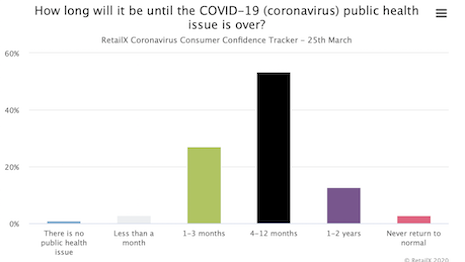

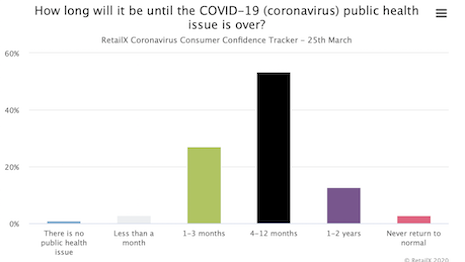

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

By Dianna Dilworth

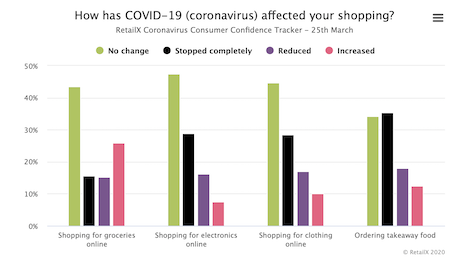

Twenty-four percent of shoppers have changed how they shop since the United Kingdom government began enacting coronavirus-related stay-at-home measures in the last two weeks, with most moving their purchases online in the new situation.

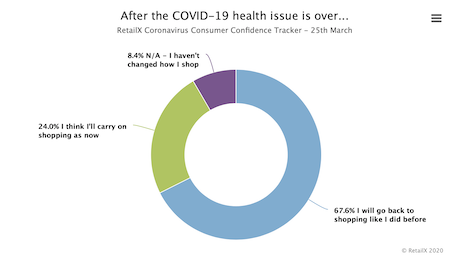

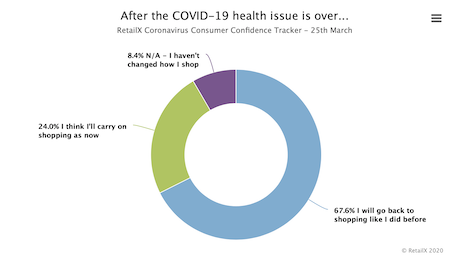

A quarter of shoppers said that they would retain this new behavior even after the crisis has abated, according to a new study from RetailX.

“The report shows an enormous change in consumer behavior following government requirements,” said Martin Shaw, head of research at RetailX, London. “We can expect to see the same or similar effects in jurisdictions that have not yet entered a lockdown, so in that respect it could be considered predictive.”

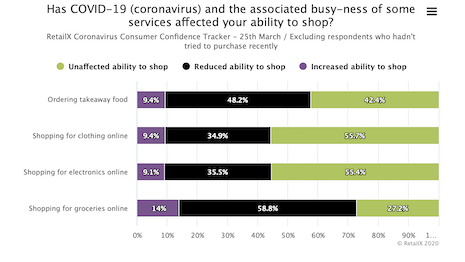

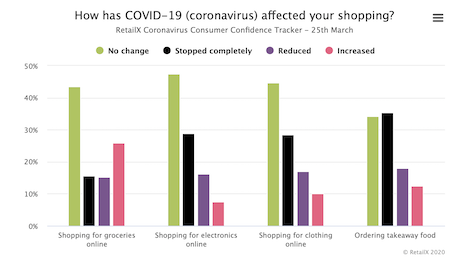

How COVID-19 has affected services when shopping online. Image courtesy of RetailX

How COVID-19 has affected services when shopping online. Image courtesy of RetailX

Ecommerce struggles to keep up

While retailers are turning to ecommerce to keep their businesses running, many are struggling to adapt their systems that are not designed to accommodate such volume of sales.

“Systems have responded admirably, but there isn't the capacity for most industries to swap to 100 percent online shopping in the space of a few weeks but otherwise carry on as normal,” Mr. Shaw said.

