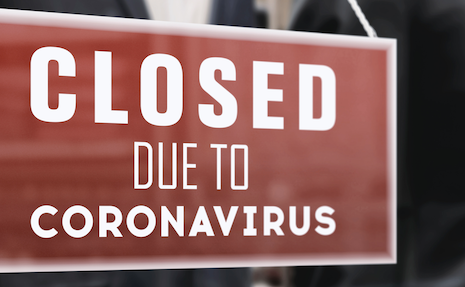

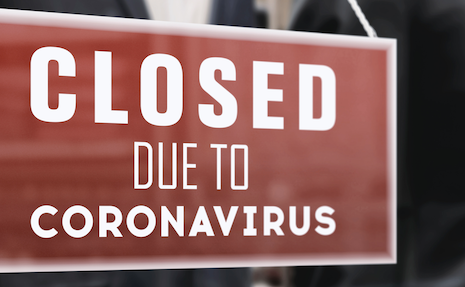

Supporting the critical supplier base is becoming essential. Image courtesy of McKinsey

By Dianna Dilworth

The COVID-19 pandemic has hit every end of the fashion spectrum and suppliers are the latest companies hurting from the virus-induced financial collapse.

One quarter of fashion suppliers are facing distress due to the coronavirus-related recession, and within six months half of suppliers will experience financial challenges, according to a new report from McKinsey called “Time for a change: How to use the crisis to make fashion sourcing more agile and sustainable.”

"The fashion industry has been deeply challenged even before the crisis," said Karl-Hendrink Magnus, senior partner and expert on sourcing and sustainability at McKinsey, Frankfurt, Germany. "Fewer and fewer super-winners where creating more than 100 percent of the value of the industry, while 56 percent of companies were value destroying, meaning they were not earning their cost of capital.

"We currently predict a negative growth of the fashion industry of between – 30 to -40 percent in 2020," he said. "This will accelerate the performance proliferation and lead to a shakeout and increased M&A activity for retailers and brands. Many suppliers on the other side are also facing financial distress likely leading to further consolidation."

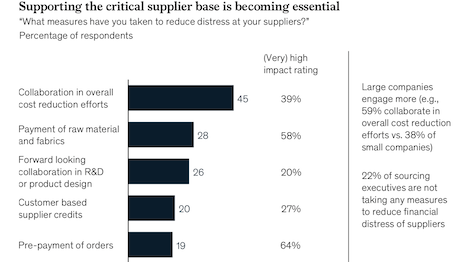

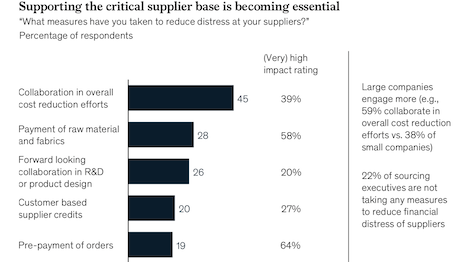

Supply disruptions and the drop in demand led to steep cuts of sourcing volumes. Image courtesy of McKinsey

Supply disruptions and the drop in demand led to steep cuts of sourcing volumes. Image courtesy of McKinsey

Distressed supply chains

After five years of growth, McKinsey is estimating that apparel and footwear revenues will contract by 27-30 percent this year over last year, with even deeper declines in some specific sectors and geographies. Pre-COVID-19, the management consultancy had anticipated a 3-4 percent increase in revenues over 2019.

As the industry contracts, suppliers will be hit hard. Sourcing executives have had difficulty understanding the future when the present is so foggy.

As they grapple with the impact of store closures, old stock lingering in the system and production lockdowns, many are placing less orders. The impact will hit sourcing volumes in the second quarter, when two-thirds of fashion sourcing executives expect a cut in volumes by at least 20 percent.

"Even before the crisis the consolidation of the supplier landscape was one of the big trends in the industry," Mr. Magnus said.

Twenty-two percent of buyers expect their sourcing volumes to be slashed in half. Only 18 percent expect a smaller decline of 5-20 percent.

This could ease in the second half of 2020, when only 7 percent of sourcing executives expect volumes to be cut by more than half, but this is dependent on the virus going away and not coming back in the fall,

per the report.

