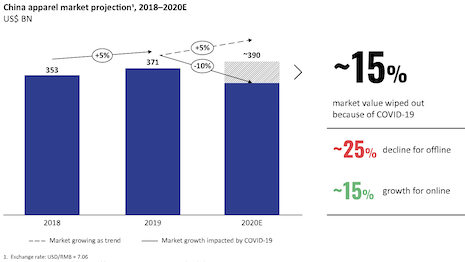

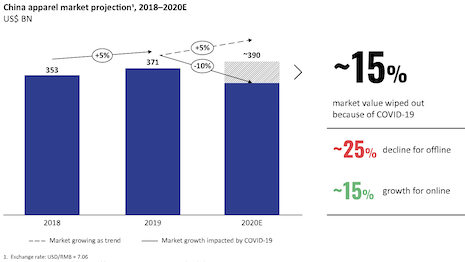

The apparel market in China will decrease 15 percent this year, per Oliver Wyman. Image credit: Oliver Wyman

By Dianna Dilworth

China’s apparel market is expected to contract by $60 billion, or 15 percent, in 2020 as the store shutdowns during the COVID-19 coronavirus outbreak hampered sales in the category.

Some 75 percent of Chinese consumers said they cut back on or postponed purchases on apparel and footwear, decreasing their average spend by 45 percent in the first quarter of 2020, according to a new report from research firm Oliver Wyman.

“It is going to be a turbulent year, with structural and longer-term shifts in the apparel and footwear market in China,” said Imke Wouters, partner at Oliver Wyman, New York.

Spending gap widens

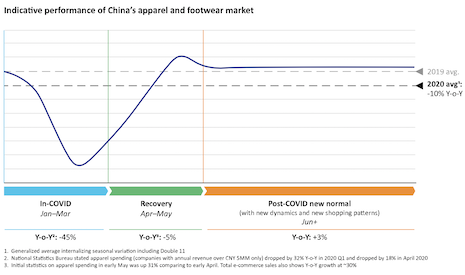

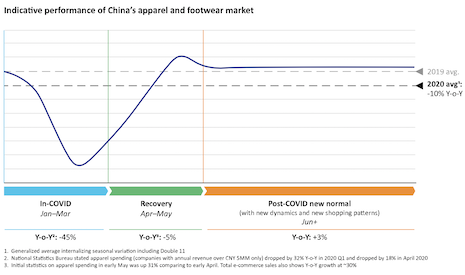

Since stores have reopened, consumers have not been quick to come back. April and May showed no hint of consumers making up for lost spending.

“We have seen the market recover to some extent as people’s lives have started getting back to normal, but retaliatory spending was not widely observed right after the outbreak began to subside,” Ms. Wouters said.

However, the data does reveal that consumer spending will likely return to its 2019 level in the second half of 2020.

The coronavirus pandemic has exacerbated the spending gap between the high and low-income groups.

The good news for luxury brands is that affluent consumers are still spending.

“The post-COVID market is expected to be more polarized across income levels and city tiers,” Ms. Wouters said.

High-income consumers are still seeking high-end merchandise. Those affluent consumers surveyed for the report said they would trade up and go for both value and quality.

Fifty-four percent said they would still look to buy products offering higher quality and functionality.

Fifty-six percent said they preferred items offering value for money. And these buyers are doing most of their shopping online, according to the report.

“Despite the industry downturn, we are seeing the further growth of ecommerce, with an accelerated penetration into sub-segments, such as high-income customer groups,” Ms. Wouters said.

Projected performance of apparel and footwear in China, per Oliver Wyman. Image credit: Oliver Wyman

Projected performance of apparel and footwear in China, per Oliver Wyman. Image credit: Oliver Wyman

Ecommerce pickup

As stores closed during the COVID-19 outbreak, consumers went online to make purchases. Even as stores reopen, many experts predict that consumers will maintain their online shopping behaviors.

The report predicts that online channels could make up 50 percent of the apparel sales market in China in 2020. If this proves true, ecommerce sales would grow by 34 percent from 2019.

The demographic with the largest shift to ecommerce: high-income shoppers.

This group’s online shopping increased the most with 64 percent of their spending through online channels.

The research found some growth in consumers identifying as pure online shoppers, but most consumers said they would do their shopping across multiple channels.

In particular, new features such as new technologies, exclusive offline products and personalized services would encourage more than 60 percent of the respondents to visit and possibly make a purchase in an offline store in future.

“The offline stores are still important, but it is imperative for retailers to re-examine the role and footprint of their offline presence, and fundamentally change the offerings and experience for their customers,” Ms. Wouters said.

Mulberry store in Shanghai. Image credit: Oliver Wyman

Mulberry store in Shanghai. Image credit: Oliver Wyman

Bricks-and-mortar's expectations

As such, offline stores will continue to play an important role, especially as consumers are looking to get out of the house after months of lockdown.

However, department store sales are not expected to perform well.

“The impact of the COVID-19 outbreak on China’s high-street fashion market has been material,” Ms. Wouters said.

More than 40 percent of survey respondents said they would still like to try on the products, as well as touch goods to ensure the quality with their hands.

Interestingly, the research revealed that consumers prefer to shop for sportswear than other categories.

Shoppers who purchase sportswear said that they plan to shop more at sportswear brands’ own stores in the next one to two years, as compared to the average consumer.

Even as some shoppers will return to stores, it will take time for the bricks-and-mortar retail apparel market in China to recover.

“For the remainder of the year, we believe the market’s overall growth will still be lower than the historical level,” Ms. Wouters said.

“Fashion retailers need to adjust their proposition to address consumers’ changing behaviors, rationalize their store networks, and take cost-control initiatives to minimize their losses while also preparing for the future,” she said.

The apparel market in China will decrease 15 percent this year, per Oliver Wyman. Image credit: Oliver Wyman

The apparel market in China will decrease 15 percent this year, per Oliver Wyman. Image credit: Oliver Wyman

Projected performance of apparel and footwear in China, per Oliver Wyman. Image credit: Oliver Wyman

Projected performance of apparel and footwear in China, per Oliver Wyman. Image credit: Oliver Wyman