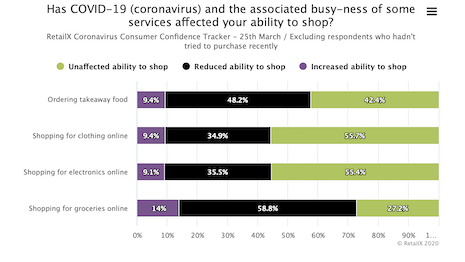

The research found that 59 percent of consumers who tried to buy groceries online were affected by busy-ness. Only 35 percent of consumers had this issue when shopping for clothes, which is likely because consumers have deferred clothing purchases.

In fact, some clothing businesses are reducing online capacity due to a drop in demand across all channels, the report found.

“These are trying times,” Mr. Shaw said. “It isn't simply a case of turning to online channels when stores close, as consumers in lockdown don't want as many new clothes.

“The industry faces a demand shock, though innovative brands may buck the trend in niche areas by finding ways to keep shoppers engaged,” he said.

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

Digital shows and pricing

Many brands are sending encouraging words to let customers know that stores are shutting to protect staff.

Additionally, messages have been encouraging consumers to keep shopping by introducing new spring season items, as well as discounted end-of-winter lines.

As fashion shows and photo shoots are cancelled, the industry is looking to online channels to see how it can tell its story from the homes of its creators and celebrity clients.

“It’s important to remember that fashion needs to be seen,” Mr. Shaw said. “It is a social construct. Online tends to be the fulfilment mechanism rather than the source of inspiration, and so it’s to be expected that sales will decline.

“Perhaps brands can use Tik Tok etc. in partnership with influencers to make fashion seen behind closed doors,” he said.

Inventory could become an issue as retailers may have over-bought for the summer.

“The upside will be that limited cash will limit the autumn-winter 20/spring-summer 21 depth of buy and therefore it is likely that more products will be sold at full price,” he said.

“This could reset the fashion sector from a period of peak wastefulness to a period of peak margin,” he said.

How consumers plan to shop after COVID-19. Image courtesy of RetailX

How consumers plan to shop after COVID-19. Image courtesy of RetailX

What is next?

While COVID-19 may have originated in China, it is in full swing in Europe and has only just begun in the United States, which now counts the most cases of the virus.

The majority of U.K. consumers expect the pandemic to keep them in lockdown for the next four to 12 months.

Even as luxury businesses are watching to see what outcome the coronavirus will have on consumption and on the global economy, many wonder when this pandemic will end and what the world will look like after it is over.

“The question that is yet to be answered is, what share of in-store sales are likely to move online as cities move into their next weeks or months in lockdown,” Mr. Shaw said.

“Products in the supply chain will dry out in time," he said. "The lack of new product, allied to depressed demand, will mean that online alone cannot sustain sales."

The RetailX report found that while 67.6 percent of consumers in the U.K. think they will go back to their post-COVID-19 shopping behavior, 24 percent say they have changed behavior as a result of the crisis and this new buying pattern will continue even after society returns to normal.

All shopping that is a function of disposable income will be affected by the sweeping impact of the global shutdown on personal wealth.

“This makes it more of a macroeconomic question and how much of a recession/depression we are headed into and how long it will depress salaries/employment figures for,” Mr. Shaw said.

“Priorities will have shifted during the downturn/isolation to home, entertainment, sustenance," he said. "Post-restriction, there will be a bounce for pubs, clothing, etc. However, this bounce will be tempered by the lack of disposable income.”

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

How COVID-19 has affected services when shopping online. Image courtesy of RetailX

How COVID-19 has affected services when shopping online. Image courtesy of RetailX How long consumers expect COVID-19 issues to last. Image courtesy of RetailX

How long consumers expect COVID-19 issues to last. Image courtesy of RetailX How consumers plan to shop after COVID-19. Image courtesy of RetailX

How consumers plan to shop after COVID-19. Image courtesy of RetailX