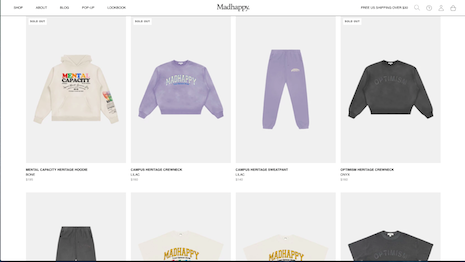

Really optimistic? Madhappy trades on a positive message, like the more mass-market-focused Life is Good. Image credit: Madhappy

Really optimistic? Madhappy trades on a positive message, like the more mass-market-focused Life is Good. Image credit: Madhappy

French conglomerate LVMH has a lock on the current luxury market. Its latest financial report testifies to that, with 16 percent revenue growth for the first nine months of 2019 to reach €38.4 billion in revenue. That comes on top of 10 percent year-over-year growth in 2018 on €46.8 billion in sales.

LVMH is the biggest and baddest player in the contemporary luxury market, with 75 brands, more than 4,590 stores and diversified holdings in wine and spirits, fashion and leather, perfumes and beauty, watches and jewelry, and selective retailing.

The Paris-based group knows what luxury consumers want, and year after year it is successful in delivering it to them. But like any other big company, there comes a time when it reaches its zenith and starts to plateau.

Venture far

Under the expert leadership of founder/CEO Bernard Arnault, LVMH has an insurance policy to make sure that does not happen. It is called LVMH Luxury Ventures. It is directed by Julie Bercovy, who was co-head of LVMH’s mergers and acquisition department for 12 years, following a two-year stint in mergers and acquisitions at Lazard Frères in Paris.

Ms. Bercovy is tasked to keep her ear to the ground, listening for up-and-coming brands that can lead LVMH to the luxury market’s future. Her future vision has led to the group’s latest investment in the hip and trendy Los Angeles-based Madhappy lifestyle brand.

When I first learned about Madhappy, it looked to me like what would happen if Life Is Good and Juicy Couture had a baby.

Popular on the street, Madhappy features sweatshirts, sweatpants and T-shirts all with happy, optimistic messages at heavily-inflated prices. “Who is going to pay upwards of $100 for a slouchy sweatshirt?” I asked.

But many others, including Ms. Bercovy, were not seeing what I was seeing.

MadHappy has tapped into the zeitgeist of the Gen Z and millennial up-and-comers. Fatigued by our increasingly contentious culture, its customers crave a positive message of hope.

Madhappy delivers it to them so that they can proclaim their optimism where all can see: in fashion statements that are comfortably unrestrictive and unfailingly positive.

Madhappy's casual, slouchy style is in line with what supposedly resonates with dressed-down millennials and Gen-Zers. Image credit: Madhappy

Madhappy's casual, slouchy style is in line with what supposedly resonates with dressed-down millennials and Gen-Zers. Image credit: Madhappy

As St. Joseph University marketing professor Michael Solomon said, “We buy what we are and we are what we buy.” Madhappy has nailed it.

While LVMH’s Ms. Bercovy did not respond to a request for comment, I suspect the company’s investment in Madhappy has less to do with the what – the brand’s fashions – than with its how, which is marketing, and why, which is its meaning and its messaging.

“The strong mission-driven angle of Madhappy and its optimism and inclusivity are nice strategic assets for LVMH to tap into to boost their own relevance,” says Martina Olbertova, founder/CEO of Meaning.Global.

“The future of marketing is value-driven,” she said. “It is all about creating an authentic meaning, being real and trustworthy to your audiences, and helping them develop new identities.”

Optimistic investment

Business of Fashion reported LVMH Luxury Ventures led a $1.8 million round of funding into Madhappy along with Tommy Hilfiger and the founders of Sweetgreen.

Based on LVMH Luxury Ventures’ stated investment criteria for companies with revenues between €3m and €30m, Madhappy’s sales reportedly fall below that at about $1 million in 2018.

Madhappy’s sales are generated online and through popup shops heavy on experiences focused on wellness and mental-health awareness.

