Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

By Dianna Dilworth

Wine and spirits auction sales exceeded $118 million at Sotheby’s Wines, up 20 percent over 2018 and a record high, revealing a healthy appetite among affluent collectors.

The most expensive bottle of wine or spirit was The Macallan Fine & Rare 1926 60 Year Old, which sold for $1.9 million, according to Sotheby's Wine 2019 Market Report.

“It was remarkable to see so many iconic bottles break records – homage to the importance of distilleries such as Bowmore, Brora, Springbank and, of course, The Macallan,” said Jonny Fowle, deputy director of spirits specialist at Sotheby's, London, in the report.

“The electricity in the auction room was palpable,” he said. “There were cheers when the hammer fell on The Macallan Fine and Rare 1926, in what has to be one of the most exciting moments in the history of whisky sales.”

Sotheby’s first single-owner whisky auction earned $10 million, the highest total for any private whisky collection offered at auction. Image courtesy of Sotheby's

Sotheby’s first single-owner whisky auction earned $10 million, the highest total for any private whisky collection offered at auction. Image courtesy of Sotheby's

Record-breaking year

Burgundy and spirits gained wallet share, reaching new highs at 50 percent and 13 percent of sales, respectively.

The largest private wine collection from Transcendent Wines cost $30 million.

Sotheby's Wine was the leading worldwide in live auction and single-owner auctions.

"Single-owner collections attract greater attention from collectors who are willing to pay a premium for provenance and Sotheby’s held a number of important, high-profile single-owner sales this year," said Yassmin Dever, associate wine advisor for Sotheby’s Wine, New York.

In response to such a big year, Sotheby’s launched its own label collection in a move to continue its expansion into fine wine retail.

The average bottle price for spirits at auction was more than 12 times the value of the average bottle price for wine.

The Ultimate Whisky Collection, the most valuable private whisky collection, earned $10 million as Sotheby’s first dedicated spirits auction.

Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Fine wine

Domaine de la Romanée-Conti remains the world’ leading fine wine for the seventh year in a row, bringing in $27 million in sales more than the top 10 Bordeaux producers combined.

The vineyard represents 25 percent of all wine sales, 44 percent of all Burgundy wine sales and 22 percent of all wine and spirits sales.

Bordeaux represented only 26 percent of Sotheby’s total wine sales, down from 46 percent last year, due to a 36 percent decline in average bottle price, while volume remained flat.

Burgundy, on the other hand, represented 50 percent of wine sales in 2019, up from 42 percent in 2018.

The wine captured a larger share of wallet, driven by 12 percent appreciation in average bottle price and a 29 percent increase in volume.

Supply in Burgundy increased over the past two years as collectors capitalized on price appreciation.

“We anticipate Bordeaux reclaiming market share through increases in both price and volume over the next few years, as supply of Burgundy normalizes and appreciation for the price-to-quality of Bordeaux gathers momentum,” the report revealed.

"Bordeaux is undervalued and we expect appreciation for the price-to-quality of this category to gather momentum," Ms. Dever said. "We anticipate Bordeaux will reclaim market share through increases in both price and volume over the next few years."

Champagne represented 5 percent of wine sales, up from 2 percent in 2018.

The average bottle price was up 110 percent. Rhone reached 3 percent of wine sales, up from 1 percent, registering an average bottle price up 66 percent year-over-year.

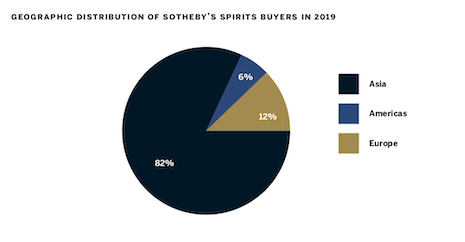

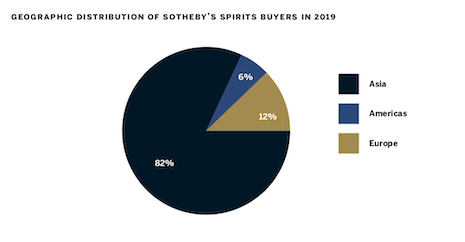

Asian consumers purchased the most spirits last year, according to Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Asian consumers purchased the most spirits last year, according to Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Who is buying

Asian buyers kept up their appetite for fine wine and spirits, dominating Sotheby’s global sales, and comprising 66 percent of sales in 2019, which is the highest share since 2013.

Demand from Asia is particularly significant for spirits. Eighty-two percent of spirits sales came from affluent Asian buyers as compared to 64 percent who purchased wine.

“Buyers from Hong Kong have historically made up over 50 percent of sales to Asian buyers,” read the report. “However, in 2019, clients from countries outside of Hong Kong have taken increasing market share, most notably Taiwan, Thailand and Singapore.”

Still, Hong Kong and the United States held the top 2 positions in Sotheby’s rankings, although their combined share of total sales decreased to 51 percent in 2019, down from 58 percent in 2018.

Meanwhile big spenders in London shelled out $28 million, the highest ever on the Sotheby’s rankings, up 60 percent over last year.

Top-selling whisky from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling whisky from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Sotheby’s first single-owner whisky auction earned $10 million, the highest total for any private whisky collection offered at auction. Image courtesy of Sotheby's

Sotheby’s first single-owner whisky auction earned $10 million, the highest total for any private whisky collection offered at auction. Image courtesy of Sotheby's Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling wines from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's Asian consumers purchased the most spirits last year, according to Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Asian consumers purchased the most spirits last year, according to Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's Top-selling whisky from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's

Top-selling whisky from Sotheby's Wine Market Report 2019. Image courtesy of Sotheby's