Giulia Prati is vice president of research for the U.S. at Opinium Research

Giulia Prati is vice president of research for the U.S. at Opinium Research

By Giulia Prati

As marketers, we get wrapped up in what we, the experts, believe, rather than what the public thinks, feels and does. We love to offer opinions about how brands and businesses should act, what they should say and why they should say it, especially during a crisis.

The past few weeks have been tumultuous for everyone. And while it is easy to voice our views, we also need to listen to the people we claim to be talking to and for whom we speak.

So we did.

Opinium surveyed a nationally representative sample of 2,006 U.S. adults ages 18-plus between March 20 and March 25. The survey was conducted online. Here is what we heard.

Do not let fear stop you from communicating with your audience

Many marketers have come out describing this time of crisis as a “tightrope” for brands: those who engage with the crisis risk being seen as disingenuous, and those that continue with commercial activity risk being perceived as tactless.

By this logic, it might appear that you are damned if you do or damned if you don’t.

So, should companies be scrapping their campaigns and going dark?

Not according to consumers, who are, after all, the targets of our efforts as communications experts and marketers.

When you actually ask consumers, brands have a lot more space to play than the tightrope analogy implies.

Consumers want and expect to hear from you right now.

In fact, across every industry surveyed, the vast majority of consumers either want to hear the same amount or more from brands and companies at this time.

Unsurprisingly the types of companies that consumers want to hear more from are those that provide the essentials: grocery stores, healthcare and pharma, household goods, food and drink.

But even brands that are less immediately relevant to the current crisis, such as fitness, automotive, fashion and beauty brands are not written off by the public, the majority of whom are perfectly happy to continue hearing the same or more from the brands that are willing to engage.

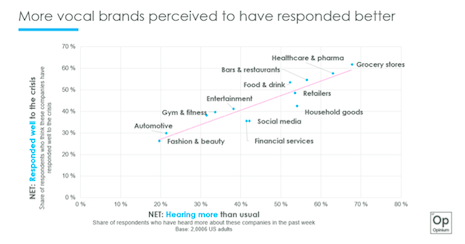

Despite the handwringing in some sectors, those that consumers have heard more about in the past week are perceived as handling the crisis better than those that have been less outspoken.

Across the board, the U.S. public has had a net positive perception of every sector’s responses to the COVID-19 coronavirus, meaning it is time for brands to get back in the saddle.

More vocal brands perceived to have responded better in COVID-19 crisis. Source: Opinium Research

More vocal brands perceived to have responded better in COVID-19 crisis. Source: Opinium Research

How to talk about COVID-19

Authenticity is still king

We may be entering an unprecedented time, but this old rule still applies.

With more than half (57 percent) of the U.S. population believing that brands are “jumping on the bandwagon” with their messaging around the coronavirus, it is clear that audiences are not convinced by the sincerity of brand communications.

Doubting the authenticity of brand messaging is nothing new, but as more people are stuck at home than ever before, consumers seek content that conveys the day-to-day experiences of employees implementing their company’s plan to deal with the coronavirus.

Yes, consumers are still interested in hearing from the CEO, but as we become more physically distant, we crave content that brings us closer to real people on the front lines.

It goes without saying that consumers do not want to hear from influencers or celebrity spokespeople right now.

Are we allowed to talk about anything else?

In short, yes, but what consumers want to hear from you and what tone is appropriate depends on your industry.

Here are a few human truths and trends revealed by the data to guide your content strategy.

- With the level of drastic change that has been thrust upon us, people miss “normal.” Nearly two thirds of Americans say they miss talking about things other than the coronavirus and 40 percent say they would prefer for brands and organizations to talk about something else, while only 16 percent explicitly disagree. A staggering 72 percent want to keep normality in their life, as 58 percent feel that their way of life has been heavily disrupted.

- The rise of escapism. More than one-third of U.S. respondents have begun actively avoiding the news in the last week, but the younger cohort is doing so most (41 percent of consumers ages 18-34). Nearly half (47 percent) are turning to entertainment to avoid what is going on in the world, again highest for those ages 18-34. And the vast majority (81 percent) say we could all use with a bit of good news – that is 97 percent for the over-65s.

- People have not stopped caring about other things. While 31 percent believe that tackling the coronavirus is the only thing that matters right now, a larger share disagree (41 percent) and over half (55 percent) think there are important things other than COVID-19 that are not being addressed. If relevant to your brand, consumers will welcome content on other important issues that are currently being sidelined.

Health warning: Though consumers are open to content beyond COVID-19, the degree to which brands can play into this depends on their proximity to the crisis.

Consumers expect to hear more practical, helpful content from companies that provide essential goods in this time of need.

If you are a grocery brand, or healthcare/pharma brand, consumers are more interested in business updates, advice on how to deal with the crisis, and new products and services that may be useful during this time.

Meanwhile, consumers are naturally more receptive to light-hearted content on how to entertain themselves and their families coming from companies that are less immediately implicated in the crisis, such as entertainment or fitness brands.

Where to reach them?

Stuck at home and seeking to escape this unpleasant reality, more than half of U.S. respondents report watching more live TV than usual, indicating an opportunity for brands to reach a wider audience during cheaper day-time slots that usually full-time workers would not see.

In the U.S., 37 percent say they would like to see TV advertising from brands, making it the preferred channel for consumers to hear from brands during these times, alongside email. Yes, good old email.

Despite viral social posts teasing brands about the onslaught of emails, the data suggests consumers are opening and interacting with emails during this time at higher rates than before.

The hierarchy of preferred channels differs most for consumers ages 18-34 who report wanting to hear from brands through owned social posts – not ads – above all other channels, with email a close second.

Giulia Prati is vice president of research for the U.S. at Opinium Research, New York. Reach her at [email protected].