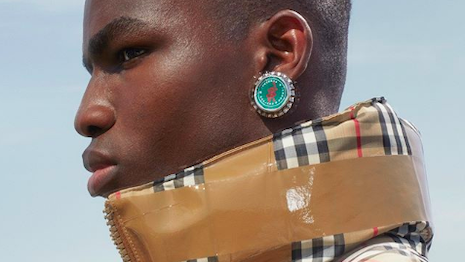

A 1990s Burberry look for the fall/winter 2019 collection. Image credit: Burberry

A 1990s Burberry look for the fall/winter 2019 collection. Image credit: Burberry

Burberry and luxury resale marketplace The RealReal recently announced a partnership as a step forward toward a more conscientious, environmentally sound future.

“Leading the way in creating a more circular economy for fashion is a key element of our Responsibility agenda,” Pam Batty, Burberry’s vice president of corporate responsibility, said in a statement.

“Through this new partnership we hope to not only champion a more circular future, but encourage consumers to consider all the options available to them when they are looking to refresh their wardrobes.”

Circles back

Burberry claims to have been at the “forefront of sustainability in fashion” for more than 15 years.

The RealReal has only been in the circular fashion business for eight years. But since its founding in 2011, The RealReal has made a really big impact on the luxury fashion market.

The RealReal reported total revenue of $270.3 million in 2018 on gross merchandise volume of $711 million. That is a rounding error for luxury giants such as LVMH ($53.5 billion in 2018), Richemont ($15.4 billion), Kering ($13.7 billion), or even Burberry ($3 billion).

However, The RealReal is the mouse that roared and is waking up the sleeping luxury giants.

The RealReal has figured out a way to reach aspirational luxury consumers who covet luxury brands, but may yet be unable to afford them in the primary market.

These aspirational customers are the future for luxury brands to drive first-time sales. The RealReal makes its money off the intrinsic value in luxury items that the brands have worked so long and hard to create.

Now Burberry realizes that The RealReal is a real player in the luxury market ecosystem.

Burberry will tap a previously ignored opportunity to reach into the lifetime value of its brand and build consumer demand in a new way beyond paid advertising.

The plan is to bring these aspirational customers in at a more affordable price through The RealReal and trade them up to being full-price customers who can feel confident paying premium prices because they already know that the primary market item they buy will retain some of its value over time.

Yes, Burberry and The RealReal are helping create a more sustainable circular fashion economy.

“I hope together we’ll be a part of pioneering a future in which circularity is a consideration for every luxury brand,” The RealReal CEO Julie Wainwright said in a statement.

But the real importance of the partnership is to nurture a virtuous circle for both brands of new customers and new consignors for The RealReal, as well as to boost first-time prices by shoring them up on the secondary market.

Burberry may be the first major brand to realize this but it will not be the last, though The RealReal has had a relationship with Stella McCartney since 2018.

“We are in constant conversations with a wide variety of brands who are looking at resale as a path to make their businesses more sustainable,” a spokesperson for The RealReal shared with me. “Brands are looking to us as there’s a heightened receptivity toward the environmental impact of resale and the circular economy.”

In the trenches

Key for The RealReal in this partnership is gaining greater access to one of its most in-demand luxury brands through consignments.

The RealReal reports demand for Burberry has increased 64 percent year over year, with millennial and Gen Z customer searches rising fastest on its site.

In addition, the ThredUp 2019 Resale Report states that Burberry is the luxury brand with the best resale value. Louis Vuitton, Gucci, Hermès and Prada are lower on that list.

Burberry owners who consign items to The RealReal will get an exclusive, white-glove personal shopping experience at select Burberry stores in the United States, which will include a British High Tea experience.

“This will directly drive our consignors to shop Burberry in the primary market,” The RealReal spokesperson said. “As people consign, it’s also freeing up space in their closets for new purchases.”

The RealReal’s experience with Stella McCartney proves the value of forging official partnerships with luxury brands.

The number of Stella McCartney consignors grew by 65 percent after their relationship was announced, and the number of items re-circulated through the resale platform increased by 74 percent.

However, Stella consignors to The RealReal were only rewarded with a $100 gift certificate to shop for more Stella McCartney fashions in the brand’s stores or online.

The Burberry relationship adds an experiential component that may have more meaning to Burberry owners.

Plus, the resulting face time Burberry will gain with existing customers in its boutiques can only benefit the brand and help grow its sales.

Real deal

Getting the choicest consignments is critical to the success of The RealReal’s business model.

Although it claims to have cumulatively paid nearly $1 billion in commissions to consignors on 9.4 million items sold, The RealReal has only scratched the surface of the available luxury resale market.

Boston Consulting Group and Altagamma’s latest True-Luxury Global Consumer Insight Survey, conducted among more than 12,000 respondents in 10 countries, found that only about one-third (34 percent) of luxury consumers have sold luxury items through resale platforms such as The RealReal. That leaves about two-thirds of the potential market of consignors as yet untapped.

While helping create a more sustainable fashion future is one reason they consign old fashions, it is hardly the most important one.

Some 44 percent of participants in the circular luxury market do so to clear out space in their closets, with another 21 percent interested in tapping the value of unwanted items to recirculate into the economy to buy new luxury items. Only 17 percent of those surveyed are driven by sustainability.

And The RealReal does not only hope to gain new consignors with Burberry.

The BCG-Altagamma survey also suggests that The RealReal could attract more consignor-customers.

Among the U.S. true luxury consumers surveyed, where 50 percent remain on the sidelines in the resale market, more than one-fifth (21 percent) both buy and sell on platforms such as The RealReal, whereas 11 percent only sell.

The RealReal does not reveal the number of its consignors, but it reports some 11.4 million members on its platform this year.

MY HAT IS off to Burberry and The RealReal in forging this landmark partnership.

While it is a good step toward a more sustainable fashion future, that is hardly what is most important about the news.

“This new partnership will help buyers and consignors join Burberry and The RealReal in making fashion more sustainable,” said Allison Sommer, The RealReal’s director of strategic initiatives.

But make no mistake, the emphasis in that statement is on getting more people to shop Burberry and join The RealReal.

Making fashion more sustainable is of secondary importance to both brands. After all, who has ever thrown a Burberry coat, scarf or handbag away?

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, cofounder of the American Marketing Group, and a luxury marketing expert. Reach her at [email protected].