I prefer to shop at: ... ”

Ulta has been moving ahead of both Amazon and Sephora as consumers’ first choice in beauty. Source: Cowen’s monthly Consumer Tracker, which surveys nearly 1,300 consumers

Ulta has been moving ahead of both Amazon and Sephora as consumers’ first choice in beauty. Source: Cowen’s monthly Consumer Tracker, which surveys nearly 1,300 consumers

Since October 2018, Ulta has been moving ahead of both Amazon and Sephora as consumers’ first choice in beauty. This is based upon Cowen’s monthly Consumer Tracker, which surveys nearly 1,300 consumers.

As much as exclusive products, such as Kylie Cosmetics and Morphe at Ulta and Fenty Beauty at Sephora, are credited with each beauty retailers’ boost in sales—and Amazon is Amazon—I think the main reason Ulta is breaking from the pack is not so much what it sells, but how it sells.

Ulta offers a breadth of assortment covering the widest range of customer needs at all price points, a personalized approach for customers in how they want to be served from full-service to self-service, and a newly expanded rewards and credit card program that actually builds loyalty, some 31.8 million strong.

Further, Ulta has a more integrated mobile application that supports customers in the many ways they want to shop.

For example, SimilarWeb reports that 60 percent of Ulta visitors in 2018 came via its mobile app, as compared with 48 percent of Sephora’s.

As strong as Ulta’s ecommerce business is – it accounted for 11 percent of sales in 2018 and grew 25.1 percent in the fourth quarter on top of 50.4 percent in the fourth quarter of 2017 – online sales growth in 2018 did not meet expectations.

But that was largely due to a channel shift, specifically “our guest’s avid interest in coming to the store,” said CEO Mary Dillon in the most recent earnings call. This is a good thing for the future of the company.

The physical store is where Ulta’s magic happens and where shoppers’ emotional connection with the brand is built and reinforced in each visit.

Unlike the Sephora store, which leans toward prestige lines that can be a bit off-putting to the everyday shopper, Ulta stores have an open feeling and more down-home friendliness delivered by the sales associate. Ulta stores are simply more accessible.

Best of Ulta happens in the store

The physical store is where Ulta can learn the most about the customer, her wants and needs, and so is able to cater to her during each visit – or him – as more men are finding it a comfortable place to shop for themselves.

Ulta also bridges the generation gap better than Sephora.

While Ulta is particularly strong among the under-34 set, as is Sephora, Ulta attracts a wider age range of customers.

In terms of its online traffic, 32 percent of Ulta visitors are 45 years and older, as compared with 25 percent for Sephora, according to SimilarWeb.

Because Ulta draws a wider spectrum of guests, it is able to execute its “mass migration” strategy, where sales associates introduce shoppers brought in to purchase mass brands to more prestige brands.

“It’s a unique aspect of the Ulta Beauty experience,” said Scott Settersten, Ulta treasurer and chief financial officer on the earnings call. “That behavior is quite strong.”

As much as Ulta is working to personalize its ecommerce experience through product and co-product recommendations, replenishment reminders and even customizing the guests’ home page depending on whether they are a first-time visitor or their history from previous visits, the ultimate personalized shopping experience is still delivered in-store person-to-person.

“We’re all really focused on what our guests are looking for at the end of the day, and if we can make sure to offer that to them, I think we’re going to continue to be in a good place,” Ms. Dillon said on the earnings call.

Among the things Ulta’s guests want is a personal experience with the many digitally native brands that are showcased in the store.

In addition to Kylie and Morphe, Ulta satisfies its guests’ digitally-fed curiosity with brands such as Morphe x James Charles Palette, Revolution Beauty, Lime Crime, Ofra and Sugarpill.

“‘New’ continues to drive traffic and share gains across all categories,” Ms. Dillon said, adding that new programs from Tarte, Urban Decay, Smith & Cult, GrandeLASH – an exclusive fragrance from Ariana Grande – and a new line of cannabis-infused skincare Cannuka, as well as the expansion of Kiehl’s to all stores will attract more guests.

IT ALL COMES down to which beauty retailer understands its customers better.

On that score, Ulta is way ahead in the United States market and its advantage is only likely to grow in the future. That is because Ulta’s strategy is to draw customers into the actual store to touch, see and try its “possibilities are beautiful” brand experience.

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, and a luxury marketing expert. Reach her at [email protected].