What drives brand love for a generation like no other, in a year like no other: Morning Consult's fourth edition of the Most Loved Brands report tries to peel back the onion. Source: Morning Consult

What drives brand love for a generation like no other, in a year like no other: Morning Consult's fourth edition of the Most Loved Brands report tries to peel back the onion. Source: Morning Consult

While Morning Consult’s latest research on U.S. Gen Z may not be entirely applicable to luxury marketers, it does heed to note what makes this highly picky, fully digital generation love brands. In this latest look at consumers born between 1997 and 2012, Morning Consult’s Victoria Sakal, author of the report and managing director for brand intelligence at the Washington-based company, examined what brands fuel love with the generation, how Gen Z poses a threat to existing brands, and how brand perception has evolved throughout the COVID-19 pandemic. Here, per the report, are key findings:

- Twenty-six percent of Gen Z’s Most Loved Brands fall under the food and beverage category including Kit Kat (No. 13) and Oreo (No. 15)

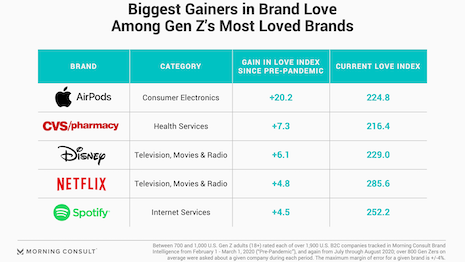

- Brands related to entertainment or convenience enjoyed the greatest increases in Brand Love among Gen Z since the pandemic: The top 5 include Apple AirPods, CVS Pharmacy, Disney, Netflix and Spotify

- Nearly a fifth (18 percent) of Gen Z’s Top 50 are television, music and radio brands such as Netflix and Spotify

- New attitudes, expectations and needs within Gen Z are surfacing amid the many life-changing events this generation is facing this year, and with these come the likelihood of new consumption behaviors, preferences and priorities that will shape the future of commerce

- Gen Z’s preference for new brands continues: sixty-eight percent will continue to buy from a company that they tried for the first time since the pandemic because of their good experience

- Even in a pandemic and recession, Gen Z is voting with their wallets to support causes that matter. Eighty-three percent of Gen Z believes brands’ actions speak louder than their words, and 74 percent believe corporations have a responsibility to play a role in addressing racial inequality in the United States. Post-pandemic, 74 percent plan to buy more from local businesses and 64 percent plan to buy more from Black-owned businesses

- Gen Z is significantly less aware of brands than other generations, and awareness continues to drop. Fifty percent or more have only heard of about three-quarters the amount of brands elder generations have. While brand awareness has marginally increased since March across all other generations, it has declined among Gen Z

- For 86 percent of Gen Z, a recommendation from family or friends plays a role in their interest or decision to buy

- Despite new pastimes and digital savviness, Gen Z misses in-person interaction more than anything. Seventy-eight percent of Gen Z misses spending time with their friends the way they used to in real life (IRL). Many have developed new pastimes and methods of socializing, but a clear majority (79 percent) will be looking for new ways to spend their time in a post-COVID-19 world when they can socialize freely again