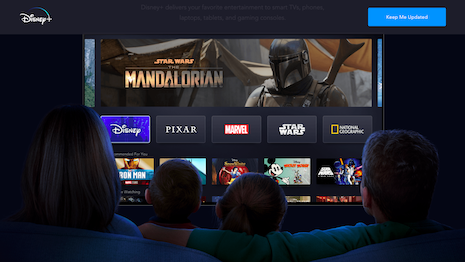

A plus point for Disney. Image credit: Disney+

A plus point for Disney. Image credit: Disney+

By Michael Avon

It has never been a more uncertain – and exciting – time to be in the digital video business.

Just as streaming upended traditional television over the past several years, the streaming industry is now undergoing a seismic change of its own, with new entrants making the market more fractured and consumers’ viewing habits becoming increasingly fickle and difficult to accommodate.

After a decade of steady growth, the future of major streaming players such as Netflix and Hulu is suddenly in question, and the uncertainty has left experts pondering a litany of questions, such as:

- Will the up-and-comers be able to vie with the established players for market share, or will they fizzle out just as quickly as they came?

- Will ad-supported platforms generate the same viewership as subscription services?

- And just how many subscriptions are people willing to pay for, anyway?

It is impossible to answer these questions with any degree of certainty at the moment, but executives must understand the forces behind this unsteady time in our industry to navigate the landscape successfully.

Here are the four major trends that are changing the nature of the streaming industry:

Great unbundling of video

Streaming is part of what media wonks have called the great unbundling of media.

For decades, media came in convenient little bundles — a newspaper, a CD, a cable package —but digital media offers news and entertainment in discrete, bite-sized form. Today, consumers can scan the article, listen to the single, and stream Seinfeld reruns without having to buy the rest.

This unbundling has been especially true for the TV industry, with streaming eating away at cable TV revenues, and even more unbundling on the horizon. Comcast, Disney and Apple are all scheduled to release their own owned and operated streaming services, populated with their own IP, over the next several months.

Meanwhile, CBS has started producing shows exclusively for its streaming service, including Star Trek: Discovery, which reportedly costs $8 million per episode.

Netflix will lose its two most-streamed shows, The Office and Friends, to new streaming services from NBCUniversal and AT&T, respectively, over the next two years. This is all on top of the established players: Netflix, Hulu, HBO, Amazon Prime and even YouTube and Facebook, which have built up their own stables of premium original programming.

Streaming video is already a fractured landscape, but it stands to get even bigger and more diffuse in the near future.

Free lunch over for Netflix? Image credit: Netflix

Free lunch over for Netflix? Image credit: Netflix

Battle for retention

All this debundling has left industry experts wondering how many subscription services consumers can afford and if they will start canceling certain services due to cost concerns. After all, one of the major appeals of cord-cutting is it is cheaper than cable, but subscribing to seven different streaming platforms most definitely is not.

Already, we see signs consumers are being spread too thin.

Earlier this year, Netflix announced for the first time in company history, its number of U.S. subscribers had decreased. Research suggests this issue is not unique to Netflix, either.

Streaming services tend to have a higher churn rate than traditional TV, meaning they have a harder time retaining customers. This is in part because it is so much easier to cancel a streaming subscription than it is to get rid of your cable package, as anyone who’s attempted the latter can attest.

Streaming platforms have responded by investing heavily in original programming, hoping to retain customers, but again, research suggests consumers are more interested in individual shows than a comprehensive bundle.

Market intelligence firm Parks Associates reports 28 percent of consumers subscribe to a streaming service to check out a single title — which means they are likely to cancel once they finish it.

Great rebundling

In a further effort to prevent churn, some streaming services are defying the unbundling trend and finding novel ways to package their offerings with other services.

In January, smart-TV device maker Roku unveiled a bundled service, allowing customers to choose from 25 different “channels” — such as Showtime, Starz and Epix, to name just a few — and pay for them on a single, consolidated bill.

Disney’s streaming service, Disney+, will give customers access to Disney’s entire film and TV catalog, as well as ESPN+, the sports network’s streaming service, and Hulu for only $12.99 a month, the same cost as a Netflix subscription.

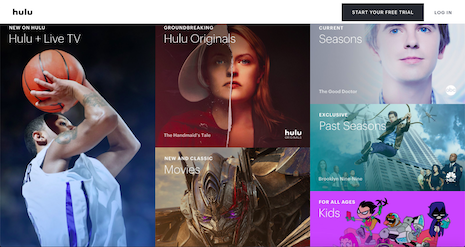

Also Hulu, in a separate, cross-channel bundling deal, now offers its ad-supported service to Spotify Premium subscribers.

No more slam dunk for Hulu. Image credit: Hulu

No more slam dunk for Hulu. Image credit: Hulu

It is more than a little ironic the bundling and unbundling trends are occurring simultaneously. But as streaming options proliferate, expect to see more of these kinds of deals forged to better meet consumers’ needs and pocketbooks.

Ad-supported TV making a comeback

While streaming has been a godsend to consumers — when it comes to streaming content, we have an abundance of riches — it has been tough for brand marketers.

Before streaming, TV was the most effective form of brand advertising available. The growth of ad-free subscription services – Netflix, HBO and Amazon Prime – have rendered TV less effective, causing marketers to look for creative ways to spread their messages.

This change has made commercials, including pre-roll and mid-roll digital ads, seem even more intrusive than before, which is why YouTube, Facebook and other platforms are moving away from interruptive pre- and mid-roll ads, in favor of more branded video.

Other streaming platforms such as Netflix and Amazon Prime have no direct advertising at all, leaving branded video as the only avenue for brands to access consumers through those subscription platforms.

There are numerous new and existing ad-supported, free-to-consumer streaming services in the market, as well, from premium ad-supported platforms such as PlutoTV – now owned by Viacom – to digital and social streaming services such as Cheddar, FreeThink and many others.

These services are betting that consumers can afford only so much subscription video, and will be willing to endure a few commercials and some targeted branded video content in exchange for free quality programming.

Big Data comes to content production

The advertising industry has long used data to identify audiences and serve them targeted, relevant advertising, but now that mindset is shifting to the content production side of the business.

With so many shows in the market, it is increasingly difficult for an individual show to cut through the noise and attract a substantial audience. Producers are trying to work smarter, using Big Data and analytics, to inform their production decisions.

Netflix is now reportedly advising TV writers when certain plot elements and events need to occur in a script to hold the viewer’s attention, based on its trove of user data.

THE FIRST ACT of the streaming video era is over. We are now moving into a much more complicated second act.

But despite all the uncertainty in the market, though, there is still a tremendous opportunity in streaming, and that opportunity will only get bigger as the market grows.

The companies that will be most successful in this volatile period will be the ones that invest in data and use it to inform their decision-making.

Michael Avon is founder/executive chairman of ICX Media

Michael Avon is founder/executive chairman of ICX Media

Michael Avon is founder/executive chairman of ICX Media, Washington. Reach him at [email protected].