To date, Forbes.com contributor Joseph DeAcetis reports it has not done any digital advertising, though it is very active in social media with nearly 50,000 Instagram followers.

But Madhappy meets LVMH’s other investment criteria as it looks for brands with “a strong identity, combining authenticity, innovation and desirability,” the Web site states. Further, it aims to “partner with visionary and talented entrepreneurs driven by a strong business acumen.”

In Madhappy’s four 20-something founders – Peiman Raf, his brother Noah Raf, Mason Spector and Joshua Sitt – it has found that happy combination.

Only Noah Raf comes from the world of fashion, having started a luxury men’s clothing line while still in his teens, then worked with fashion entrepreneur Ugo Mozie. Brother Peiman worked in banking. Mr. Spector comes from sports and Mr. Sitt has a joint bachelor’s degree in finance/psychology.

These young men took one mad idea – to create a community-based fashion brand with the mission to promote optimism – and figured out how to scale it though content-rich activations driven by their own and their customers’ passions, not by throwing money into advertising and marketing.

“Madhappy is more than clothing, it’s a lifestyle choice and it’s a community,” Noah Raf said. “We are equally eager to share our stories as we are to hear new ones.”

That community is called the “Local Optimist Group,” and the community is bound by the meaning stitched into the fashion.

“When people get dressed in the morning, the clothes they put on represent them,” Mr. Raf said. “How they feel and how they want to be seen by others.

“Wearing Madhappy really means more than just wearing clothes,” he said. “You are wearing something with meaning, with a message that brings people together and reminds us that we have way more in common than we do differences.”

Madhappy launch party

Young won

This new luxury message of inclusivity and optimism is what young people crave and LVMH needs to understand.

“Being on the lookout for new luxury startups and new value-driven brands with a distinctive voice that cater to young consumers is a smart strategy for a luxury house to adopt,” Ms. Olbertova said, crediting both Madhappy and LVMH as leaders in that elusive quality of meaning.

“Luxury brands are naturally value creators,” she said. “The meaning or essence of the brand is expressed in a network of symbolic associations that create value for the customer.

“Luxury brands are particularly sensitive to meaning, as their symbolic value far surpasses the functional aspects of the products.”

To chart a path to continued growth, LVMH has to get inside the heads and hearts of the future luxury customers on which its future depends.

“To culture-proof the new luxury strategies, brand managers must learn to see and manage brands as dynamic ecosystems of cultural meaning,” Ms. Olbertova said.

Madhappy will help LVHM gain access to the cultural meaning of new luxury being defined by the next generation of luxury customers.

“If LVMH can cater to this target audience of Gen Z and millennial customers, they can then develop their own products that are relevant to this audience,” Ms. Olbertova said.

“Then LVMH will have those relationships ready when these people grow up and start looking for more elevated forms of luxury,” she said. “It also makes sense as a long-term strategic move for the Arnault family because they are all about reinforcing their long-term vision in everything they do.”

As an investment, LVMH risks little but stands to gain much in its investment in Madhappy.

As only its fourth investment, Madhappy, like second-hand footwear platform Stadium Goods before it, are outliers in the luxury space.

Gabriella Hearst, which was funded at the beginning of this year, and Paris-beauty “emporium” L’Officine Universelle Buly, funded at the end of 2017, are much more mainstream.

With its aim to acquire 5 percent to 25 percent of shareholdings in funded companies, LVMH made a quick turn in Stadium Goods, having invested in February 2018 only to be acquired by Farfetch for $250 million in cash.

HOPEFULLY MADHAPPY will stick around longer to give time for its happy meaning-driven new luxury magic to rub off on the rest of the company.

“If you invest in brands that are already seen as relevant by their younger audiences, you can make sure that the brand is authentic,” Ms. Olbertova said.

“It’s a good investment for them to undertake as well to ensure the future relevance of the diversified LVMH portfolio caters to millennials and Gen Z,” she said.

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, cofounder of the American Marketing Group, and a luxury marketing expert. Reach her at [email protected].