“

While we have been saying that the days of transactional supplier relationships are over since some years, the current crisis will act as a catalyst to this," said Saskia Hedrich, senior knowledge expert and leader of the apparel, fashion and luxury group at McKinsey, Frankfurt.

"Fashion companies now need to build long-term partnerships," Ms. Hedrich said. "Important is a tailored approach – some suppliers need much more help than others to address the financial challenges."

The study revealed a disconnect between fashion brands and their source material suppliers. Only 19 percent of those executives surveyed said that they make advance payments on orders to suppliers.

Suppliers are a key link in a fashion brand’s ecosystem, but still about one-quarter of executives said that they provide no safety net to their suppliers.

Forty-nine percent of executives said they have canceled less than a quarter of their existing orders of finished goods and 22 percent have not canceled any orders at all.

European fashion companies are cancelling less orders than North American firms. One third of European companies have not cancelled any orders. Only 13 percent of North American companies said the same.

Additionally, North American companies are cancelling a larger share of orders, with 11 percent cancelling half of their orders as compared to only 2 percent of European companies.

"In many cases, the starting point has to be close collaboration to create full transparency of the situation and the pain points," Ms. Hedrich said. "Long-term commitments are among the most effective collaboration forms we see as these enable suppliers to weather the storm and make the required investments.

"In addition, we see a range of approaches applied depending on the specific supplier context, from pre-payment of orders or payment of raw materials which have direct impact on suppliers’ cash flow, to collaboration on cost-reduction efforts, credits, payment of wages," she said.

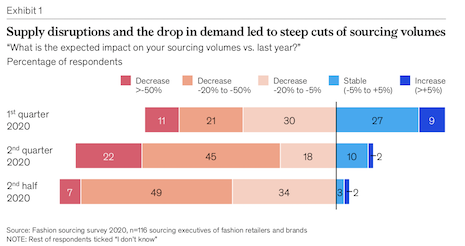

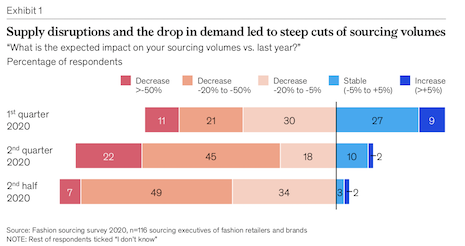

COVID-19 disrupts country trends. Image courtesy of McKinsey

COVID-19 disrupts country trends. Image courtesy of McKinsey

Nearshoring

Suppliers are having a hard time fulfilling orders due to delays and closures, which could impact how fabrics are sourced in the long term.

More than half (53 percent) of executives said their suppliers can only partly deliver orders in the second quarter and 38 percent expect to only partially deliver orders in the second half of the year.

Ninety percent of fashion retailers and brands will accept orders delayed by shipping, due to the crisis at hand.

Two-fifths of those surveyed said they are accepting delays for more than half of their orders.

Sourcing volume will likely shift from China to other Asian countries over the next year.

Since shipping has become such an issue in the crisis, many fashion companies are rethinking their sourcing mix and are looking for suppliers closer to home.

Sixty percent of those surveyed expect to use some form of apparel manufacturing in nearshore markets such as Eastern Europe and Central America. Slightly more expect to see integrated regional supply chains developed to cut back the dependency on international fabric imports.

"The disruption of the supplier landscape creates the unique chance to raise the bar on sustainability and shift to long-term partnerships that include real co-investments into sustainable technologies," Mr. Magnus said.

"Companies can use the time of transition to integrate sustainability across all purchasing processes and their decision making in sourcing," he said. "Rather than about an individual sustainability initiative, this is about rewiring the fashion sourcing model."

Closed due to coronavirus. Image courtesy of McKinsey

Closed due to coronavirus. Image courtesy of McKinsey

Supporting the critical supplier base is becoming essential. Image courtesy of McKinsey

Supporting the critical supplier base is becoming essential. Image courtesy of McKinsey

Supply disruptions and the drop in demand led to steep cuts of sourcing volumes. Image courtesy of McKinsey

Supply disruptions and the drop in demand led to steep cuts of sourcing volumes. Image courtesy of McKinsey COVID-19 disrupts country trends. Image courtesy of McKinsey

COVID-19 disrupts country trends. Image courtesy of McKinsey